What is veToken? veToken is a new Tokenomics model introduced by Curve Finance, thereby promoting DAO and project development. It can be said that veToken is a strong revolution in bringing Native Token and Holder closer together, it will not only be about holding for growth and taking profits but also many other accompanying strategies.

What are you waiting for? Come join me to find out what veToken is in the article below.

Overview of veToken

What is veToken?

veToken stands for Vote Escrowed Token and is a revolution in reform and redesign to optimize Tokenomics introduced by Curve Finance. It is the veToken model that has pushed Curve and Curve’s DAO to grow stronger and stronger, creating a Curve Wars with a series of big names such as yEARN Finance, Convex Finance,… To this day, this is still the A model favored and applied by many projects.

veToken has turned Holders into not only people who simply buy, hold and take profits, but also participate in the project operation process and coordinate liquidity to earn maximum profits for themselves. Sometimes this profit is even higher than their daily purchases.

Mechanism of operation of the veToken model

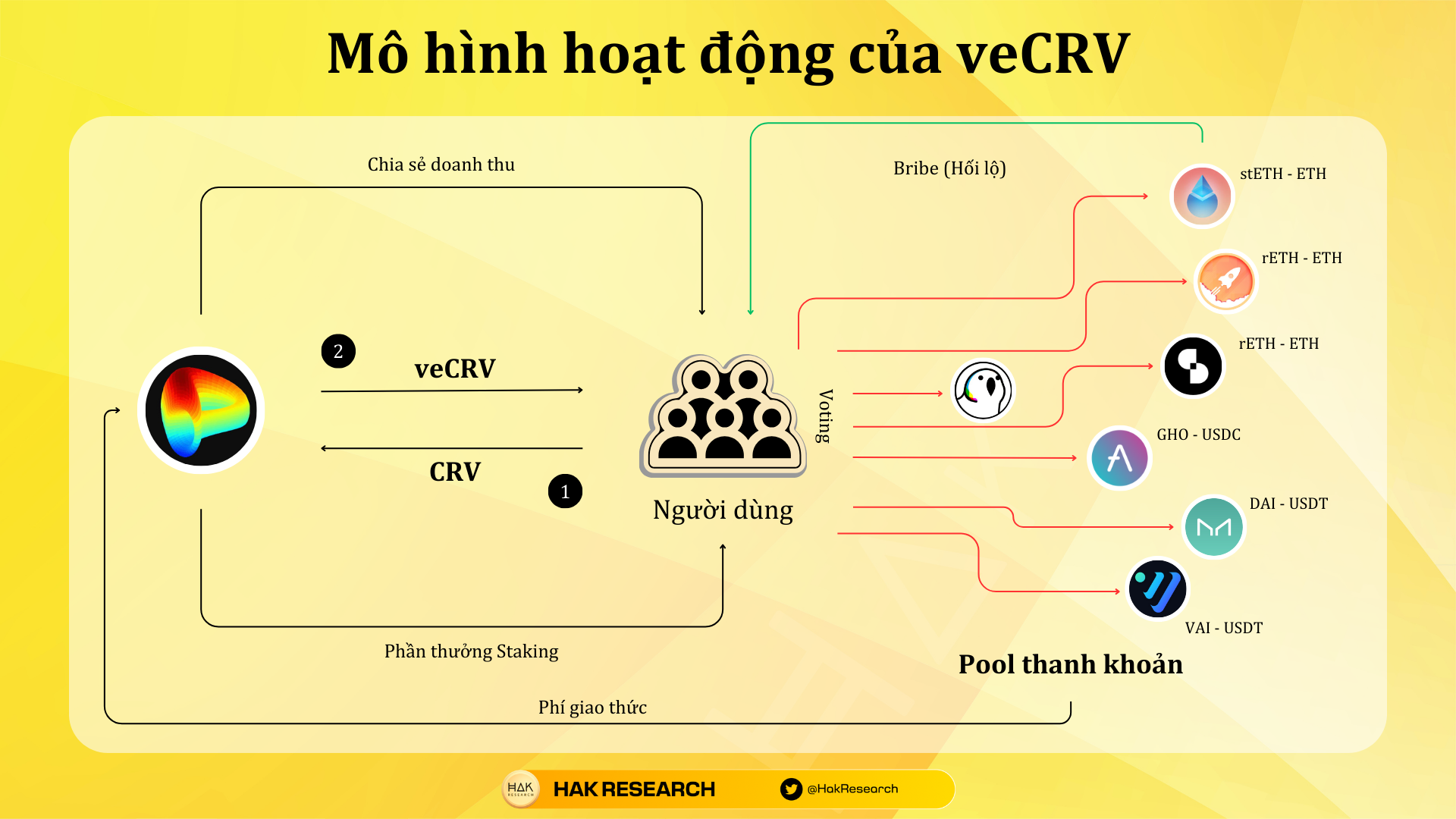

Because the originator of this veToken model is Curve Finance, we will learn about the operating mechanism of Curve Finance. The operating mechanism will be through some basic steps as follows:

