What is USDV? USDV is a form of Stablecoin, fully written as Verified USD, bringing a revolution to the current Crypto market. So what is special and interesting about Verified USD? Let’s find out together in the article below.

To better understand Verified USD, people can refer to some of the articles below:

- What is DeFi? All About DeFi

- What Are Real World Assets (RWA)? Potential Projects In RWA Array

- What is crvUSD? Overview of Stablecoins Released by Curve Finance

- What is GHO? Overview of Stablecoins Released by AAVE

Overview About USDV

What is USDV?

USDV, fully written as Verified USD, is a Stablecoin pegged 1 to 1 to the US Dollar, backed by many types of assets such as cash, Overnight Repo – short loans that only take place within 1 day and bonds. short-term bonds. It can be said that USDV is a form of Stablecoin with assets coming from the real world. In the future USDV will continue to expand its collateral to other assets.

Not only that, USDV is also a Native Stablecoin Omnichain built on the Omnichain Fungible Token (OFT) standard and supported by LayerZero’s recently launched Color Trace technology, which allows community participants to receive reward in a worthy and transparent manner based on their own contributions.

Mechanism of operation of USDV

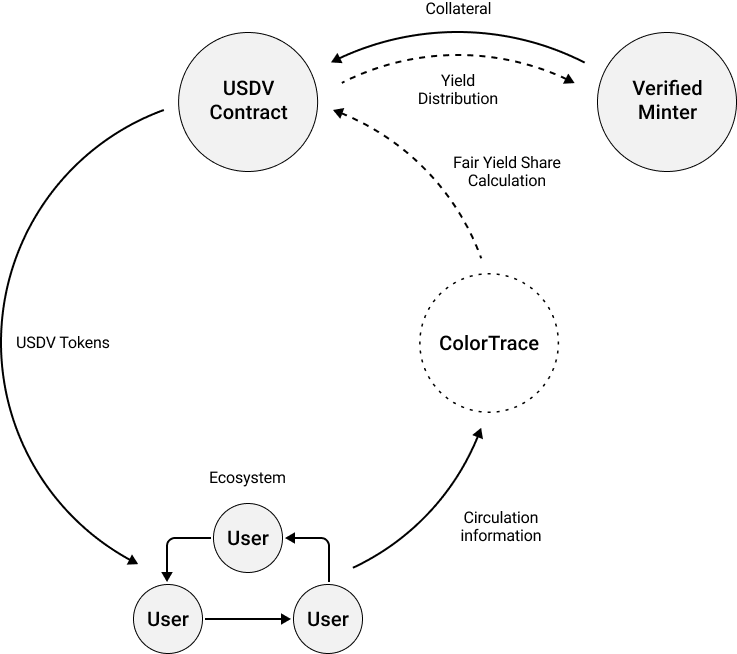

LayerZero’s newest technology is Color Trace. With Color Trace, it allows the exact origin of USDV to be determined. Simply imagine that when Verified Minters use collateral to mint USDV, this USDV will be colored to represent Verified Minter, from which Verified Minters will earn profits by increasing the circulating supply of USDV. .

As users interact with Verified Minter’s Stablecoins, their rewards continue to increase.

The ultimate purpose of Color Trace is to encourage Verified Miners to actively participate in the minting process and develop Stablecoin USDV, not only that but also improve liquidity or features in the Crypto market.

USDV difference

Some of the differences between USDV and some Stablecoins on the market today include:

- Become a Verified Minter: In the context of Stablecoins such as USDC, USDT, it is almost difficult for users to participate in becoming Stablecoin mints. Meanwhile, with USDV, Verified Minters after being KYC have the right to mint USDV and access real-world profits.

- Share profits in the real world: Color Trace algorithm allows USDV to share Transparent and fair profits based on USDV circulation due to each Verified Minter contribute.

- Omnichain Stablecoin: Building on OFT technology helps USDV become Native on many different Blockchains to help improve liquidity problems.

- Transparency: USDV’s transparency is okay real-time on-chain transaction tracking, reserve checks to daily real-world asset monitoring.

Besides, in the early stages of development USDV is designed with 100% of reserve assets being STBT (Short-term Treasury Bill Token). STBT is released by Matrixdock – a digital asset platform that provides access to Real World Assets (RWA) through tokens.

