What is Prosper? Prosper is a short-term non-custodial risk prediction and hedging platform built on Ethereum and BNB Chain. So what is special about Prosper? Let’s find out with HAK Research in this article.

To better understand what Prosper is, people can refer to some of the articles below:

- What is Liquidity Pool? Lifeblood of the DeFi Market

- What is Uniswap (UNI)? Uniswap Cryptocurrency Overview

Prosper Overview

What is Prosper?

Prosper is a short-term non-custodial risk prediction and hedging platform built on Ethereum and BNB Chain. Prosper operates through Smart Contracts ensuring transparency of transaction processes. Besides, the project has completed integrating the Polygon network and the future will include Avalanche, Tron, Near and Polkadot.

What is Prosper?

Prosper’s mechanism of action

Prediction Pools

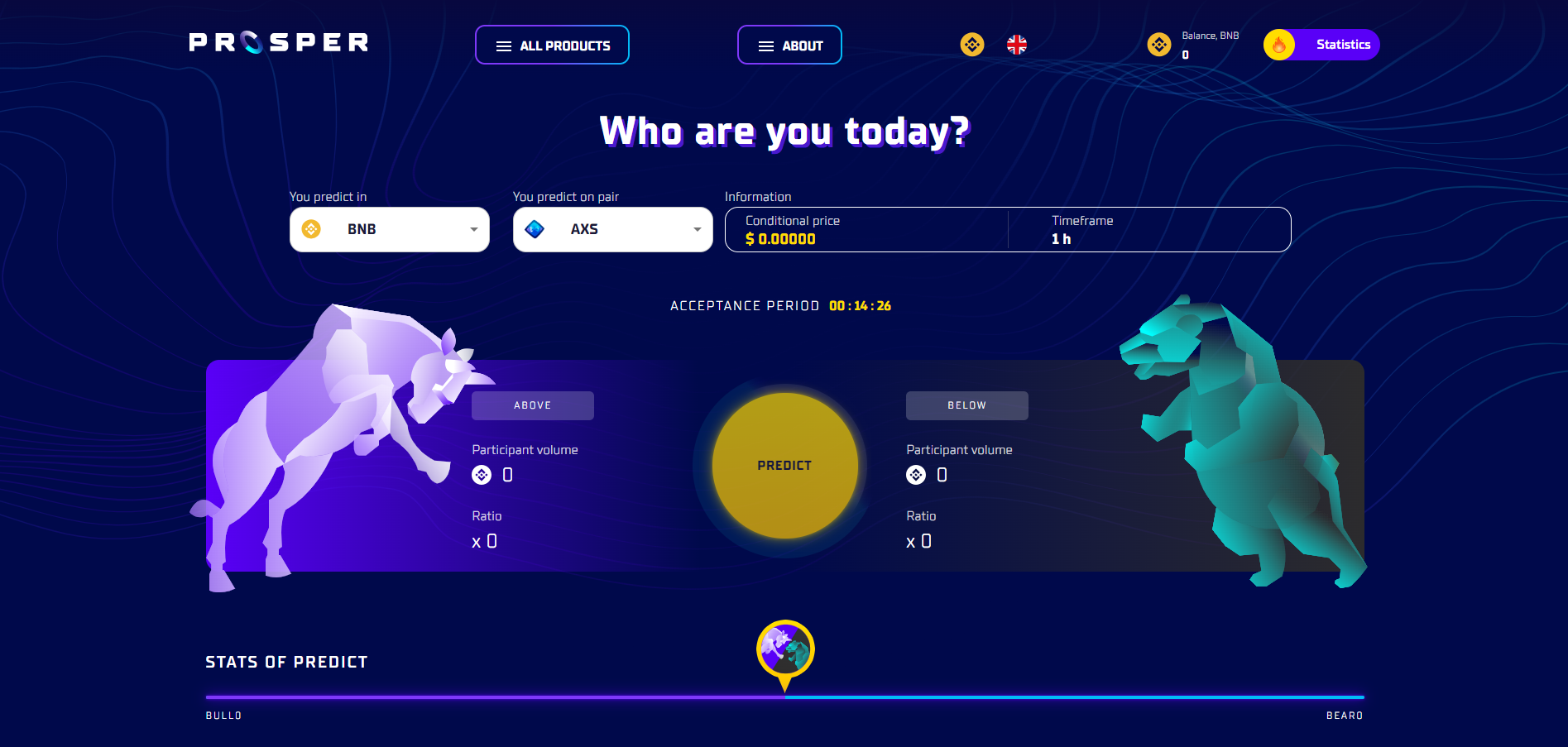

Prosper includes Pools, which are unique prediction markets. Each Pool has two sides: Bull and Bear. In addition to the internal Pools (available), users can create custom prediction Pools with the requirement to hold Pros tokens. Pool owners can set custom fees and profit from the pool.

