What is Syndr? Syndr is a project born with the purpose of providing a derivatives trading platform for general and institutional users. The project received great attention from the community when participating in the Orbitchains ecosystem, Layer 3 built on Arbitrum’s platform.

Overview of Syndr

What is Syndr?

Syndr is a Layer 3 Orbitchain built from Caldera’s support service with the Arbitrum Orbit Stack toolkit. Syndr is a Layer 3 chain developed on Layer 2 Arbitrum and provides a platform for derivatives trading including options contracts (Option) and perpetual futures contracts (perp).

Like current Derivative application chains, Syndr uses the CLOB order book to create liquidity for asset types. With CLOB order book, the order matching process will be processed Off-chain and orders placed on Onchain.

Syndr features one-click deposits, withdrawals, no gas fees for trading, integration with fiat support programs, and a smooth user interface for both retail and commercial traders. professional trader.

Collateral will be converted into USD thanks to updated data using Oracle Pyth Network. Trading pairs are also paired with USD to help increase liquidity, focusing more on liquidity for transactions. It also makes it convenient to use multiple assets as collateral.

Syndr is a Layer 3 using Optimistic Rollup technology so it has very fast transaction speed. The platform can process transactions at a speed of thousands per second. With this speed, Syndr is not inferior to competitors such as Aevo, Orderly or dYdX.

Socket is the bridge facility to help traders transfer funds from other chains to Syndr Chain with just a single click.

Syndr will not collect network fees when trading on the platform, this fee will be paid entirely by Syndr. But users still have to pay transaction fees:

- Options: Charge 0.03% for market orders, 0.05% for Limit orders.

- Perp: Charge 0.03% for market orders, 0.05% for Limit orders.

- Futures (dates): Charge 0.02% for market orders, 0.05% for Limit orders.

Additionally, there are liquidation fees that will apply to all market types. For Perp and Futures, the liquidation fee will be calculated at 0.8%-1%, 0.02% for Options.

Special features of Syndr

- Low latency and high throughput: Users can trade on our order book with a latency of 1–30 milliseconds.

- Capital efficiency for traders and market makers: Easily implement delta hedging strategies with reduced collateral requirements. As of September 2022, no one has done portfolio escrow in the entire DeFi space.

- Perpetual contracts and dated futures contracts: Syndr also allows easy hedging of options through perpetual contracts and dated futures contracts native to the same platform.

- Block transactions on Syndr: Native support for block trading platforms and easy integration via RFQ platform for institutions. One-click trading on spreads, combination products,…

- Multi-collateral support: Syndr will support depositing more than just stablecoins as collateral. Can use many assets such as USDC, USDT, ETH, WBTC,…

- Easy to join: Easy to use, send money from any chain using Socket.tech

- Low Fees: Transactions do not require network fees and will also support transaction fees in the future.

