What is Suiswap? Suiswap is a trading (Dex) and token exchange platform built on the SUI blockchain by Vivid Network. It aims to provide a safe, fast and flexible trading environment for the SUI ecosystem. So What is Suiswap? Let’s find out in this article!

To understand more about Dex and the Sui ecosystem, you can read the following articles:

- What is Cetus Protocol (CETUS)? Overview of Cetus Protocol Cryptocurrency

- What is MovEX Exchange (MOVEX)? MovEX Exchange Cryptocurrency Overview

- What is Turbos Finance (TURBOS)? Turbos Finance Cryptocurrency Overview

What is Suiswap?

Overview of Suiswap

Suiswap is a trading (Dex) and token exchange platform built on the SUI blockchain by Vivid Network. It aims to provide a safe, fast and flexible trading environment for the SUI ecosystem.

Suiswap hopes to provide the entire SUI community with an order book-based trading platform or rapid token exchange. The vision of the development team is to make the project the leading trading platform of the Sui ecosystem.

Mechanism of action

Traditional Liquidity Pools

Similar to UniswapSuiswap will offer a token exchange built on top of traditional liquidity pools. Users can trade tokens such as SUI/USDC from liquidity provided by liquidity adders. Liquidity providers (LPs) can stake assets to the pool, earning a portion of the trading fees generated by the platform.

Stablecoin Liquidity Pools

Suiswap will also have Stablecoin liquidity pools, much like Curve’s USDC/USDT pools. These pools offer lower slippage and tighter spreads when trading Stablecoins, making them an attractive option for traders and LPs alike.

Central Limit Order Book Trading Platform

To cater to more professional traders, Suiswap offers an order book (CLOB) trading platform. This component allows users to place limit orders, providing more control over their trades and potentially offering better prices than automated market makers (AMMs). .

Decentralized Aggregator

Aggregator is a key component of Suiswap, combining liquidity from the order book and liquidity pool to deliver higher liquidity and lower slippage to traders. By aggregating multiple liquidity sources, Suiswap aims to provide a more efficient and seamless trading experience.

Liquidity Farming

Users who provide liquidity to Suiswap’s pools will be able to participate in liquidity farming, earning SSWP tokens as rewards. This incentive mechanism aims to attract more users to the platform, increase liquidity, and improve the overall trading experience.

Yield Farming and Platform Revenue

Staking SSWP tokens will allow users to participate in yield farming and receive a portion of the platform’s revenue. This feature provides additional incentives for users to hold and use SSWP tokens, further supporting the growth of the Suiswap ecosystem.

Development Roadmap

Future development of Suiswap will focus on expanding the platform’s services and continuously improving the user experience. Some potential growth areas include:

- Cross-chain integration : Integration with other blockchain networks will allow Suiswap to reach a broader user base and facilitate cross-chain asset transfers, further solidifying its position as a leading exchange .

- New financial products : The expansion of Suiswap’s products to include more advanced financial instruments, such as options and derivatives, will serve more traders and investors.

- Enhance user experience : Continuously refining the platform’s interface and functionality will ensure that users have a seamless and efficient trading experience.

- Community governance : Implementing a community governance model will allow Suiswap governance token holders to have a say in the future direction and development of the platform, promoting a more decentralized ecosystem and community-oriented.

- Partnerships and integrations : Collaboration with other projects and platforms in the SUI ecosystem will strengthen the overall network and increase the utility of the Suiswap platform.