Every hour, users can participate in predictions by betting on the Bull side (bullish) or the Bear side (bearish) and can bet multiple times on any side. When the time ends, the user’s predicted price information will be updated through Chainlink Oracle to provide the most accurate information data.

For details on how to use this feature of Prosper, everyone can refer to instructions from the project team:

- Steps to start a prediction – Video

- Steps to start a prediction – Image

Prosper Prediction

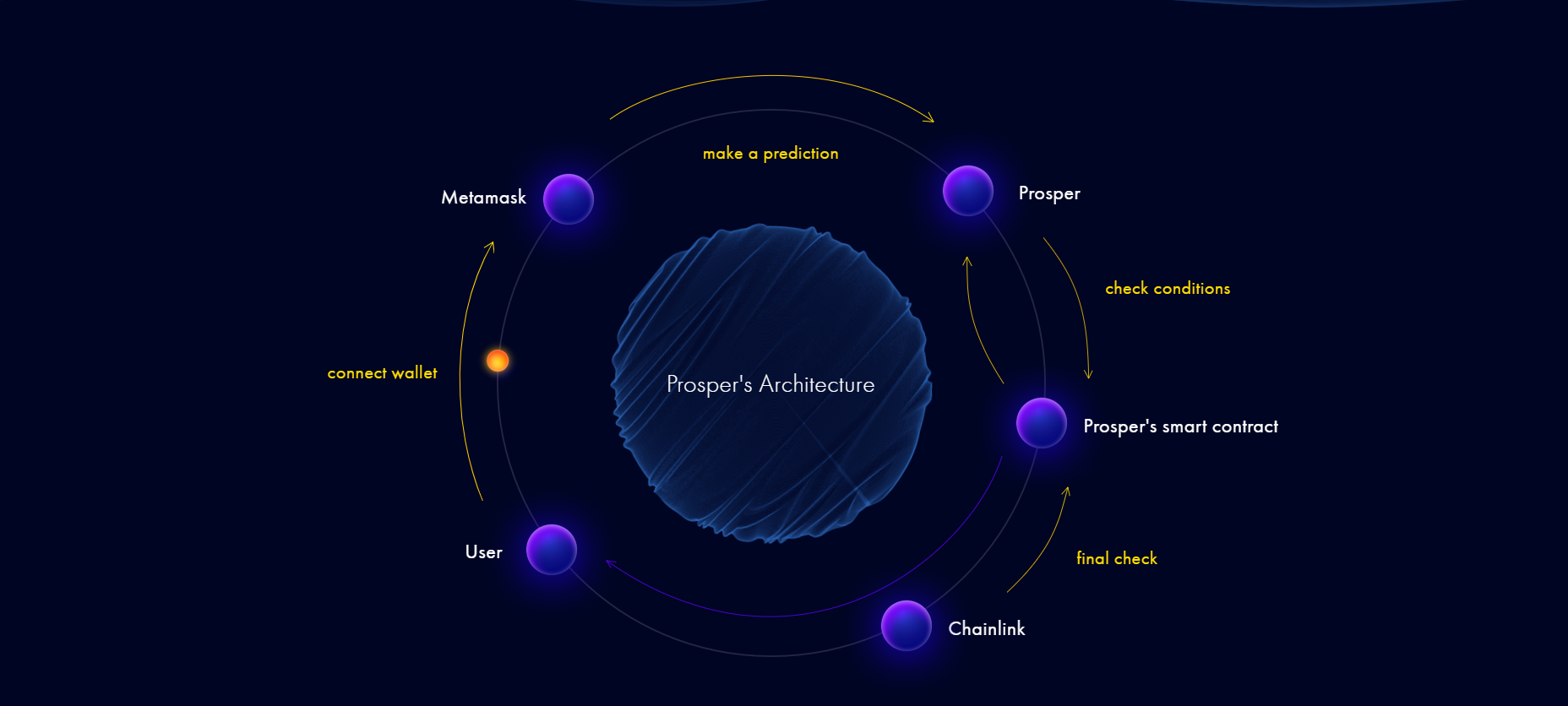

The process works when Prediction is started

When a prediction is confirmed by a user on the Wallet, the Smart Contract will have its feature activated to check the condition then go through ChainLink for final verification. Then when the prediction time expires, Smart Contracts will divide the reward according to the original bet ratio to the user.

