- What is Pancakeswap (CAKE)? Pancakeswap Cryptocurrency Overview

- What is Matcha? Matcha Cryptocurrency Overview

- What is Raydium (RAY)? Raydium Cryptocurrency Overview

- What is Curve Finance (CRV)? Curve Finance Overview of Cryptocurrencies

What is Uniswap?

Uniswap Overview

Uniswap is a leading AMM platform in Defi today and supports the most trading pairs, so people can easily find and trade new tokens. Launched in November 2018, Uniswap has released 3 versions V1, V2, V3 and brought more efficiency in terms of liquidity for the first decentralized exchanges.

Uniswap is a protocol implemented as a set of persistent, non-upgradeable smart contracts; designed to prioritize censorship resistance, security, self-management, and operate without any trusted intermediary that can selectively restrict access.

Uniswap uses liquidity pools instead of order books like CEX exchanges, and currently the most used version is Uniswap V2. Uniswap builds a connection model between buyers and sellers without a third party, but still shares profits with each other.

Mechanism of action

Participating in Uniswap will have 3 main parts:

- Liquidity Providers: Are liquidity providers for the market.

- Trader:

Users can trade any ERC20 token that the platform supports, and pay a fee for that transaction. - Professional Traders: Make profits by eating price differences by monitoring different exchanges.

Main features of Uniswap

Swap

Swap is the most basic feature of Uniswap. If a user wants to swap token A for token B, they just need to enter the number of A tokens and the protocol will automatically calculate the number of B tokens the user can receive.

Pools

Liquidity providers will put assets into the pool to provide liquidity, each pool will have 1 pair of assets, for example A and B, liquidity providers will put 2 assets into the pool at a ratio of 1. :first. The platform will automatically send LP tokens to the wallet to the liquidity provider. LP tokens will represent ownership of a portion of assets in the pool.

Uniswap’s pool model is mostly associated with Ethereum for the following reasons:

- Uniswap uses a 50:50 ratio pool model: Most pools on Uniswap are 50% ETH and 50% ERC20.

- ETH will be used as the common currency on Uniswap.

- ETH will be the point connecting pools together, aiming to help traders go through fewer routes to reduce swap costs.

Flash Swap

Flash Swap appeared in Uniswap V2, allowing users to withdraw any amount of ERC20 tokens, free of charge, with the condition that at the end of each transaction the tokens are paid or returned for a small fee.

Oracle

All pools on Uniswap V3 can act as oracles, providing access and historical data on price and liquidity. Storing price and liquidity history directly in the pool contract significantly reduces the likelihood of logic errors in the call contract and reduces integration costs by eliminating the need to store historical values.

Fees

- Swap Fees: For each swap order of a certain asset pair, the trader will be charged a small fee of 0.3%.

- Pool Fees Tiers: Uniswap V3 launches more asset pairs, each asset pair will have a different fee. Initial providers can create pools with different fees: 0.05%, 0.3%, 1%. Other fees may also be added by UNI administration.

- Finding The Right Pool Fee: The platform predicts that there will be certain asset pairs that will target specific fee levels, incentivizing both traders and liquidity providers. For low volatility assets there will be low fees, and for high volatility and novel assets there will be interest because the fees will be high.

- Protocol Fees: Uniswap v3 has protocol fees that can be enabled by UNI administration. Compared to version 2, UNI administrators have more flexibility in choosing protocol swap fees.

