SundaeSwap is an AMM platform built and developed on the Cardano ecosystem. Here users will provide liquidity and create markets for others to participate in trading. So what is SundaeSwap? What makes SundaeSwap stand out? Let’s find out below in this article!

To understand more about the AMM platform, you can read the following articles:

- What is Pancakeswap (CAKE)? Pancakeswap Cryptocurrency Overview

- What is Frax Finance (FRAX)? Frax Finance Cryptocurrency Overview

- What is SyncSwap? SyncSwap Cryptocurrency Overview

- What is Mute.io (MUTE)? Overview of Mute.io Cryptocurrency

What is SundaeSwap?

Overview of SundaeSwap

SundaeSwap is a decentralized exchange on the Cardano ecosystem. Platform participants will provide liquidity and create a market for others to trade tokens, in return the trader will pay a small fee and the liquidity provider will receive interest from it.

Mechanism of action

SundaeSwap is a basic AMM platform similar to other AMM platforms. This is where users can optimize their profits by using the following features:

- Swap: Is where users exchange tokens for other tokens and get ADA coins as a swap fee.

- Stake: Users will Stake ADA tokens into the platform and earn profits.

- Lending & Borrowing: Here the lender will deposit assets into the liquidity pool and receive a fee. The borrower will mortgage assets to borrow and pay the fee.

- Farming: Liquidity providers will receive LP tokens and take that LP token to farm and receive profits. (usually 30 days)

Project highlights

Constant Product Liquidity Pools

SundaeSwap initially provided an AMM that was an adaptation of the UniSwap model and later needed adjustments to fit on Cardano. One of the adjustments is Constant Product Liquidity Pools, which helps increase the efficiency of swaps.

Initial Stake Pool Offerings (ISPO)

AMM projects often sell project tokens to raise capital through IDO, Public, etc. But the project is that they will not call for capital from the community through the sale of SUNDAE, but they choose to allocate tokens to the market via airdrop using ISPO. Using the Initial Stake Pool Offering (ISPO) funding mechanism, SundaeSwap leverages them to determine how SUNDAE tokens are distributed to participants.

This mechanism is a form of calling for capital on the products themselves and maintaining liquidity stability right on the DEX. Users will also receive rewards in the form of native SUNDAE tokens when participating in staking ADA in Stake Pools.

Stake Pools Operators (SPO)

Because the token distribution that SundaeSwap deploys is ISPO, the community will have to vote to select 30 Staking Pools Operators (SPO – Pool operator) perform staking into pools available in Cardano. These SPOs are responsible for recording and dividing rewards and giving them to stakers in the pool. This will attract more people to stake in the pools and create better liquidity for the project.

Development Roadmap

The project has not announced a development roadmap but has set goals for the future of the project:

- The role of the SUNDAE token

- Throughput spike mechanism

- Mechanism to provide centralized liquidity to the market more effectively

- Mechanism to provide secondary derivatives market

- A mechanism to further decentralize the role of the liquidity group

Core Team

Marteen Motavaf: Co Founder

- Has many years of experience in strategy and is the head of design for technology start-ups.

Artem Wright: Co Founder

- In August 2020, Artem Wright worked as an intern at Viant Group.

- In April 2021, Artem Wright and his colleagues co-founded SundaeSwap Labs, Inc.

Matt Ho: CTO

- August 2006: Matta Ho became Senior Development Director at Salesforce.com.

- May 2009: Matta Ho held the position of Technology Director at LOYAL3.

- December 2017: Matta Ho worked at Anywhere Real Estate Inc as Chief Cloud Architect.

- May 2021: Matta Ho became Technology Director at SundaeSwap.

Investor

On September 21, 2021, the project successfully raised $1.3M in capital from 3 investment funds cFund, Alameda Research and Double Peak.

