What is Symmio? Symmio is a project that provides comprehensive infrastructure for Perpetual DEX (derivatives exchange), projects can take advantage of Symmio’s infrastructure to easily build a your own DEX floor with many special technologies.

The project has many special things, everyone should read through the analysis below.

Symmio Overview

What is Symmio?

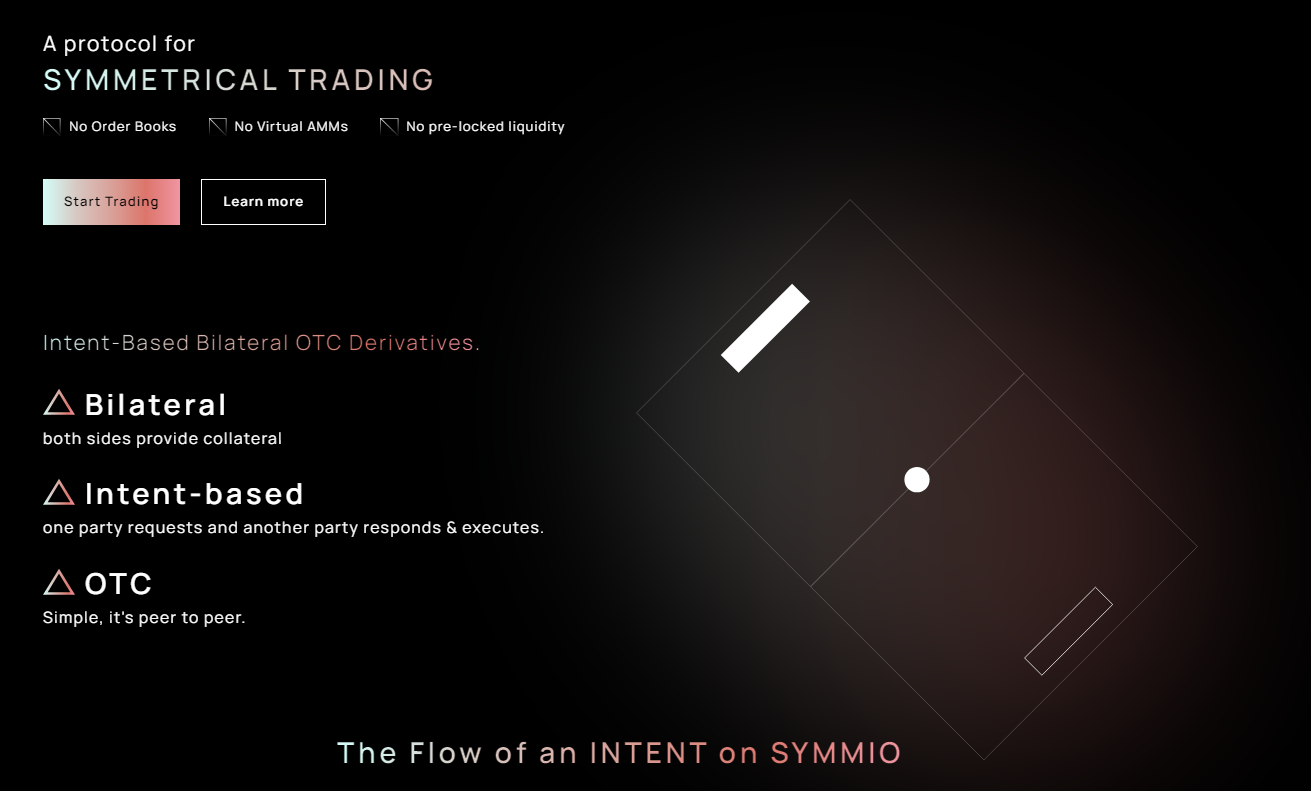

Symmio provides a comprehensive Perpetual DEX infrastructure that can be easily integrated into an existing or newly built decentralized exchange. For example, a DEX fork from Uniswap can add derivatives or leveraged trading using the Symmio SDK. That DEX can fork the code-base from Symmio or have Symmio’s team deploy it.

For DEX forks with the vAMM-based perps model of GMX, GAINS or OrderBook-based of DYDX, liquidity fragmentation will often occur. With Symmio they want to minimize this as much as possible by providing an extensive pool of institutional providers (LPs) or “hedgers”.

Symmio leverages elements such as OTC trading, Request for Quote (RFQ) price finding and off-chain trustless technology combined into a new concept called automated Markets for Quotes aka aMFQ. Symmio plays the role of the underlying infrastructure, while the interface will be taken care of by DEXs using Symmio’s technology.

Symmio will provide this technology to third parties and offer infrastructure for Perp DEX exchanges.

