dYdX is a Layer 2 that provides derivatives trading products with leverage. The project quickly attracted users and processed billions of dollars in transaction volume every day thanks to its technology and extremely fast order matching speed.

But in 2022, the project approved a proposal to convert dYdX into Blockchain Layer 1 in the Cosmos ecosystem. While projects like Celo or Fantom are moving from Layer 1 to Layer 2 on Ethereum, why is dYdX going in the opposite direction?

Let’s find out the reasons and motivations for the dYdX project to move from Layer 2 to Layer 1!

Overview of dYdX

dYdX is a perpetual derivatives exchange (Perpeptual) developed to compete with CEX exchanges. dYdX creates trading liquidity using a CLOB-style order book, meaning trading orders will be matched in the Offchain environment.

With the V3 version in operation at the present time, this is a Layer 2 on Ethereum developed based on StarkEx’s zkRollup technology. Using STARK proof will bring transaction privacy.

In essence, dYdX’s order book is operated by a third party similar to CEX exchanges. The difference is that the project allows users to access using Web 3 wallets and user-controlled assets. That is also the biggest difference between centralized and decentralized platforms.

dYdX is also Layer 2 on Ethereum using zkRollup technology, so the transaction or order placement speed is hundreds of times faster than Ethereum but still meets high security for users thanks to transactions being aggregated and sent to the Layer. 1 Ethereum.