USDV peg retention mechanism

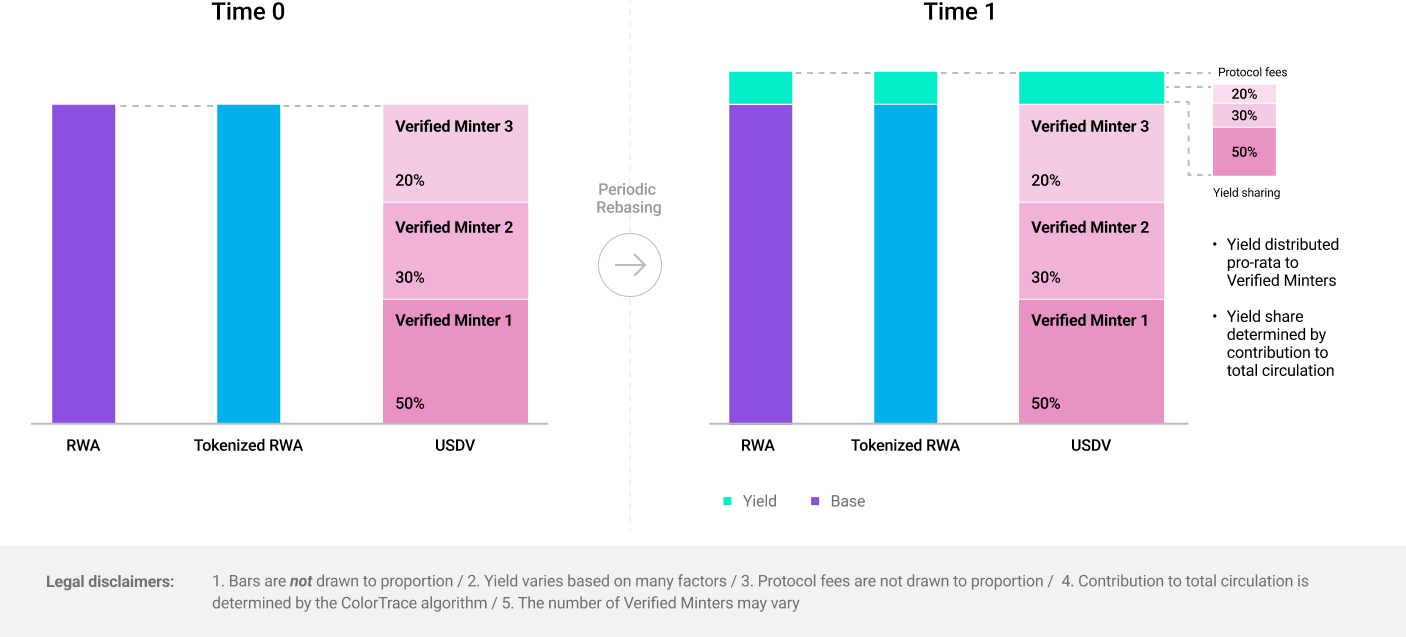

The total supply of USDV will always be adjusted to maintain equal vs Net asset value (NAV) of the underlying portfolio on a daily basis. Meaning that if the total real-world assets of USDV are $1,000,000 then there will also be 1,000,000 USDV on the Blockchain. In the context of real-world assets continuously increasing because those assets carry interest, the total supply of USDV is also flexibly adjusted.

From there, it is guaranteed that 1 USDV will have 1 US Dollar behind it.

Development Roadmap

Update…

Investor

Update…

Core Team

Matthew Commons: President

- Matthew earned a Bachelor’s degree in International Studies and German at the University of Pennsylvania then continued to study for an MBA at Harvard University specializing in Mergers & Acquisitions, Blockchain and Fintech.

- Matthew continued to delve into Blockchain as a Lecturer in an MIT Cambridge Business Forum in 2009 with topics related to Blockchain, Fintech, Startups or Venture Capital.

- Matthew spent time as CEO and CFO at Ogin, Inc – a company specializing in designing and manufacturing high-performance wind turbines. Here, Matthew led the company to complete Series A, Series B and Series C funding rounds, raising more than $150M.

- Matthew used to work as CEO, President and Co Founder of Cambridge Blockchain, Inc. Cambridge Blockchain, Inc was invested by PayPal in 2019 and sold the company to Blockchains Inc in 2020.

- Matthew delved deeper into Crypto as CFO for the Algorand platform and as President for Commons Partners LLC.

- By October 2023, Matthew officially became President at Verified USD Foundation.

Tokenomics

Update…

Exchanges

Currently USDV begins to expand its ecosystem on DeFi and CeFi.

Project Information Channel

Summary

USDV can open up a completely new direction for LayerZero and the Crypto market in recent times. Hopefully through this article, everyone can understand more about what USDV is?