What is Vesta Finance? Vesta Finance is a prominent CDP platform on the Arbitrum ecosystem with a decentralized tablecoin called VST. So what is special about Vesta Finance and why should we pay attention to this project? Let’s find out through the article below!

To understand more about Vesta Finance, people can refer to some of the articles below:

- What is Lending & Borrowing? The Essential Puzzle Piece in DeFi

- What is Venus Protocol (XVS)? Venus Protoco Cryptocurrency Overview

- What is Maker DAO (MKR, DAI)? Overview of Cryptocurrency Maker Knife

Overview of Vesta Finance

What is Vesta Finance?

Vesta Finance is a product in the Lending & Borrowing segment but belongs to the CDP (Collateralized Debt Position) branch. Simply envisioned, Vesta Finance is the Maker DAO on Arbitrum’s ecosystem. Users will deposit their collateral to mint stablecoin VST.

Similar to Maker DAO, Vesta also has 2 tokens: VST (stablecoin pegged for $1) & VSTA (governance token).

Mechanism of Action

Currently, Vesta Finance accepts ETH, renBTC, gOHM, GMX, GLP (representative token when providing liquidity on GMX) and DPX as collateral to mint stablecoin VST.

For GMX and GLP, immediately after depositing into Vesta Finance, this platform will take GMX and GLP for staking on the GMX platform itself. As for why accept gOHM as collateral because Vesta Finance is a product of the incubator of the once famous DeFi 2.0 project Olympus.

Core Team

The project construction team is anonymous. According to my observations on Arbitrum Ecosystem, many projects are built on Arbitrum anonymously.

In fact, most of the projects on Arbitrum are built by anonymous teams such as GMX, Dopex, Jones DAO, Radiant Capital, Vesta Finance,…

Investor

Vesta Finance is backed and invested by many leading names in the crypto industry such as:

- 0xMaki: has made important contributions to Sushiswap, LayerZero,…

- DCFGod: KOLs have more than 70k followers on social networks

- Lau Brother: 2 famous brothers founded their own VCs

Above are 3 advisors of Vesta Finance during the construction process, followed by prominent Angel Investors in the crypto market such as: Tetranode, DCFGod, Fiskantes, Not3Lau CapitalSam Kazemian, 0xmons, Wangarian, OmniscientAsian, PopcornKirby, Nick Chong, Calvin Chu, Jae Chung, Anthony Sassano, Eric Conner, Mariano Conti, Shuyao Kong, Feir,…

- 0xmons: Founder 0xmons & Sudoswap

- Calvin Chu: Impossible Finance

- Sam Kazemian: Frax Finance

It can be said that Vesta Finance is one of the rare projects that receives the support of many famous KOLs in the crypto community.

Development Roadmap

Vesta Finance provides a relatively comprehensive roadmap from short, medium and long term

In the short term: The project wants to build a DEX Aggregator platform that helps users use leverage in transactions. I think with this DEX Aggregator, people can easily invest right after receiving VST (stablecoin) without needing to access another DEX platform and then use collateral on Vesta itself and continue like that.

In the medium term

Vesta Finance will improve its operating model

Building an AMO liquidity pool helps VST regain peg when de-peg. Currently the project’s stablecoin is de-peg at 0.975. In the past, VST used to be at the lowest level of 0.9 and the highest level of 1.03.

- The project designs a new interest module that brings more revenue to the protocol.

- Improve the liquidation ability of the project.

- The VSTA token staking module has been improved to help optimize costs for users.

- Improvements help the project have more collateral in the future.

Besides improving the project’s operating model, Vesta Finance also aims for a Multichain vision after deploying on Layer 2 like Arbitrum, the next destination will be zkSync & Optimism and targets all existing Layer 2 platforms. .

After Layer 2, the next destination will be Layer 1 (non-EVMs) like Solana & Near. Vesta Finance is quite interested in Layer 1s using the Rust language.

In the long term

- Accept more collateral to mint stablecoin VST.

- Accept NFTs as collateral.

- There are products that involve fixed interest rates.

Besides, the project has been audited by Trail of Bits, Coinspect and Verilog. In addition, Vesta Finance also has a number of notable updates such as:

- June 24, 2023: Vesta Finance has officially introduced version V2 to the community with many changes in the operating model of Stablecoin VST and a number of other programs. To understand more about Vesta V2, people can refer to the article Vesta V2: Ambition to Build the Largest Native Stablecoin on Arbitrum.

