What is Delta Neutral and why could it become one of the main trends of the crypto market in the near future? Currently, which projects are applying the Delta Neutral strategy and which pieces of the crypto market puzzle do they belong to?

Reveal the secret about Delta Neutral with Weakhand in the article below!

Overview of Delta Neutral

Define

Delta Neutral is an investment strategy that helps the total profit/loss of the investment portfolio always stay at 0. With this strategy, the investor’s position is not affected by market fluctuations, even when going up, down or sideways.

Although the definition is quite simple, there are many different ways to implement the Delta Neutral strategy.

Illustration

The problem is posed: You have USDC but to join Binance Launchpad you need to hold BNB but are worried about whether the profit from participating in Binance Launchpad will compensate for the loss if BNB drops? And you ask a question: “How can I hold BNB without worrying about the price of BNB going down and can I reap all the profits from Launchpad?”.

Answer: Apply the Delta Neutral strategy. So how will we apply this strategy?

Step 1: Assuming the current price of BNB is $200 and you want to buy about 100 BNB, you need to spend $20,000.

Step 2: At the same time, you open a Short order of 100 BNB at a price of $200 with a margin of $30,000 and do not use leverage.

After these 2 steps, the total Delta of your position with BNB is 0. So at this point you no longer have the risk of holding BNB and will reap all profits from participating in Binance Launchpad.

Howevernothing is perfect and the Delta Neutral strategy also has a few loopholes: if the BNB price drops too much before the Binance Launchpad takes place, your Short order will be liquidated and to avoid this situation, it can happen. The higher your margin must be.

So applying the Delta Neutral strategy also requires you to have more margin assets to avoid the worst risks.

Some Projects Use Delta Neutral Strategy

Delta Neutral Strategy Around GLP

GLP is an LP token that represents users’ assets when participating in providing liquidity on GMX. GLP equivalent is an index of a basket of assets such as BTC, ETH, UNI & Chainlink. Therefore, when the market goes into a downtrend, BTC ETH, UNI & Chainlink will all decrease, leading to a decrease in GLP, this is the IL of LPs in GMX.

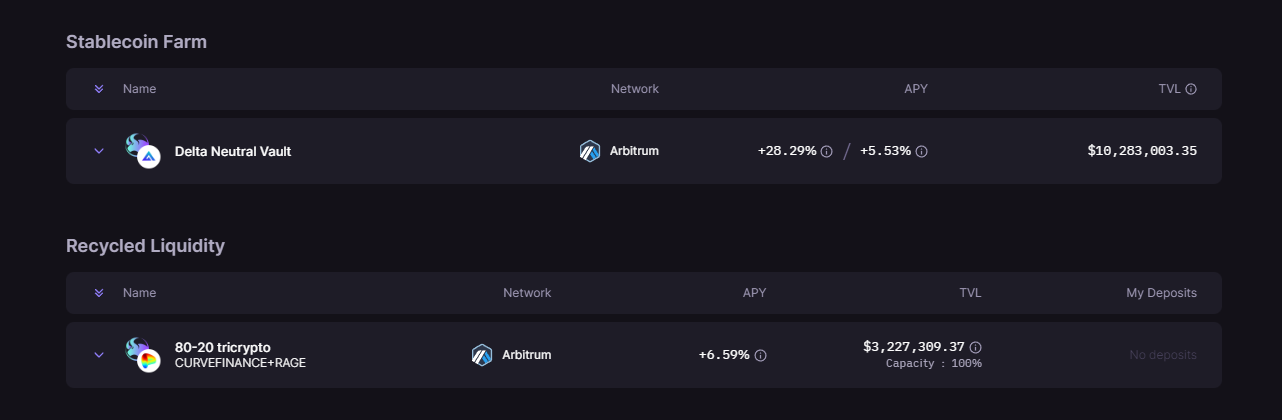

Because of this, projects like Jones DAO, Rage Trade and Umami Finance have devised strategies so that GLP holders do not worry when the market drops but they can feel secure in providing liquidity on GMX.

I have a very detailed article about the Delta Neutral strategy and the applications and implementations of this strategy for projects in the article What is Delta Neutral? When The Game Is Built Around GMX. Everyone should re-read this article to better understand how to strategically deploy projects and games being built on Arbitrum!

Although they apply the same Delta Neutral strategy, the projects have different implementation and execution methods.

- Rage Trade applies Flash Loan on Balancer to bring risk to zero when users hold GLP.

- Umami Finance built a new type of vault, Delta Neutral USDC Vault, with the strategy of dividing it into 2 different vaults. Umami also brought the risk to zero for LPs on GMX.

- Jones DAO introduces a strategy that optimizes the disadvantages of the Delta Neutral strategy but does not have much information.

Up to now, only Rage Trade is the first project to implement the Delta Neutral strategy with GLP. Rage Trade’s products also attract a large portion of users, shown by the fact that the pool is full of assets and the TVL is 3 times larger than the first product they deployed.