Tokenomics

Overview information about SUNDAE token

- Tokenname: Token SUNDAE

- Ticker: SUNDAE

- Blockchain: Cardano

- Total supply: 2,000,000,000

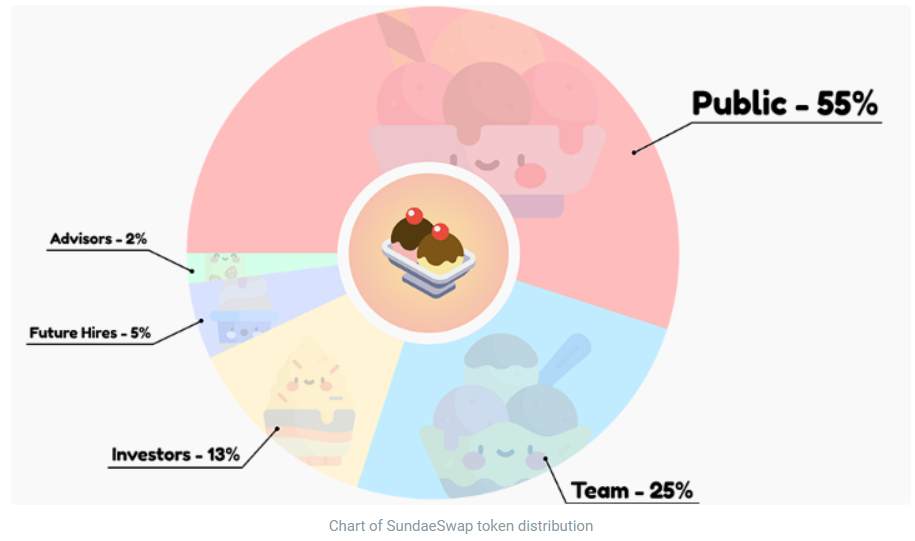

Token Allocation

- Public: 50%

- Team: 25%

- Investors: 13%

- Future Hires: 5%

- Advisors: 2%

Token Relesea

- Community: At the time of the DEX launch, the ISO will start and the SundaeSwap token will be available to users on the SundaeSwap DEX protocol. With 5% of the total token supply distributed through ISO, users will also be able to earn additional SUNDAE as rewards from providing liquidity to any XX/SUNDAE pair at launch. Users will then be able to earn additional SUNDAE rewards through yield farming, fee sharing initiatives, and other features.

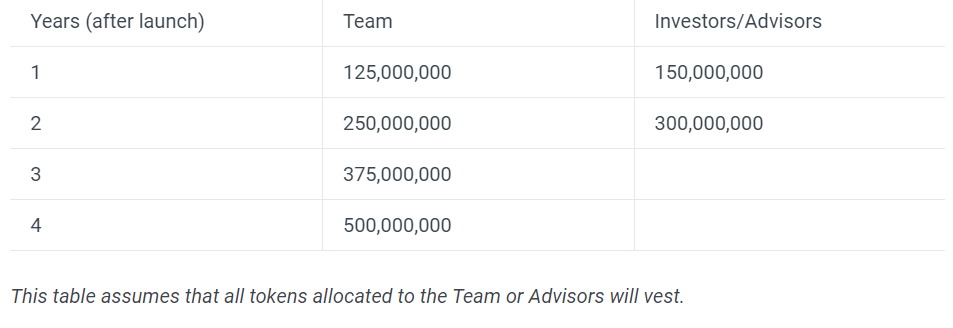

- Team and Investor: Token payment schedule will be 4 years for Team and 2 years for Investors and Advisors paid in monthly installments.

Token Use Case

Holders holding SUNDAE will receive the following benefits:

- Administration: Participate in votes to decide project changes

- Profit sharing: SUNDAE token holders will enjoy profits from the protocol.

- Fee reduction: Use SUNDAE to get reduced fees.

Exchanges

Currently SUNDAE tokens are being traded on the following exchanges: CoinEx, Bitrue, SundaeSwap, WingRiders,..

Project Information Channel

- Website: https://sundaeswap.finance/

- Twitter: https://twitter.com/SundaeSwap

- Medium: https://sundaeswap-finance.medium.com/

- Discord:

Summary

Above are the things you need to know to understand what the Sundae Swap project is? The current project is still developing and needs further monitoring!