What is Zest Protocol? Zest Protocol is a protocol that allows users to borrow Bitcoin built on-chain with open source code under Layer 2 Stack technology. So what is different about Zest Protocol compared to other lending protocols? Let’s find out through the analysis below.

Zest Protocol Overview

What is Zest Protocol?

Originating from the fact that most current lending or borrowing of Bitcoin requires users to place most of their trust in organizations in the traditional market. That Bitcoin will often sit in a cold wallet and not be used to fuel the economy around Bitcoin. The need here is that users need to access a safe source of liquidity without selling their BTC, and organizations need to borrow Bitcoin to expand their operations.

What is Zest Protocol?

Zest Protocol is the solution to the above problems by building an on-chain market powered by the Layer 2 Stack’s Clarity smart contract while inheriting the security of the Bitcoin network itself. The audience that Zest Protocol targets for its products are organizations, market makers, and businesses that have Bitcoin loan needs.

Clarity smartcontracts on Stack can help interact with Bitcoin by reading Bitcoin-state directly from the Bitcoin network without going through another intermediary.

Mechanism of action

In Zest Protocol there will be 3 main participants including:

- Liquidity Providers (LPs): LPs are people who deposit their BTC into the pool from which they can make profits in BTC

- Pool Delegates: These are people with financial expertise who will manage the pool on behalf of Zest Protocol. These will be the people who set the terms for the borrower and are appointed by Zest Protocol. In case of rights abuse issues, the protocol will freeze the loan.

- Borrowers: Zest Protocol targets institutional customers who are in need of borrowing BTC to develop their businesses. Those organizations will include Market Maker, exchanges, businesses that accept payments in BTC. Organizations will often be introduced by Zest Protocol and pass the Pool Delegates assessment.

Zest Protocol operating mechanism

To be able to participate in Zest Protocol’s pool, users should follow these steps:

- Step 1: Users need a Stack and Bitcoin wallet address. Currently there are 2 wallets that support both addresses of the 2 networks above: Xverse wallet and Hiro Wallet. Zest Protocol currently also supports LPs that want to use multisign signing.

- Step 2: Users choose a pool then deposit their native BTC into the pool. This may take about 10 minutes to confirm.

- Step 3: Users will receive the LP token Zest Pool Token (ZPT) in their Stack wallet representing the amount of BTC they deposited into Zest Protocol. When there is a profit, that profit will automatically be reinvested back into the pool.

