What is Redacted Finance? Redacted Finance is an ecosystem of products that solves liquidity, governance, and cash flow on DeFi. Redacted Finance has built products like Hidden Hand, Pirex and soon Dinero to solve the above pain points in DeFi.

So what is it about Redacted Finance that attracts the community and even Bankless is “shilling” this project very strongly? Let’s find out together in this article.

Overview of Redacted Finance

What is Redacted Finance?

Painful problems DeFi are facing issues regarding liquidity, management and cash flow, Redacted Finance was born and built an ecosystem including many different products such as Hidden Hand, Pirex and Dinero to solve the above problems.

Redacted itself is a DAO consisting of developers, researchers, testers,… all focused on building Redacted and expanding Redacted’s influence in the DeFi market. Besides, the Redacted protocol is built around the project’s governance token, BTRFLY, which we will go deeper into in the project’s tokenomics section.

Redacted Finance’s ecosystem

Hidden Hand

Hidden Hand was launched with the purpose of encouraging users to participate in voting, also known as expressing administrative rights to the project, and the reward to encourage users is the token of the project they are holding. hold.

The operating mechanism of Hidden Hands is relatively simple:

- Step 1: Platforms that want to encourage holders to participate in gorvernance will put a certain amount of rewards into Hidden Hand’s smart contract.

- Step 2: Everyone will participate in voting in the proposal.

- Step 3: Hidden Hand will send the above rewards to those who participated in the voting.

The Hidden Hand platform will charge a fee of 4% for each time a 2% project is sent to Tresury and the remaining 2% will be divided back with BTRFLY lockers. It can be seen that Hidden Hand’s business and operating model is relatively easy to understand and clear.

Pirex

Pirex is a Liquid Staking product for many different asset types. Currently Pirex only supports Convex and GMX platforms. We will go into each asset that Pirex is supporting together.

How Pirex works with CVX assets

Normally, when users lock CVX on the Covex platform, they will be locked for a certain period of time and returned to vlCVX. This vlCVX is not traded and cannot be transferred, so it can be said that user liquidity is stagnant on Convex. So how does Pirex solve this problem?

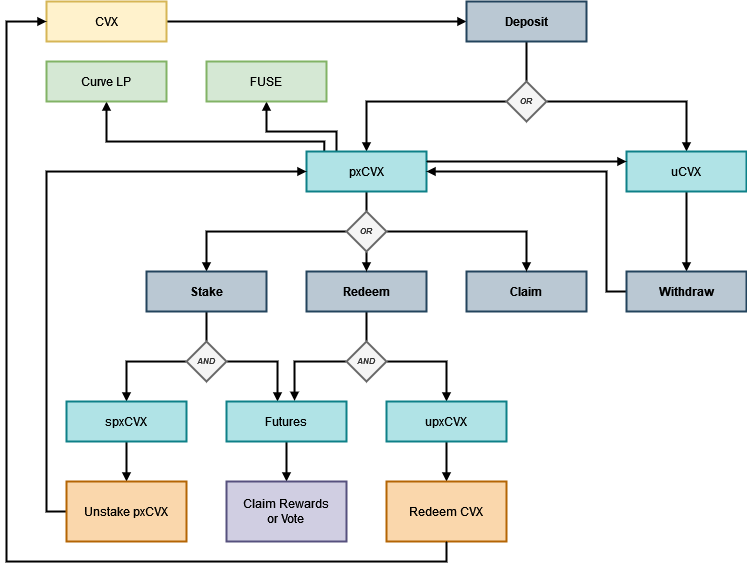

First, with Covex, Pirex’s operating mechanism will be as follows:

- Users will send their CVX to the Pirex platform, then Pirex will immediately send their CVX to Convex to receive vlCVX. In addition, people will have 2 options to choose from:

- Standard Mode: With this mode, users will receive pxCVX and every 2 weeks you have the right to request to pay revenue from the Pirex platform which is CVX.

- Easy Mode: With this mode, all profits that people earn through Pirex will be automatically transferred from CVX to uCVX to maximize your CVX amount.

