Perpetual Protocol is one of the leading projects in the DeFi market in the Perp DEX trend – a decentralized derivatives exchange. Although it has been in operation for two years, has had a “revolution” in its operating mechanism, and is also a project that received Optimism Incentive, Perpetual Protocol still cannot gain market share before other competitors.

So where did the failure of Perpetual Protocol come from? Is the problem internal to the project or are competitors in the same industry like dYdX and competitors in the same Optimism system like Kwenta/Polynomial too strong? This article will provide you with some useful perspectives in your quest to find GEMs in the Perp DEX industry for the coming season!

Perp V1 Opens Up the Concept of vAMM

When Perpetual launched in 2021, it was the first project to bring to the DeFI market the concept of a vAMM (virtual AMM). Everyone can learn about the working mechanism of vAMM through the article What is vAMM (Virtual AMM)? Overview of Virtual Automated Market Makers.

Here I will use the word “vAMM V1” to refer to vAMM of Perp V1 version. Basically, vAMM V1 is a tool to calculate the exchange rate of a token pair based on the quantity of each token in the pool, using the formula x * y = k (of Uniswap V2). Unlike Uniswap’s AMM, vAMM V1 does not need real assets to establish and maintain the pool, the initial balance of a token pair as well as the “k” value will be set by the project itself. So there is no need for LPs either.

For example, when users trade the vETH/vUSDC pair (virtual ETH and USDC) on vAMM V1, they only need to use USDC as collateral, then choose the leverage level and trade. Next, depending on the buy or sell order, the protocol will “burn vETH and mint vUSDC” or “mint vETH and burn vUSDC” with the volume multiplied by the leverage factor (eg: x10 leverage, buy ETH with volume 30 vUSDC => vAMM mint 300 vUSDC and burn vETH at current exchange rate).

No liquidity needed! This model eliminates the limitation of leverage. Because if we use a real full liquidity AMM, and then give users 10x leverage to trade by lending Margin, then Perp DEX will need to request 10x more liquidity than a DEX normally. Furthermore, margin borrowing costs will also be a big problem.

The idea of vAMM V1 from the early days of DeFi is a gigabrain idea, many other projects also use the same vAMM V1 model, typically Drift Protocol V1 on Solana.

The problem with vAMM is that the price in vAMM can deviate from the price of the trading pair on the spot market. Therefore, Perpetual Protocol has applied a funding rate to keep the price of vAMM from going too far compared to the DEXs that Perpetual references.

