What is Sovryn? Sovryn is a DEX platform for Bitcoin players developed on the Rootstock network. Sovryn offers Bitcoin-based trading, lending, and leverage features. What’s special about this platform? Let’s find out below this article!

You can read the following articles to better understand Sovryn:

- What is dYdX (DYDX)? dYdX Cryptocurrency Overview

- What is Laminar? Laminar Cryptocurrency Overview

- What is GMX (GMX)? Overview of GMX Cryptocurrency

What is Sovryn?

Overview of Sovryn

Sovryn is the most feature-rich DEX platform for Bitcoin, Sovryn offers features for trading, lending, yield farming BTC and other assets and receiving decentralized stablecoins backed by Bitcoin.

Mechanism of action

Sovryn’s existing features

- 0% interest loans on Bitcoin issue a stablecoin pegged to USD.

- AMM trading is low-cost, low-slippage, allowing instant trading of tokens, including limit orders.

- Manage portfolio and bridge between Rootstock (BTC) – Ethereum – BSC networks.

- Margin trading, create buy/sell transactions with 5x leverage.

- Lending pool – allows holders to earn interest by lending tokens to traders and borrowers.

- Borrow – allows users through smart contracts to borrow assets in the lending pool and requires collateral. The loans were overcollateralized.

- Yield Farm – deposit assets to the platform, provide liquidity to earn more profit.

- Stablecoins are backed by Bitcoin and pegged to USD.

- FastBTC Relay – used for simple and fast two-way conversion between BTC and RBTC.

Development Roadmap

Sovryn builds new features in the future:

- Fiat off ramp

- Sovryn Dollar (DLLR)

- Zero SDK

- Further LN integration

- Sovryn Bank

Core Team

Edan Yago – Co Founder & CEO

- 2000 – 2004: Edan Yago studied at Tel Aviv University, majoring in Philosophy and History of Science.

- 2009 – 201: Edan Yago studied at Carnegie Mellon University – Tepper School of Business, majoring in MBA, Marketing, Technology.

- 2004 – 2009: Edan Yago was Co Founder & General Manager at Charisma company in Israel.

- 2011 – 2013: Edan Yago worked as product manager at Zynga.

- 2014 – 2016: Edan Yago is a board member of DATA – Digital Asset Transfer Authority headquartered in Washington DC.

- 2010 – 2017: Edan Yago was both a Co Founder and a member of the board of directors of an Enzyme company in the diagnostics and life sciences industry.

- 2013 – 2017: Edan Yago was Founder & CEO at Epiphyte Group working on enterprise software development that allows banks and other financial institutions to securely integrate with Bitcoin and the crypto finance industry.

- 2018 to present: Edan Yago is Founder & CEO at CementDAO working on a decentralized exchange platform for stable coins.

- 2020 to present: Edan Yago is Co Founder & CEO of Sovryn.

Investor

- December 15, 2020: The project successfully called for $2.1M in Seed Round from 3 investors led by Green Field.

- October 9, 2022: The project successfully called for $5.4M Venture Round from 3 investors led by General Catalyst.

