What is Tokenomics? Tokenomics can be roughly translated as the economy of the token, which includes many different factors that can directly and indirectly affect the price of the token. So what is interesting about Tokenomics and what elements make up Tokenomics? Let’s find out together in the article below.

What is Tokenomics?

Overview of Tokenomics

Tokenomics is an abbreviation of two words Token and Economics, which can be called Token Economy including 3 main elements: Token Allocation, Token Release and Token Use Case. It can be said that among the factors for fundamental analysis of a project that I presented in the article 7 Steps for Complete Fundamental Analysis of a Crypto Project, it can be said that Tokenomics is one of the important factors. best.

It is no exaggeration to say: “In essence, when participating in the crypto market, we do not invest in projects, but we invest in tokens.” However, with the current market context, this saying is no longer completely true because:

- There are many token projects that do not have too many Use Cases but still have token prices that still have typical growth like Lido Finance’s LDO. Some projects are still building very strongly such as Uniswap’s UNI, AAVE’s AAVE or Chainlink’s LINK, which we still have the right to trust.

- There are many projects with extremely diverse Token Use Cases but they are not successful, causing the token price to not maintain even though there are many use cases like SUSHI of SushiSwap.

- There are many projects that even though the Team has locked the token for a year, the token still has selling pressure for unknown reasons.

So in my opinion, to evaluate an aspect, we should build as many perspectives as possible so that we can have the most objective perspectives instead of subjective, biased perspectives. We should avoid thinking that is just classic erroneous thinking such as:

- Do not invest in projects without Token Use Cases and only invest in projects that have many, many Use Cases such as having to have staking, having to share profits,…

- Team and VCs both lock tokens for 1 year so there will be no pressure to sell before the previous period so buy & hold with confidence.

- Do not invest in projects with high inflation rates of about 10%, only invest in projects with token burn or small inflation rates.

The importance of Tokenomics to the project

Can say Tokenomics is vital to a crypto project, the project itself must not only be attractive in terms of products and services, but also must be attractive to users in terms of Tokens. Tokenomics includes three main elements: Token Allocation, Token Release and Token Use Case. The development team must balance all three elements.

If only one factor has a problem, the remaining factors will be more or less affected. In a context where a project’s incentive is often used using the project’s own token, as mentioned in the article Liquidity Mining, Fair Launch, Incentive: Popular Liquidity Attraction Strategies in the Crypto Market, the Tokenomics factor becomes even more important.

We can understand with a logical mindset as follows:

Incentive project with native token => If that native token is not “attractive” => Users and LPs will dump native tokens => Native tokens will be discounted => Incentives will be discounted => Users and LPs will abandon the project = > The project lost liquidity and returned as if nothing had ever happened => The project died and was weak.

Unattractive here is that the project does not have an attractive tokenomics for people to be willing to hold and even buy more of that token.

Factors That Make Up Tokenomics

Token Allocation

Token Allocation is where we know who owns the majority of the project’s tokens such as Core Team, Investor, Ecosystem, Marketing, Advisor, Tresury,… Here we have some of the following standards:

- Core Team should hold between 15 – 25%, the current market standard is 20%. If it’s too low, the team may not have the strength to work, and if it’s too high, the team has too much power to govern the protocol. Because most tokens have a gorvernance feature.

- Investors should account for around 20% of the total token amount equivalent to Core Team. New projects should have a share for Investors because getting a product to have users and revenue is very difficult in the crypto market. That’s why the project needs money from VCs to survive and survive.

In the Allocation section, we must accurately determine each component, each component to see if it is suitable for the project or not. For example, a crypto project in the US can deduct a small portion of tokens of less than 7% to “make laws” or Legal, but in other regions such as Singapore and Hong Kong, having that element is unreasonable. Or if the project spends up to 70% of tokens for Liquidity Mining, it is necessary to carefully consider the project’s LM strategy.

And to know if the project divides a portion of tokens to do work A or B, we must read as many projects as possible. We will see successful cases and failed cases from which we can filter experiences for ourselves.

