What is Siphon Lab? Siphon Lab is on a mission to build the Siphon universe on the Sui network. Siphon Universe is the Siphon ecosystem that includes Tradeify (Derivative Exchange), Liquidify (Liquid Staking Protocol) and many other innovative products to be revealed in the future.

So What is Siphon Lab? What’s special about it? Let’s find out in this article!

You can read articles about the project in the Sui ecosystem below:

- What is Cetus Protocol (CETUS)? Overview of Cetus Protocol Cryptocurrency

- What is Turbos Finance (TURBOS)? Turbos Finance Cryptocurrency Overview

- What is MovEX Exchange (MOVEX)? MovEX Exchange Cryptocurrency Overview

What is Siphon Lab?

Overview of Siphon Lab

Siphon Lab is on a mission to build the Siphon universe on the Sui network. Siphon Universe is the Siphon ecosystem that includes Tradeify (Derivative Exchange), Liquidify (Liquid Staking Protocol) and many other innovative products to be revealed in the future.

Tradeify is a Derivative Exchange protocol that offers price-neutral trading, up to 100x leverage, self-custody, pooled liquidity, and an optimized on-chain trading experience. Additionally, Tradeify is the first multi-chain native protocol to unify pooled liquidity across deployed chains to maximize capital efficiency.

Liquidify is a Liquid Staking solution built on Sui. We allow users to stake their Sui tokens to earn profits and help contribute to network decentralization while maintaining liquidity.

Mechanism of action

Tradeify

This derivatives exchange can be understood as GMX, using the same model and operating method.

Main components in Tradeify:

- Perpetual Trading: Lis a decentralized derivatives exchange that allows users to open highly leveraged long or short positions in crypto assets. All traders trade with Tradeify Liquidity Pool (TLP).

- Liquidity Pool: Lis a basket of Blue-chip and Stablecoin assets pooled together, acting as an AMM for leveraged trading. Liquidity providers can deposit any listed asset into the TLP pool in exchange for TLP tokens, which represent the LP portion of the multi-asset liquidity pool.

- Earning: By depositing TRY into the vault, TRY holders will begin earning staking rewards that are paid out continuously.

- Synthetic Assets: Dcalled tAssets on Tradeify, can track price movements and risk-reward profiles of traditional assets such as stocks or shares, commodities such as gold and oil, currencies such as the US dollar or Euro; crypto assets such as Bitcoin, Ethereum, and NFTs, and even baskets of multiple assets, like index funds or ETFs.

Users can provide liquidity by purchasing TLP using assets authorized by the portfolio. TLP tokens are minted when buy orders are made and burned when sold. The TLP token price is calculated by dividing the TLP pool value by the total TLP supply. After purchasing TLP tokens, users can stake the tokens to earn protocol income and TRY rewards.

USDY is Tradeify’s core tAsset and is a US dollar-pegged stablecoin. USDY is important because the total value of all synthetic assets created on Tradeify is valued and calculated in USDY.

Tradeify will ensure that USDY is priced at $1 when minted or burned. The value of USDY that exists on the open market may fluctuate in price (based on supply/demand forces), but that will create arbitrage opportunities for profit between the open market and Tradeify. USDY will also facilitate the trading of other tAssets that will be available on Tradeify.

Liquidify

Liquid staking on Liquidify is an alternative to traditional staking with validators. It allows you to stake your SUI on the SUI Network and receive Liquid SUI (LiSUI). The LiSUI you receive represents your staked SUI and acts as a receipt, allowing you to redeem them later for staked SUI and earned rewards.

LiSUI is a tokenized Liquid for bettors’ SUI. LiSUI allows stakers to obtain liquidity for their staked SUI and allows the locked value of staked SUI to be used on decentralized finance applications on the SUI Network.

Liquidify will offer the option to cancel shares immediately to users in exchange for a fee (0.3% – 3%). This will involve a limited amount of SUI being held specifically for this purpose. And Delayed bet cancellation feature will allow users to cancel any amount of LiSUI they want without paying any fees. However, this process can take up to 30 days to cancel a bet as this is only done at the end of each betting registration period.

Liquidify has an ongoing management fee of 10% of validator rewards as part of supporting ongoing product development. This means less than 1% per year on the value you bet, without affecting your principal amount deposited.

50% of the Protocol fees will go to Liquidify’s treasury and 50% will go to SIP Token investors.

Development Roadmap

Update…

Core Team

Update…

Tokenomics

Token TRY

TRY is Main token of the Tradeify protocol. Users can lock TRY to receive gTRY, allowing them to receive protocol income and TRY rewards.

The supply limit will not change unless an administrative proposal to increase the limit is initiated and passed. If the supply limit is voted to increase, the change will take effect after a 14-day lock-in period.

Users can lock TRY to receive gTRY, terms range from 2 weeks to 4 years. Locked shares are time-weighted, so longer time locks will be allocated with more gTRY distributed.

gTRY is the protocol governance token with more gTRY comes more voting power over protocol governance. Users can receive gTRY from locking TRY. NHolding gTRY will grant users protocol income (protocol fees and TRY rewards).

TLP tokens

TLP is the protocol’s liquidity provider token that users can purchase with assets permitted by the pool category on the Tradeify protocol. After purchasing tokens, users can stake them to earn protocol income (protocol fees and TRY rewards).

