What is Themis? Themis is a multi-chain Lending Protocol platform that allows users to borrow and lend using both tokens and LP tokens. Let’s find out what is special about this project with Weakhand in this article.

If you don’t understand what Lending Protocol is, you can read the following article about Aave – one of the leading Lending platforms today.

What is Themis?

Themis is a multi-chain enabled peer-to-peer lending platform that allows users to borrow and lend in both tokens and LP tokens. Themis uses Chainlink as its price data source.

User objects on themis:

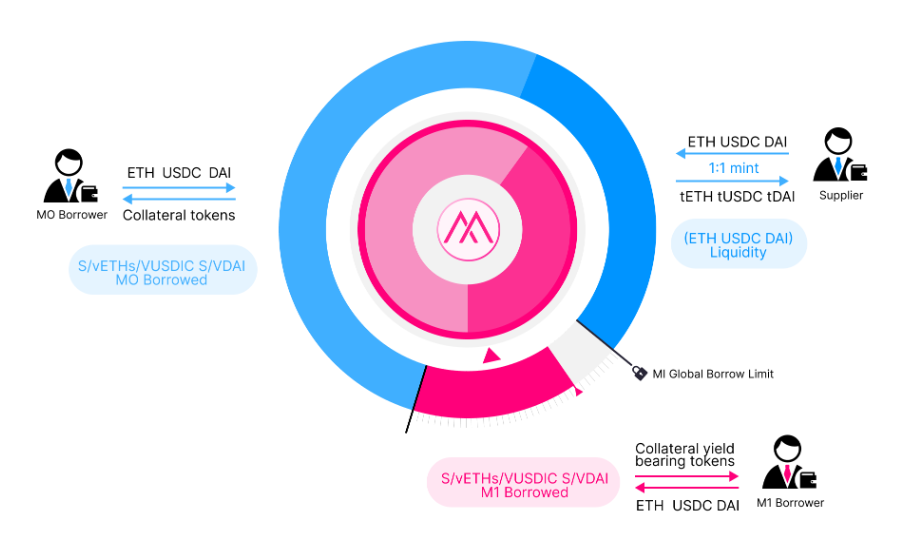

- Lender (Lender): Deposit assets (tokens) into the platform. Then Themis mints 1 amount of tToken tokens 1:1 ratio represents the amount of user assets. The number of tTokens will gradually increase over time. Users can transfer all tTokens back to the original assets at any time. Then the entire amount of tToken will be burned from the system.

- Borrower(Borrower): Provide collateral (token or LP token) to borrow a corresponding amount of money. In addition, themis also mints a corresponding amount of sToken or vToken tokens 1:1 ratio represents the debt that the user must pay. Over time, the number of s/vTokens also gradually increases. When the debt + interest is paid off, the borrower will receive the collateral back. Then the entire amount of s/vToken will be burned from the system.

What is Themis?

Due to accepting different types of collateral. Assets on Themis are divided into 2 groups:

-

M0: Represents a high amount of liquid collateral.

-

M1: Representing collateral assets are LP tokens.

Lenders can offer assets into any of the two groups. When they provide liquidity into M1, they will receive higher APY returns.

Sale: When the borrower’s loan exceeds 80% of the value of the collateral, their assets will be liquidated. Themis is divided into 2 situations:

For assets in group M0: The liquidator repays part or all of the outstanding amount and the liquidator receives a liquidation bonus. The liquidator can choose to receive the relevant amount of tToken instead of the underlying asset.

For assets in group M1: There is no Liquidation Bonus in M1, the liquidator repays the full amount owed to receive the collateral at a discounted price.

What is the Themis Difference?

Themsis introduces the E-mode feature to help users maximize capital efficiency when collateral and loan assets have correlated prices.

Only assets of the same type (e.g. stablecoins) can be borrowed in E-mode. E-mode does not restrict the use of other assets as collateral.

For example: Borrowers can provide 100 USDC into the Themis platform to borrow out 95 USDC. In addition, users can also provide other collateral such as ETH to borrow ETH…

Core Team

Update…

Investor

November 9, 2021Themis announced its successful call for $2M from investors: NFX, Dao Maker, LD Capital.

Tokenomics

Update…

Themis Project Information Channel

- Website: https://www.themis.exchange/

- Twitter: https://twitter.com/ThemisProtocol

- Medium: https://blog.themis.exchange/

- Discord:

summary

Themis has a creative direction to help optimize capital efficiency for users, as well as improve the limitations of previously appeared Lending products. Hopefully this article has helped you understand What is Themis?