What is Prisma Finance? Prisma Finance is a decentralized lending protocol that allows users to mint stable coin mkUSD by mortgaging Liquid Staking Tokens (LST) such as stETH, rETH, frxETH. The project is not only mentioned by many KOLs, the TVL of the project has also witnessed a rapid increase in recent days. So what makes Prisma Finance so attractive? Let’s find out in this article.

To better understand Prisma Finance, people can refer to some articles:

- What is LSDfi? The First Puzzle Pieces & Potential In The LSDfi Array

- Lybra V2 Review: Innovations With LSDFi Trend-Leading Ambitions

- Overview of the LSDfi Wave Ahead

Overview of Prisma Finane

What is Prisma Finance?

Prisma Finance is a decentralized lending protocol that allows users to mint stablecoin mkUSD fully collateralized by Liquid Staking Tokens (LST). mkUSD can be used to provide liquidity on Curve Finance or Convex Finance to receive trading fees, CRV, CVX and PRISMA in addition to profits from ETH staking.

By mortgaging Liquid Staking Tokens to mint mkUSD, users’ capital usage is more optimal and makes the DeFi market more vibrant.

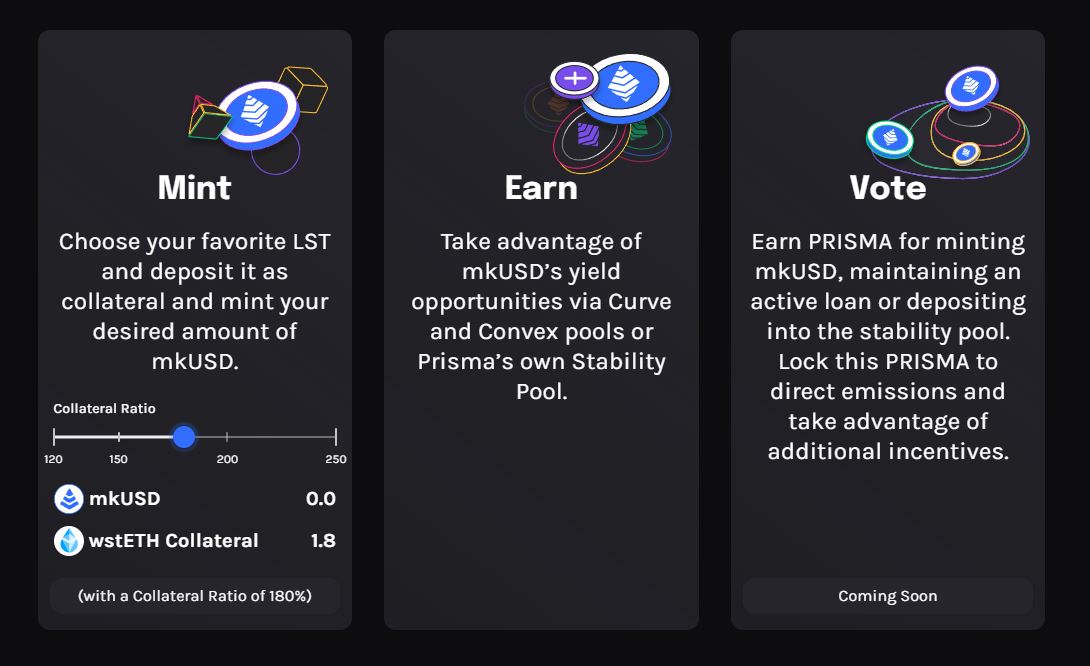

Mechanism of Action

When users participate in using Prismia Finance, they will go through a number of steps as follows:

- Mortgage of property: Users can deposit LSTs including Lido Finance’s wstETH, Rocket Pool’s rETH, Coinbase’s cbETH, and Frax Finance’s sfrxETH into the project’s Vaults for loans as low as $2000 mkUSD (of which 200 mkUSD is Liquidation Reserve)

- Mint Stablecoins: The minimum collateral ratio on Prisma Finance is 120%. For example, if you want to borrow $2000 mkUSD from Prismia Finance, you must have a minimum of $2400 in collateral ($2400 USD rETH, cbETH…).