Core Team

Update…

Investors

Update…

Tokenomics

Overview information about Suiswap Token

Update…

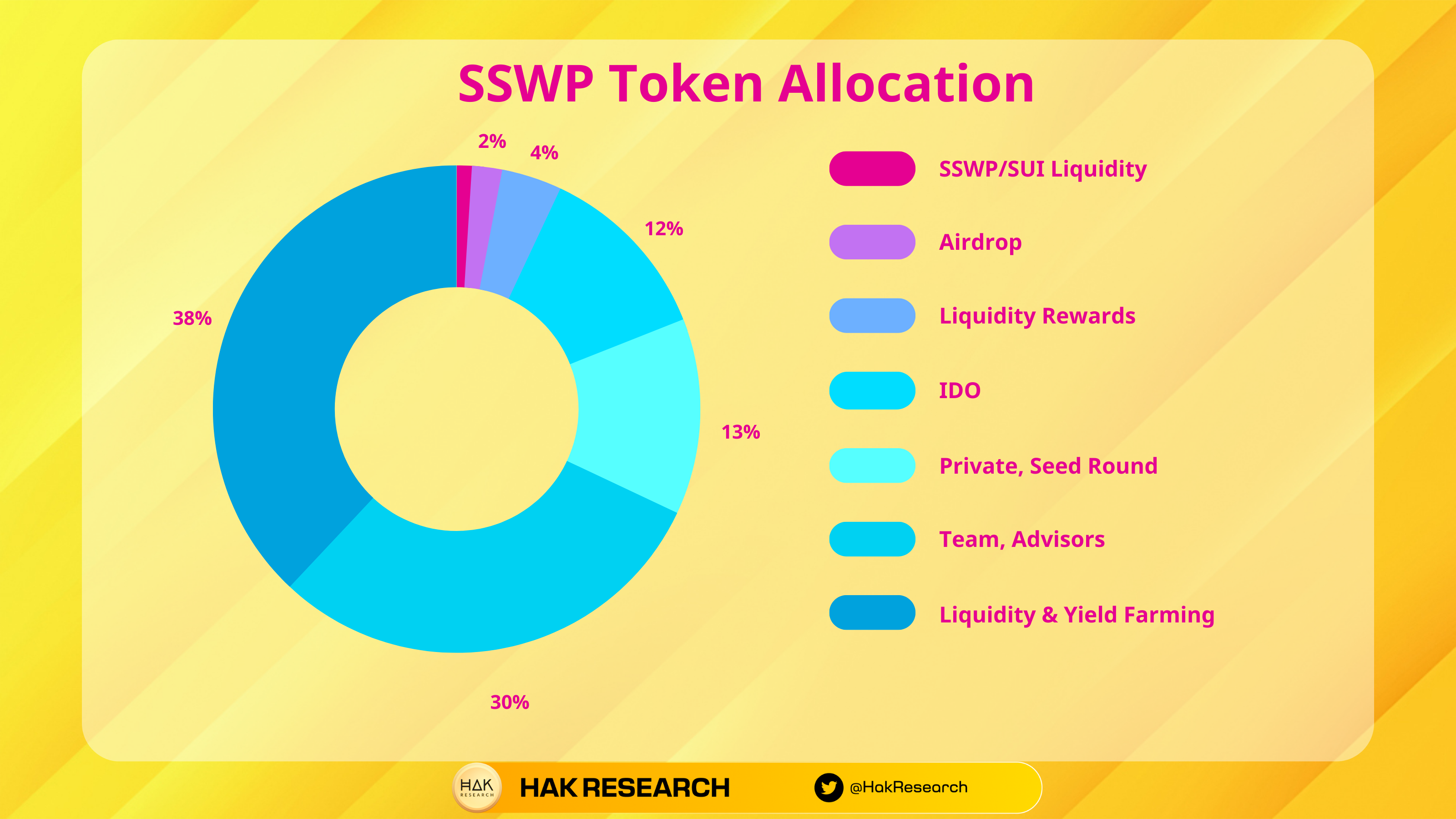

Token Allocation and Token Release

- Liquidity & Yield Farming – 38%: Implement liquidity incentive programs and operate on Suiswap. This amount of Tokens will be distributed over 48 months.

- Team, Advisors – 30%: Team and Advisor allocations will be locked in for 12 months and then amortized over 24 months.

- IDO – 12%: The amount of IDO Tokens sold will be 100% unlocked.

- SSWP/SUI Liquidity – 1%: This amount of Token will be used as initial liquidity for SSWP Token.

- Private, Seed Round – 13%: This allocation will be unlocked 20% upon TGE, the rest will be paid in installments over the next 6 months.

- Liquidity Rewards – 4%: Allocation for community programs.

- Airdrop – 2%: Reward for early supporters and contributions to the project.

Token Use Case

SSWP Token holders share in protocol revenue and participate in Suiswap governance. In addition, revenue from the protocol is also used to buy back SSWP Tokens for permanent burning.

Exchanges

Update…

Suiswap’s Information Channel

- Website: https://suiswap.app/app/

- Twitter: https://twitter.com/suiswap_app

- Discord:

Summary

Suiswap is a project that has been present since the Sui ecosystem was born and has participated in testing many times with Testnet and Devnet networks. And Suiswap’s product is also integrated by many models but Dex on Sui is facing very strong competition from other projects.

So I have clarified what Suiswap is? Overview of Suiswap cryptocurrency. Hope this article provides you with a lot of useful information and knowledge!