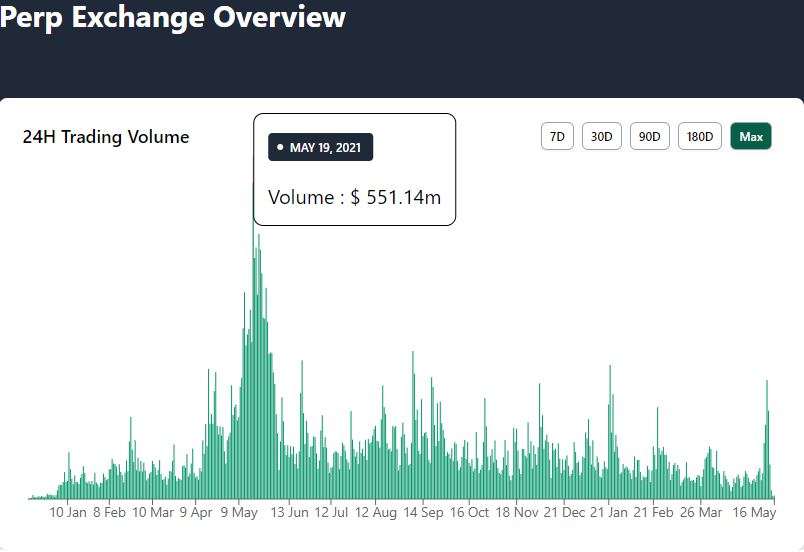

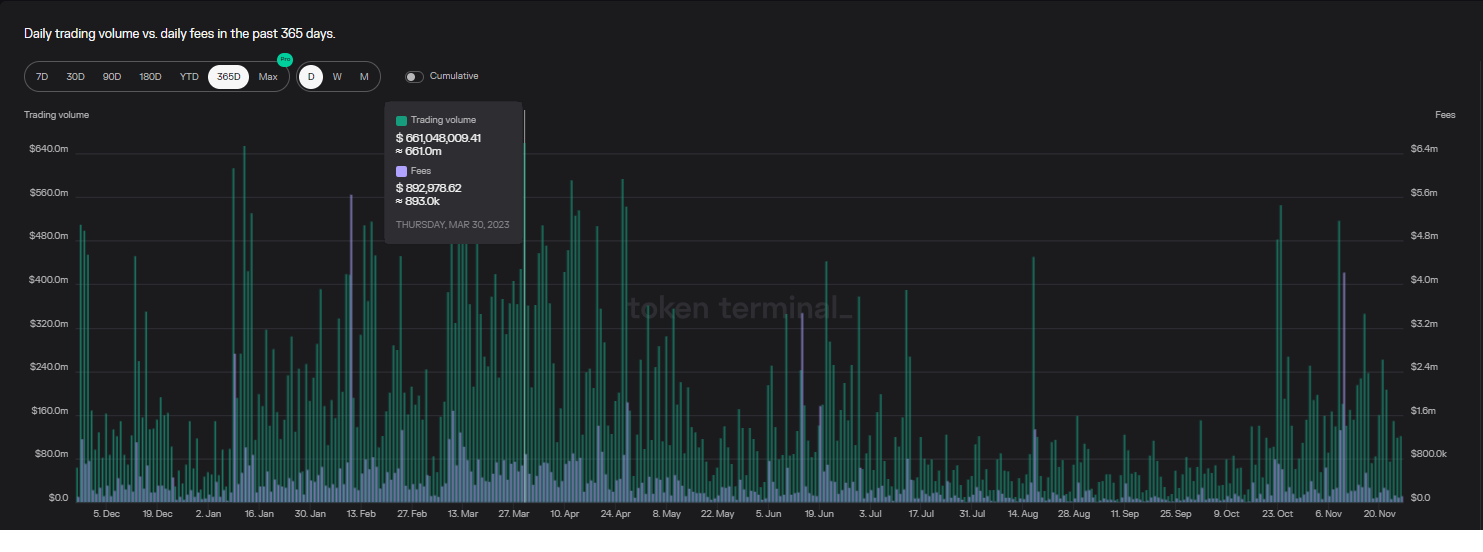

Perpetual Protocol v1 is the largest decentralized derivatives trading protocol in terms of trading volume during the summer 2021 period.

During the first month of summer 2021, trading volume on Perp V1 reached about $200M – $400M a day, peaking up to $550M on the highest day. At that time, dYdX did not even have a foothold in the market, the trading volume recorded on Ethereum was usually only around $10M – $30M a day.

To put it into perspective, GMX’s highest daily trading volume is about $660M. It can be seen that the heat of Perpetual with vAMM V1 at the beginning of the Perp DEX market is undeniable.

However, in reality, when the market fluctuates strongly, especially dumps are too strong, DEXs using vAMM V1 begin to deviate greatly from the base market. For example, the price on Perp does not decrease in time compared to the actual price, the project will have to open short orders to make vAMM move closer to the price. However, this means that the funding rate is greatly increased and must be free. paid project.

Failure Before Event LUNA – UST

During the LUNA-UST event series in 2022, strong fluctuations in the market caused an Oracle price error to appear in Perp V1, causing Perp V1 to not have time to liquidate loss-making positions, leading to a huge bad debt that the insurance fund of The project cannot make up for it all.

There are many traders with very large positive PnL but cannot take profits. Total user losses amounted to $44.6M (approximate figures). Perpetual DAO had to decide to do two things to compensate:

- Mint added the project’s governance token PERP to gradually sell and repay users. This case for a project seems to be the last step. Mint adding native tokens for sale will ensure benefits for users, but it will cause great damage to holders, investors and Perpetual’s own team. Proposal details – discussed here.

- Use monthly revenue to buy back PERP tokens from holders, then compensate users. Proposal details – discussed here.

In summary, Perpetual V1 with vAMM without liquidity is a risky model, mainly due to the fact that the price of vAMM is often different from the actual market price. Having failed with LUNA-UST, Perp V1’s past market dominance is reduced to ashes.

