What is RociFi? RociFi is a subprime mortgage lending platform (Under Collaterized Loan) built and developed on the Lens Protocol ecosystem on Polygon’s blockchain. So, everyone, let’s find out in the article below what RociFi’s operating mechanism and loan conditions are like!

What is RociFi?

RociFi is a project in the field of Credit Protocol (Unsecured loans or more easily understood as collateral smaller than the loan or even without collateral) and to do this, the project has a credit scoring system. User adoption through minting NFTs on wallets. These credits cannot be transferred or traded from one wallet to another.

RociFi takes advantage of transparent, clear data on the blockchain to be able to calculate users’ credit scores to allow them to borrow under collateral and best manage risk.

Most projects in the Credit Protocol segment at this time are mostly aimed at companies and corporations, but few projects directly target users.

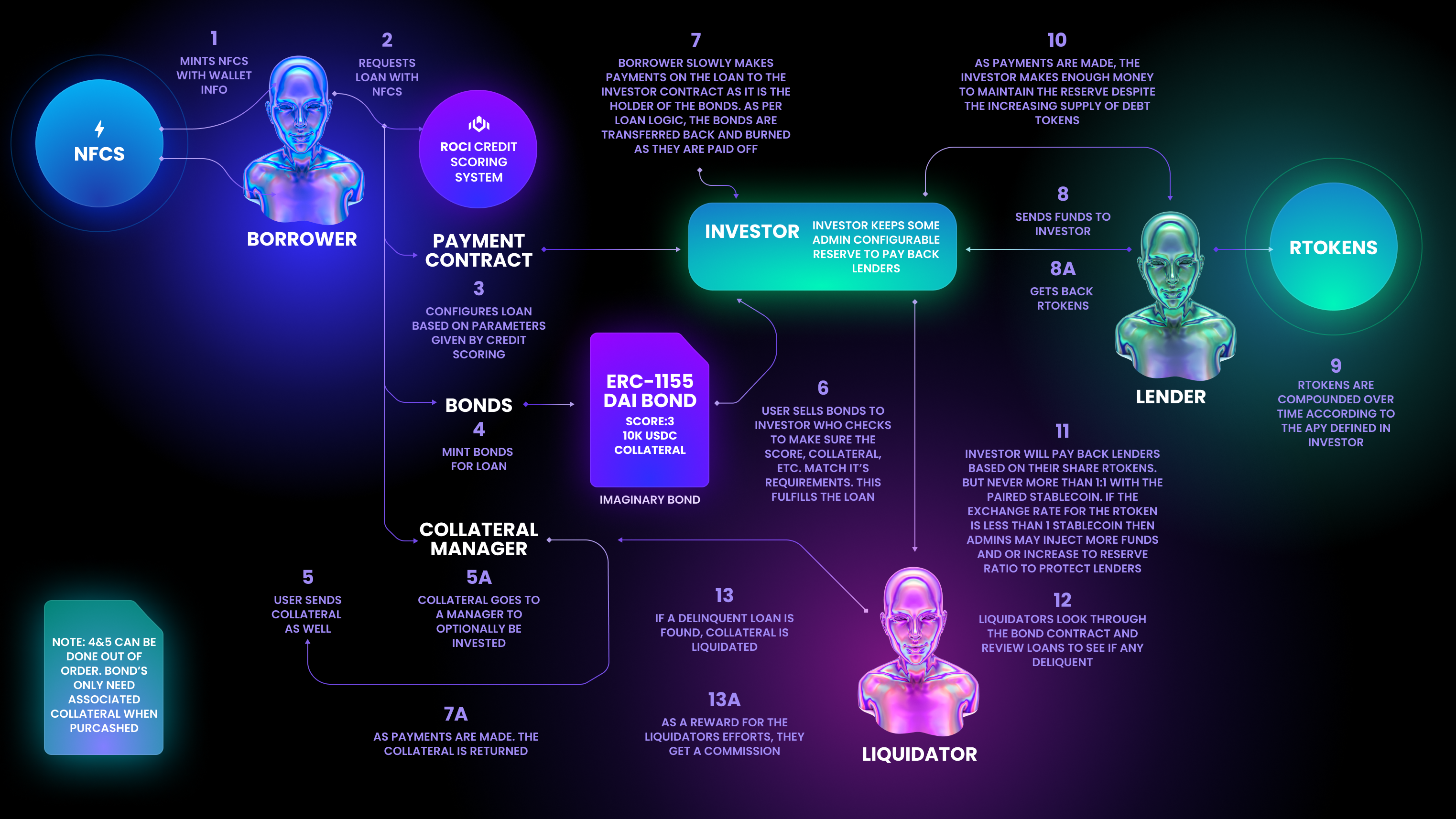

Mechanism of Action

- Step 1: The borrower will cast NFCS (soundboun token) is a non-transferable token and it represents credit score of the borrower.

- Step 2: Borrowers will send a loan request with the parameters they desire (amount they want to borrow, interest rate, payment method,…) to Investors – a smart contract, accompanied by collateral.

- Step 3: Payment Contract will be shaped based on credit score of the borrower.

- Step 4: If the loan is approved then Bond Contract will be minted to represent the loan.

- Step 5: Collateral Manager is a contract that collects collateral from the borrower.

- Step 6: Investors will “buy” BONDs from borrowers, in simple terms, providing loans to borrowers.

- Step 7: The borrower pays slower than the terms in the Payment Contract.

- Step 7A: When the lender begins to repay the debt, the Collateral Manager will gradually pay the collateral to the borrower.

- Step 8: Pool Investor is a system of investors responsible for managing liquidity pools.

- Step 8A: When lenders deposit their assets into the Pool, they will receive Debt tokens representing their assets in the pool.