- Expert Mode: Users can stake their pxCVX to receive spxCVX in addition to everyone receiving future votes but tokenized to exist in the form of Reward Futures Note (RFN) or Vote Futures Note (VFN).

- To exit pxCVX’s position, you have the following two ways:

- Trade pxCVX/CVX on Curve Finance. Before trading you should check liquidity and peg level. This will be the fastest way.

- Redeem from pxCVX to CVX when you redeem, you will receive upxCVX representing CVX in the future. When you redeem, Pirex will immediately redeem on the Convex platform but it takes a lot of time for you to get your CVX back but the amount is definitely equivalent without fear of loss that can happen when you trade on Curve.

Similar to Convex, Pirex also has products for GMX, but we will have 2 tokens in GMX: GMX (project governance token) and GLP (LP Token of liquidity providers).

After receiving GMX and GLP from users, Pirex will immediately stake it on the GMX platform to receive revenue sharing from the protocol, in return users will receive pxGMX and pxGLP. With modes like Convex, for GMX and GLP there are also 2 modes: Standard Mode & Easy Mode. Expert Mode will be available soon.

In the future Pirex is expected to support even more assets.

In terms of revenue, 75% of the fees collected by Pirex will be paid to Redacted, besides 42.5% will be distributed to rlBTRFLY holders, 42.5% will go to the project’s Tresury and 15% will be based on the project. reserve.

Dinero – Decentralized Stablecoin

Before entering Dinero, we need to understand the concept of Blockspace. This concept has gained more interest after the EIP 1559 update, it is clear that the Blockspace of a block on Ethereum is limited because this factor makes it difficult for many Node Operators to participate in the process of extracting MEV on Ethereum. net. Dinero also wants to enter this market with a number of products including:

- RPC is public and anyone can participate.

- A decentralized Stablecoin is DINERO for medium of exchange on Ethereum.

- An LST profits from Stacking and Dinero Protocol.

First, when users deposit ETH into Dinero Protocol, they will immediately receive pxETH representing their assets in the protocol (in fact, this pxETH is issued by Redacted Cartel’s Pirex product) and the user’s ETH will Staking on Dinero Validator to participate in validating transactions on the Ethereum network.

Next, DINERO is a Collateralized Debt Position Stablecoin (Overcollateralized Stablecoin similar to DAI) backed by ETH and pxETH. This means users can collateralize with ETH and pxETH.

DINERO’s price retention mechanism accepting USDC as collateral operates simply in a few steps as follows:

- If $1 DINERO is less than $1 USDC, users can use USDC to buy DINERO and repay the debt for the difference.

- If $1 DINERO is higher than $1 USDC, users can issue more DINERO and sell it to the market to earn USDC. Wait until case 1 occurs to exchange USDC back to DINERO.

When users issue DINERO, they will start being charged interest and this interest rate is based on each different type of vault and is decided by the DAO. Interest will be collected in DINERO.

Besides, the liquidation on Dinero Protocol will be in the form of a Dutch auction.

Core Team

Update….

Investor

Update….