Not Making Effective Use of Incentive Resources From Optimism

Post-incident, Perpetual is one of the protocols with the most OP Incentives, with 9,000,000 OP and worth about $6.5M as of June-July 2022. However, Perpetual has not effectively utilized the resource. this capital.

- Immediately sell 500,000 OP through Uniswap, then bridge out of Optimism through Hop Protocol.

- 1,800,000 OP is used to airdrop to users, many of these “users” are project family members. This results in the majority of users only receiving a small amount of OP.

- The remaining amount is allocated to 15 trading pools on Perp with an incentive of 5,000 OP/pool/week.

Received incentive from Optimism, but Perpetual immediately reduced TVL by ¼. This is the most miserable period of Perpetual Protocol. However, we all realize that Perpetual has used every measure to refund victims of Perp V1.

Perp V2 “Real” Liquidity, “Virtual” AMM

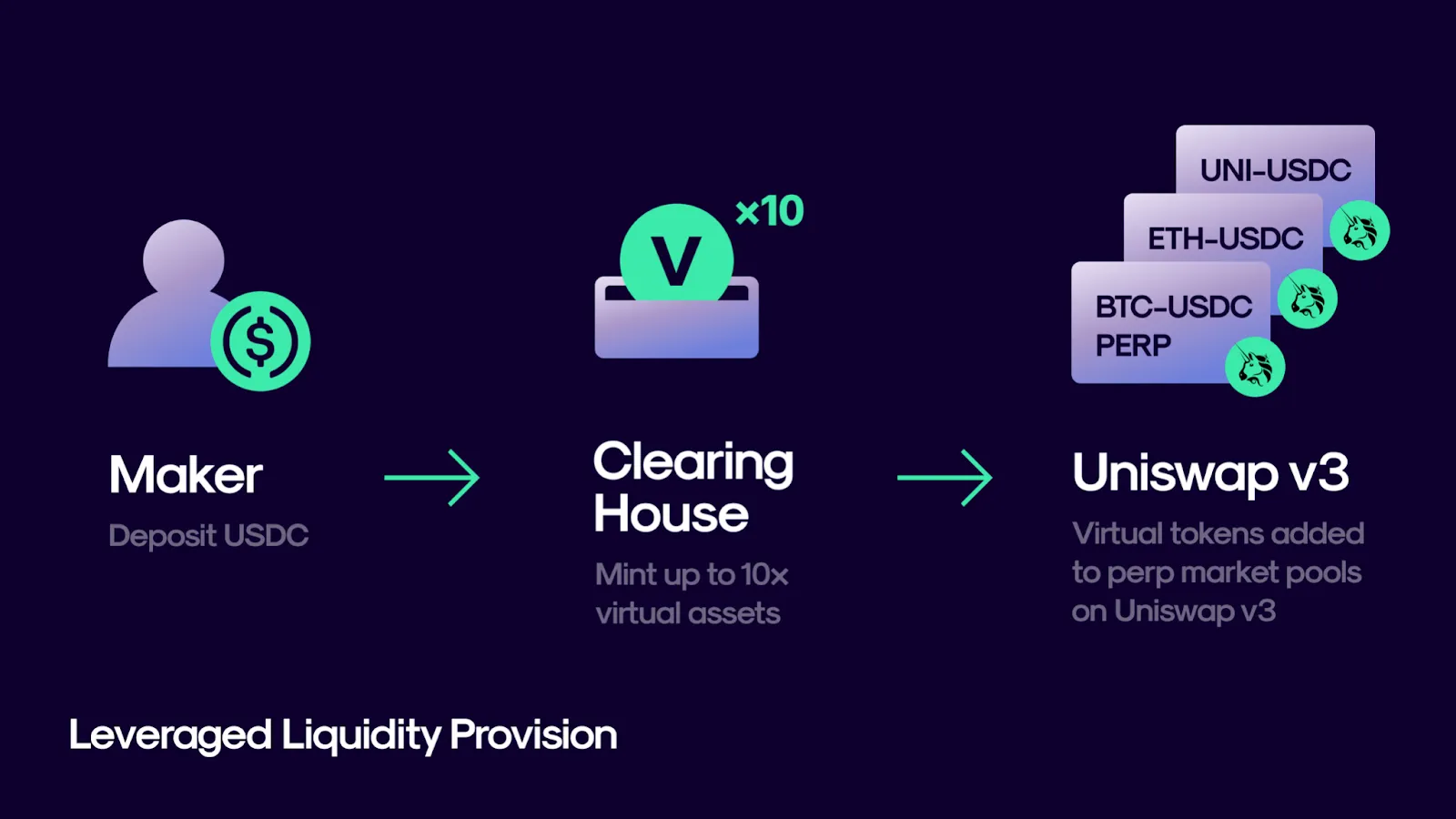

Perpetual Protocol soon realized that virtual liquidity was an impossible dream, they quickly built and developed Perp V2 with real liquidity on Uniswap V3.

With vAMM V2, Perpetual’s model allows collateralizing USDC to mint other token pairs in an amount x10 times. For example, using 100 USDC mint gets 1000 vUSDC tokens, or 500 vUSDC plus 0.25 vETH tokens (assuming ETHUSDC is 2000). These vUSDC and vETH are real tokens and can be brought to Uniswap V3 to create a pool.

- For liquidity providers, they will mortgage USDC to Perpetual, then Perpetual will self-mint and provide liquidity on Uni V3.

- For traders, they only need to mortgage USDC. Depending on the buy or sell order, Perpetual will mint vUSDC or vETH to swap on the vUSDC/vETH pool on Uniswap V3.

Accordingly, this is an AMM model with real liquidity, however the liquidity of asset pools is v-tokens minted from USDC mortgages, which are not freely traded on the market.

Perp V2 has been relatively stable up to now, and although the project has made a lot of efforts to develop, it has not achieved great results.

Perpetual’s Weak Efforts

Vetoken

In August 2022, Perpetual launched veToken with vePERP. The characteristics of vetokenomic are that it will stimulate liquidity, ensure benefits for holders and aim for a long-term game.

However, the key is still that the price of the $PERP token must be attractive enough and the incentive attractive to stimulate liquidity.

In fact, $PERP has completely out performed compared to the general market. Therefore, Perpetual’s vetokenomic cannot create the necessary heat to warm up the entire model.