Tokenomics

Sovryn Token Overview

- Token Name: Token Sovryn

- Ticker: SOV

- Blockchain: Ethereum

- Token classification: ERC 20

- Contract: 0xbdab72602e9ad40fc6a6852caf43258113b8f7a5

- Total supply: 100,000,000

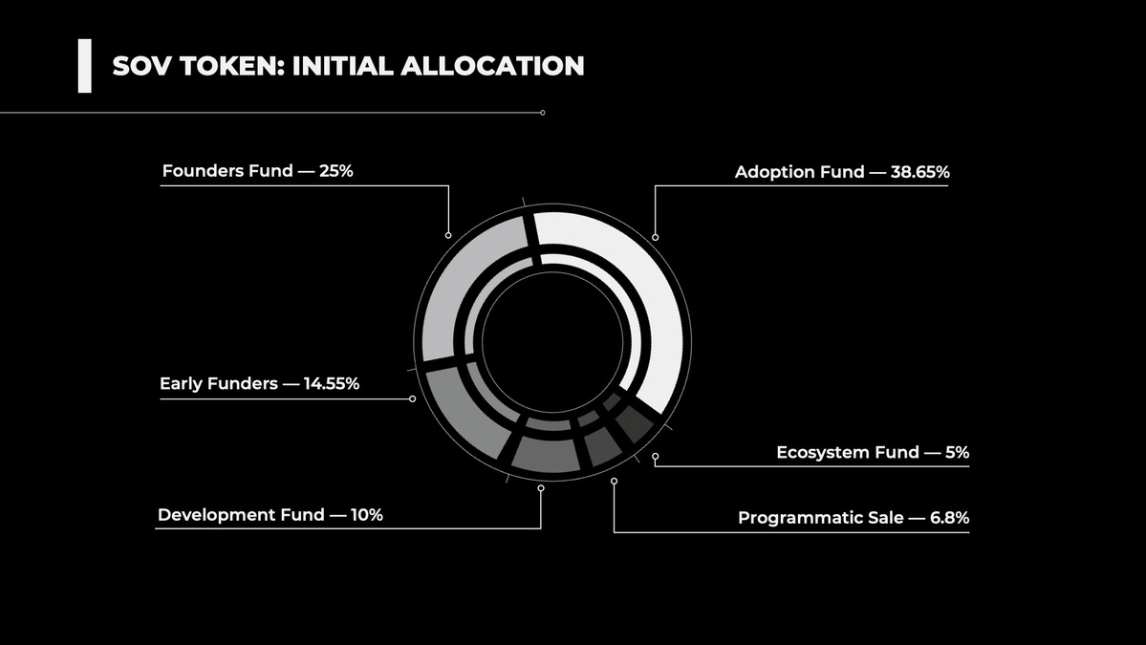

Token Allocation

- Founders Fund: 25%

- Early Funders: 14.55%

- Development Fund: 10%

- Adoption Fund: 38.65%

- Ecosystem Fund: 5%

- Programmatic Sale: 6.8%

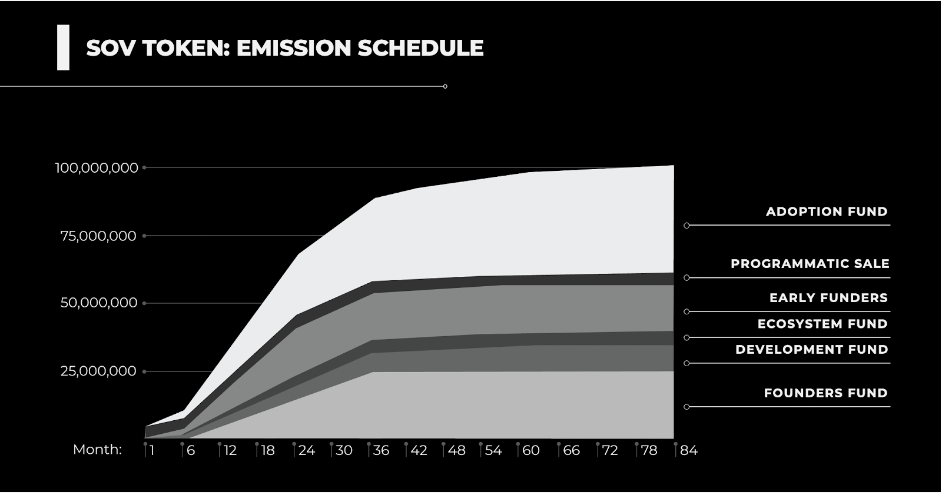

Token Release

- Founders Fund: 25% locked for 6 months and 3 years

- Early Funders: 14.55% locked for 10-24 months

- Programmatic Sale: 6.8% To continue distribution and attract users, the protocol will organize programmatic sales. Users participate in purchasing SOV tokens as voters and stakeholders of Sovryn.

- Development Fund: 10% will be the project treasury for funding and bonuses related to project construction and development.

- Ecosystem Fund: 5% as a bonus for ecosystem initiatives to attract the community and encourage new users to join the platform.

- Adoption Fund: 38.65% will be distributed to users and contributors of the system through discounts, referral fees, and liquidity mining.

Token Use Case

- Use SOV tokens to vote on SOV staking time on the platform.

- Use SOV as transaction fee

- SOV reduces risk to the protocol by acting as a pool of staking value that can be burned, redistributed, or inflated to prevent and offset possible losses.

Exchanges

SOV tokens are currently being traded on exchanges: Kucoin, Gate.io, Uniswap V2, Bitmax, LATOKEN, Sovryn,…

Project Information Channel

Summary

Above are the things you need to know to understand what the Sovryn project is? The project is the most feature-rich platform for Bitcoin, the project is still in development and needs further monitoring.