The zkSync ecosystem has recently had a strong boom following the exodus of new retroactives winning on Arbitrum and including those participating in retroactive farming for the first time. However, in this article we will analyze the zkSync ecosystem recently to see how it is developing.

To better understand this article, people can refer to some of the following articles:

- What is Zk Rollup? Zk Rollup Solution Overview

- What is ZkSync? ZkSync Cryptocurrency Overview

Arbitrum Ecosystem On-chain Parameters

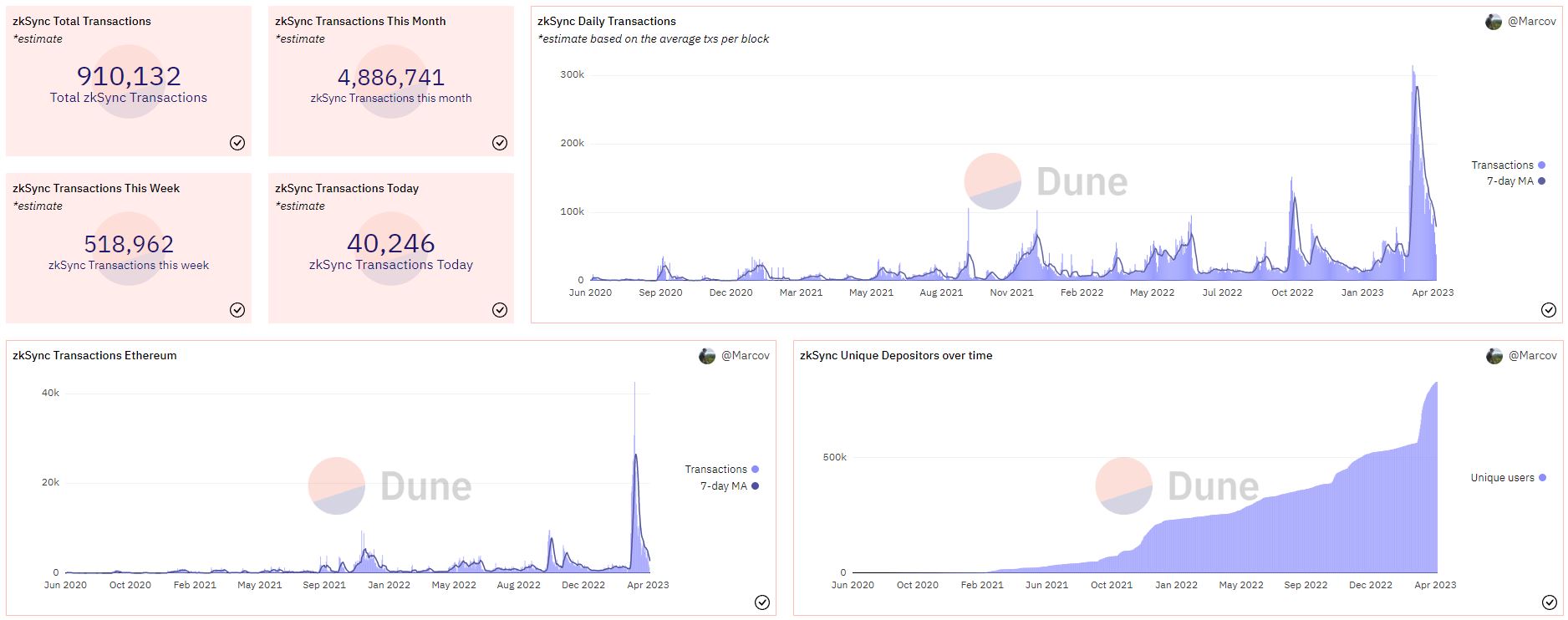

Overview number of wallet addresses & transactions

Most indexes such as Daily Transactions and Unique Depositers have grown strongly since the beginning of the year when the market started to warm up and had a significant impact after Aptos airdropped to testnet participants on its network. They amount to thousands. Not stopping there, after Arbitrum airdropped tens of thousands of dollars, zkSync really exploded.

- Daily Transactions increased 700% in just a few short days from the Arbitrum Airdrop event.

- Unique Depositers also grew more than 100%.

People flock to experience zkSync because zkSync has many similarities with Arbitrum such as:

- Both are Layer 2 built by a potential team.