Tokenomics

Overview information about Token Redacted Finance

- Token Name: Redacted Finance

- Ticker: BTRFLY

- Blockchain: Ethereum

- Standard: ERC-20

- Contract: 0xc55126051b22ebb829d00368f4b12bde432de5da

- Total supply: 173,703

- Maximum supply: 173,703

Token Allocation

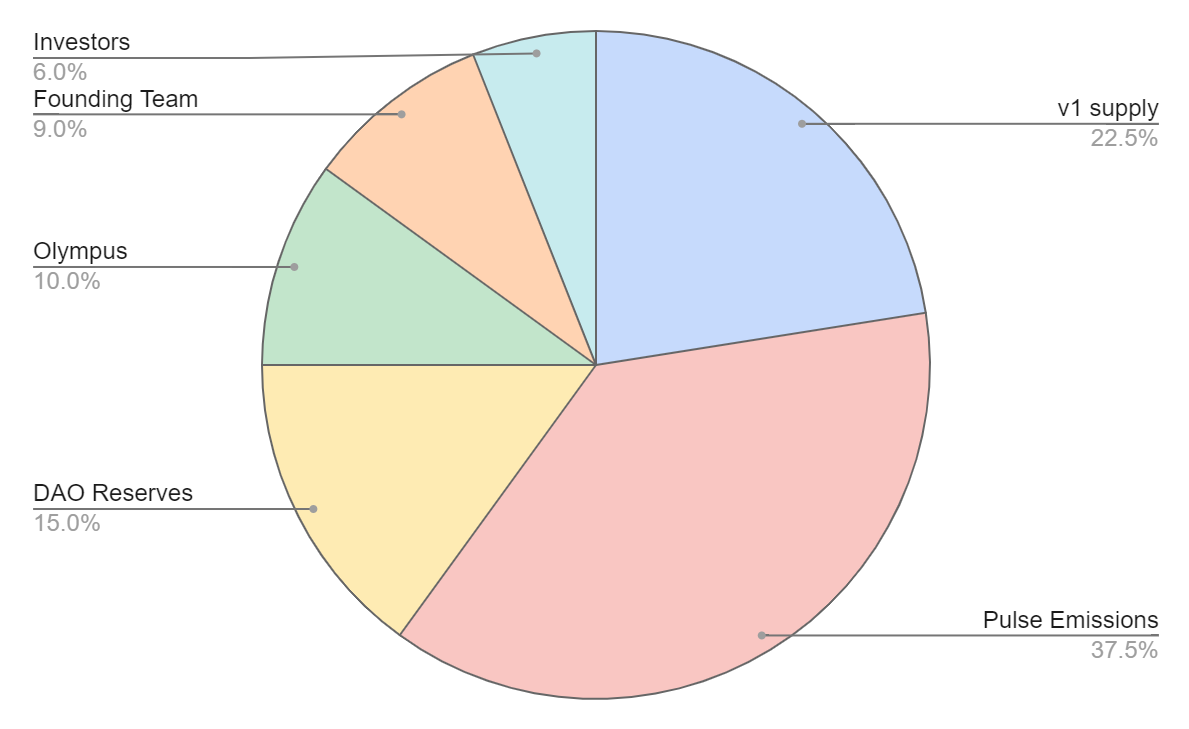

- Investors: 6%

- Core Team: 9%

- Olympus: 10%

- V1 Supply: 22.5%

- Pulse Emissions: 37.5%

- DAO Reserves: 15%

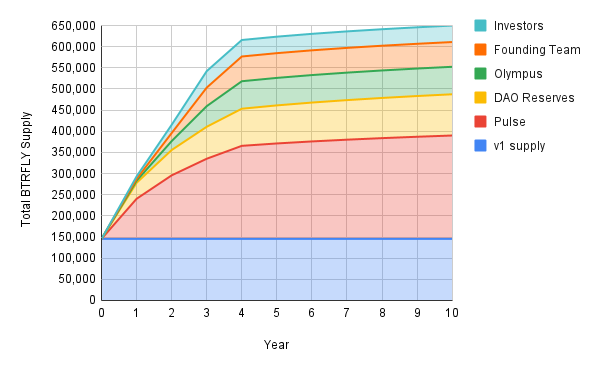

Token Release

All project tokens will be paid in installments within 10 years.

Token Use Case

Redacted Finance has 2 projects: BTRFLY and rlBTRFLY, in which BTRFLY is the governance token of the Redacted ecosystem. Besides, if users lock BTRFLY, they will receive rlBTRFLY and receive additional BTRFLY inflation & a portion of revenue from the ecosystem. .

So how can you own BTRFLY:

- Buy directly on DEXs or CEXs that support BTRFLY.

- Receive BTRFLY by purchasing bonds on Bond Protocol.

Summary

Whoever masters Convex will rule the Curve. So if Redacted Finance holds Convex, it will also invisibly hold Curve Finance. A Curve, Convex or even Redacted Wars is ahead.

What will grow?