Development Roadmap

Update…

Core Team

Update…

Investors

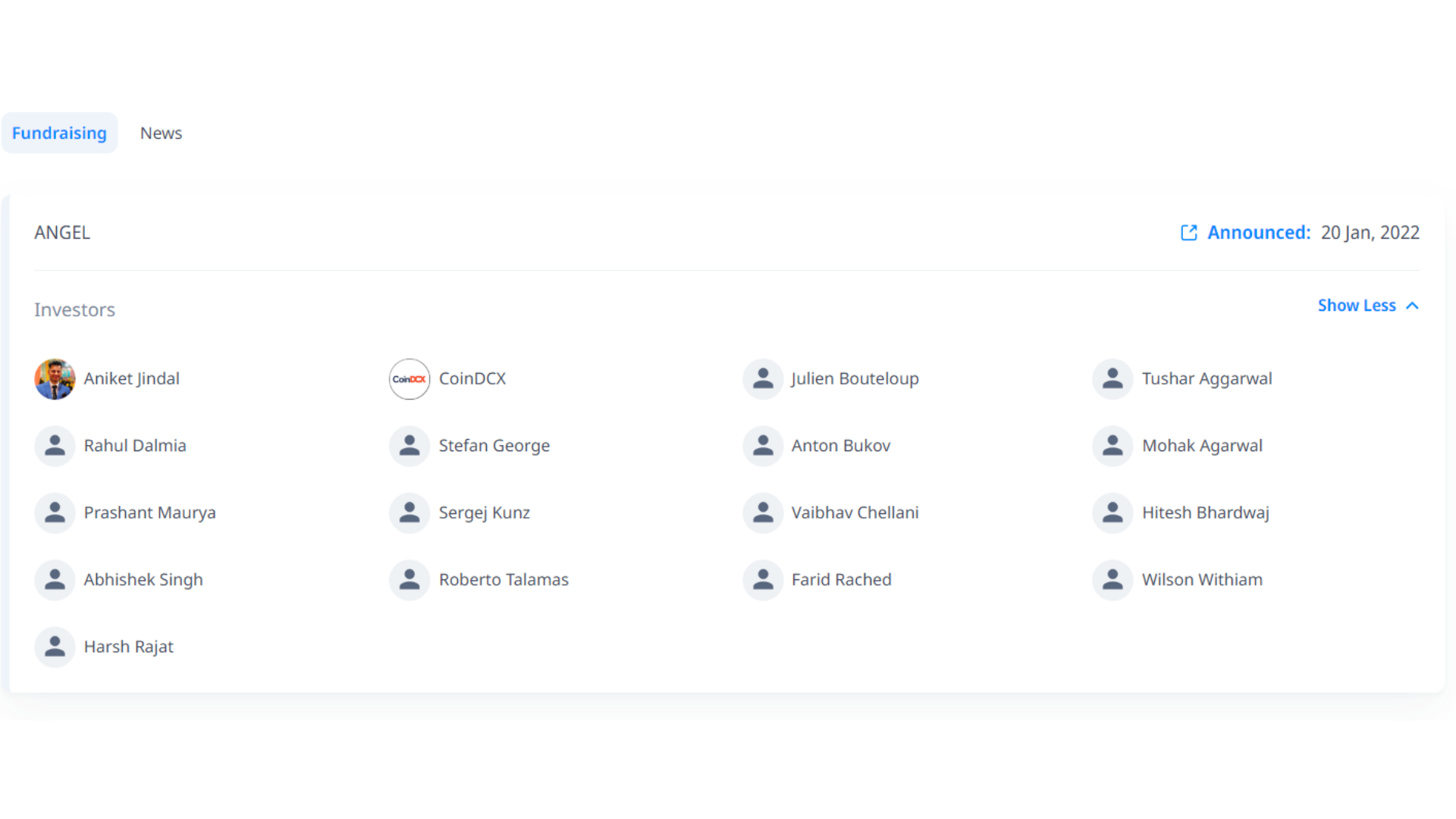

January 20, 2022: Pre-Seed round successfully raised $500K from many angel investors such as Anton Bukov (Co-founder of 1inch), Sergej Kunz (Co-founder of 1inch), Julien Bouteloup (Core Team at Curve Finance), Stefan George (Co-founder of Gnosis), Vaibhav Chellani (Co-founder of Socket.tech), Aniket Jindal (Co-founder of Biconomy), Roberto Talamas (Research Messari), Wilson Withiam (Research Messari), Farid Rached (Angel , Ecosystem development at Avalabs), DCX Ventures (venture arm of CoinDCX).

Tokenomics

Update…

Exchanges

Update…

Syndr’s Information Channel

- Website: https://www.syndr.com/

- Twitter: https://twitter.com/SyndrHQ

- Blog:

Summary

Syndr Chain is an Orbit Layer 3 chain that offers unprecedented scalability. With fine-tuning to suit Derivative products and integrating many of the most advanced technologies on the market. Syndr will be the most prominent name in Arbitrum’s Layer 3 ecosystem, able to compete with other blockchains or blockchain ecosystems.

So I have clarified what Syndr is? Syndr cryptocurrency overview. Hope this article brings you a lot of useful information!