The income of TLP holders comes from transaction fees and DEX mining output. In addition, TLP also has additional profits from the increase in price of assets in the portfolio.

SIP tokens

SIP is Siphon’s main token, helping to decentralize the protocol and implement a Tokenized economy for Siphon Lab.

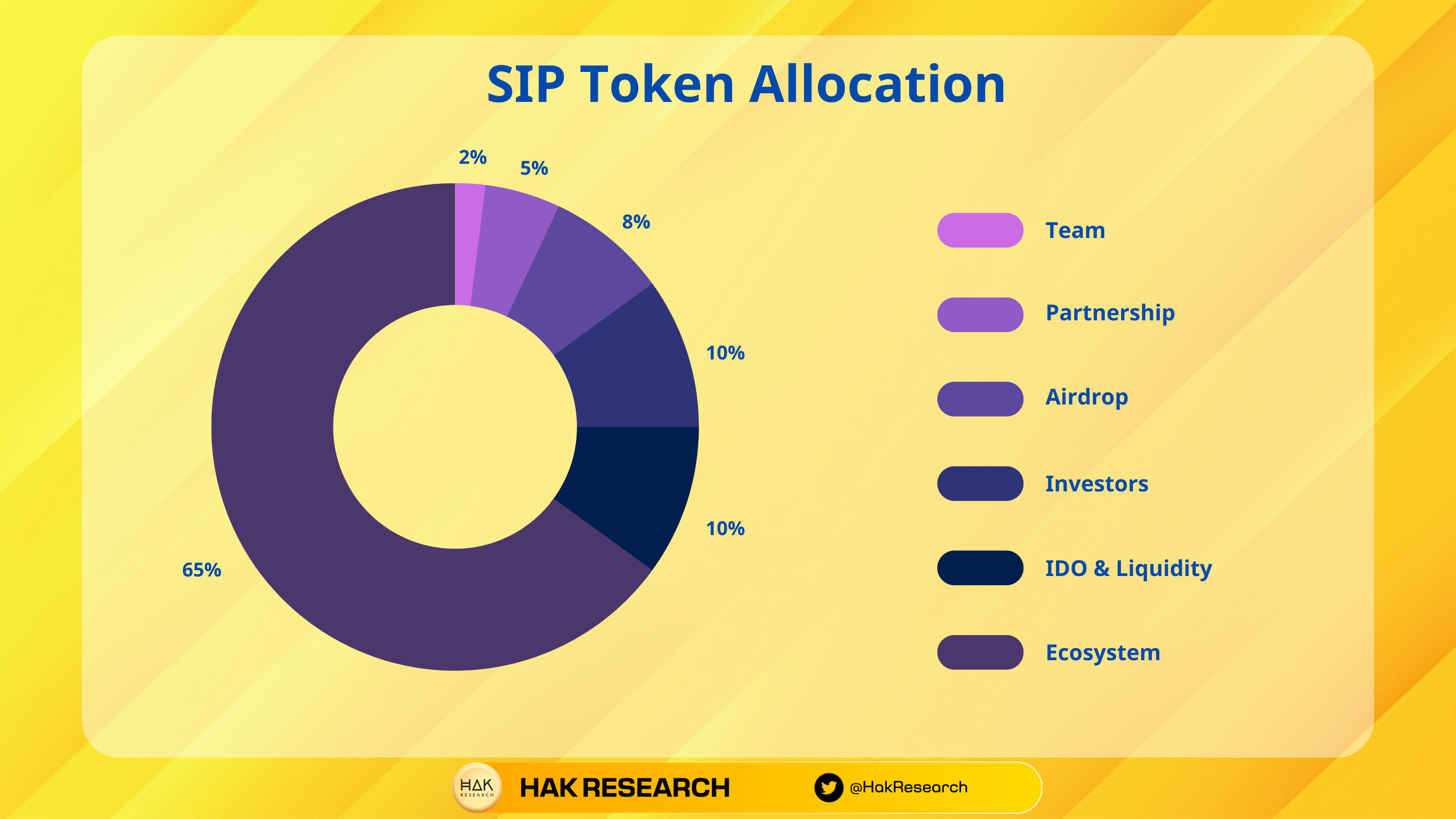

Token Allocation and Token Release

- Ecosystem: Allocated 65% to reward stakers, LPs for supporting and protecting Liquidify.

- Partnership: 5% is used for all marketing costs of Liquidify and its ecosystem, minted linearly over 12 months.

- Team: 2% for core contributors, minted after Liquidify launch and distributed for one year.

- Investors: Cast linearly for 24 months.

- Airdrop: 8% is allocated to airdrop to community users in batches. Airdrop receipt criteria will be evaluated based on testnet participation, Zealy campaign (formerly CREW3), having OG in Discord.

- IDO & Liquidity: 10% used for initial liquidity, minted before Liquidify launch.

Token Use Case

SIP Token holders can participate in Siphon Lab governance.

Exchanges

Update…

Siphon Lab’s Information Channel

- Website: https://www.siphonlab.org/

- Medium:

Summary

Siphon Lab is the universe that brings the extremely important Derivative Exchange and Liquid Staking pieces to the Sui ecosystem. In addition, Siphon Lab will create many other useful products and protocols in the future.

So I have clarified what Siphon Lab is? Overview of Siphon Labs cryptocurrency. Hope this article provides you with a new perspective and useful knowledge.