What is Turbos Finance? Turbos Finance is an AMM Dex using the Concentrated Liquidity Market Maker (CLMM) model, built and developed on Sui. The project also receives investment from large funds such as Jump Crypto and especially receives support from Mysten Labs.

So what is Turbos Finance? What’s special about it? Let’s find out in this article!

To understand more about the AMM Dex segment on the Sui ecosystem, you can read the following articles:

- What is Cetus Protocol (CETUS)? Overview of Cetus Protocol Cryptocurrency

- What is MovEX Exchange (MOVEX)? MovEX Exchange Cryptocurrency Overview

What is Turbos Finance?

Overview of Turbos Finance

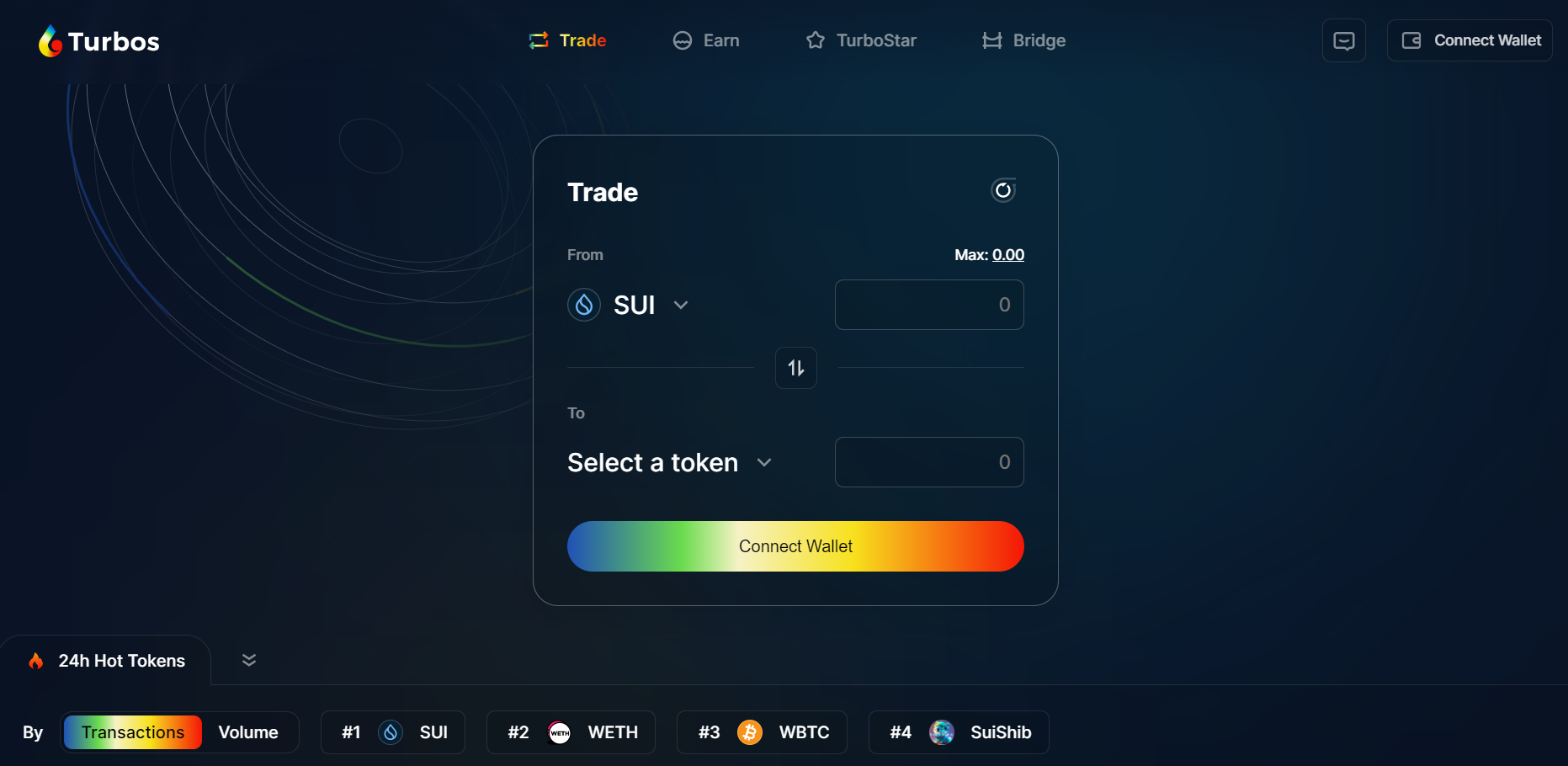

Turbos Finance is an AMM using the Concentrated Liquidity Market Maker (CLMM) model, also known as centralized liquidity. With the vision of developing complete products such as TurboStar, Bridge, Earn, Staking, Governance.

Turbos Finance is designed to make trading as simple and intuitive as possible. With a minimalist design and user-friendly UI/UX features, the tools you need to navigate the centralized liquidity model with ease.

Initially, Turbos focused on the Perp DEX product but later the project changed to AMM DEX (CLMM). Perhaps the reshaping project is the newly born Sui ecosystem, so AMM will be more essential and more accessible to users. Perp DEX can then be developed when there is a large community.

Mechanism of action

Turbos Finance offers products such as:

- Trade: A place for users to fulfill their asset exchange needs with a friendly interface, low price slippage, transaction fees as well as fast transaction speed of the Sui network.

- Earn: A place for users to provide liquidity to AMM to earn trading fees. By using the CLMM model, liquidity providers can earn more fees and incur less Impermanent Loss.

- TurboStar: Is Launchpad, which provides initial liquidity for newly launched projects. Projects can also receive support from Turbos to access Cex exchanges.

- Bridge: Use the Wormhole communication protocol to build a user interface for a cross-chain asset transfer product. The purpose is to help Turbos easily access users and cash flow from other ecosystems.

In addition, in the future Turbos Finance will develop products such as Staking and Governance to support TURBOS Token holders to participate in protocol governance as well as share protocol revenue.

Development Roadmap

Phase I: Quarter 4 of 2022

- Complete the Move smart contract (internal Devnet).

- Perpetual trading and slippage-free swaps on Sui Devnet.

Phase II: Q1 2023

- Launch of Centralized Liquidity Market Creation DEX (CLMM) on Sui Devnet.

- Launch testnet version for public testing.

Phase III: Mainnet Launch

- Launched Sui mainnet, providing users with CLMM trading and liquidity provision.

- Launch ecosystem functions including Staking, Governance and reward distribution.

Core Team

Update…

Investors

- January 2023: Seed round successfully raised $1M at $20M valuation.

- March 28, 2023: Funding round received investment from Jump Crypto for an undisclosed amount.