- They all raised a huge amount of capital before the product officially became mainnet.

- A little different, zkSync said from the beginning that they have their own native token.

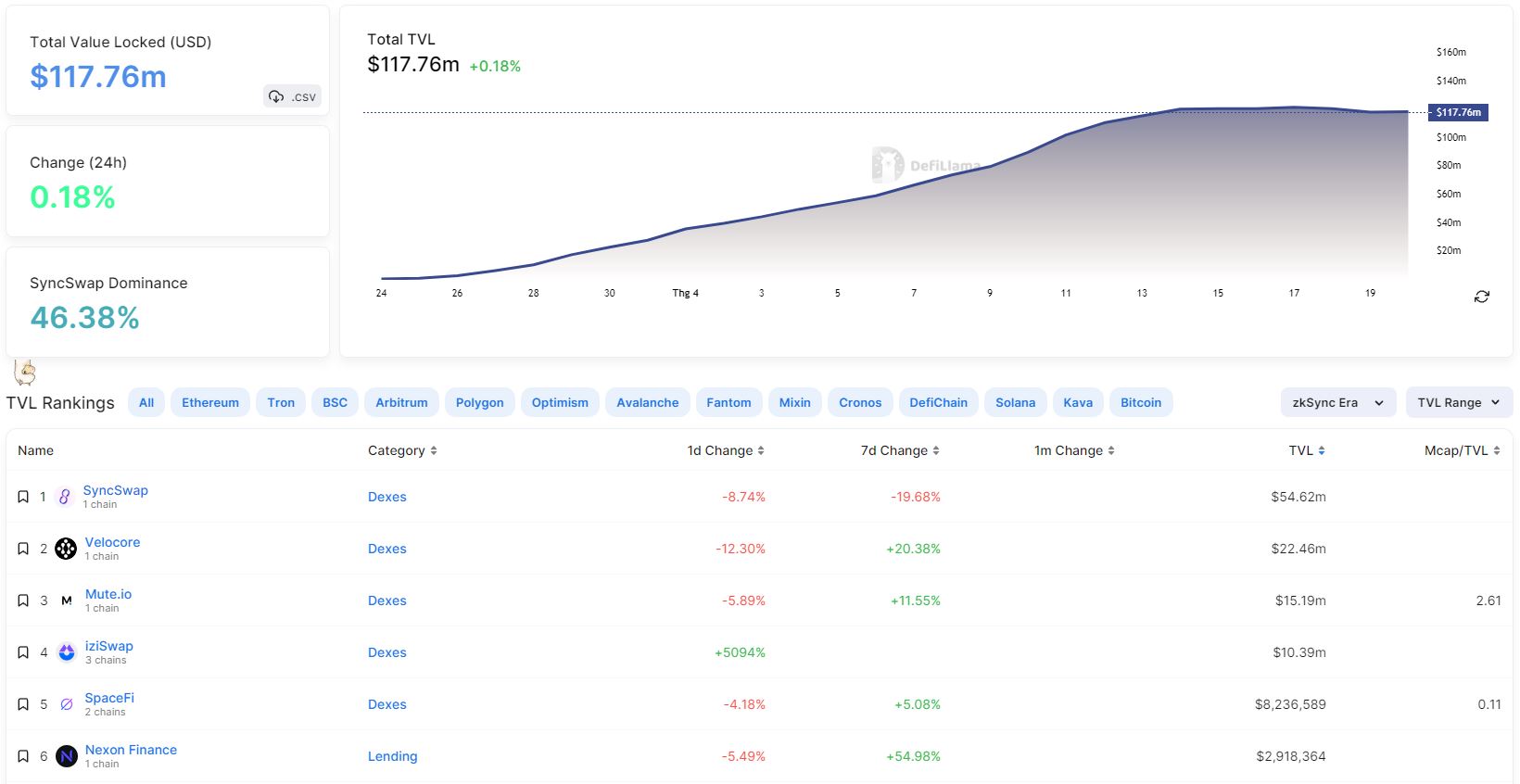

About Total Value Locked

According to data from DefiLlama, in less than a month, zkSync Era’s TVL has gone from zero to nearly $120M and has only shown signs of slowing down since about the 14th. Most of the projects on zkSync are in the AMM segment and a few are Lending & Borrowing, Yield Farming, Derivatives,… However, there have been many projects after TVL increased but there has been a decline. decline.

