What is SFT? SFT is a type of semi-alternative token with a combination of two popular asset types today: NFT and token. SFT was mentioned recently after the popularity of Inscription that originated from Bitcoin and spread to other blockchains in the market. So what is SFT and what is special about it? Let’s find out with Weakhand in this article.

Before jumping into the article, everyone can refer to some of the following articles to understand better.

- What is Bitcoin Ordinals? Everything about Bitcoin Ordinals

- What is BRC 20? All you need to know about BRC 20

What is SFT?

For a long time we have only witnessed the popularity of two types of assets: NFT and Token. The first is the token with the full name Fungible Token (FT), also known as a fungible token. True to its name, the characteristic of FT is that the tokens of any two units are identical and can be substituted for each other, so they are identical overall.

Because FT corresponds directly to units of value such as currencies, stocks, etc. and can perform addition and subtraction calculations, it is easy to understand why it appeared very early. As early as 2015, when Ethereum was first launched, Vitalik Buterin proposed the idea of implementing FT through Smart Contract and Fabian Vogelsteller proposed the ERC 20 standard in November 2015. Then in 2016, ERC 20 became a well-known and widely used token standard, opening up a huge industry worth hundreds of billions of dollars.

Next is NFT with the full name of non-fungible token and right in the name it is shown to be an antonym of Fungible Token. Each NFT is unique and non-fungible so we cannot substitute any two NFTs for each other.

While FT represents an abstract unit of quantity, NFT represents specific digital items such as a piece of digital art, domain name, etc. To represent its uniqueness, each NFT will have a unique ID and metadata, also known as metadata. The main standard for NFTs is ERC 721, proposed by William Entriken and three others in January 2018.

In the first three years, NFTs were not very popular, and it was not until 2021 with the popularity of cryptography that the NFT industry suddenly exploded. By May 2022, the NFT market capitalization has reached 36 billion USD. Today NFT is considered one of the important infrastructures of many different segments in the Crypto market such as: SocialFi, GameFi, Metaverse,…

We now see the emergence of the new token type SFT and it is the third most popular asset class after NFTs and Tokens. SFT’s full name is semi-fungible token and is known as semi-fungible token. As the name suggests, SFT will be between FT and NFT when it is decomposable, computable and also unique.

What is SFT?

A simple example of SFT in practice to make it easier for everyone to understand is the issuance of football tickets in which each ticket will represent 1 SFT. Thus, if tickets have the same face value, people can exchange one ticket for another, but each ticket is still guaranteed to be unique and distinguishable from other tickets through the ID code of each ticket.

SFT first appeared following Solv Finance’s ERC 3525 standard proposal in September 2022. Even though the ERC 3525 standard has been around for over a year on Ethereum, it has yet to receive much attention from the community. Part of the reason is of course the bear market at the time but another reason is that the SFT tokens issued by Solv belong to the bond market and are aimed at institutional investors, having nothing to do with the Ordinary single investor.

Why Say The Nature Of Inscription Is SFT

First we have to take a look at Bitcoin Ordinals introduced by Casey Rodarmor in January 2023. The purpose of Bitcoin Ordinals is to enable the creation of NFTs on the Bitcoin network based on the idea that as each new Block of Bitcoin is mined, a new amount of Bitcoin will be created as a mining reward, which the protocol will give each Satoshi in Bitcoin has a value based on the time it was mined. Users can then engrave any data onto the sat to give it unique characteristics.

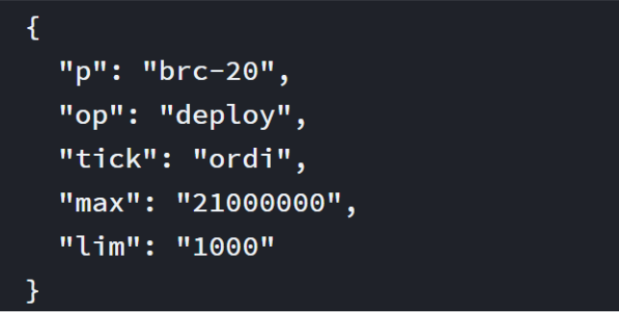

However, Bitcoin Ordinals launched in the early stages did not receive much attention, until the appearance of BRC 20 in March 2023. BRC 20 uses the Bitcoin Ordinals protocol to create tokens on the Bitcoin network. This is done by attaching a JSON format code that describes the various attributes of the token such as: Supply, maximum mining capacity and project code.

BRC 20 token standard

So when people pay attention on the BRC 20 markets, BRC 20 tokens are sold in batches, where each batch will contain a certain number of tokens. Since each batch is formatted as an NFT, we see that BRC 20 is essentially an SFT format that combines the characteristics of both NFT and Token.

Why Is Inscription Successful?

Looking back at history, we see that NFTs are really not very successful and only account for a small part of the Crypto market. So the focus of discussion at that time was after the NFT version (ERC 721), is it worth issuing NFTs on the Bitcoin blockchain?

As we know, NFTs on Ethereum store image data or content in NFTs in an offchain form. Therefore, if the content in the NFT is stored on servers, there is a risk of being hacked or if the server for some reason loses data, the content in the NFT will no longer exist.

The Inscription version allows onchain data storage, which is an advantage but this is not enough because before March 2023, Ordinals NFT was quite quiet, until the appearance of BRC 20. In my opinion, this These are the reasons that helped BRC 20 succeed:

- The BRC 20 is the first SFT on the Bitcoin network. SFT tokens are a new type of asset compared to NFTs or tokens, and this brings appeal to investors.

- BRC 20 applies the principle of fair selling, different from the common VC model in most projects on the market. Because of the low participation cost and fair launch model, it can expand user participation and fomo in a short period of time.

- SFT combines the dual advantages of NFT and FT, allowing direct use of existing FT and NFT infrastructure. So we can see SFTs being traded on NFT trading markets like: OpenSea, on centralized exchanges like Binance or OKX and even on Dexes like: Uniswap. This will help SFT gain popularity and add a large amount of liquidity when traded on many different platforms.

- Take advantage of Bitcoin’s huge capital and community. After a long time, BTC holders can now participate in DeFi, NFT or GameFi activities on the Bitcoin ecosystem.

summary

Inscription has brought a new trend and breeze not only on Bitcoin but also spread throughout the major Blockchains on the market. Above is the information that I want to introduce in this article, hope everyone has received useful knowledge.