What is Seneca? Seneca is one CDP platform Allows users to borrow and mortgage assets to earn profits senUSD, is a Stablecoin built and developed on the Arbitrum chain. So what’s different about Seneca? Let’s find out through the article below.

To understand more about Seneca, people can read some of the articles below:

- What is Helio Protocol (HELIO)? Overview of Helio Protocol Cryptocurrency

- Overview and Liquidity Flow in LSDfi

- What is Real Yield? New Breeze For DeFi Market

Seneca Overview

What is Seneca?

Seneca is a CDP platform built and developed on the Arbitrum ecosystem. Seneca allows users to collateralize crypto assets to mint stablecoin senUSD and use senUSD in DeFi protocols on the Arbitrum ecosystem.

Seneca uses LayerZero’s Omnichain technology to increase capital efficiency by mortgaging assets such as LST or yield-bearing tokens to mint senUSD.

Seneca provides loans senUSD for the listed profit-making assets. This gives DeFi investors access to institutional-grade leverage and lending while maximizing capital efficiency.

The Seneca Difference

- Seneca accepts decentralized assets as collateral and a number of highly decentralized asset types in the market.

- Seneca uses LayerZero’s Omnichain solution. Users can borrow and lend assets on any chain. At the same time, lenders can also withdraw assets from the chain they want.

- Seneca manages debt in isolation: Seneca uses collateralized debt positions (CDPs) called “Apricus Chambers”, Therefore, all risks related to assets are independent, liabilities are not subject to mutual risks.

Seneca uses stablecoin senUSD. senUSD is a pegged CDP stablecoin kept at 1:1 price with USD. To maintain stability, senUSD Try to maintain as close a link to the USD as possible. This is achieved through arbitrage.

- User has debt senUSD can buy more senUSD at a discounted price and use that money to pay off their debt.

- Users who have deposited collateral can borrow senUSD and sell it when it’s over $1, to spend the proceeds on something else.

-

Users who own other cryptocurrencies can purchase senUSD on one DEX priced below 1 USD and sell it on another DEX priced at or above 1 USD.

Mechanism of action of Seneca

Seneca’s operating mechanism takes place in a number of basic steps as follows:

- Step 1: Users deposit assets into Seneca. Seneca accepts asset types such as LST or yield bearing tokens.

- Step 2: Mint users issue stablecoin senUSD.

- Step 3: Users using senUSD bring in other DeFi protocols to earn profits.

- Step 4: Users burn senUSD to receive collateral.

Development Roadmap

Update…

Core Team

Update…

Investor

Update…

Tokenomics

Seneca uses a 2-token mechanism: SEN token and veSEN token.

- SEN tokens is the native token of the Seneca Protocol.

- veSEN used to access revenue redistribution and vote on governance proposals.

Information about Seneca tokens

- Token Name: Seneca

- Symbol: SEN

- Blockchain: Ethereum and Arbitrum.

- Contract: Update.

- Total supply: 100,000,000.

SEN Token Allocation

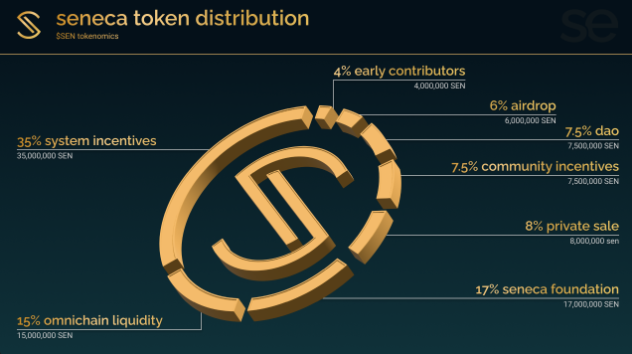

- Seneca Foundation: 17% equivalent 17,000,000 SEN.

- Community Incentives: 7.5% equivalent 7,500,000 SEN.

- DAO: 7.5% equivalent to 7,500,000 SEN.

- Airdrop: 6% equivalent to 6,000,000 SEN.

- Early Contributors: 4% equivalent to 4,000,000 SEN.

- Private Sale: 8% equivalent to 8,000,000 SEN.

- Omnichain Liquidity: 15% is equivalent to 15,000,000 SEN.

- Incentives: 35% is equivalent to 35,000,000 SEN.

SEN Token Release

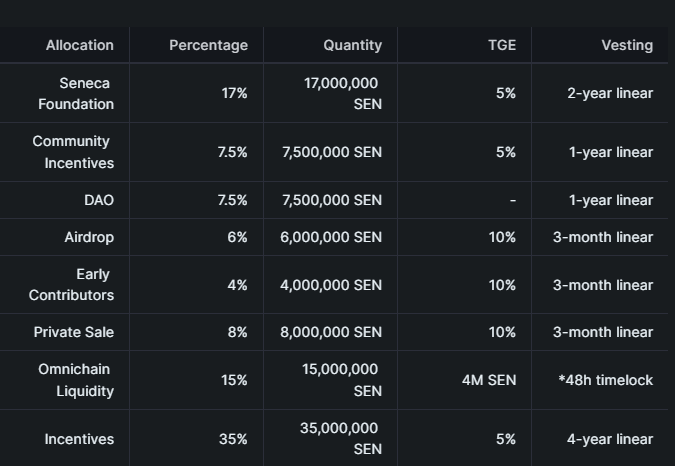

- Seneca Foundation: 5% TGE, then linear vesting for 2 years.

- Community Incentives: 5% TGE, then linear vesting for 2 years.

- DAO: Linear vesting for 1 year.

- Airdrop: 10% TGE, then linear vesting for 3 months.

- Early Contributors: 10% TGE, then linear vesting for 3 months.

- Private Sale: 10% TGE, then linear vesting for 3 months.

- Omnichain Liquidity: 4M SEN TGE, fully vested after 48 hours .

- Incentives: 5% TGE, then linear vesting for 4 years.

SEN Token Use Case

- SEN tokens is the native token of the Seneca Protocol.

- veSEN used to access revenue redistribution and vote on governance proposals, pRewards for project support.

SEN Token Exchange

Updating

Seneca Project Information Channel

- Website: https://senecaprotocol.com/

- Twitter: https://twitter.com/SenecaUSD

- Discord: https://discord.com/invite/senecaprotocol

- Telegram:

Summary

Seneca is designed to provide users with a new way to generate long-term income and unlock liquidity for their crypto assets. Seneca uses LayerZero’s Omnichain technology to increase capital efficiency by using assets such as LST or yield-producing assets.

Through this article, you probably have some basic information about the Seneca project, to make your own investment decision.