Rug Pull, also known as (rug pull), is a term that we often hear but not everyone understands its true meaning and significance. In fact, Rug Pull plays a very important role in the field of cryptocurrency and understanding its meaning can help increase their understanding. In this article, Weakhand will help people better understand what rug pull is and how to prevent the risk of rug pull in the Crypto market.

Below are some articles that people can refer to to better understand the Crypto market:

- What is Bitcoin? All About Bitcoin

- What is Ethereum? All About Ethereum

- What is DeFi? All About DeFi

- What is Decentralized Exchange (DEX)? The Role of Decentralized Exchanges in DeFi

What is Rug Pull?

Rug Pull is short for Pull the rug out from under someone, which means to pull the rug so someone falls. Simply put, according to Vietnamese folk, “Crossing Cau Rut Van”, this refers to a scam in the field of cryptocurrency, where investors are left with worthless assets.

Rug Pull can be understood as project developers creating tokens and raising capital from investors with promises of high profits, then the developer will disappear with the investors’ money and What stays last are tokens with zero value because there is no more liquidity in the pool.

Rug Pull is a sophisticated and common type of scam that takes place in decentralized finance (DeFi) because this is where tokens can be easily created and then listed on the Dex without having to prove their identity. (KYC). Because not providing identity makes it easier for scammers to hide their identity and earn a large amount of cryptocurrency. Unlike listing tokens on centralized financial exchanges like Binance or OKX where the project must go through rigorous selection and auditing rounds.

Types of Rug Pulls

Rug Pull is divided into 2 types: Hard Rug Pull and Soft Rug Pull

Hard Rug Pull occurs when developers and influencers quickly leave the project after a token price pump causing investors to be enticed by increased value (FOMO), just wait for the developer will suddenly steal all the assets in the pool, causing the value to collapse and these scammers will flee with the assets.

Soft Rug Pull is more devious in nature, where scammers gently drain the token’s liquidity creating a gradual decrease in value over time. This fraudulent strategy aims to correct the early suspicion of investors and the community.

Popular Rug Pull Forms

There are 3 common types that often appear in the DeFi world: Liquidity theft, Limiting sell orders, Dumping.

Liquidity theft (Liquidity theft): This is a form of Hard Rug Pull, liquidity theft or liquidity stealing which refers to when the project founder suddenly withdraws all the money from the liquidity pools being used to fund the project. judgment. When this happens the value locked in the token is erased, leaving investors with a worthless asset that cannot be used for any purpose. This type of Rug Pull is most popular in the DeFi market.

Limiting sell orders (Restricting sell orders): This is also a form of Hard Rug Pull, with more sophistication for founders to commit fraud to appropriate investors’ assets. In this scam, the developer installed some codes in the smart contract so that they are the only party that can sell tokens. This means investors cannot sell their tokens anywhere, locking them into a non-tradable asset. When the scammers feel they have enough profit they simply sell their tokens and leave investors with worthless tokens that cannot do anything.

Dumping (Dumping): This is a form of Soft Rug Pull, the developer will inflate the value by using social networking platforms to advertise to create a surrounding community and increase the value of the token quickly. quickly. Investors who cannot resist the appeal of pumping tokens will often be a lucrative prey for scammers to gain illegal profits. After the investors have bought in, the scammers just need to sell the tokens slowly to avoid suspicion and also legitimize the price.