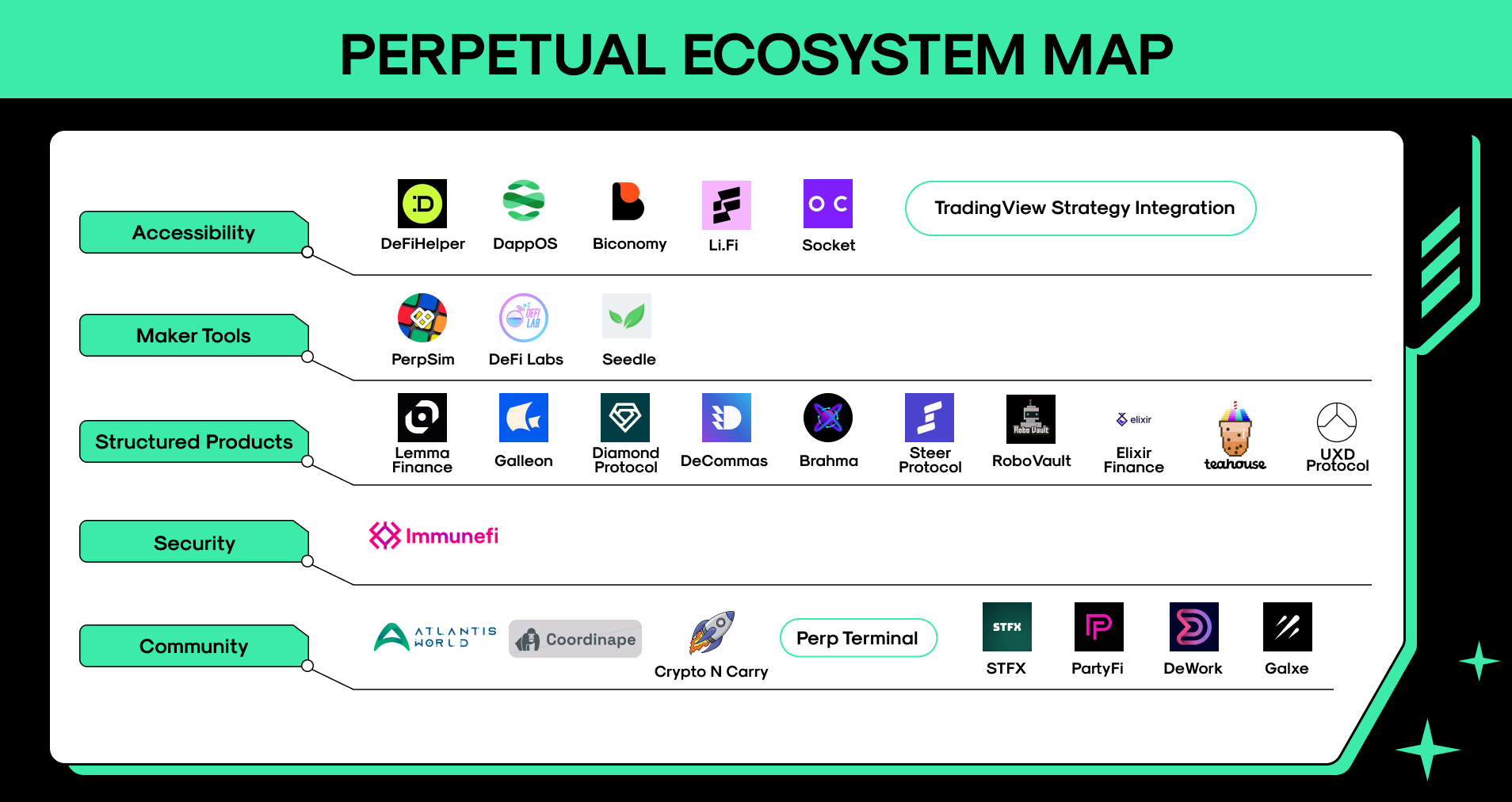

Ecosystem development

Perpetual spends a lot of resources on granting grants to “build on” Perpetual projects. Every quarter, many projects are awarded and build products to create an ecosystem around Perpetual.

These could be security projects, a few clients, projects providing trading bots, data analysis projects, etc. However, most of them do not make a big difference.

Build complementary products

The weakness of AMM or vAMM is that it cannot support limit orders and take profit/stop loss orders. Often, vAMMs will need to deploy additional smart contracts to add the feature of placing pending orders. More advanced can be hybrid with CLOB.

Perpetual has also integrated CLOB into vAMM V2 to provide additional features to users. This update took place in July 2022, when dYdX dominated the Perp DEX market.

In addition, Perpetual also provides users with arbitrage trading bots with FTX. Whenever there is a price difference on Perpetual and on FTX, these bots become active. However, FTX collapsed at the end of 2022, causing the product to fall short of expectations.

Losing Competitive Edge With Young DEX Perps

On both product and tokenomics factors, Perpetual has gradually lost its advantage compared to new generation Perp DEXs.

- First of all, the most effective CLOB model in the market is dYdX’s Perp DEX.

- On layer 2 Optimism, Perpetual lost to Kwenta or Polynomial of Synthetix’s ecosystem, taking advantage of sUSD’s liquidity model.

- In addition, Arbitrum’s ecosystem is also a potential land for decentralized derivatives exchanges. Many new generation projects such as Vertex and Rage Trade V1 also apply the vAMM model of Perpetual Protocol.

Users are finite, Perp DEXs must gain market share from each other. At the present time, one of the important factors to attract users to the project is the economic model. A project that has been financially exhausted after the Terra – Luna crisis like Perpetual will find it difficult to regain its position based solely on product changes.

Summary

Above are some perspectives on the failure of the once glorious Perp DEX – Perpetual Protocol. Obviously, in the process of looking for potential projects, we not only need to look at the brilliant glory of dYdX, GMX or lower tiers like Gains Network, Kwenta, Vertex,… but we also need to look at the failures. of leading projects.

Although Perpetual currently does not have much development potential, it has also created a great premise for the Derivatives segment in the DeFi market. The project’s efforts in ensuring user rights also deserve recognition. .

Hope everyone can draw useful insights from this article.