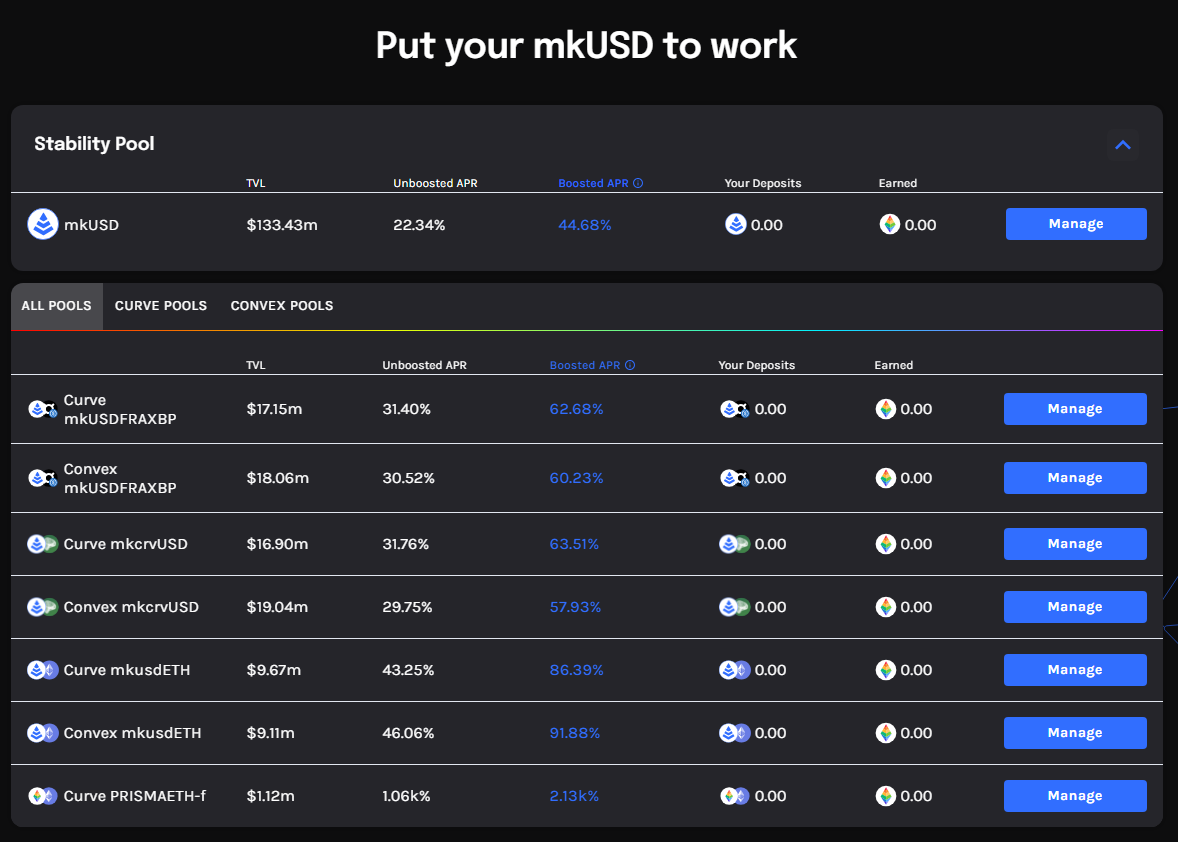

- Provide liquidity: Once users have held mkUSD, they can provide liquidity on platforms such as Curve Finance, Convex Finance.

- Stability Pool: Users can also deposit mkUSD to provide liquidity to Stability Pools and these Pools act as asset liquidation pools on Prisma Finance.

Some Points to Pay Attention to Prisma Finance

Liquidation Reserve

When a Vault is activated, the protocol will hold 200 mkUSD for gas fees and this is called Liquidation Reserve, in case the loan is liquidated. However, this 200 mkUSD will be returned when the user repays the loan.

An important point to note is that the Liquidation Reserve is considered part of the loan, so when users borrow a minimum of $2,000 mkUSD, they can only hold out $1,800 mkUSD to participate in DeFi.