Mechanism of action

Symmio’s mechanism of action

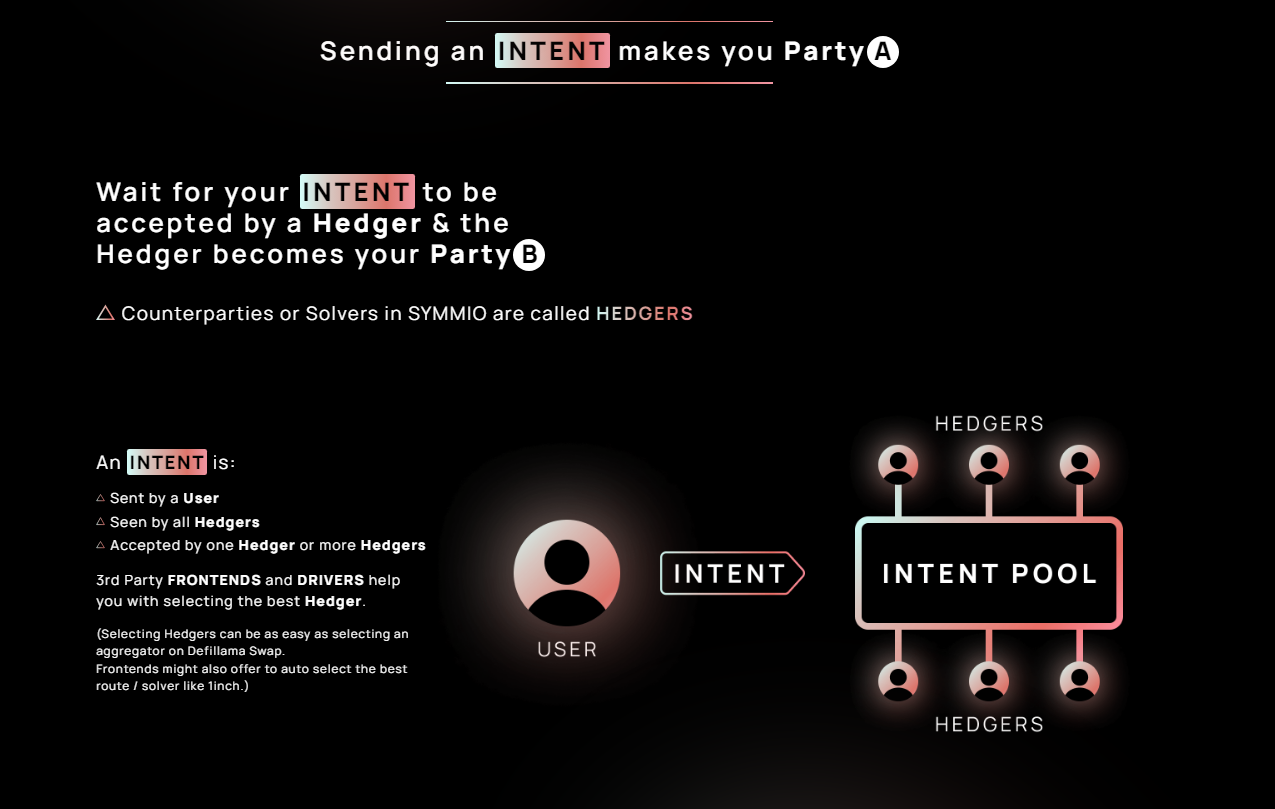

- Step 1: Party A (user) will send Intent (Intent is like Limit order on Binance) to Party B

- Step 2: Party B will be the liquidity providers (Hedgers), Party A’s Intent will be sent to Party B and wait for them to accept the terms of their Intent.

- Step 3: When the Intent is accepted, the transaction takes place. The transaction only ends when party A closes the order or one of the two parties cannot repay the debt. There will be a third party monitoring the order status to ensure that the two parties still have enough ability in the transaction. When one party loses the ability to repay, the order will be liquidated.