Tokenomics

Overview information about Token Turbos Finance

Update…

Token Allocation and Token Release

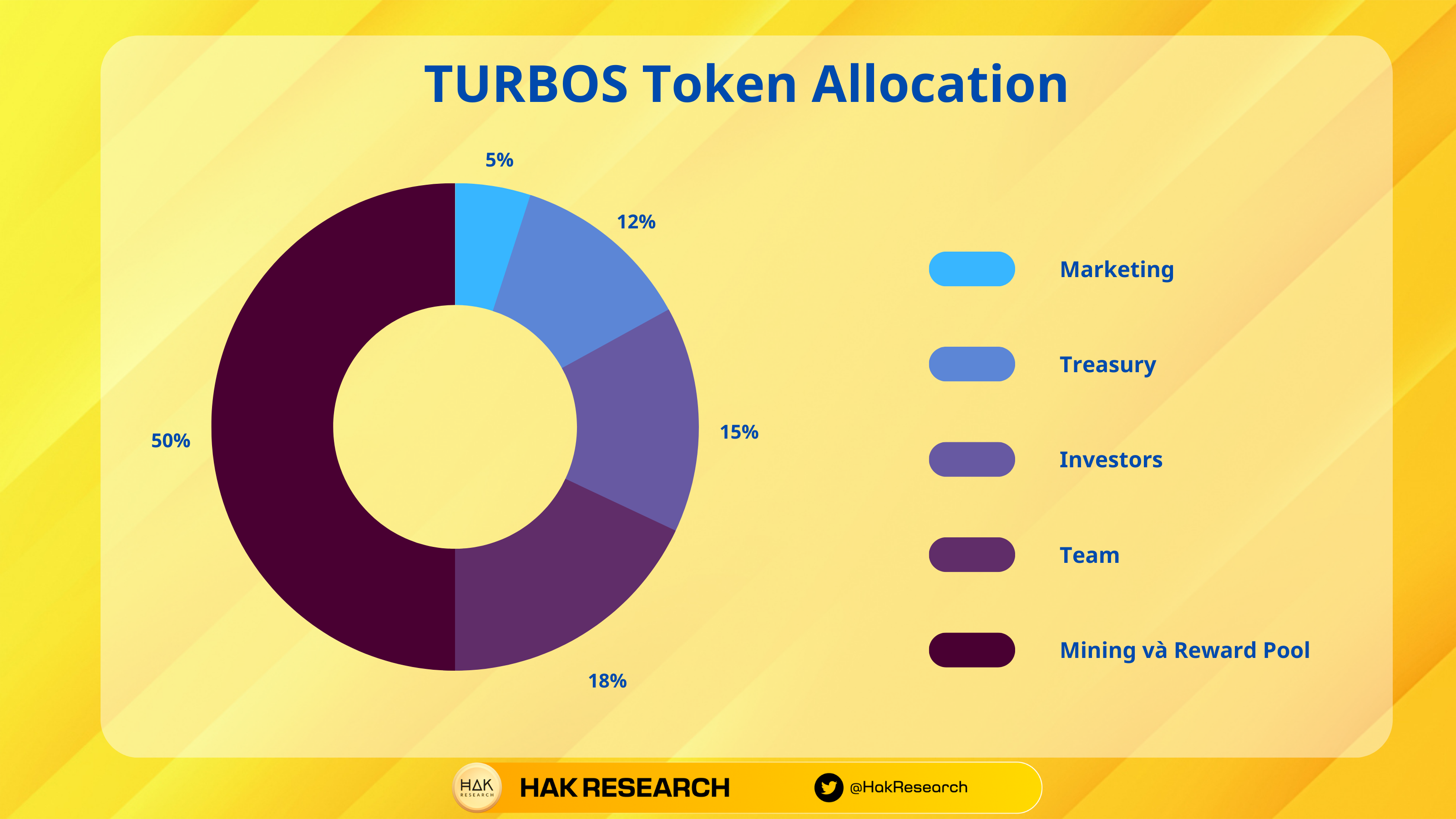

- Marketing: Allocated 5% of total supply to implement Marketing strategies.

- Investors: Allocated 15% of total supply to mobilize initial capital from funds and individual investors. Tokens will be locked for the first 6 months and paid in installments over 3 years.

- Treasury: Allocated 12% to implement project development strategies such as expanding partnerships, IDO, IEO,…

- Team: Allocated 18%, which is a reward for the work and effort to create the protocol. Tokens will be locked for the first 6 months and paid in installments over 3 years.

- Mining and Reward Pool: Allocated 50% to implement liquidity incentive programs.

