What is Self Repaying Loan? Self Repaying Loan is a next generation form of Lending & Borrowing formed based on the inspiration of Yield Bearing Tokens. It can be said that Self Repaying Loans along with other pieces of the puzzle continue to build an increasingly diverse and growing LSDfi industry. So to learn about the operations of Self Repaying Loans, please join me in the article below.

To understand more about Self Repaying Loans, people can refer to some of the articles below:

- Overview and Liquidity Flow in LSDfi

- What is Cat in a Box Finance? Overview of Cryptocurrencies Cat-in-a-Box Finance

- What is ZeroLiquid (ZERO)? ZeroLiquid Cryptocurrency Overview

Overview of Self Repaying Loan

Introducing Self Repaying Loan

The projects belonging to the Self Repaying Loan puzzle are a similar Lending & Borrowing project but the difference here is in collateral. The collateral will be the Yield Bearing Token (YBT) can be understood as profit-bearing tokens. For example:

- You provide liquidity for ETH – USDC on Uniswap V3, the protocol will return you LP Token representing assets in the pool. So this LP Token includes the ETH – USDC liquidity you provide and the benefits you receive such as incentives, transaction fees, bribes in the future, the LP Token here is a form of Yield Bearing Token.

- When you deposit ETH into Compound, you will receive cETH representing ETH and future interest. So cETH is a form of Yield Bearing Token.

- You deposit ETH into Lido Finance and receive stETH at a 1 – 1 ratio. In fact, after depositing ETH into Lido Finance, it will be sent to stake on the Beacon Chain and have a profit of about 4 – 7%/year. Profits will be added directly to stETH, meaning that as the amount of stETH you hold increases, stETH is a form of Yield Bearing Token.

In fact, this model has been developed before but did not receive the attention of users. Until LSD exploded, the number of LSTs became increasingly large, which prompted this model to return and focus on Yield Bearing Token assets, which are LSTs of LSD platforms, especially stETH or rETH.

The special point is in the collateral, if you use YBT as collateral, during the process of making collateral, YBT itself generates profits and this profit will automatically pay both principal and interest to you. (if the protocol did not charge interest) then YBT profits would eat away at your loan and:

- Your debt will gradually decrease and at some point your debt will automatically go away.

- The lower your debt, the more likely you are to be able to borrow more.

- The lower the debt, the lower the risk of liquidation.

And these are the differences that YBT assets create compared to regular assets such as BTC, ETH, DAI, USDC, USDT,… assets that stand still and cannot generate profits.

Self Repaying Loan’s operating mechanism

The general operating mechanism of the protocols includes:

- Step 1: Users will send YBTs which are LSTs into the protocol.

- Step 2: The protocol will allow users to borrow an asset similar to mortgaging stETH to receive boxETH or 1 Stablecoin.

- Step 3: Users use received assets to participate in DeFi to earn profits while YBT continuously generates profits to reduce liquidation risk, reduce debt and help users continue to borrow more.

- Step 4: Users can reclaim the collateral at any time by burning the assets they received in step 2.

Most protocols will not charge users interest but will charge users profits generated from YBT. Thus, users do not need to pay fees when they do not have any benefits and the protocol can also charge higher fees. This partnership is a win-win for the protocol and the users.

Some Potential Self Repaying Loans Protocols

ZeroLiquid – SRL Boot War in LSDfi

ZeroLiquid is a Self Repaying Loan platform for stETH or ETH collateral (which will immediately convert to stETH after the user transfers into the protocol). ZeroLiquid allows users to mortgage stETH to borrow zETH with a maximum LTV of 50%. Some features of ZeroLiquid include:

- stETH profits will be automatically deducted from user debt.

- Users borrow zETH at 0% interest.

- With low LTV and a peg guarantee strategy for zETH, ZeroLiquid guarantees no liquidation to users.

- There is no need to sell assets if you need money because when borrowing zETH you can convert to ETH with the zETH – ETH liquidity pool.