Tokenomics

Information about Vesta Finance tokens

- Name: Vesta Finance

- Code: VSTA

- Blockchain: Arbitrum

- Token classification: ERC 20

- Contract: 0xa684cd057951541187f288294a1e1c2646aa2d24

- Total supply: 100,000,000

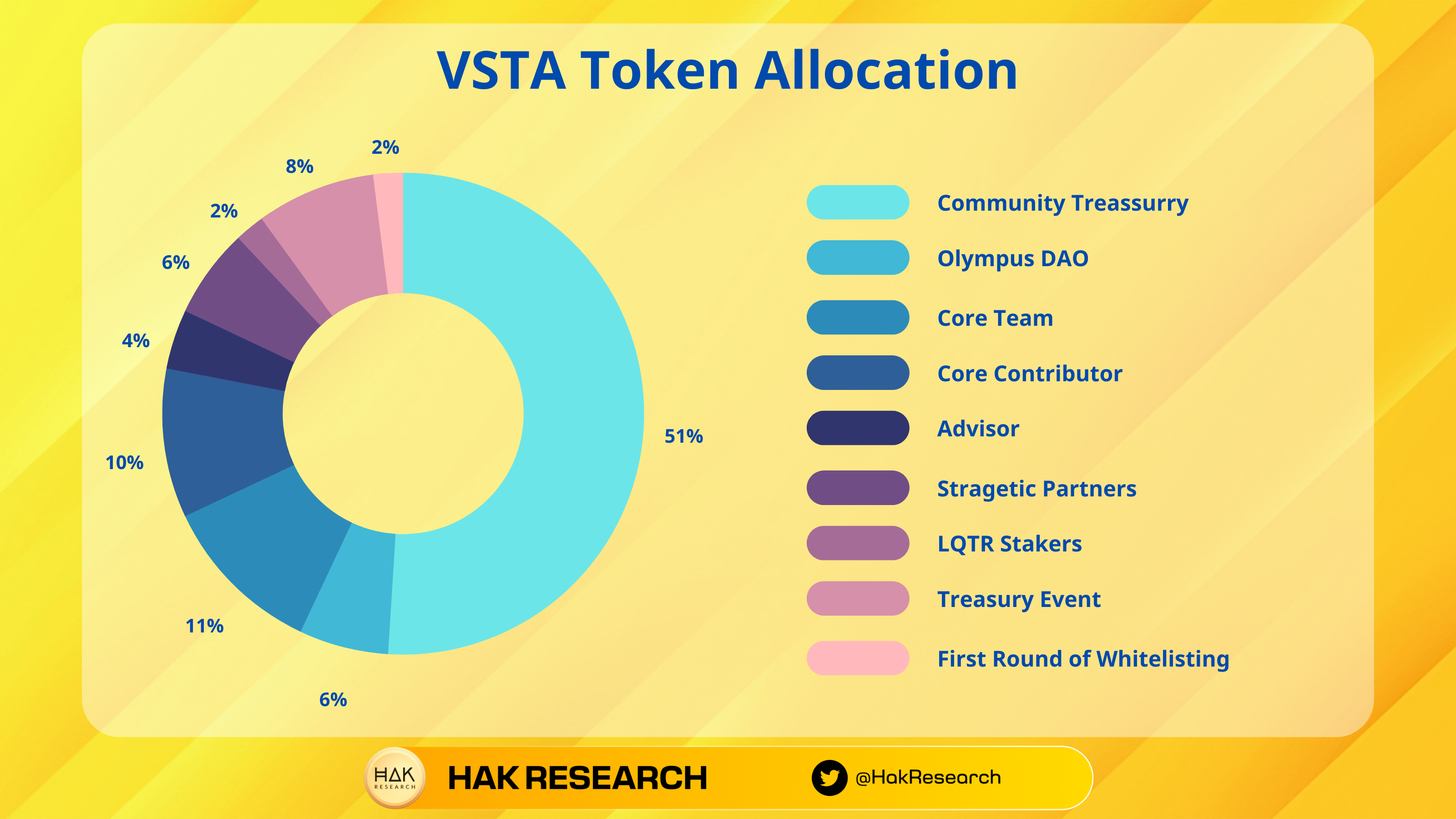

Token Allocation

- Current & Future Core Team: 21%

- Advisor: 4%. Of which more than ⅓ is still held by the team to search for new advisors in the future. This 25% will be paid linearly within 2 years between the core team & advisor, there will be a difference of 6 months. There is no information about the token key.

- Olympus DAO & Stragetic Partner: total 7% paid linearly over 2 years with lock-in period of 6 months

- Liquidity Mining/Tresury: accounts for 63% of the total project token supply.

- Whitelist: for the community that has supported the project for a long time is 1% with a price of $0.375.

- Bootstrap events for the protocol accounted for 4%.

Exchanges

Currently, users can trade VSTA on a number of exchanges such as Balancer, MEXC, Uniswap V3 or OpenOcean.

Project Information Channel

- Website: https://vestafinance.xyz/

- Twitter: https://twitter.com/vestafinance

- Discord:

Summary

The project is advised by influential individuals in the crypto market and is supported by Olympus DAO, a DeFi 2.0 project that once caused a stir in the market, so it can be said that this is one of the notable projects in the industry. the crypto market in general and the Arbitrum ecosystem in particular.