Although GMX V2 has been deployed for a period of time, it is clear that GMX V2 has not achieved many achievements. So why has GMX v2 not been as successful as expected, and what factors have affected GMX in the past? Let’s find out together in the article below.

To better understand why GMX V2 has not been as successful as expected, people can refer to some of the documents below:

- What is Layer 2? Complete Guide to Layer 2 Solutions

- What is Arbitrum (ARB)? Arbitrum Cryptocurrency Overview

- What is GMX (GMX)? Overview of GMX Cryptocurrency

- GMX 2.0 Review: Changes to Overthrow dYdX

GMX Health Index

GMX is one of the most successful Perp DEX platforms built and developed on Arbitrum in recent times, surpassing a series of big names such as Perpetual or Kwenta although still unable to approach dYdX. However, GMX has certain limitations. Their liquidity model did not allow GMX to expand many major asset classes so they needed a change and that was GMX V2.

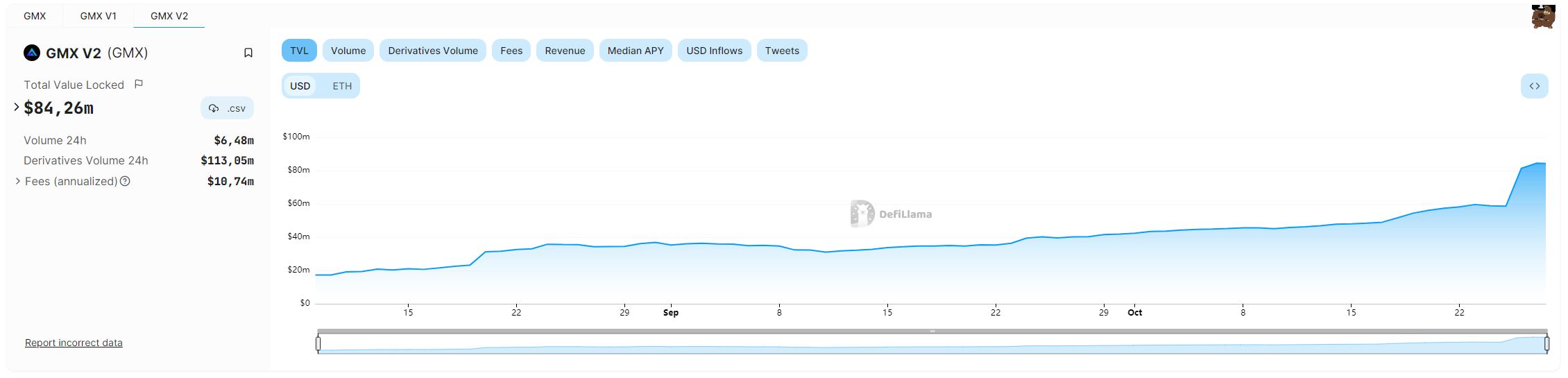

On August 3, 2023, the GMX development team officially launched GMX V2 Beta version and now nearly 3 months have passed, but the on-chain numbers show that GMX V2 is still quite sluggish. although there are many differences compared to version V1.

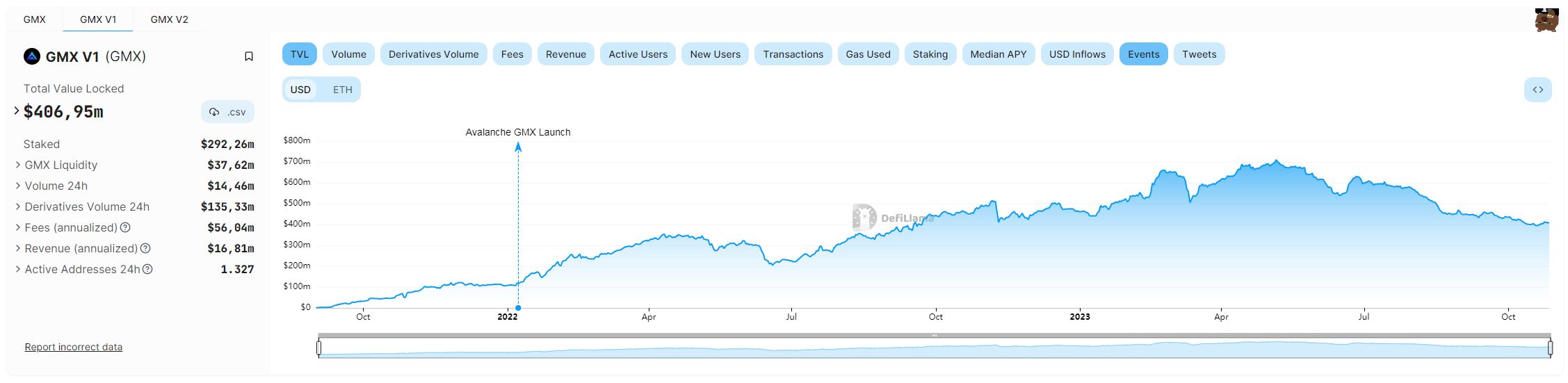

Total Value Locked of the entire GMX

Total Value Locked of GMX V1

Total Value Locked on GMX V2

|

Index |

GMX |

GMX V1 |

GMX V2 |

|---|---|---|---|

|

TVL |

$491.92M |

$408.19M |

$84.26M |

|

Derivatives Volume |

$1,323B |

$778M |

$543M |

|

Fees |

$2.3M |

$1.85M |

$448K |

|

Revenue |

$555K |

$555K |

No parameters yet |

Note: The above indices such as TVL will be calculated at the time of writing and the remaining indices will be based on the monthly frame and are for the entire month of September 2023.