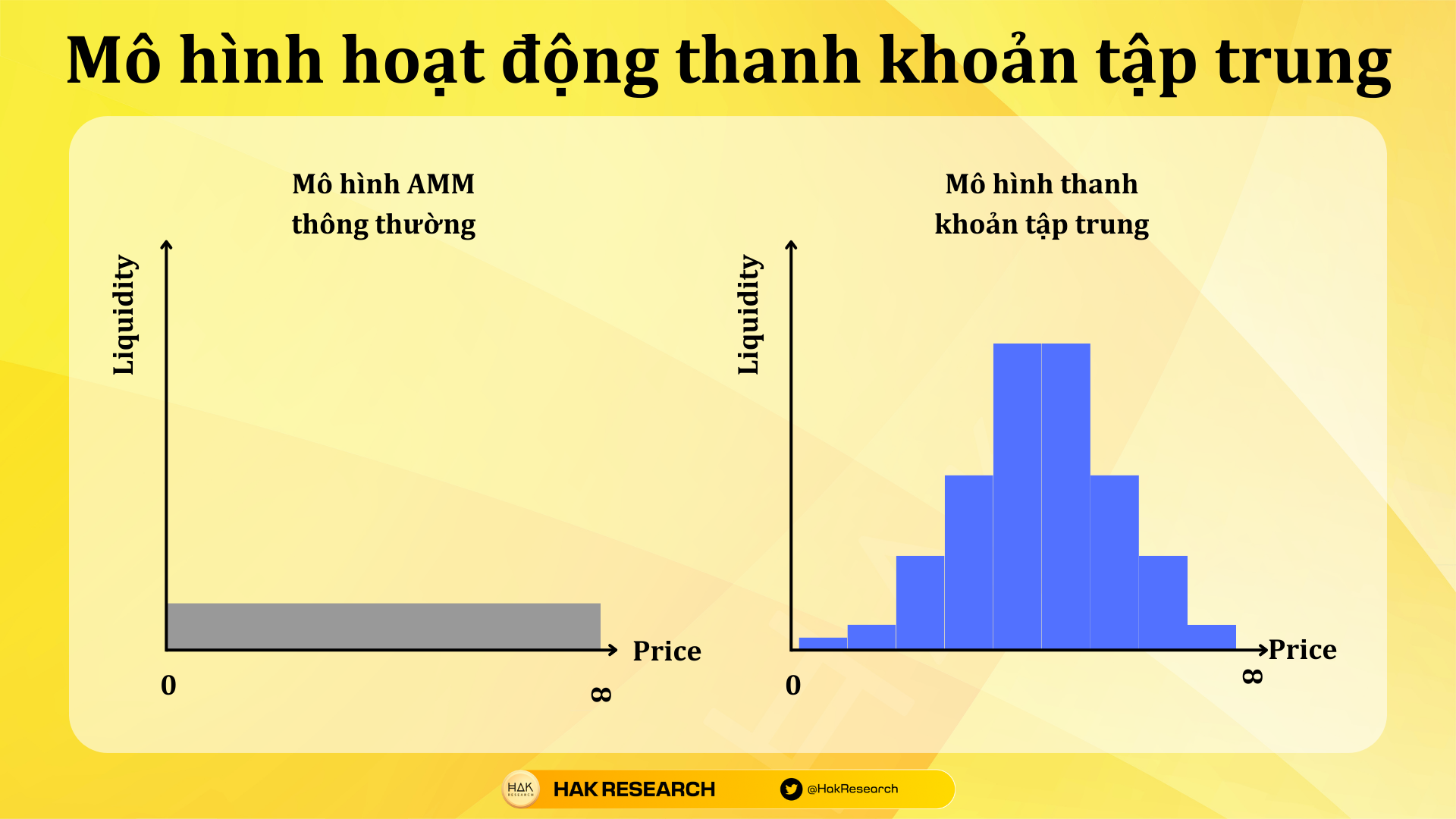

Centralized liquidity

In Uniswap V1 and V2 versions both support liquidity spread from 0 to infinity, which shows that liquidity aggregation is efficient, but the majority of assets held in multiple pools are never used. For example, stablecoin pairs’ prices are relatively stable, so liquidity outside the stablecoin pair’s price range is rarely touched.

Seeing those points, the project team launched V3 with a centralized liquidity group. With V3 Liquidity Providers can focus capital on smaller price ranges from 0 to infinity. As a result, traders are provided with deeper liquidity at mid-price levels and LPs earn more trading fees with their capital.

Range Oders

Range Oders allows us to place a buy / sell order within a price range that we determine. When the price of that asset pair fluctuates to the price we set, the buy / sell order will automatically be executed. .

Unlike markets where limit orders will incur fees, this feature will generate fees when buy/sell orders are executed. This is because a range order is technically a form of liquidity provision and not a typical swap.