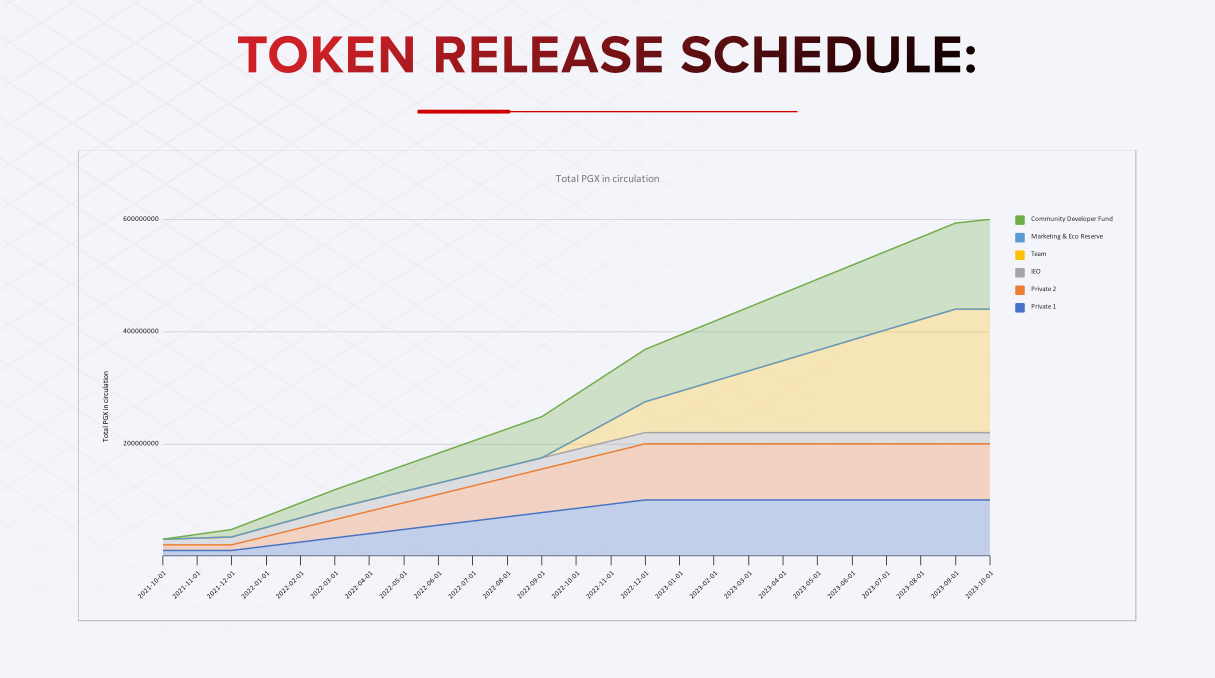

Token Release

In the Token Release area we must identify factors such as:

- Core Team and Investors will usually be locked for 1 year or more for projects that want long-term development, 6 months for medium-term projects and less than 6 months for short-term projects. As for unlocked projects, watch out! Not only that, it is necessary to determine at what price the VCs’ position is purchased, and how many times has it been?

- How to determine the remaining locked parts? How much is the first payment and then gradually pay over how many years?

Normally, to pay off 100% of project tokens, projects will usually take 4 years. If longer, it may be an ineffective model like Pangolin’s story, having to change Tokenomics to revive a project. Projects that want to pay tokens like the Bitcoin model.

The remaining parts such as Ecosystem, Marketing, Tresury,… the development team can completely take tokens from there and sell them, that’s why it’s clear that Core Team & Investor’s tokens are locked but the token price is still the same. reduce. The project can argue that it is selling to cover personnel, office costs,… but we wonder if they have raised money from VCs yet.

And maybe you won’t expect that both Core Team and VCs agree to sell the tokens they have early from other items to get their capital back sooner so that when they receive the tokens, it is already their profit. To avoid these cases, Core Team research requires seriousness because essentially when investing in projects besides Tokenomics, we are also investing in People.

Besides the above factors, we need to determine the inflation rate of the token in the beginning of the project. The inflation rate will be very high and then begin to stabilize. However, accepting high inflation is only for a short initial period of time to attract liquidity. If the project shows no signs of reducing APY/APR, the project will certainly collapse sooner or later.

Token Use Case

Token Use Case, also known as the application of the token. The most popular application of tokens today is Gorvernance – which is voting on project proposals, but don’t dream about decentralization because if you look at Token Allocation, it’s still a long way to go. The project is decentralized, so sometimes I say this is just a token application.

Some other applications of tokens include:

- Stake: Allows users to stake or lock tokens to receive token inflation rewards to limit the total supply of tokens in the market.

- Share Revenue: Revenue sharing. The project will share project revenue with token holders. Typically users must lock or stake tokens to receive a portion of protocol revenue.

- Private interests: Like experiencing new products first, reducing costs when using products,…

In the use case area, we need to determine what elements the Token has? Are the factors really causing the token to be less available in the market?

For example, if a protocol has low transaction volume and TVL but says it shares revenue with Token Holders, it is definitely not reasonable because no matter how much revenue is divided, it is even less, so it is not a driving force for holding. keep sustainable. Such Share Revenue is more advertising than the true essence of the project.

That is the driving force that drives us to the end of each issue such as:

- If it is focused on Gorvernance, why do users have to Gorvernance on the protocol? What additional benefits do they get from Gorvernance? What is that benefit? If so, what percentage of capital do they get?

- If it is revenue sharing, is there project revenue yet? Come from the beginning & are there many? How much to divide to Token Holder & what is the ratio compared to the cost?

- How much is the APR for Staking? How long does it take to receive my tokens after unlocking?

Tokenomics Is Not the Only Factor

Remember that to evaluate a Crypto project, Tokemomics is not the only factor to determine the success of a project. Besides, there is also the contribution of Core Team, Invetor, Products, Operational Mechanism, Difference or Development Roadmap. Therefore, when analyzing each project, we need to fully analyze the above factors.

For Tokemomics, we need to spend a lot of time analyzing, pondering and even observing token price fluctuations when one of the factors in tokenomics fluctuates. For example, when a large part of Token Allocation is opened such as Core Team, Investor, the price fluctuates.

Summary

Tokenomics is one of the extremely important factors for a Crypto project. Tokenomics is not only for observing and reading, but also for observing for a certain period of time to make wise investment decisions.