A few simple metrics show that V1 TVL, Derivatives Volume, Fees and Revenue still make up the majority of the total protocol.

- TVL accounts for 83% of the total TVL of the entire protocol.

- Derivatives Volume accounts for 58% of the total TVL of the entire protocol.

- Fees account for 80% of the total TVL of the entire protocol.

This helps us continue to confirm that GMX V2 has many special updates to the liquidity model allowing for more asset types. And GMX V2 has done exactly what people expected it to do, but in terms of attracting users, the project has not yet achieved it.

So what is happening with GMX in general and GMX V2 in particular?

Why Was GMX V2 Not as Successful as Expected?

Airdrop cools down the Arbitrum ecosystem

GMX emerged next to the strength of the development team, besides being a really good product, besides having strong support from Offchain Labs & Arbitrum Foundation, besides being a Tokenomics model full of ponzi characteristics. The Airdrop/Retroactive fever cannot be denied. Obviously, for any user coming to the Arbitrum ecosystem to do Airdrop, it is impossible not to ignore GMX and its vast ecosystem.

It is this factor that helps GMX quickly become one of the largest Perp DEXs in the Crypto market, surpassing a series of famous names such as Perpetual or Kwenta.

Looking back at the trading volume on GMX in 2022 and 2023 we can see that:

- Trading volume on GMX reached its highest level in the end of 2022 (at this stage the market leaked rumors that Arbitrum would launch ARB tokens in the end of the year).

- Trading volumes on GMX continue to trade at high levels in the early part of 2023.

- Trading volume on GMX shows signs of decreasing starting in April – May 2023 when the Arbitrum ecosystem fever shows signs of abating.

Obviously, the trading volume on GMX is closely related to the keyword “Arbitrum Airdrop”.

There is not much communication about GMX V2

In addition to the general context of the Arbitrum ecosystem officially cooling down after the Airdrop, the fact that GMX V2 was officially introduced to the community without hesitation also contributed to making the community not know too much about the V2 version.

Blockin GMX V2 Fund just hit an ATH APY of 28.94%!

Premium yields @GMX_IO + proactive strategies @Blockin_ai + robust risk management @SolvProtocol = next-gen passive income #SolvV3

Why let your assets $USDC $USDT sleep in your wallet when they could be earning up to… pic.twitter.com/zE5EawqS5s

— Solv Protocol (@SolvProtocol) October 19, 2023

So many GM liquidity pools present excellent yield opportunities, making it challenging to decide where to allocate liquidity.

The GMX V2 fund makes earning easy. Just invest and our managers handle:

– Monitoring markets

– Analyzing data

– Hedging risks

– Managing… pic.twitter.com/Uppt9CoblA— Solv Protocol (@SolvProtocol) October 11, 2023

LP yields of @GMX_IO v2 looking very juicy

Mint GMLP uses USDC at for easy access to the top GM tokens.

GMLP DEX Liquidity

pic.twitter.com/XvUUwf42F7

— ╼╾ Nitro Cartel ╼╾ (@nitrocartel) October 22, 2023

With a success @arbiturm Short-Term Incentive Proposal (STIP) pass, @gmx V2 looks to be a great benefactor of the first round of ARB distributions.

So, what is GMX V2?

– How does it work for traders and liquidity providers?

– What will happen to GMX V1 and GLP?

Here’s… pic.twitter.com/KoC9eAPYbu

— blocmates. (@blocmatesdotcom) October 17, 2023

Currently, GMX V2 is only mentioned by a few KOLs or small projects within the GMX ecosystem, so it does not make a big impact. Besides, the community is being pushed towards LSD, LSDfi, Real World Assets, macro information,… making information about GMX V2 even less widely accepted and popular. .

Obviously, GMX V2 does not have strong communication to the market and from my perspective, this is not the preferred approach of the GMX development team. GMX’s development team focuses on development. product rather than product marketing. In fact, GMX has never had famous marketing events for its products.

Competition comes from many competitors

One of the factors directly affecting the decline of GMX in general and GMX V2 in particular is the birth of a series of new Perp DEX names. It seems that Arbitrum has become a good land for Perp DEX projects as the number of new Perp DEXs on the platform has increased continuously in recent times.