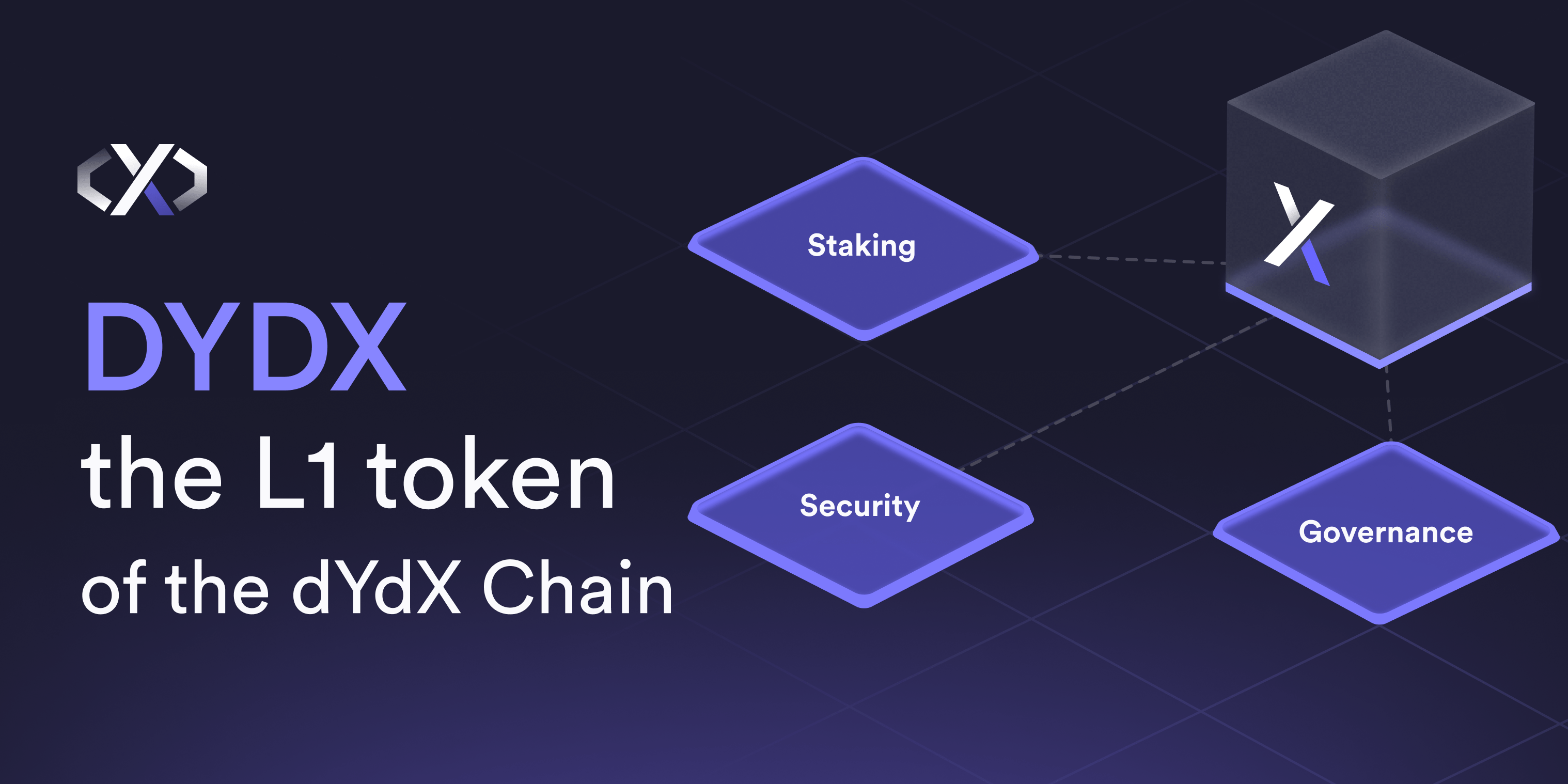

As for the V4 version of dYdX, it is a Layer 1 using the PoS consensus mechanism built based on the Cosmos SDK toolkit. This Layer 1 officially Mainnet on October 26, 2023. It uses DYDX Token as proof of stake for the network. Therefore, in addition to the Governance feature, DYDX is also used to pay transaction fees and Stake to Validators.

The transaction fees that Layer 1 dYdX collects in USDC and DYDX will be used as rewards for Validators and Stakers. But for market makers, they will be free to participate in creating liquidity for the market.

Currently versions V3 and V4 of dYdX will work in parallel with each other. So why did the V3 version have a resounding success with a daily transaction volume of up to billions of dollars and hundreds of thousands of traders participating in transactions every day, but did dydX develop Layer 1 with the V4 version? To answer this question, let’s go to the next part.

Why Did dYdX Change to Layer 1?

Although currently the V3 and V4 versions of dYdX operate in parallel, the project’s vision is to transfer all values from dYdX V3 to dYdX V4. The project when founded had a vision of creating products for everyone and being completely decentralized and Layer 1 is the destination.

dYdX is new to the Mainnet and has not yet been put into stable operation, so the project needs time to develop. Especially in need of high security from the Validator system, a large enough amount of dYdX is staked to ensure that no one can attack. Then, dYdX will fully work with the only Layer 1 version.

So why move dYdX to Layer 1? This is true to the vision of delivering decentralized products. The first is that dYdX Chain will operate independently with its Validator network, it is not dependent on Ethereum, not affiliated with StarkEx or StarkWare. Layer 1 dYdX will be a completely decentralized network, managed by the community.

With version V3, dYdX uses off-chain order matching Orderbook (Offchain) to respond at the fastest speed possible, similar to CEX. It unintentionally brings concentration risks and lack of transparency to the Crypto market. With dYdX Chain, the Validator will operate this order bookthereby turning the order book into a space that is not controlled by anyone.

The zkRollup technology that dYdX V3 uses from StarkEx offers higher scalability than Ethereum with a TPS of about 100. But when moving to Layer 1, the project can handle with Speed up to 10 thousand transactions every second. Needing fast speed to meet market demand for the upcoming season, the scale of Crypto will be much larger than at present.

dYdX is built using the Cosmos SDK toolkit to be Layer 1 compatible with EVM and connect to all blockchains other, especially the Cosmos ecosystem. This orientation helps dYdX become a trading platform ready to accept users and cash flows from any other blockchain, not just Ethereum.

The development team built dYdX Chain as a Layer 1 which also helps increase the applicability of the project’s original Token, DYDX. This token with version V3 is only used for administrative voting and incentivizing core users. In version V4, in addition to being used for Governance, the DYDX Token is also used to pay transaction fees and Staking in Validators to receive rewards.

dYdX chose Cosmos SDK because the toolkit was very optimized to help the team build a Layer 1 quickly, in fact about 1 year. The Cosmos SDK allows for a very high level of customization of the structure and components in the chain. Especially since there aren’t many dependencies and constraints on Cosmos. Allows Layer 1 to develop freely.

Personal Projection

dYdX is the largest decentralized perpetual derivatives exchange in the Crypto market, handling billions of dollars in trading volume every day. Therefore, the project is developing in appropriate directions such as decentralization and improving scalability to meet the transaction needs of millions of users that will pour in in the next cycle.

The founder of dYdX is Antonio, he used to work for Coinbase so he has a lot of experience and ability to develop products in this field. Antonio and dYdX are also supported by Fred Ehrsam Co-founder of market-leading venture capital fund Paradigm. Fred Ehrsam was also a co-founder of Coinbase Exchange. In terms of talent, it goes without saying. And he participated in advising and supporting the project a lot.

With talented people developing a product together, do you know how good it is? And in fact, dYdX is leading in the Derivative segment and its trading volume even exceeds Coinbase.

The project has launched a mobile application, this product is futuristic and truly necessary. Placing orders right on the phone will be much more convenient and easier to follow. We can’t always carry a computer with us. I see that Forex traders prefer placing trading orders on the phone, but analyzing entry points using a computer is most intuitive.

Summary

With dYdX’s position, vision and future direction, the project will continue to thrive and become a competitor that CEX exchanges fear every time they hear its name mentioned.

Hope this article helps you gain more useful information and knowledge!