Liquid Staking is an indispensable piece for Blockchain Layer 1 using the Proof Of Stake consensus mechanism. While Ethereum is dominated by Lido Finance, other Layer 1s are the landing spots for many Liquid Staking projects. VoloSui is a Liquid Staking project on the Sui Blockchain. Let’s find out if there are any special things about the project in this article.

To better understand VoloSui, you can refer to the following articles:

- What is LSDfi? The First Puzzle Pieces & Potential In The LSDfi Array

- Overview and Liquidity Flow in LSDfi

- What is Lido Finance (LDO)? Overview of Electronic Conveniences Lido Finance

- Operating Model of Lido Finance (LDO)

Overview of VoloSui

What is VoloSui?

VoloSui is a Liquid Staking project on the Sui Blockchain platform. To be able to become a Validator to participate in confirming transactions on Sui, a node will have to hold at least 20 million Sui Tokens. This causes a huge barrier for retail investors. Therefore, so that everyone can participate in Staking and at the same time unlock liquidity for SUI, many projects have provided Staking solutions that do not require a large amount of Tokens but can still participate. VoloSui is also one such project.

Mechanism of action

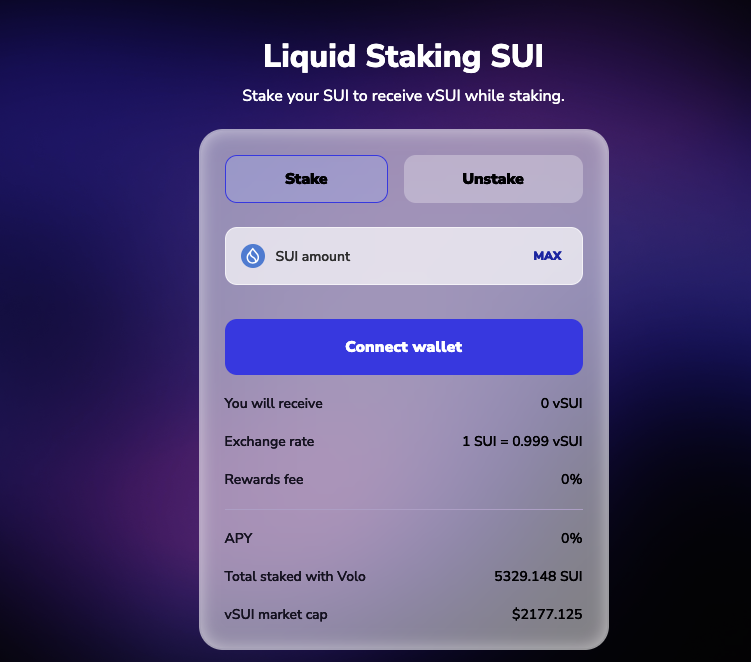

VoloSui’s operating model is quite simple, everyone sends SUI Tokens to the project, and will also receive vSUI tokens (voloSUI) representing the value of the user’s assets deposited.

The project will take this SUI Token to Stake on Sui Network and earn profits to pay users. Here, the project will collect Staking fees through 10% of the profits from the user’s Staking process.

In addition to the profits earned from the SUI Staking process, users who own the vSUI Token can participate in many other Staking projects to receive additional Yield:

- Use vSUI as collateral to borrow other Tokens on NAVI Protocol

- Collateral vSUI to borrow BUCK (a stable coin pegged to USD) with 0% fee.

- Swap, Earn or participate in providing liquidity for vSUI/token pairs to earn trading fees on Cetus.

- Trade, Lend, Farm and Staking vSUI to earn more Yield on Wlsp Swap…

Depending on the purpose and risk appetite, people choose a strategy for using vSUI that is suitable and brings the best profits.

Development Roadmap

Update…

Core Team

Update…

Partners

The project has strategic cooperation with many projects such as: Navi, Releap, Wlsp Swap, Cetus, Kriya DEX, Scallop, MoveBit, OtterSec, Turbos, SupraOracles, Bucket, Pyth, Ankr, Hacken.

Tokenomics

Update…

Exchanges

Update…

Project Information Channel

Summary

The problem for Liquid Staking projects lies in how to create liquidity for their LST tokens. It seems that VoloSui has also grasped this and is actively collaborating with other projects on the Sui ecosystem to increase the use case for the vSUI token. If you are interested in the project, please follow me to update the latest news.