What is ve(3,3)? ve(3,3) is one of the unique solutions around project related issues including LP, Users & Holders. ve(3,3) has become extremely familiar to the community today, but when it was introduced, it really created a fever for the DeFi market.

What are you waiting for? Everyone, let’s find out what ve(3,3) is in the article below.

Overview of ticks(3,3)

Motivation for the birth of ticks(3,3)

ve(3,3) was born in the context of the DeFi market booming with the trigger coming from the Liqidity Mining mechanism, meaning the project will use its Native Token to reward users on the platform. . It can be said that Liquidity Mining has had positive impacts to help new projects without abundant financial resources from investment funds but can still bootstrap liquidity. However, there is also the problem that if the project overuses Liquidity Mining, sooner or later the project will not be able to survive in the DeFi market.

Because if users and LPs keep receiving Incentive as a Native Token whose Use Case is not too special, simply staking, there is a high possibility that they will sell it, causing the value of the Native Token to decrease, thereby leading to a decrease in Incentive. then everyone left the project.

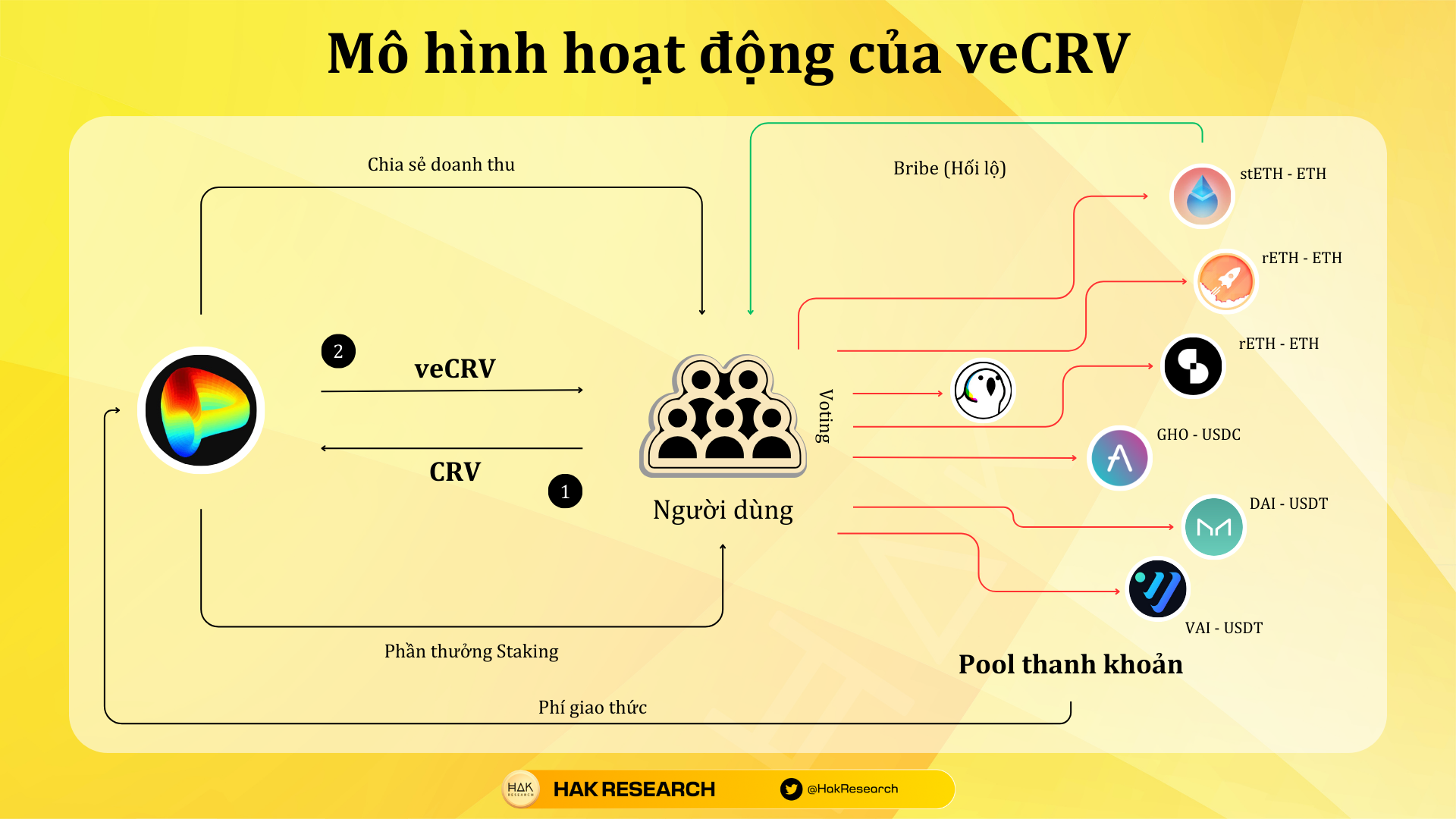

To solve this Liquidity Mining problem, Curve Finance has introduced the veToken model. With the veToken model, users are required to participate more deeply in protocol activities. Not only users but also LPs who want to optimize profits must lock CRV to receive veCRV and then vote for the pools. beneficial for yourself.

With the veToken model, it has solved the user problem. LPs still lock their Native Token and Incentive rewards if they want to optimize profits. However, veToken still has some problems, especially the user’s Native Token can be locked in the protocol for up to 4 years (equal to Bitcoin’s Halving cycle). ve(3,3) was born to solve this outstanding problem.

What is ve(3,3)?

The ve(3,3) project model was first introduced by Andre Cronje with the AMM Solidly platform built and developed on the Fantom network. ve(3,3) is a combination of Vote Escrow from Curve Finance and (3,3) from the Olympus DAO platform. To put it simply:

- Vote Escrow: Is the act of locking a Token to have voting rights on the protocol. There will usually be a lock-in period and the longer the lock-in, the more voting power there will be. For example: If you lock 1 CRV for 4 years, you will receive 1 veCRV, and if you lock for 1 year, you will only receive 0.25 veCRV. veCRV will have administrative rights on Curve Finance.