Uniswap’s operating mechanism

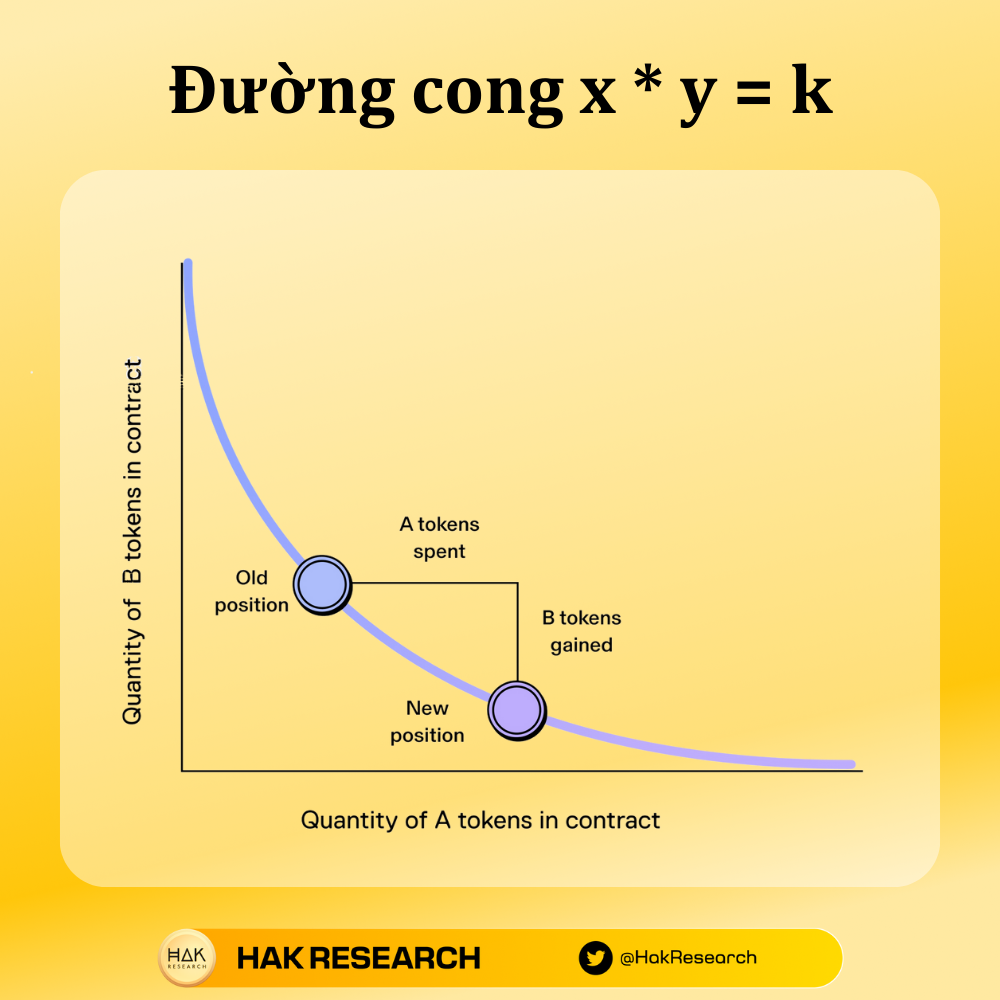

Uniswap is a typical AMM, which will work according to the formula x * y = k. Where x and y are the token reserves in pairs (eg ETH and USDT) and k is a constant.

The created pool wallet has ETH/USDT with 1ETH and 1000 USDT and according to the formula x * y = k it will be: 1 * 1000 = 1000, there will be 2 cases:

Case 1:

- Swap USDT for ETH. Buu wants to enter the swap pool for 500 USDT plus 0.3% fee to get ETH. At that time y = 1000 + 500 = 1500 USDT and k is constant at 1000 so x = 1000 / 1500 = 0.66666667.

- It follows that x = 1 – 0.66666667 = 0.33333 equals the value of 500 USDT. At this time, ETH price = 2500 USDT. That 0.3% fee will be added to the pool.

Case 2:

- Swap ETH for USDT. Buu sold 0.5ETH for USDT. At that time x = 1 + 0.5 = 1.5. => 1000 / 1.5 =666.66667

- It follows that at that time y = 1000 – 666.66667 = 333.33333, equivalent to 0.5ETH. At this time, the price of 1ETH = 666.66667 USDT decreased by 33.33%. When swapping causes prices to slip this high, the platform will remind you before swapping.

Highlights of Uniswap

Uniswap does not need to register an account like CEX, users just need to connect their wallet and swap immediately. As a decentralized exchange, Uniswap removes user identity and anyone can create a liquidity pool for any token pair. Currently, Uniswap is the DEX with the most trading pairs and abundant liquidity.

Uniswap V2 is an AMM automated market making protocol, allowing users to swap any ERC20 token, using a liquidity pool instead of an order book. Uniswap V2 has a step forward compared to Uniswap V1, that is, Uniswap V1 only supports transactions from ETH – ERC20 tokens, but when Uniswap V2 launches, users can trade from ERC20 tokens – ERC20 tokens.

Instead of Uniswap V2’s inefficient zero-to-infinity liquidity support, Uniswap V3 was born with centralized liquidity support. Uniswap V3 also supports more transaction fees.

Development Roadmap

Update ..

Core Team

Hayden Adams – Founder & CEO

- 2012 – 2016: Hayden Adams studied in the senior class of Bachelor of Engineering and Mechanical Engineering at Stony Brook University.