- Step 9: Debt tokens will be accumulated with APY in the contract between the borrower and lender.

- Step 10: When Payment Contracts are deployed, Investors will have profits to put into their reserves

- Step 11: The investor will return the collateral to the borrower but it will never exceed 1:1.

- Step 12: Liquidators will review Bonds Contracts to see if any loans are overdue.

- Step 13: For overdue loans, the collateral will be liquidated and Liquidators will have a portion of the profits.

The borrower’s credit score will be in 3 main levels: 1 – 3: low risk group, 4 – 6: medium risk group and 7 – 10: high risk group.

Currently RociFi only accepts ETH and WBTC as collateral, and the assets the borrower will receive are stablecoins such as DAI, USDC, USDT.

Core Team

Konstantin Zagaynov: Co Founder & CPO

- 2021: Founding a Lending platform in the crypto market called Loanwolf.finance, however this project has ceased operations

- 2020: Worked as Head of Product Development at Kreditech, also a loan service product.

- 2017 – 2019: Konstantin established and developed an investment fund.

- 2012 – 2014: At Huntington National Bank, Konstantin was in charge of the role of Commercial Credit Analyst. It seems that these are thin foundations for Konstantin to build RociFi later.

Chris Brookins: Co Founder & CEO

- 2019 – 2021: Co Founder and CIO of Valiendero Digital Assets investment fund also targeting the crypto market.

Investor

April 12, 2022: RociFi successfully raised $2.7M invested by Arrington, Goldentree, Nexo, LD Capital and Skynet Trading.

Besides, the project has also been audited by CertiK and Chainsulting.

Tokenomics

The project has not issued tokens yet.

Exchanges

The project has not been listed on any exchange.

RociFi Project Information Channel

- Website: https://roci.fi/

- Twitter: https://twitter.com/rocifi

- Telegram: https://t.me/RociFi

- Medium: https://blog.roci.fi/

- Discord: https://discord.com/invite/dq7cDETKxd

- Youtube:

Summary

Continuing to be a potential project in a potential ecosystem such as Lens Protocol and an area I also have a lot of feelings about is Credit Protocol.