- (3,3): This is the game theory introduced by Olympus DAO. With this model it initially works to everyone’s advantage then it moves to the disadvantage of everyone and finally it finds an equilibrium where no one benefits too much.

How does Solidly with ve(3,3) work?

To understand in detail the operating mechanism of Solidly, people can read more here. Some of Solidly’s features include:

- The liquidity pool combines both Uniswap V2’s model for volatile assets and Curve Finance’s model for Stable assets.

- SOLID & veSOLID: SOLID key receives veSOLID. For example, 6 months from 1 SOLID to 0.125 veSOLID.

veSOLID holders will receive a number of benefits including:

- Get SOLID from locking program.

- Receive all transaction fees from the groups they vote on.

- Liquidity pool voting received Incentive.

- Receive support from DAOs, protocols,… that require their vote.

Everyone is not mistaken. The Liquidity Provider (Liquidity Provider) does not receive anything, the benefits will go to veSOLID holders. Liquidity providers on Solidly can lock LP Tokens to receive SOLID rewards, and if they want to optimize profits, they will continue to have to lock SOLID to participate in voting for the pool they provide liquidity to. .

Advantages of the ve(3,3) model

Obviously, the ve(3,3) model has certain advantages such as:

- Creates scarcity for SOLID because if you want to have SOLID, you must provide liquidity to receive SOLID. As an LP, if you want to optimize profits, you must lock all of your SOLID to participate in voting. From there, creating growth momentum for SOLID.

- Bootstrap provides quick liquidity for the protocol since only LPs can get SOLID, and there is no other way.

Disadvantages of the ve(3,3) model

Besides advantages, this model also has some disadvantages such as:

- In the beginning, the inflation of Native Tokens like SOLID was very large, so without careful calculation, the project could easily fail. Solidly failed, learned and upgraded, Velodrome on Optimism succeeded and Aerodrome achieved the same thing.

- When you miscalculate, it is simply very difficult to change the outcome. And if the project is not really attractive, it will not attract LPs.

Summary

ve(3,3) created a breakthrough in the DeFi market but Solidly failed, it was not until Velodrome appeared that they were able to restore ve(3,3).