- 2012-2014: Hayden Adams was a researcher at Columbia University Medical Center.

- 2015: Hayden Adams worked as a mechanical engineering intern at Vista Wearable Inc.

- 2016 – 2017: Hayden Adams worked as an Engineer at Siemens, a company specializing in automotive and aerospace technology.

- 2017 to present: Hayden Adams is a Founder and CEO of Uniswap Labs.

Mary-Catherine Lader – COO

- Mary – Catherine Lader studied at Harvard University with two Master’s degrees in business administration and a Doctor of Laws.

- 2008 – 2011: Mary – Catherine Lader was an investment analyst at Goldman Sachs in New York.

- 2014 – 2015: Mary – Catherine Lader is Co Founder of hiWatson, an online benefits manager (insurance, retirement, taxes, etc.) for independent contractors.

- 2015 – 2019: Mary – Catherine Lader started working as Chief of Staff for BlackRock, then she was promoted to CEO & Global Head of Aladdin Sustainability here.

- 2019: Mary – Catherine Lader holds the position of Term Member at the Council on Foreign Relations.

- June 2021: Mary – Catherine Lader came to work at Uniswap Labs as Executive Director.

Scott Gray – Head of NFT Product

- 2021 – 2022: Scott Gray is Co Founder at Genie, then this company was acquired by Uniswap Labs.

- June 2022: Scott Gray returned to Uniswap Labs to work as NFT Product Manager.

Investor

The project successfully raised $176M through 2 funding rounds:

- August 7, 2020: Series A round, successfully raising $11M in capital from 8 investors led by A16Z.

- October 13, 2022: Series B round, successfully raising capital of $165M from 5 investors led by Polychain.

Tokenomics

Overview of Uniswap Tokens

- Token Name: Uniswap

- Ticker: UNI

- Blockchain: Ethereum

- Token classification: ERC20

- Contract: 0x1f9840a85d5af5bf1d1762f925bdaddc4201f984

- Total supply: 1,000,000,000

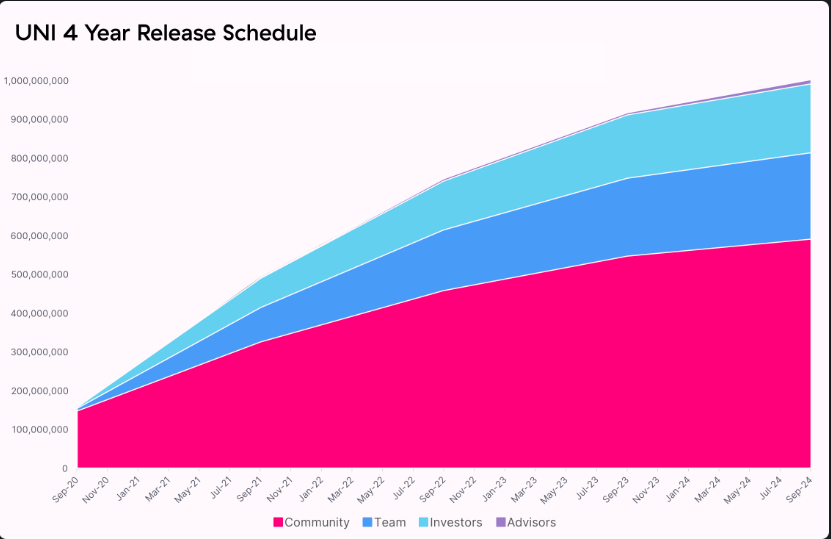

Token Allocation

- Community: 60%

- Team: 21.3%

- Investors: 18%

- Advisor: 0.7%

Token Release

- For Community, it will be locked for 4 years until 2024 and paid in installments each year. First year pay 40%, second year pay 30%, third year pay 20%, fourth year pay the rest.

- For Teams, Advisors and Investors, it will be locked for the same period.

Token Use Case

Currently, the UNI token has the following features:

- UNI has the administrative function and has the right to decide on project changes.

- Used as a conversion fee.

- UNI tokens also serve as rewards for Liquidity Mining.

Exchanges

Currently UNI is being traded on most major exchanges such as: Binance, Coinbase, Kucoin, Uniswap,..

Project Information Channel

Summary

When launching Uniswap V1, the product features were limited and did not attract users. Until the launch of Uniswap V2, the project really exploded, attracting many users. From there, Uniswap rose to become a leading DEX in the Defi market in terms of liquidity, number of users, TVL,…. Uniswap provides users with an easy interactive interface with the protocol, high security and hide user identity. This can be considered a unicorn in the crypto market.