- Step 1: Users can lock CRV from 1 week to 4 years to receive veCRV. For example, if you lock 1 CRV for up to 4 years, you will receive 1 veCRV, but if it is lower, you will receive less veCRV.

- Step 2: Users holding veCRV will have rewards including CRV inflation, bribe fees from voting, and protocol revenue sharing.

It was because of two factors, voting on the protocol and sharing protocol revenue, that the first Curve Finance war broke out.

Curve Wars explodes

We will dive deeper into two factors: protocol voting and protocol revenue sharing. First, with voting, the amount of CRV emitted to make Incentive for the regular pool is the same. Through voting, the DAO will agree on which Pool will receive the most Incentive as CRV. Of course, there will be Solutions to avoid voting in Pools with low Volume.

Second, Curve is a better protocol than Uniswap V3 for peer-to-peer assets, especially Stablecoins, that’s why Curve Finance’s revenue is extremely huge because the demand for Stablecoin transactions is so great. That’s why everyone wants a part of Curve Finance’s revenue.

We will see that the first and second elements interact with each other through a simple flyweel as follows:

- Step 1: Holders will focus on voting for pools with large volumes to put Incentive there.

- Step 2: The liquidity pool has many Incentives and is prioritized by LPs to provide liquidity because of the attractive rewards. The more liquidity, the larger the liquidity pool, leading to a decrease in Impermanent Loss, thereby making LPs even more motivated to add liquidity.

- Step 3: High liquidity, low Slippage leads to more and more users coming to swap.

- Step 4: The more crowded the Swap, the more beneficial it is for Holder and continue to return to step 1.

Obviously, with the veToken model, the project has had cooperation in developing the protocol from everyone including LP, Holder, Users,…

That’s why Curve Wars exploded when protocols competed for veToken with the Liquid Staking solution for veCRV. This battle seemed like yEARN Finance had won, but an emerging project has gained the main position, Convex Finance.

Advantages of the veToken model

veToken brings a difference to both users, projects and LPs as follows:

- Token price will be the first factor to benefit because when this model is activated veToken, the amount of Tokens outside the market will be locked, thereby reducing supply and having a positive impact on Token prices.

- Players who want to maximize profits must become a veHolder. The more active you are, the more rewards you get, because if you vote in the wrong pool, the rewards will be less, thereby making the project’s DAO more active.

- Similar to Holder, liquidity providers who want to optimize profits must also lock their CRV Incentive to participate in voting.

- The project benefits when they can use Bribe (bribe) to encourage the community to vote for them.

Disadvantages of the veToken model

Although it is great, the veToken model also has certain disadvantages such as:

- Some Whales take advantage of their veToken amount to vote in pools with few traders and they are the ones who both provide liquidity and trade the most.

- Locking in 4 years is an extremely long period of time equal to an entire cycle in the Crypto market, so it has somehow reduced the excitement of investors. Perhaps it would be better to shorten the time to about 1/2.

- Because veCRV was only used to participate in voting on the platform, the user’s main asset, CRV, was locked.

Wars continuously broke out

veCRV, Curve Wars have had a huge impact on the Crypto market and many projects have later changed their token model to veToken or designed the veToken model from the beginning:

- Trader Joe – an AMM project on Avalanche and Arbitrum has also converted to the veToken model.

- Wombat Exchange – StableSwap on BNB Chain and Arbitrum later also followed the veToken model from the beginning, later we had the war between Wombex, Quoll Finance and Magpie.

- Maverick – an emerging AMM on Ethereum and zkSync has also implemented the veToken model and Maverick Wars officially kicked off recently.

Summary

veToken has created a drastic change in the way users participate in DeFi and in projects building an ambitious Tokenomics model.

Hopefully through this article everyone will understand more about what veToken is?