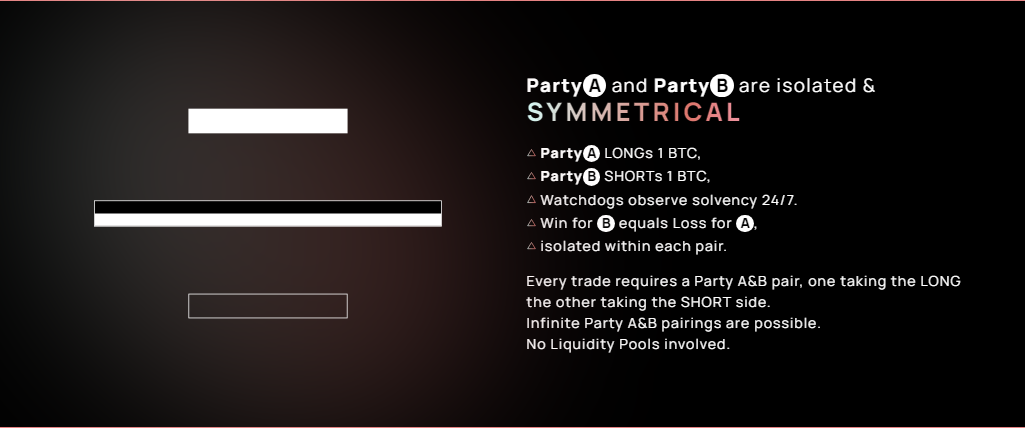

Example of trading order on Symmio

- Party A opens a Long order of 1 BTC

- Party B accepts the Intent and opens a Short order of 1 BTC

- Watchdogs is a 3rd party that monitors the status of these two orders 24/7

- If side B wins, the winnings will be sent to them and vice versa. Each transaction intent is isolated, and there is no need for a liquidity pool, everything works Peer-to-peer.

Symmio technology

GMX and Gians use the Virtual AMM mechanism, for DYDX it is Onchain Order Book, and for Symmio it is aMFQ. So what is aMFQ and what is the technology behind Symmio’s infrastructure?

Immutable “automated Request for Quote”

Users can create immutable “Requests for Quote” on the blockchain with their desired trade parameters. Once one party accepts the request, the transaction is executed, matching the transaction off-chain with the 3rd party system, achieving maximum throughput while preserving integrity through on-chain settlement. chain. chain.

Isolation

SYMM Derivatives works on the principle of separating transactions between parties, party A and party B. In a Peer-to-peer trading environment, both parties get equality because they contribute funds. collateral and represents one side of the transaction. One party’s long position corresponds to the other party’s short position, and the transaction can only be carried out when a suitable counterparty is found. The main goal of the Symmio platform is to facilitate the connection between party A and party B, allowing to establish transactions between them.

Profits and losses are effectively regulated in the agreement between the buying and selling parties, preventing losses from affecting other parties. Although users can share PnL between different B-side participants, it is essential to understand that both parties have equal rights. In traditional terms, “taker” and “maker” are treated the same. If makers do not have enough collateral, they will be liquidated in the same way as takers.

This approach sets Symmio apart from Perp Dexes that provide liquidity by LPs, while still providing trading efficiency without the need for order books.

Decentralized Oracles

Although the aMFQ system itself does not have an oracle, Symmio uses a threshold-signature based oracle to help resolve disputes between parties. These Oracles act as market observers, ensuring the system operates safely and trustlessly in times when party A and party B participating in a transaction do not agree on the rules or price. Reserve.

N-dimensional Orders

Symmio introduces the order placement system n-dimensional , allowing liquidity providers to create derivatives with their preferred set of rules. This approach allows for unlimited diversity of markets instead of a one-variable parametric model (single-variable parameter ) Traditionally based solely on price.

Minimized Trust Trade Setup

To ensure reliability and increase security, both buyers and sellers lock collateral in the AccountManager tool.

Oracle-Verified PnL

There will be a neutral Oracle that verifies balance changes against each party’s uPnL at any given time, ensuring the solvency of counterparties and allowing for smooth and secure transactions.

Free Market for Derivatives

Symmio promotes a free market around derivatives, where liquidity providers compete to dictate the most desirable parameters, such as price, funding rate, and maintenance margin. This competition drives innovation and creates a vacuum for liquidity, sucking everything into the Symmio ecosystem.

Outstanding features

Symmio introduces a new method that turns bilateral OTC trading (with the consent of both parties) into an intent-based, on-chain and permissionless format (permissionless).

- Intent-Centric Execution Environment: Symmio operates under a purpose-driven framework focused on giving traders and market makers 100% control and the ability to customize everything, while providing the highest throughput without affects decentralization.

- P2P Bilateral Escrow System: With P2P, users are guaranteed direct and trustless settlement. between relevant parties.

- Economically Incentivized MEV Researchers (Watchdogs): These are dual role entities.. They ensure all parties involved are solvent and participate in the potential of arbitrage or subsequent disputes.

Development Roadmap

- 2023 (Ongoing): Develop White labeling Perp service for main Liquidity Hub on each chain.

- June 2023 – June 2024: There is a new Frontend to help provide more value-added services.

- H2 2024: Developing RFQs as a service

Core Team

Update….

Investor

Symmio Fundraising

The current project has completed a Funding round with an amount of $1.1M led by retail investors.

Tokenomics

Update…

Exchanges

Update…

Project Information Channel

- Twitter: https://twitter.com/symm_temp

- Telegram: https://t.me/SYMM_IO

- Website:

Summary

With the innovative model in the Symmio operating model, it has brought a new breeze to the DeFi market in general and derivatives on DEX in particular when compared to old models. However, success with this P2P model is difficult. If not, that’s another matter. Hopefully through the article, everyone has an overview of what Symmio is.