What is Tenet Protocol? Tenet Protocol is one of the next projects following the LSDfi trend that is currently exploding with many projects such as Agility, unshETH or Lybra Finance. So, if there is anything interesting about Tenet Protocol, let’s find out together in the article below.

To better understand Tenet Protocol, you can refer to some of the following projects:

What is Tenet Protocol

Overview of Tenet Protocol

Tenet Protocol is an EVM-oriented Blockchain platform that uses Diversified Proof Of Stake consensus mechanism which means users can use assets issued from LSD platforms as LST to deploy a validator. on Tenet Protocol.

Validators can mint tLSD (Tenet Liquid Staking Derivative) so validators enjoy incentives + transaction fees in addition to using tLSD on the ecosystem Tenet’s LSDfi-protocols. Not only that, users can mortgage tLSD to mint stablecoin LSDC (Liquid Staking Dollar).

Tenet Protocol differences

Although born after many LSDfi projects, Tenet Protocol has the following differences:

- Not only limited to Ethereum LSTs, Tenet supports a basket of crypto assets such as ETH, ATOM, BNB, MATIC, ADA and DOT.

- Using multiple types of tokens makes Tenet’s network decentralized and not controlled by VCs, Whales,… that own a single type of token.

- It is one of the rare LSDfi that follows the Layer 1 development direction while the other protocols follow the CDP direction.

Strategic product of Tenet Protocol

Stablecoin LSDC is a strategic product of Tenet Protocol that allows validators to mint stablecoins from assets in their validators to optimize capital usage. Some advantages of LSDC are as follows:

- The interest rate is 0 when you mint LSDC and make profits from putting LSDC into Tenet Protocol’s LSDfi ecosystem.

- Unlock liquidity for validators.

- Tenet Stablecoin Protocol is managed by Tenet Protocol’s validator team, thereby inheriting security and decentralization from the original chain.

- High mortgage rates up to 125%.

- Balancing mechanism like many other popular stablecoins.

Development Roadmap

Update….

Investor

Update….

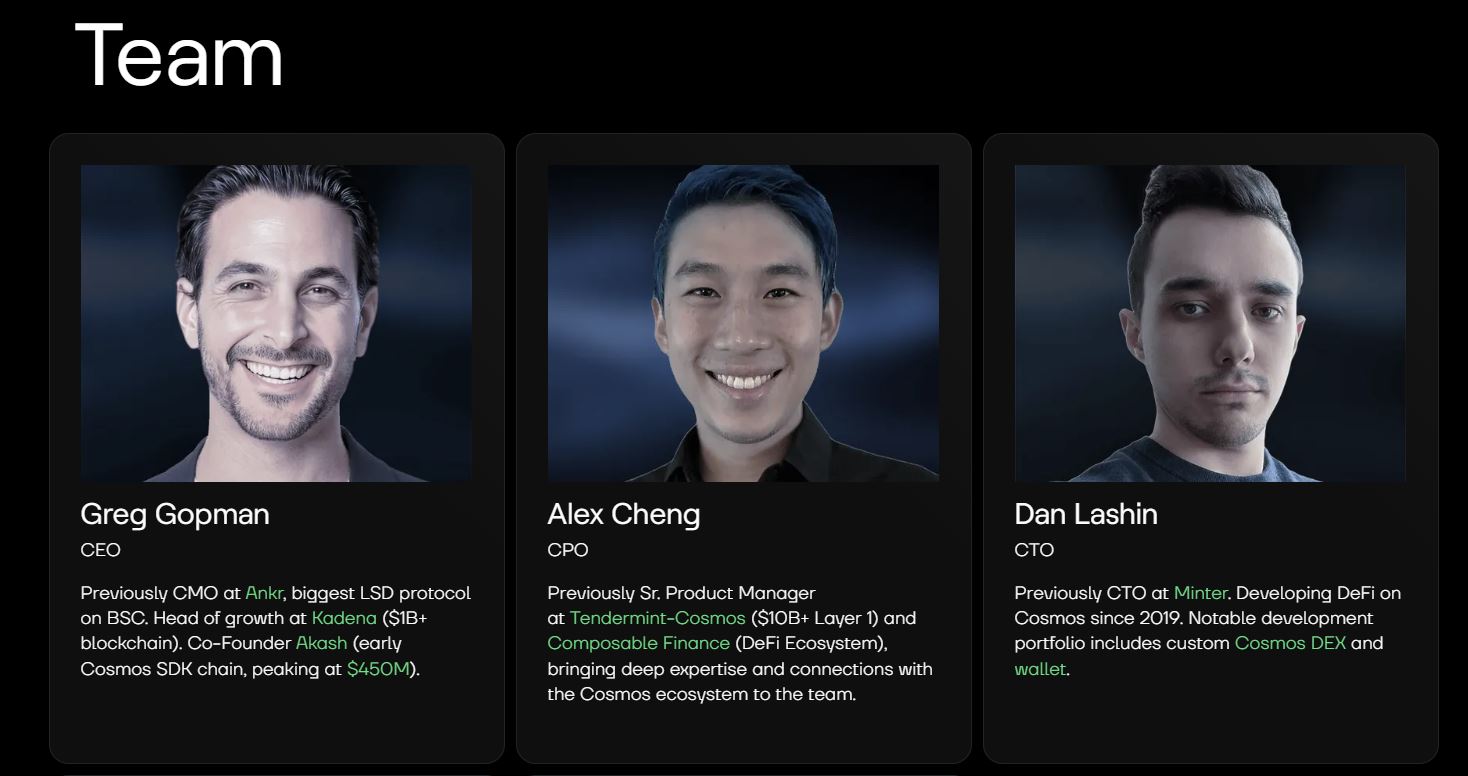

Core Team

Greg Gopman: CEO

- Greg has experience working in the crypto market with many different projects, especially Layer 1 blockchains in the Comos ecosystem.

- Used to be CMO at Ankr – Liquid Staking platform but not too prominent. Head Of Growth at Kadena blockchain platform. Co Founder of Akash.

Alex Cheng: CPO

- Worked as a product manager at Tendermint – Cosmos and Composable Finance.

Dan Lashin: CTO

- Dan also worked as CTO at Minter. Besides, Dan has participated in the Cosmos ecosystem since 2019 and developed many products related to DEX and Wallet.

Tokenomics

Information about Tenet Protocol tokens

- Token name: Tenet Protocol

- Code: TENET

- Blockchain: Tenet Protocol

- Token classification: TE 20

- Contract: 0x9663677b81c2d427e81c01ef7315ea96546f5bb1

- Total supply: 1,200,000,000

Token Allocation

Token Release

Token Use Case

When you lock TENET to become a validator on Tenet Protocol’s network, you will receive tTENET and then hold the locked tTENET for a minimum of 1 week and a maximum of 4 years to receive veTENET. When owning veTENET, users will have some of the following benefits:

- Network administrator rights.

- Share revenue from protocols across the ecosystem.

Exchanges

Currently, users can buy, sell & trade TENET on exchanges such as MEXC Global, Bybit, Houbi, Gate.io, Kucoin,…

Project Information Channel

- Website: https://tenet.org/

- Twitter: https://twitter.com/tenet_org

- Telegram:

Summary

Tenet Protocol is one of the rare projects in the LSDfi industry that chooses a direction that is full of risks and challenges but is full of development opportunities. Will Tenet Protocol be successful?