QiDao is a stablecoin protocol that uses collateralized debt positions (CDPs), allowing users to borrow USD-pegged MAI stablecoins at 0% interest. So what makes QiDAO stand out? Let’s find out with Weakhand.

To understand more about QiDAO, please read the articles below:

- What is AAVE (AAVE)? Overview of AAVE Cryptocurrency

- Morpho Labs – Potential Next Generation Lending & Borrowing Platform

- DeFi Panorama 101 | Episode 3: What is Lending & Borrowing? The Essential Puzzle Piece in DeFi

What is QiDAO?

Overview of QiDAO

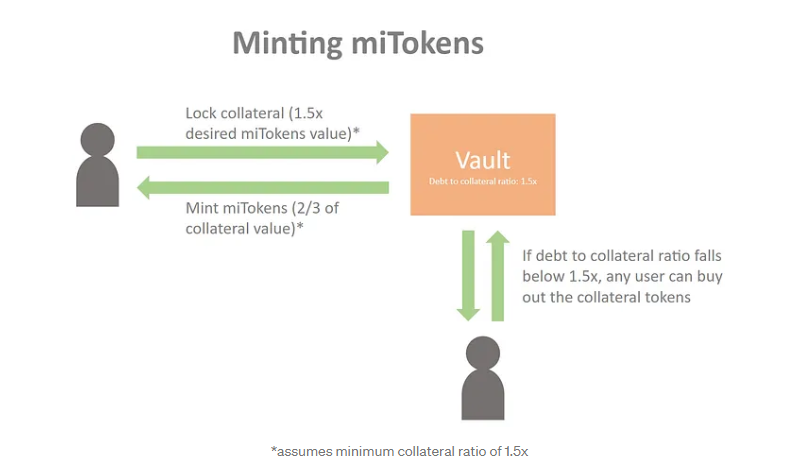

QiDAO is a decentralized protocol that allows users to borrow (Borrow) stablecoin MAI by collateralizing crypto Asset. Users can mortgage crypto Assets up to 130 -150% to borrow MAI at 0% interest.

QiDAO is a decentralized protocol run and managed by the community. Changes are made through proposals and voted on by QI governance token holders.

Stablecoin MAI is not an algorithmic stablecoin, it is a stablecoin created by the QiDAO protocol, stablecoin MAI has a price equivalent to 1 USD.

Currently QiDAO accepts more than 60 collateral assets on 10 blockchains such as: Polygon, Optimism, Ethereum, Metis, Fantom, Arbitrum, …

QiDao has integrated the Chainlink oracle to provide accurate price data to the platform, allowing users to borrow against crypto Assets on supported blockchains.

Highlights of QiDAO

- Interest-free loan: Borrow MAI stablecoin based on Crypto Asscet collateral with 0% interest rate.

- 0% interest rate leverage: Users mortgage Crypto Asscet to borrow MAI stablecoin, then use MAI to buy Crypto Asscet or use MAI for other purposes to make profits depending on your strategy.

- Use MAI stablecoin as collateral: Users can use MAI as stablecoin collateral in supported platforms.

- Borrow to “hold on for dear life” (HODL): QiDAO helps users hold their crypto assets while still using the value of those crypto assets as stablecoins without having to sell the crypto assets.

- Bridge: QiDAO uses Multichain and Stargate to transfer cross-chain stablecoin MAI between blockchains for cross-chain liquidity.

QiDAO’s Development Roadmap

Updating

Core Team

Updating

Investor

Updating

Partners

QiDAO has outstanding partners such as: QuickSwap, AAVE, Chainlink, Curve, Polygon, …

Tokenomics

Basic information about QI token

- Token Name: QI Token.

- Ticker: QI.

- Blockchain: Polygon

- Contract: 0x580a84c73811e1839f75d86d75d88cca0c241ff4

- Total supply: 200,000,000

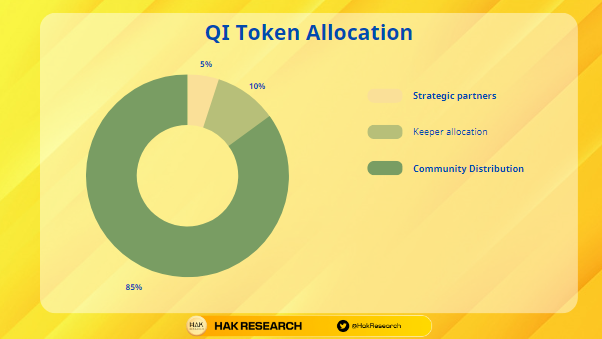

QI Token Allocation

- Strategic partners: 5% equivalent to 10M QI tokens.

- Keeper allocation: 10% equivalent to 20M QI tokens.

- Community Distribution: 85% equivalent to 170M QI tokens.

QI Token Release

- Strategic partners: Release linearly in 18 months.

- Keeper allocation: Vesting within 3 years.

- Community Distribution: Year 1 vesting 50%, year 2 vesting 30%, year 3 vesting 20%.

QI Token Use Case

Participate in governance: Users who stake QI tokens can participate in voting and propose changes to the protocol. QI tokens are used to reward users for participating in LP and staking.

QI Token Exchange

Currently QI tokens are traded on exchanges: BKEX, QuickSwap, Balancer, Hotbit

Project Information Channel

- Website: https://app.mai.finance/

- Twitter: https://twitter.com/QiDaoProtocol

- Discord: https://discord.gg/mQq55j65xJ

- Medium: https://0xlaozi.medium.com/

- Telegram:

Summary

QiDAO a decentralized stablecoin borrow protocol that allows users to mortgage crypto assets to borrow MAI stablecoins at 0% interest, MAI stablecoins are pegged to USD. The protocol currently supports 60 collateral assets across 10 blockchains.

Hopefully this article provides useful information for readers about QiDAO and QI token.