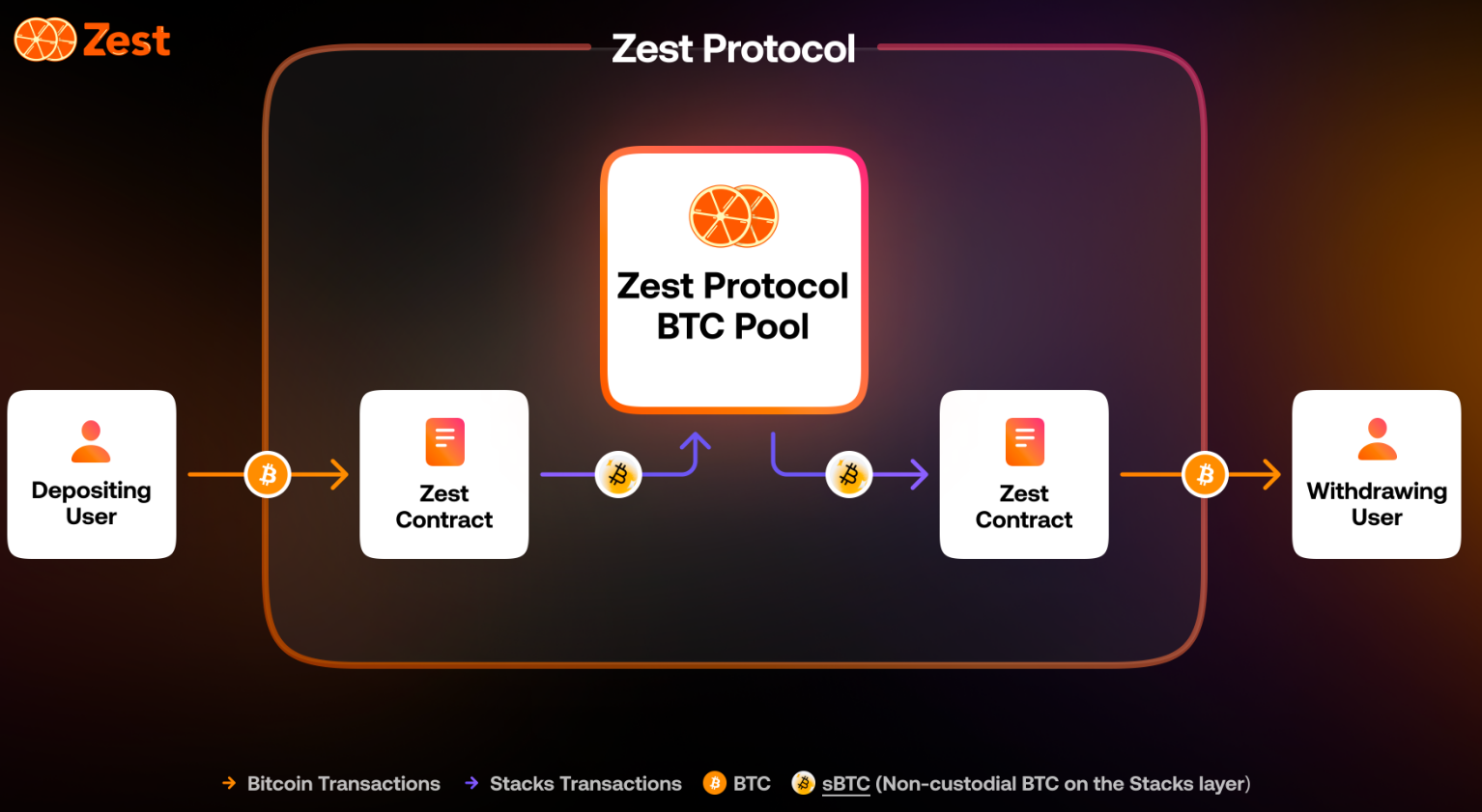

- Send money: When users deposit BTC into Zest Protocol, the BTC will be wrapped and converted to sBTC on the Stack network.

- Withdraw money: When a user withdraws BTC from Zest Protocol, the protocol will convert sBTC back into BTC. Users will receive native BTC directly to their Bitcoin wallet.

For organizations wishing to borrow BTC. They need to connect to the Pool Delegate. Once on the Whitelisted list, they can create a Loan Vault to deposit collateral and receive BTC. All information about the borrower will be kept confidential and loan terms such as amount, loan period, and interest rate will be censored by Pool Delegates.

The amount of sBTC stored in Zest Protocol’s pool, the equivalent amount of original BTC will be kept in threshold-signature script on the Bitcoin network and governed by consensus Stack.

For other protocols, BTC will have to be wrapped or converted into wBTC before participating in on-chain activities. Wrapping BTC into wBTC or unwrapping BTC will cause users additional fees and liquidity problems. In many cases it can make interacting with lending protocols cost-effective.

Liquidation

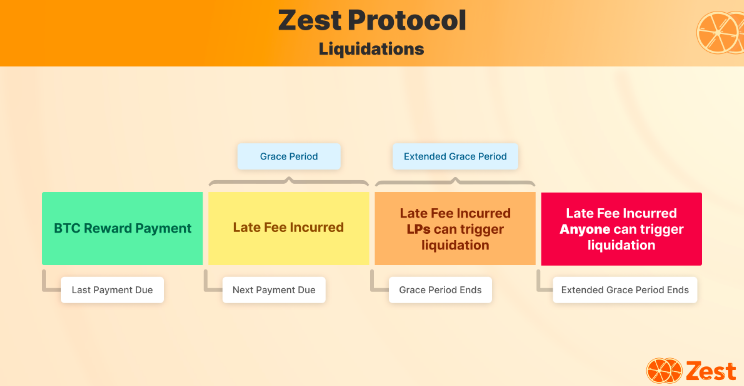

When borrowers forget to pay interest, they have an additional 5 days (Grace Period) to do so before the collateral is liquidated to compensate.

Risks on Zest Protocol

Bitcoin is a coin with a completely different value than the altcoins out there, so users should also consider the following risks when participating in the protocol:

- Bad debt: Lending will come with the risk of bad debt from the borrowers. This can happen at any time, the current Credit sector on DeFi has also witnessed many such cases.

- Risks of Smart Contract: Zest uses Clarity instead of Solidity. Clarity is described as more secure than Solidity, but the risks of security vulnerabilities are always present.

- Risks with L2 Stack: Because the pool on Zest is a smart contract on Stack, this means that if there is an attack on Stack’s network, the risk is also there for the BTC in the Pool.

Development Roadmap

Update…

Investor

Update…

Core Team

Update…

Tokenomics

Update…

Exchanges

Update…

Project Information Channel

- Twitter: https://twitter.com/zestprotocol

- Telegram: https://t.me/zestprotocol

- Website:

Summary

The ecosystem around Bitcoin is gradually forming, which is both an opportunity and a challenge for projects that want to build special things around the king of the Crypto market. Hopefully through the article, everyone has an overview of what Zest Protocol is?