Token Use Case

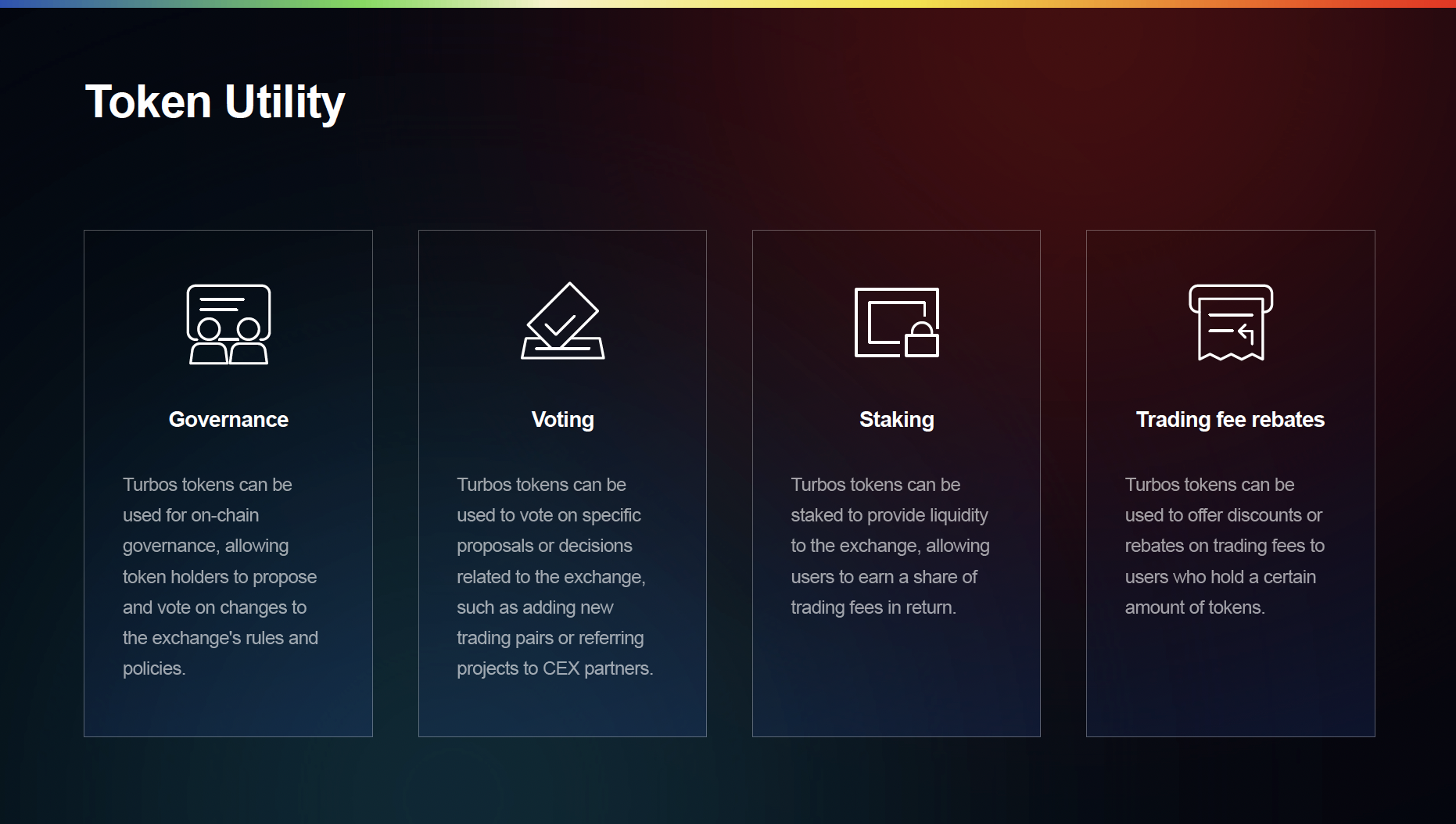

- Governance: The TURBOS token facilitates on-chain governance, empowering token holders to propose and vote on amendments to the DEX’s rules and policies.

- Voting: The TURBOS token allows holders to participate in voting on specific proposals or decisions related to the DEX, such as introducing new trading pairs or introducing projects to CEX partners, promoting collaborative decision-making process.

- Staking: TURBOS tokens can be staked to provide liquidity to the platform, allowing users to earn a portion of trading fees as rewards.

- Trading Fee Rebates: TURBOS tokens can be used to provide discounts or discounts on trading fees to users holding a predetermined amount of tokens, stimulating token usage, demand, and potential value increases.

Exchanges

Update…

Turbos Finance’s Information Channel

- Website: https://turbos.finance/

- Twitter: https://twitter.com/Turbos_finance

- Discord: https://t.co/k11LYUR3rv

- Medium:

Summary

Turbos Finance is an AMM Dex project on the Sui ecosystem that deserves attention with its centralized liquidity model. And Sui is also quite competitive when Cetus, Turbo, MovEX all develop with this model.

So I have clarified what Turbos Finance is? Turbos Finance cryptocurrency overview. Hope this article brings you a lot of useful information.