What is StakeWise? StakeWise is a Liquid Staking platform built and developed on Ethereum. Here users will stake ETH to earn more passive profits. So what’s good about StakeWise? How does the project work? Let’s find out with Weakhand below in this article!

To understand more about StakeWise, you can read the following articles:

- What is Rocket Pool (RPL)? Overview of Rocket Pool Electronic Turning

- What is Lido Finance (LDO)? Overview of Electronic Conveniences Lido Finance

What is StakeWise?

Overview of StakeWise

StakeWise is an area about Staking, allowing users to stake ETH into Ethereum 2.0 on Beacon Chain. StakeWise operates a secure and stable infrastructure, combined with unique token technology to deliver the highest staking returns to users. For StakeWise, there is no minimum stake for ETH and the platform fee is the lowest in the Liquid Staking segment.

Mechanism of action

StakeWise Pool

StakeWise Pool is a pooled ETH staking solution for users. Each ETH deposit to the platform will receive sETH2, which also represents the amount of ETH staked. StakeWise Token plays an important role in the Pool by making user stakes liquid and opening up opportunities to earn more profits in DeFi protocols.

Users will deposit ETH into the platform to receive sETH2 (stake ETH) and reward rETH (reward ETH).

StakeWise Pool’s operating mechanism

- Pool represents a network of validators operated by StakeWise.

- For every 32 ETH collectively deposited by a user into the Pool, StakeWise will create a new validator and add it to the network.

- The rewards generated by these validators are shared among users in proportion to their ETH contribution in the Pool.

StakeWise Solo

StakeWise Solo has stopped accepting new deposits, with new users being encouraged to stake via the pool instead. Previously, StakeWise Solo provided users with the ability to deposit 32ETH and run their own validator on StakeWise. Despite not accepting new deposits, existing users of the product still benefit from all future infrastructure upgrades and full access to their balances through ownership of the withdrawal key .

How StakeWise Solo works:

- Solo allows stakers to leverage StakeWise’s bespoke infrastructure and validator management tools to run single validators and use their own withdrawal credentials to maintain custody. sole custody of validators’ funds.

- StakeWise uses submitted withdrawal credentials to register validators and handle the complex task of running them on behalf of users to maximize rewards.

- Users are charged monthly for each validator they run, payable in DAI.

Highlights of StakeWise Pool

- Provide a profit-optimized Pool: StakeWise uses a pool Charge competitive fees and tokenize deposits and rewards separately to maximize staking returns for users.

- Custom Stake Solo offering: StakeWise Solo is a great combination of stable performance, intuitive validator management tools, and DAI-based service fees, created for stakers who care about profits and do not compromise on security.

- Strong track record: StakeWise has been running a public testnet for more than half a year with more than 200,000 ETH staked to stress-test and perfect the project’s product, and use that experience to run the infrastructure in Phase 0 and beyond. more in the future.

Development Roadmap

Update…

Core Team

Dmitri Tsumak – Fouder

- 2013 – 2016: Dmitri Tsumak studied at the University of Tartu, majoring in Bachelor of Computer Science.

- 2016-2017: Dmitri Tsumak studied at Aalto University, majoring in Master’s degree, Mobile and Cloud Computing.

- 2017 – 2018: Dmitri Tsumak studied at KTH Royal Institute of Technology, majoring in Master’s degree and Mobile Computing.

- 2014 – 2017: Dmitri Tsumak was a software developer at OpenNode LLC.

- 2017 – 2021: Dmitri Tsumak is a software developer at Ericsson.

- 2021: Dmitri Tsumak and his colleagues founded StakeWise.

Kirill Kutakov – Co Founder

- 2013 – 2014: Kirill Kutakov studied at Warwick University, majoring in Bachelor of Accounting & Finance.

- 2014 – 2017: Kirill Kutakov studied at Warwick University, majoring in Bachelor of Science, Philosophy, Politics & Economics.

- 2015: Kirill Kutakov worked as a credit intern at Gunvor Group.

- 2017 – 2020: Kirill Kutakov worked as an Analyst at Avaron Asset Management in the field of independent asset management.

- November 2020: Kirill Kutakov and his colleagues founded StakeWise.

Investor

On March 8, 2021, the project successfully called for $2M from 5 investors led by Greenfield.