Operating model

Prosper has a recurring task that automatically launches at certain intervals and checks for new block numbers on BNB Chain or Ethereum. If any prediction pool has finished within the checked block range, it will call a trigger method in Smart Contracts and wait until the trigger will reconfirm with the last price from the supply contract. Chainlink feed.

As soon as Prosper’s Smart Contracts receive back an activation method, it sets the final price for the ended prediction pools. If that method does not receive a price data supply, it repeats the action until it receives a response from the Chainlink data supply contract.

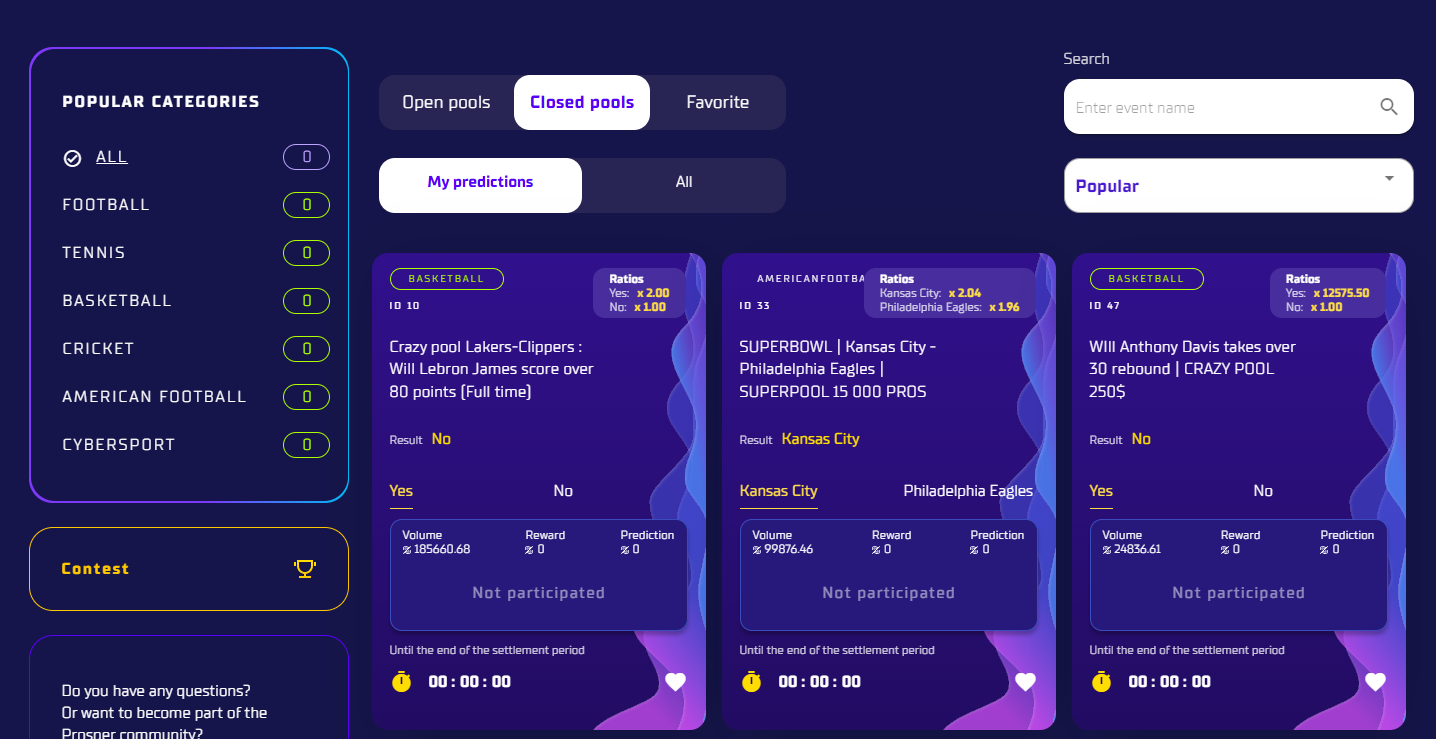

Community Pools & Custom pools

A quite special feature mentioned above is when users can create their own Pool and predict and bet on all fields in the real world. Especially worth mentioning is sports, a field where from time immemorial there has always been a dark side, which is the form of Betting. Popular Betting topics on Prosper include sports such as football, basketball, baseball, tennis, Esport.