Not only that, ZeroLiquid has a relatively clear plan in keeping peg for zETH such as Arbitrage, Incentive, slowly expanding loan limits, Zero Fund or Protocol Own Liquidity. ZeroLiquid is only in the early stages of development, so zETH’s use cases are not too numerous yet. Therefore, ZeroLiquid will still have a lot of work to do in the future.

Alchemix – A project from the DeFi 2.0 past

Alchemix is a DeFi protocol with the Alchemist product targeting the Self Repaying Loan market. Alchemix allows users to mortgage many different types of assets, especially 2 LSTs, wstETH of Lido Finance and rETH of Rocket Pool, to be able to mint Stablecoin alUSD with a maximum LTV of 50%.

Similar to other Self Repaying Loan protocols, YBTs will automatically generate profits to deduct from the Stablecoin alUSD loan. Some of Alchemix’s distinctive features include:

- No Liquidations: The protocol will never liquidate user deposits

- Completely Flexible: Users can reclaim their assets at any time without the permission of the protocol or anyone.

- Wide Range of Tokens: Alchemix will accept even more collateral types in the future. This increases the ability to use capital for users.

- Leverage Your Wealth: You can use multiple assets at the same time.

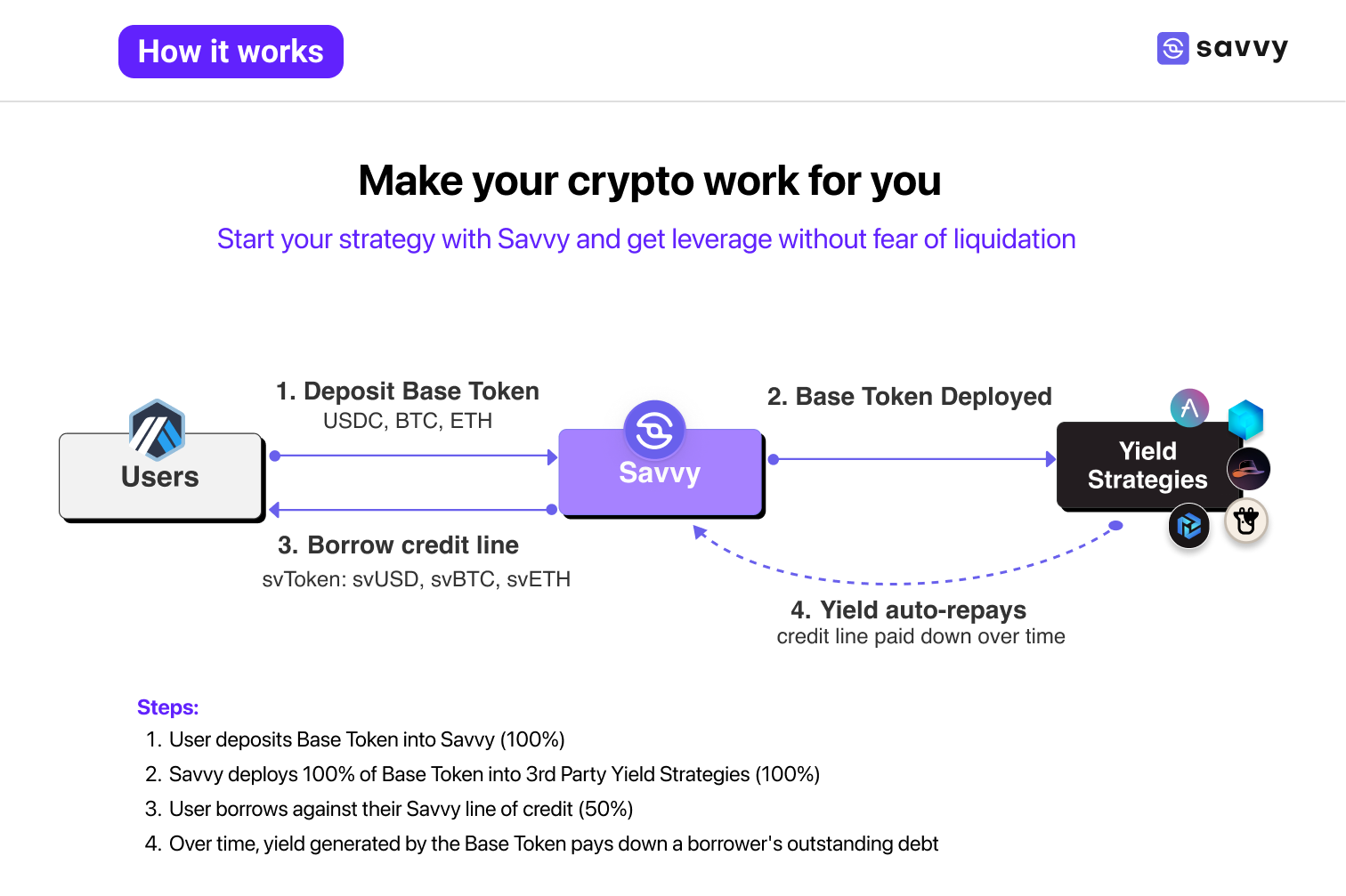

Savvy DeFi – Protocol combining SRL & Yield Farming

Savvy allows users to deposit assets into their CDP pools. Each type of asset deposited into the protocol as a type of collateral such as USDC, BTC, ETH can then be borrowed out corresponding to svUSD, svBTC, svETH to participate in DeFi to make profits. User assets will be carried by the protocol to earn profits through many different strategies.

Profits from assets will be gradually paid for the debt above. The same thing with other Self Repaying Loan protocols is that users borrow svTokens at a zero interest rate. 10% of the profit earned will be sent to Savvy Tresury and the remaining 90% will be sent to Savvy Sage to automatically pay back. for users or reinvestment.