Delta Neutral Strategy with AMMs

Recently during the crypto winter, protecting the liquidity of projects has always been a top priority. If the profit is not much, if you want to retain LP, the project must limit the risk of Impermanent Loss. This problem has been solved somewhere with Uniswap V3 but that is not enough.

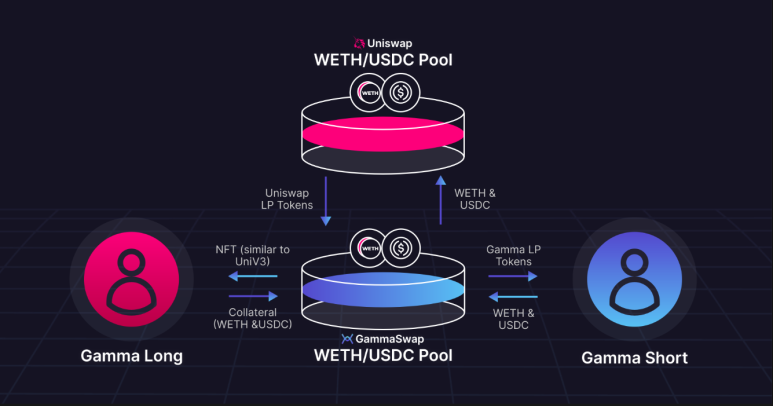

That’s why two projects that started the movement to apply the Delta Neutral strategy in providing liquidity on AMM were initiated with Lyra and GammaSwap.

I will use GammaSwap as an example so everyone can refer to it.

GammaSwap has created a market consisting of two sides, Short Gamma (LPs) and Long Gamma. Here each party will have different roles such as:

- Short Gamma are LPs (Liquidity Providers).

- Long Gamma is the liquidity borrower.

For LPs, they can deposit the LP tokens they receive from AMM or send the token pair to GammaSwap and then Gamma will send that trading pair to Uniswap on their behalf, meaning the final asset on GammaSwap’s contract is the LP. token and users will receive GS – LP token representing their LP token on GammaSwap.

LP Token Holder will not only receive profits from providing liquidity on Uniswap but also receive interest from Long Gamma borrowing liquidity.

When a user wants to borrow liquidity and participate in Long Gamma, GammaSwap will return the LP Token to Uniswap to receive the token pair that provided liquidity and provide the loan to Long Gamma. The Long Gamma party must of course deposit its collateral into GammaSwap.

With this strategy, LPs will increase their profits

Delta Neutral Strategy While Farming

The Yield Farming project is taking the lead in applying the Delta Neutral strategy called Pseudo – Delta Neutral Hedging Strategy. This strategy will be implemented as follows:

For example: Your total assets are $400 to farm, then Francium will apply a strategy by dividing $400 into 2 different investments of $100 and $300.

Invest $100 to farm the SOL – USDC pair with 3x leverage (borrow USDC).

- 3x leverage is similar to borrowing 200 USDC from the platform.

- Farming is based on adding liquidity on the AMM platform Raydium, so it will deduct 150 USDC to buy more SOL to have enough 1 pair of $150 SOL and $150 USDC to add liquidity.

- This is similar to if you just bought another $150 SOL.

The remaining $300 will be used to farm the SOL – USDC pair with 3x leverage, but instead of borrowing USDC, we will borrow SOL.

- 3x leverage is equivalent to borrowing $600 SOL.

- We continue $150 SOL to 150 USDC then we have $450 SOL and 450 USDC to be able to add liquidity.

- Same goes for converting $150 SOL to USDC which helped balance the risk

With the Fracium strategy, Delta Neutral has been successfully applied to farmers.

Build a sustainable stablecoin model with the Delta Neutral strategy

UXD Protocol is a Stablecoin project backed by underlying assets built on the Solana ecosystem. UXD Protocol has the following operating mechanism:

Let’s say you want to mint $100 UXD in BTC

- Step 1: Deposit BTC worth $100 into the vault of UXD Protocol (UXD Protocol uses oracle to calculate BTC price).

- Step 2: UXD Protocol’s vault will mint 100 UXD for users.

- Step 3: UXD Protocol will send the user’s BTC to Derivatives Dex to create a Short order for this BTC amount.

- Step 4: When a user deposits 100 UXD into the UXD Protocol vault, the protocol will close the Short order on Derivatives Dex.

- Step 5: The Vault will return the corresponding $100 worth of BTC to the user and burn 100 UXD.

Why is it necessary to place a Short order on Derivatives Dex?

Suppose BTC at that time was $20,000, after 2 days the price increased to $40,000, the Short order would also be negative $20,000. At this time, the user’s BTC value is still $20,000 unchanged from when UXD minted.

Summary

The Delta Neutral strategy is extremely popular today in the traditional financial market, but it is still a very new concept in the DeFi market. It can be seen that this strategy was initially relatively successful when newly launched platforms attracted users or UXD Protocol’s UXP stablecoin is holding its peg very well.

Besides, the Delta Neutral strategy is expected to bring a leap forward for the AMM segment in the near future.