To create a Custom Pool, users need to hold a certain amount of PROS tokens on their wallet. Owners of this Custom Pool can set custom price rates for their own Treasury.

Community Pools

Liquidity Program

The market always has problems with lack of liquidity. So the team came up with a solution to that problem by implementing binary liquidity supply models. Specifically, Prosper will use liquidity from liquidity providers (LPs) for Seed Pools. For Pools where bets are not proportionally matched, LPs will provide funds in return for a portion of the platform fees in PROS tokens.

Liquidity providers will receive:

- Free maximum insurance fund

- High profit margin income

- 0% treasury

Prediction insurance

At the time of staking the prediction, each user can reserve an amount of PROS tokens to guarantee his prediction. The maximum amount of reserved tokens is equal to 10% of the user’s predicted amount.

Each Pool will have its own insurance fund. At the time of reward distribution, 15% of the prize will be transferred to the Insurance Pool and distributed to users who made a wrong prediction but reserved PROS tokens for insurance. The distribution is linear based on the number of reserved Tokens. This feature is currently in development and will be released soon.

Core Team

The team behind Prosper is a software development company with a scale of only 11 to 60 employees. Core members are:

Project Head: Ivan Smirnov

CEO Prosper

- From 2015 to 2017, he worked as the Quality Assurance Team Leader for Artlogic company.

- Then from 2017 to 2019, he held the position of Quality Assurance Team Leader at Radario LLC.

- 2019 to 2020, He worked as a technical project leader at Yandex.Money

- Then starting from September 2020, he and his team established and developed Prosper

Investors & Partners

With a large Backer team and partners behind it, especially Animoca Brands, it can be said that this is a long-term and sustainable construction project. However, there is no authentic information or investment capital rounds from these Backers. Proven raises are almost always through early sale to the community.

Tokenomics

Basic information about PROS tokens

- Token name: Prosper

- Ticker: PROS

- Blockchain: Ethereum, BNB Chain

- Standard: ERC-20, BEP20

- Total supply: 100,000,000 PROS

- Contract BEP-20: 0xEd8c8Aa8299C10f067496BB66f8cC7Fb338A3405

- Contract ERC-20: 0x8642A849D0dcb7a15a974794668ADcfbe4794B56

Information about Token Sale

Seed rounds

- Price: 0.05$ per PROS

- Raised: $200,000

- Lock ups: 10% on listing (400,000 PROS), after 10% per month.

- Price: 0.08$ per PROS

- Raised: $400,000

- Lock ups: 20% on listing (1,000,000 PROS), after 12% per month, last month 20%.

- Price: 0.1$ per PROS

- Raised: 300,000$

- Lock ups: 50% on listing (1,500,000 PROS), after — 6.25% per month.

- Price: 0.08$ per PROS

- Fundraising target: $50,000

- Lock ups: no lock ups.

- Price: 0.1$ per PROS

- Fundraising target: $700,000

- Lock ups: no lock ups.