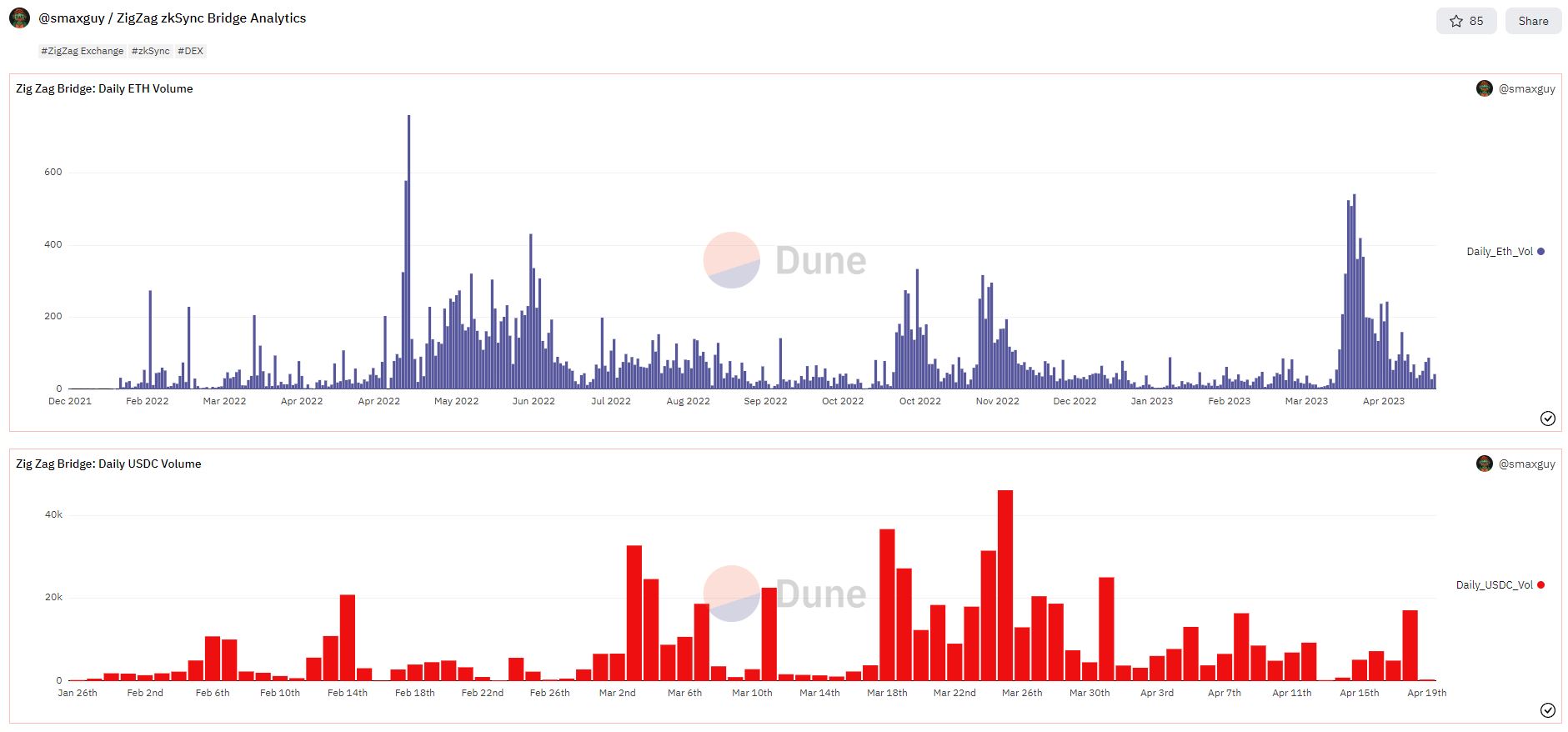

One of the projects that benefited a lot from the Aptos event, Arbitrum Airdrop and the heat spreading to zkSync is ZigZag Exchange on the zkSync Lite network when most of the parameters of TVL, USDC Bridges, ETH Bridges and Volume are traded. Transactions on Zigzag Exchange have exploded strongly in recent times.