Statistics of Rug Pulls

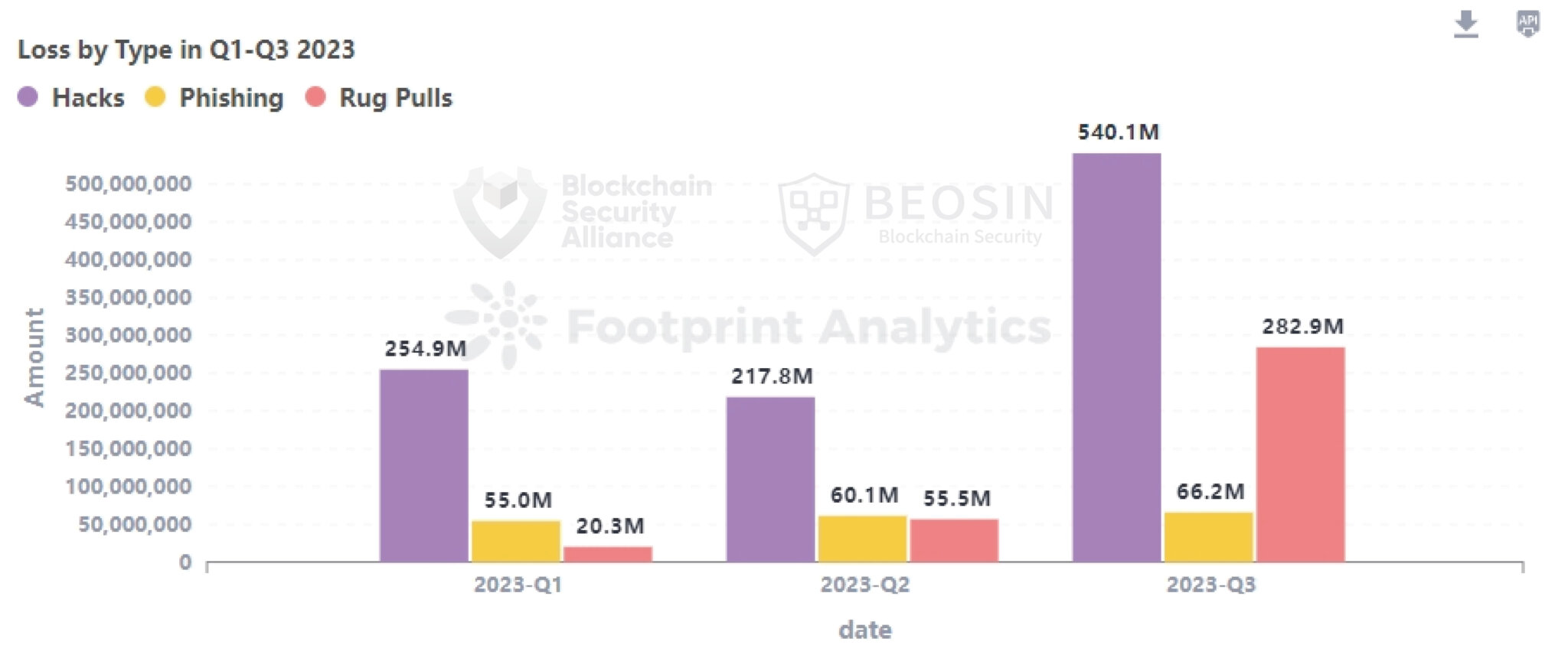

According to the latest statistics from Beosin security unit, about 358.7M USD of Crypto was stolen by Rug Pull form between Q1 and Q3 of 2023 compared to the same period in 2022, this number increased by 13M USD lost. in the DeFi market. Ethereum is the blockchain that suffered the heaviest losses, with up to 16 incidents in Q3 alone.

Big Rug Pulls in History

Arbix Finance

Arbix Finance is a Yield farming platform operating on Binance Smart Chain that is said to have rug pulled and caused losses of up to 10M USD. After the rug pull move, the project took down social networking platforms such as Telegram, Twitter, and Discord. Blockchain security firm CertiK reported that the 10M USD deposited by users went to unverified liquidity pools and the scammer eventually withdrew all the funds.