A new factor that comes with new projects is Airdrop/Retroactive, so the remaining users tend to gradually switch to new Perp DEX platforms in the hope of receiving rewards. As for sharks and individuals with large capital, they will definitely stay at GMX because of low liquidity, low Impermanent Loss, familiar experience,…

Some emerging names include:

- Rage Trade: Rage Trade builds the infrastructure that helps ETH Perp products have the most abundant liquidity.

- Gains Network: Gains Network is a Perpetual platform built and developed on Polygon. The platform is geared towards user experience and creating liquidity for derivative assets. Thanks to its development on Polygon, the platform provides services with low fees and very fast transaction speeds.

- Hyperliquid: Hyperliquid is a Perp DEX platform built with the goal of fast speed, low cost and the largest liquidity in the community.

- Vertex Protocol: Vertex Protocol positions itself as a Defi Hub platform on the Arbitrum ecosystem with the goal of providing users with a variety of services such as Spot and derivative transactions and borrow & lend Crypto on a single application.

- Vela Exchange: Vela Exchange is a decentralized exchange for perpetual futures contracts (Perpetuals) and spot contracts (Spot) developed on the Arbitrum ecosystem.

- Level Finance: Level Finance is a decentralized perpetual contract exchange (Perpetual Dex) that allows investors to trade Crypto with leverage up to x50 times. Level Finance was developed and officially launched mainnet on December 26, 2022 on the BNB Chain ecosystem.

Obviously, with the appearance of many competitors, GMX’s market share is also somewhat affected. Not to mention that on the other side of the ecosystem there is a Kwenta with an abundant amount of OP that has had a strong growth in transaction volume recently.

Can GMX Return to the Track?

The future still belongs to Perp DEX

With the instability of CeFi platforms such as Binance, Houbi, Kucoin,… DeFi becomes even more necessary. In a similar context, I believe that Perp DEX will be one of the flagships of DeFi to bring the industry towards Mass Adoption. Today, we have a few names that bring the same experience as Perps on CEX such as dYdX, GMX V1 or Aevo and there will be more names in the near future.

Perp DEX also plays an extremely important role in a DeFi ecosystem. The market goes up and down, if there is an uptrend, there will be a downtrend, but Perp is always prosperous at all times of the market because no matter how the market moves, traders can still make money. Therefore, Perp in particular and Derivatives in general play an indispensable role as DeFi grows.

GMX still plays a pivotal role in the Arbitrum ecosystem

After 2 years of mainnet, the Arbitrum ecosystem has not yet appeared any competitor worthy of GMX. GMX still plays an extremely important role in the Arbitrum ecosystem in attracting and retaining users. The main people who stay in the Crypto market today are mainly Traders and Airdrop/Retroactiver. Airdrop/Retroactiver has moved to other Blockchain platforms, Traders stay with Arbitrum mainly because of GMX.

Besides, GMX’s ecosystem is still continuing to explode because the GLP model (GMX’s LP Token) is still maintained in version V2. GMX’s ecosystem will continue to play a role in building a multi-layered economy within the Arbitrum ecosystem.

GMX V2 will return with Incentive ARB

One of the Keywords that helps GMX come back strongest is Incentives. In the first phase when Arbitrum deployed ARB listing, along with Treasure DAO, GMX received 5,000,000 ARB as a reward from Arbitrum Foundation for the companionship of projects.

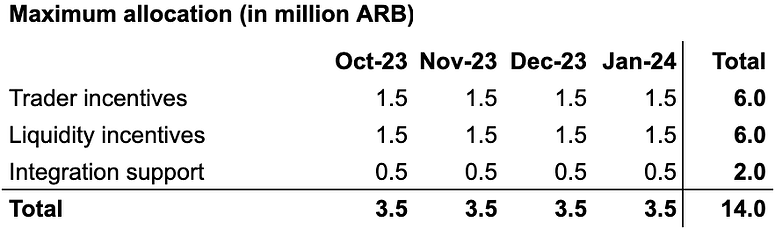

Most recently, Arbitrum launched the Arbitrum Short-Term Incentives Program with a total value of up to 50M ARB. GMX is the first approved platform and will receive a total of 12M ARB, accounting for 24% of Incentive’s total, and in addition, there are 29 projects participating in this program. If the average 50M ARB is divided among 29 projects, each project only receives about 1.7M ARB. Through this, we can see the influence and prestige of GMX on the entire Arbitrum ecosystem.

12M ARB will be used for a number of purposes such as:

- As a reward for Traders.

- Available as rewards for liquidity providers.

- Available as rewards for projects participating in the Arbitrum ecosystem.

It can be seen that GMX is facing a great opportunity to regain what it has lost recently. However, Incentive is only suitable in the short and medium term, GMX needs to have truly long-term plans to continue to maintain its position on Arbitrum.

Summary

GMX has clearly lost steam in the Perp DEX race recently for many different reasons, but the project also has many opportunities to regain what has been lost. Hopefully through this article everyone can understand more why GMX V2 has not been as successful as expected?