Tokenomics

Overview information about StakeWise token

- Token Name: Token StakeWise

- Ticker: SWISE

- Blockchain: Ethereum

- Contract: 0x48c3399719b582dd63eb5aadf12a40b4c3f52fa2

- Token classification: ERC 20

- Total supply: 1,000,000,000

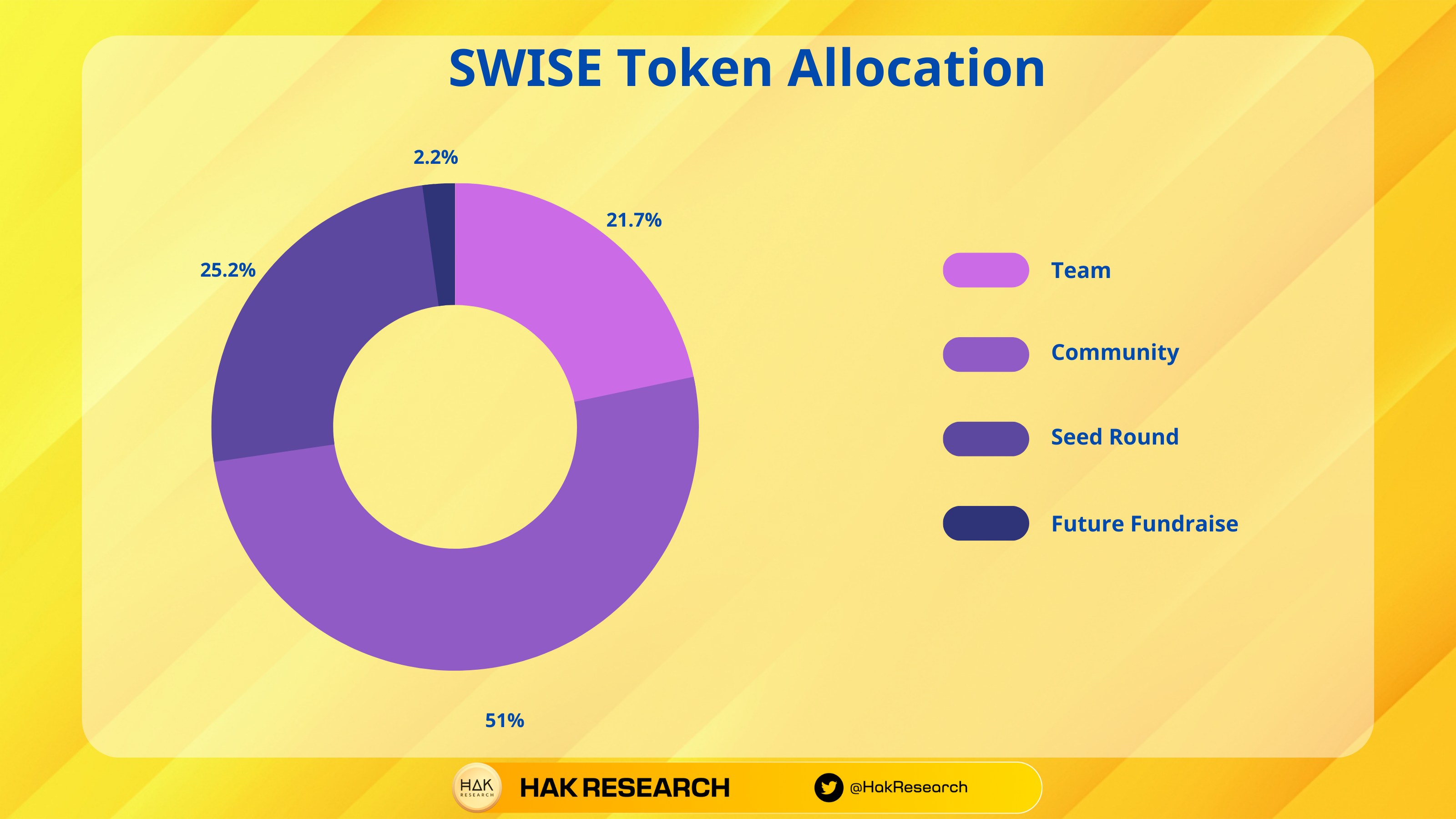

Token Allocation

Token Release

Currently, the Seed Round and Future Fundraise groups have been 100% unlocked.

- For Community groups: Tokens are locked for 4 years, and will be completely unlocked by March 2025.

- For the Team team: Tokens are locked for 42 months, and will be completely unlocked by March 2025.

Token Use Case

Currently, the SWISE token is used to reward users who stake ETH into the platform.

Exchanges

Currently SWISE tokens are being traded on Uniswap V3, Poloniex, Deepcoin, etc.

Project Information Channel

Summary

Above is information about the StakeWise project that Weakhand learned. The project is about Liquid Staking on Ethereum and has high staking fees on the market. The platform allows users to stake ETH and receive project tokens. The project is still developing and needs further monitoring.