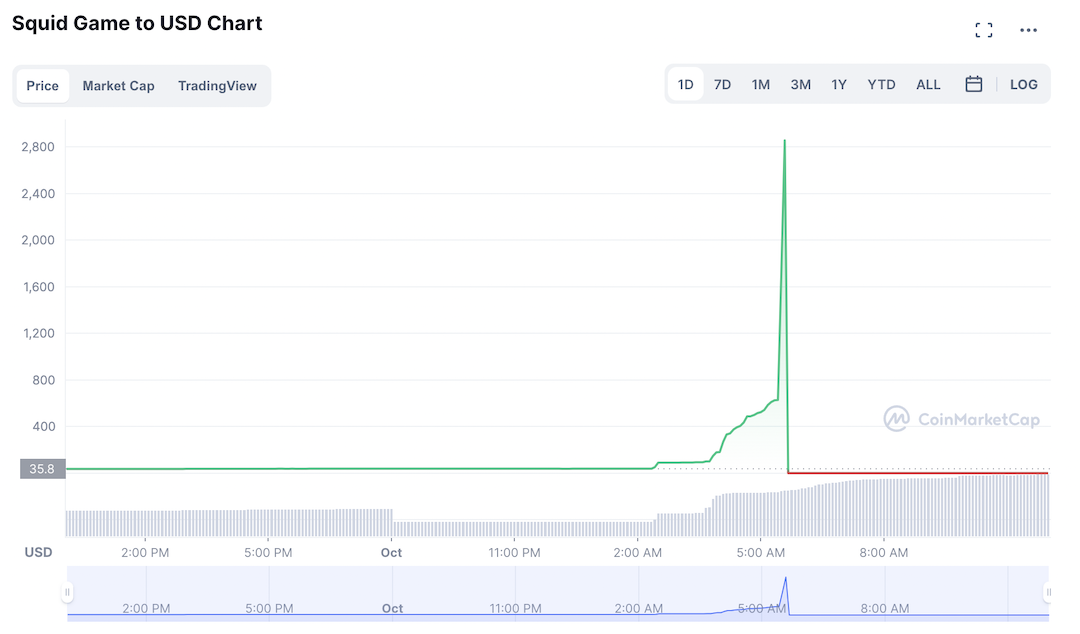

Squid Game Coins

Making its market debut at $0.01 on October 20, 2021 on the decentralized exchange (DEX), Squid quickly skyrocketed to around $2,861 in less than a week. When investors are excited, the price suddenly drops to zero in just one candle. After the incident, investors who bought the token were unable to sell it, and the project website also disappeared along with other social network accounts.

AnubisDAO

Nearly 2 years ago, after the decentralized finance project inspired by the dog AnubisDAO pulled the rug and earned the scammers 60M USD, investors were still in shock. Launched in October 2021, AnubisDAO raised 13,556 ETH from cryptocurrency investors thanks to the pre-existing Dogecoin (DOGE) trend. However, after about 20 hours of investing, the money was transferred to another wallet address, causing the investor to only sadly watch his money disappear.

Is Rug Pull Illegal?

Whether or not Rug Pull in Crypto is illegal depends on the specific circumstances. Crypto regulation is still in its early stages and there needs to be a clear consensus in identifying or prosecuting theft activities like this.

Some countries and jurisdictions are still taking steps to finalize their legal framework. The US Securities and Exchange Commission (SEC) has filed a lawsuit against several Crypto companies for allegedly engaging in fraudulent activities, including rug pulling.

Additionally, rug pull scammers often operate in areas with weak or non-existent laws against cryptocurrency fraud, which makes it difficult for authorities like the SEC and FBI to pursue and judge.

Signs of Rug Pull

The developer is unknown or anonymous

The anonymity of project developers always brings many risks. Investors may have difficulty assessing the potential and reliability of the project, easily encountering Scam projects. You should consider carefully and always ask yourself questions when investing in these projects.

- When was the project social network platform born?

- What is the technological potential here?

- Competitive advantages compared to other projects in the same segment?

No liquidity lock

Sometimes to prove that it is a legitimate project the developer will lock their liquidity with a trusted third party to ensure that they cannot withdraw that liquidity even if they want to, this is a Very good sign that the project limits rug pull risks. If the liquidity pool is not locked, developers can withdraw money and run away. Pay attention to how long the liquidity pool will be locked.

Wallets that own large amounts of tokens

It is very likely that this is the wallet of the project developer, as soon as this happens dumping by these wallets can cause token prices to plummet, these whale wallets can easily manipulate the prices of tokens.

Do not publish source code

Not making the source code public may mean that the project does not disclose the technology or algorithms it used. This makes the project less transparent and investors do not have information to evaluate the project’s potential and risks.

Profits are too high

Crypto is a highly volatile and uncertain market, and a project that promises excessive returns could be a scam and untrustworthy. Financial market risk: when prices decrease or the project no longer meets financial needs, investors will lose money. Playing on investor greed is how these projects work.

How to Prevent the Risk of Rug Pull in the Crypto Market

Before making an investment decision, learn carefully about the project. Read the whitepaper and learn about the development team and upcoming project goals and plans. Check the project’s transparency and look for suspicious signs.

Check Smart Contract this helps investors evaluate the transparency and safety of the project. Scam projects will code limiting sell orders so investors cannot sell. Check carefully to ensure that these Smart Contracts do not have security issues, vulnerabilities,…

Follow Crypto groups and communities for the latest information and potential experiences from others, gauging the community’s credibility in the project.

Following a project’s GitHub can be a good way to track the progress of updates and development team activity. This allows investors to review the issues being resolved and discussed in the project community to get an overview of project activities.

Summary

Above is all the information to help everyone understand what Rug Pull is? And how to prevent the risk of rug pulling in the Crypto market from Weakhand. Hopefully this article can bring everyone useful content.