Real World Assets is receiving the attention of the Crypto market after many moves by big players inside and outside the Crypto industry. So what is the actual situation of Real World Assets? Let’s find out together in the article below.

To better understand Real World Assets, people can refer to some documents such as:

- What is TrueFi (TRU)? Overview of TrueFi Cryptocurrency

- What is MakerDAO (MKR, DAI)? MakerDao Cryptocurrency Overview

- What is Maple Finance (MPL)? Maple Finance Cryptocurrency Overview

Overview of Real World Assets

Introducing Real World Assets

Real World Assets, abbreviated as RWA, are valuable assets that exist in the real world such as Real Estate, Stocks, Bonds or Cash. There are assets that can be tokenized to put on Blockchain with many benefits such as:

- Reduce transaction costs: Thanks to Blockchain, transactions can eliminate intermediaries involved in the transaction process, saving costs for buyers and sellers.

- Increase liquidity: When an asset is tokenized, it becomes a global asset that is not dependent on borders from which it can be exposed to anyone, anywhere as long as there is an Internet connection.

- Enhanced security: It can be said that Blockchain technology is one of the leading technologies in decentralized security.

Puzzle Pieces That Make Up Real World Assets In Crypto

There are many different pieces and projects that are coming together to create a colorful Real World Assets ecosystem in the crypto market, including:

- Blockchain: These are Private or Public Blockchains designed specifically for Real World Assets.

- Tokenization: These are protocols that play a role in bringing real assets to the Blockchain called Tokenization. The current prominent project is Centrifuge.

- Campliance: Service to help investors and those who put RWA on Blockchain in the right process.

- Under Collateral: These are loan projects with individuals and organizations in the real world. Some outstanding projects such as Maple, TrueFi,…

- Real Estate: These are projects that bring Real Estate to Blockchain.

- Climate: These are projects that put weather information on Blockchain.

- Emering Market: These are loan projects with organizations in emerging countries and territories. Projects can be mentioned as Goldfinc or Credix.

RWA is an ecosystem consisting of many different pieces, each of which has a different role, as well as a different way of interacting with the real world. However, all pieces of the puzzle were created with the purpose of bringing DeFi and TradFi closer together or helping Crypto and the Real World to blend together, thereby complementing each other’s greatest strengths.

Reasons why RWA is receiving strong attention

Maker DAO

It can be said that Maker DAO was one of the first names to lay the foundation for RWA when in 2020, Maker DAO proposed building a vault where users could deposit real-world assets as assets. collateral to be able to mint Stablecoin DAI. Not stopping there, Maker DAO recently took advantage of idle assets in Tresury to buy US Bonds.

It can be said that, at the present time, although it does not account for much proportion in Maker DAO, RWA is generating a huge amount of revenue for this protocol.

Goldfinch

Goldfinch is a Credit Protocol platform that acts as a connection between TradFi and DeFi. Goldfinch allows companies and startups to access loans in DeFi with collateral from the real world. Basically, companies and startups in TradFi will mortgage real assets to borrow money from users on DeFi, of course, the assets will have to be verified by Goldfinch’s team globally.

Currently, Goldfinch has a total of more than $100M being lent and has collected nearly $30M at relatively attractive interest rates with Stablecoin for users. Goldfinch itself, with its new customer base, has also avoided the heavy collapse of the Crypto market recently.

Maple Finance

Maple Finance is also a similar project to Goldfinch, but the biggest difference is the market. While Goldfinch chooses emerging regions and countries, Maple Finance chooses a more familiar market, which is companies. TradFi in the Crypto industry such as Alameda Research, Celsisus,… It can be said that before Alameda was collapsed, Maple Finance was the project that provided billions of dollars in loans outside of TradFi and was considered one of the Credit protocols. Protocol was the most successful at that time.

But when Alameda Research officially collapsed, Maple Finance had to bear an extremely large bad debt of more than $50M.

Currently, Maple Finance has taken new directions in limiting exposure to risky companies in the Crypto market. The customer base that Maple is targeting today is DAO, Fund, Startup and other people. normal use.

Ondo Finance

In early 2023, Ondo Finance began launching a number of products with direct exposure to RWA and to date, Ondo Finance is offering 4 main products related to RWA including US Money Markets (OMMF) , Ondo Short – term US Government Bond Fund (OUSG), Ondo Short – term US Grade Bond Fund (OSTB) and Ondo High Yield Corporate Bond Fund (OHYG). Each RWA has different APR, the higher the APRR, the higher the risk.

Some positive information about Real World Asset

In addition, we have positive information about RWA both inside and outside the Crypto market such as:

- Avalanche Foundation launches an incentive package worth $50M to develop the RWA segment. Previously, at the beginning of the year Intain – a company in the Structure Finance segment – deployed the product IntainMARKETS with the goal of tokenizing securities built on the Subnet.