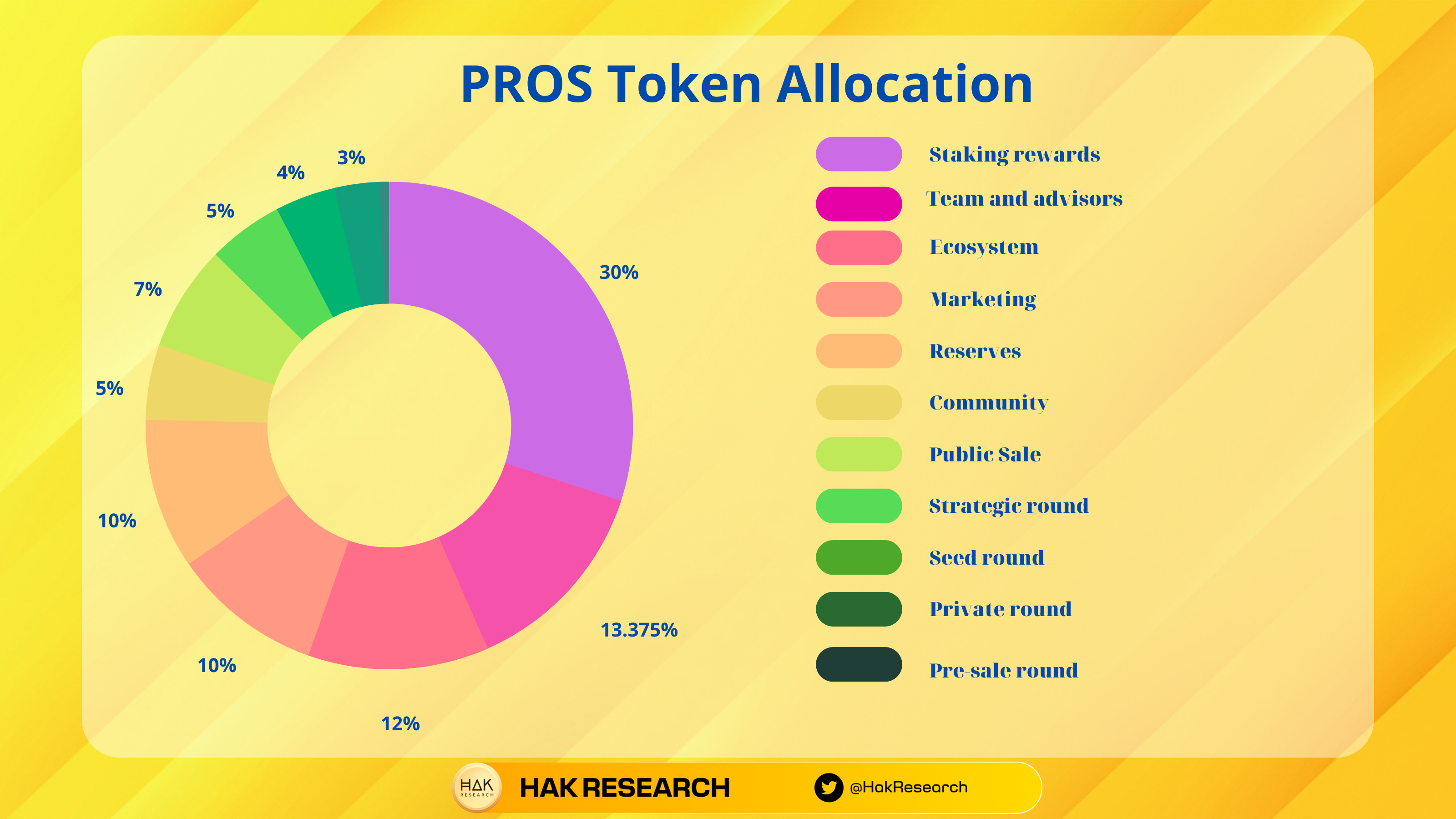

Token Allocation

The total supply of PROS tokens will be distributed as follows:

Token Release

Updating…

Token Use Cases

- All platform fees will contribute to Prosper’s Smart Treasury. Those who participate in DAO governance will receive a portion of the monthly Smart Treasury (Governance).

- Users can create custom Prediction Pools. To create a Custom Pool, users need to hold a certain amount of PROS tokens in their wallet. Pool owners can adjust parameters such as pool, fees, rates and time frames (Use Custom Pools).

- 15% of the total losing bet amount will be redistributed to qualified losing participants. Each Pool has its own insurance fund that is calculated and allocated immediately upon pool settlement. Users must hold PROS to participate in the program. If they lose their bet, PROS holders will be locked for 14 days (Insurance System).

- Users will get 50% discount by paying in PROS. Platform Fees received in PROS will then be burned (Platform Fees).

Exchanges

Currently PROS is present on almost all electronic exchanges or DEXs such as: Binance, Uniswap, PanCake Swap, Sushi Swap, Gate.io, MEXC…

Prosper’s Information Channel

- Website: https://prosper.so/

- Twitter: https://twitter.com/Prosperpredict

- Telegram:

Summary

Above is an overview of Prosper, a small niche and quite a useful feature of DeFi. It is growing strongly, has a lot of potential to exploit and completely new approaches. A Betting platform that can attract a large number of users who are passionate about this field.

When there are some major sporting events taking place, PROS will receive some benefits thanks to its sports betting feature. The proof is that PROS has had an impressive growth of 1000% in just 3 months when the World Cup event is about to start in 2022. If similar major sporting events return, PROS will be a token. well worth following.