Currently, Savvy has not made any moves to enter the LSDfi market. But with the story of LSD growing bigger and bigger, the possibility of Savvy entering this market is entirely possible in the future. With LSTs, the project does not need to have a headache in finding a source of profit because the collateral itself is already profitable.

Savvy is not 100% a Self Repaying Loan protocol but it has the 50% chance of becoming one with just a few minor changes.

Cat in a Box Finance: New project in the Self Repaying Loan industry

Similar to ZeroLiquid, Cat in a Box also accepts stETH as collateral to lend boxETH. Profits from stETH will be automatically deducted from the boxETH loan. The biggest difference lies in the fee. While ZeroLiquid collects up to 10% of the user’s total profit, Cat in a Box Finance only collects 1%, a much lower number.

However, Cat in a Box’s peg retention model is relatively simple and Cat in a Box may not have carefully prepared its derivative products.

Projecting the Future of Self Repaying Loan

Self Repaying Loan is a new piece of the puzzle in LSDfi’s Lending & Borrowing segment. Previously we were very familiar with the CDP protocols, now we have a new piece of the puzzle, although it is not a product that is not too different, it also makes the ecosystem, the pieces of the puzzle that form LSDfi increasingly diverse.

The project that is receiving the most attention from the market is ZeroLiquid and is also the leading project in this segment. Obviously, if ZeroLiquid is successful, it could create a small trend in the LSDfi industry similar to how Pendle Finance or Lybra Finance did but the probability of success will be relatively low. Perhaps we still need to monitor more about this segment in the future. Some of the indicators we can track are:

- TVL of all protocols in the Self Repaying Loan industry.

- TVL of the largest protocol in the industry.

- Are the number of users, transaction volume, etc. of the industry and leading projects skyrocketing?

- Media stories especially cannot be overlooked with small projects like this.

Summary

Self Repaying Loan opens a new trend in the LSDfi industry. Can Self Repaying Loan lead LSDfi to grow stronger in the future? Hopefully through this article everyone can understand more about Self Repaying Loan.

Enter your text here…