- Binance Labs is also paying special attention to the RWA segment when it publishes Real World Assets: State of the Market after launching the Report on LSDFi. It seems that Binance is quite interested in some areas such as Social, AI, RWA, LSDfi,…

- JP Morgan remains committed to its plan to tokenize traditional assets. The bank has settled $700B of short-term debt through the Onyx platform built on Ethereum.

- Goman Sach developed the GS DAP platform on a Private Blockchain platform that issued bonds in the form of tokens using that same platform.

The Future of RWA in the Crypto Market

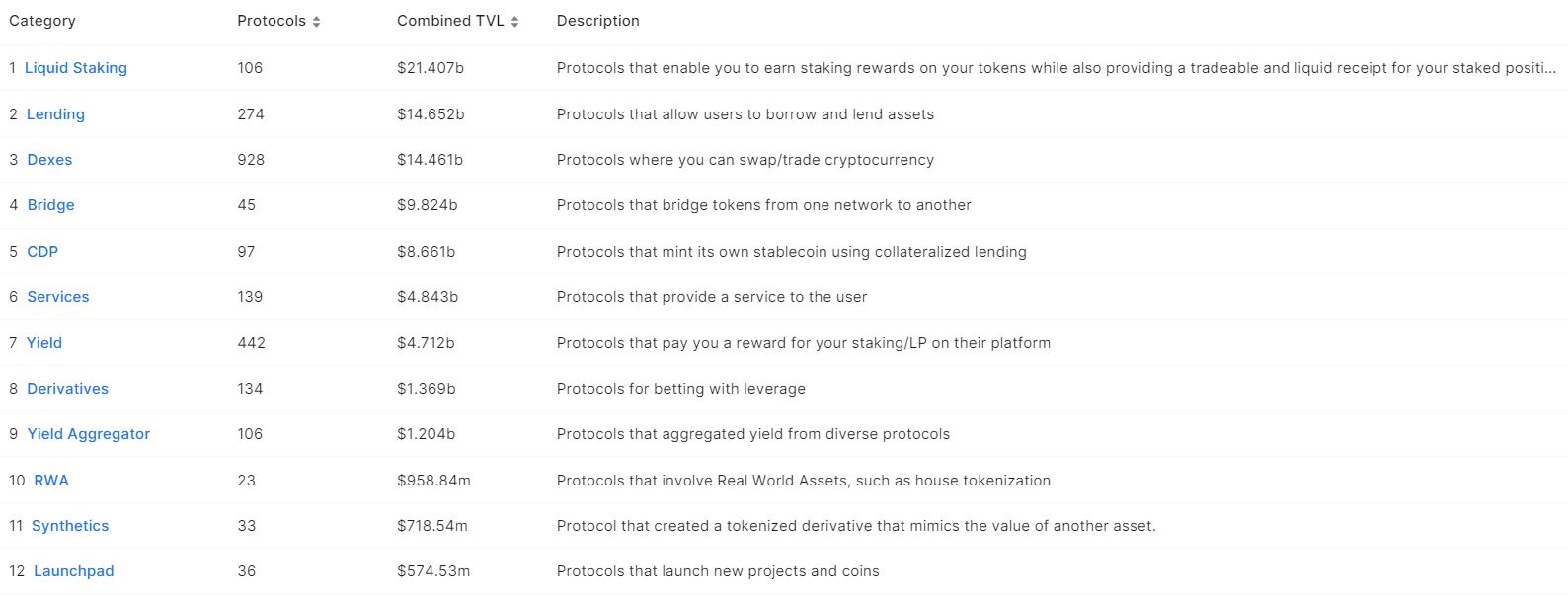

TVL is still too small compared to other industries in DeFi

As of the time of writing, the TVL of the entire Real World Assets industry is only about less than $1B compared to the entire DeFi industry at about $43B and the largest LSD industry currently is $21B, so there is still room for RWA to continue to develop. still too big. Even though DeFiLlama has not yet fully listed the projects in the RWA segment, RWA’s potential is still very large.

One thing worth noting is that RWA is one of the segments with the best TVL growth in the entire DeFi industry in recent times.

The industries outside of TradFi are too large and have great potential for exploitation

If you know that the Real Estate market is up to $330B, Bonds are up to $300B, Cash is $12B, Equities are $115B then you can see that the potential to exploit RWA is very much. In this context, even the giants in the TradFi market such as JP Morgan, Goman Sach,… all have clear plans and products in tokenizing real-life assets, it is clear that this is a Extremely good signal for RWA in the medium and long term.

However, tokenization of assets will certainly encounter legal problems. If the legal framework is more complete and comprehensive in the future, RWA will certainly explode even more than what DeFi used to do.

Summary

RWA is an extremely important piece of the puzzle in bringing DeFi and TradFi together. With the moves of the big guys, it is clear that RWA is becoming one of the brightest pieces of the crypto market in the near future.