However, similar to zkSync Era’s TVL, the indices on Zigzag Exchange are showing signs of slowing down after a hot period. But after the SUI event, there is a high possibility that users will continue to return to retroactive farming on zkSync if the overall market situation is still good.

Overview of zkSync Ecosystem

ZkSync officially launches zkEVM

March 24, 2023: Matter Labs has officially launched zkEVM – one of the important steps forward for Layer 2 platforms in particular and the entire crypto industry in general. With zkEVM, developers on Ethereum or other EVM Blockchains can easily expand their products to zkSync Era. Indeed, there have been many projects announcing early deployment on zkSync Era such as:

- Wallets: Fox Wallet, Wallet Connect, Tally, Rollups, Fox Wallet, HasKey Me, Echooo, Raise Finance, AlloPay, DGG Wallet,…

- Infastructure: Li.Fi, Chainlink, Automata Network, Snapshot, Hop Protocol, LayerZero, Razor Network, Arweave,

- DEX: Balancer, 1inch, SushiSwap, Uniswap, Multichain, Warden Swap, Open Ocean,…

- Lending & Borrowing: Alchemix, Vovo Finance,

- Derivatives: Thales, Synfutures,…

It is clear that not only developers themselves are looking forward to zkEVM, but projects themselves are also looking forward to the birth of zkEVM because according to long-term assessment, zkRollup still has clear advantages compared to Optimistic Rollup even though on a basic basis. Infrastructure is lagging behind a lot. However, the zkRollup projects themselves still have many problems.

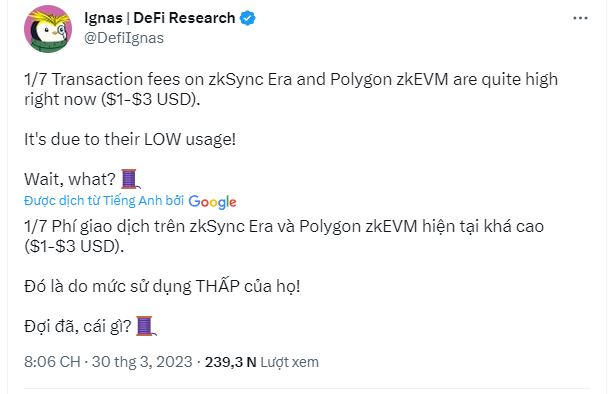

Transaction Fees and Transaction Speed in the early days of launching zkSync Era

According to one researcher Ignas | DeFi Research shared that the transaction fee on zkSync Era has reached a level of $1 – $3 for 1 transaction order and the matter does not stop there. On April 19, when Bitcoin had a strong correction within 15 minutes, the fee The network on zkSync Era has reached $50 per transaction order and it is on par with Ethereum.

Agree that zkRollup’s technology is the future, but at present, the zkRollup platforms still have a lot of work to do, especially related to infrastructure. These are just the users participating in retroactive farming on zkSync. If in the future the number of users becomes more and more large and zkSync Era cannot solve the problem, they will definitely have to face users leaving the platform.

Besides, transferring money from zkSync Lite to Ethereum takes up to 1 day, which is a far cry from the theoretical requirement of just a few minutes.

Updating the zkSync ecosystem has exploded dramatically in a short time

Up to now, the total TVL on zkSync Era is about $107M and is showing signs of decreasing after yesterday’s Bitcoin crash through SyncSwap, AMM, the protocol with the largest TVL on the zkSync Era ecosystem as of now. This accounts for nearly 40% of the TVL of the entire protocol. In addition to being an AMM, SyncSwap also integrates Launchpad or Bridge from third parties.

Liquidity on SyncSwap focuses mainly on the USDC – ETH pair and a small part of the USDC – BUSD pair, while other pairs have not too large liquidity.

Besides, SyncSwap has platforms such as Velocore, iziSwap, Mute.io, iziSwap and Velocore are implementing Liquidity Mining programs and if these projects do not have a post-Liquidity Mining plan, TVL will certainly decrease. no brakes.

Besides, there are a number of protocols on Lending & Borrowing, Derivatives, but I think they are not really outstanding and different when the operating model of these protocols is no different from the existing models in the market. crypto school.

Summary

In my personal opinion, zkSync Era’s ecosystem at the present time is still very pristine as the number of projects is large but the quality is still a question mark as developers are willing to scam users to get money. earn money so people are very careful when investing on zkSync.