Stability Pool

Prisma Finance’s Stability Pool

The main task of the Stability Pool is to provide the necessary liquidity to buy back liquidated assets (LST) in Vaults.

For example: When a Vault is liquidated, an amount of mkUSD (corresponding to the amount of debt) from the Stability Pool is used to buy back collateral from that Vault, and that collateral is transferred to Stability Pool.

mkUSD is in the Stability Pool provided by users (Stabability Providers). Over time, if more Vaults are liquidated, Stability Providers will see their mkUSD amount decrease compared to the amount they initially put into the Stability Pool. In return, they will receive a proportionate share of the mortgaged assets.

Typically, Vaults will be liquidated if the value slips slightly beyond the 120% ratio, which will allow Stability Providers to receive collateral worth more than the debt they offset. This means they have the opportunity to buy back mortgaged assets at more favorable prices without having to spend gas fees or use bots.

For example: There is a total of 2,000,000 mkUSD in the Stability Pool, and you have deposited 200,000 mkUSD into the Stability Pool. If a Vault with debt of 200,000 mkUSD and collateral of 300 rETH is liquidated when the price of rETH drops to 666 USD, and another Vault with debt of 100,000 mkUSD and collateral of 200 wstETH is liquidated at the price of wstETH is 666 USD. Here your amount will be affected by 10% of the total Pool.

Specifically, your deposit amount will be reduced by 10% according to the amount of debt that has been liquidated (which means your mkUSD deposited into the Stability Pool has been used to buy back the amount of liquidated assets), equivalent to 30,000 mkUSD. This means your deposit will decrease from 200,000 to 170,000 mkUSD. As compensation, you will receive 10% of the liquidated collateral: 30 rETH and 20 wstETH. At the liquidation price ($666), this collateral is worth $33,300, giving you a net profit of $3,300 from the liquidation of the above 2 Vaults.

Another benefit when users provide liquidity in the Stability Pool is that they receive Prisma tokens.

Liquidation

When the liquidation occurred, everyone still held all the mkUSD from LST mortgage to borrow. However, people still have to suffer a loss of up to 20%, which is not a small loss, especially with the asset types that Prisma Finance is supporting. Therefore, everyone should maintain a mortgage ratio above 120%, and ideally above 150% in case there are unexpected black swan events that cause losses to themselves.

Anyone can start liquidating a Vault as long as its collateralization ratio is below 120%. And to encourage this, the liquidator of those debts will be compensated for gas fees. Because liquidating a Vault will come with gas fees that the liquidator must bear. Gas fees will be compensated according to the following formula:

Gas fee= 200 mkUSD + 0.5% from liquidated collateral

Of which 200mkUSD will come from Liquidation Reserve.

Conversion

The conversion is calculated as $X mkUSD to $X USD collateral. Users can convert mkUSD to any asset that Prisma Finance supports. However, the conversion fee will be based on the total conversion value. In normal circumstances, the conversion fee will be calculated according to the following formula:

(Baserate + 0.5%) * Collateral is withdrawn

The Baserate is automatically updated in each Vault, and it increases with each conversion and decreases over time since the last conversion or release of mkUSD.

Protocol fees

Prisma Finance has 2 types of fees:

- Fixed charge: mkUSD mint fee and conversion fee.

- Interest rate when borrowing.

The mkUSD mint fee is a fee charged when users borrow money from the protocol. In normal conditions, this fee is 0.5% and this fee will return to 0% in Recovery Mode. This fee also applies to $200 mkUSD from the Liquidation Reserve however will be refunded once the user repays the loan. This mint fee ranges from 0.5% – 5% and is decided by Baserate.

Interest is often the revenue that helps keep protocols running. At Prisma, this fee is calculated according to the amount of mkUSD borrowed against the collateral. The DAO will have a say regarding these parameters.

Recovery Mode

Recovery Mode is activated when the total global collateral ratio (Global Total Collateral Ratio or GTCR) in the system is lower than 150%. In this case any Vault has a lower collateral ratio GTCR (150%) will be liquidated. So GTCR What is it and how is it calculated?

GTCR = Total value of collateral in the protocol/Total outstanding debt in the protocol.

If the resulting number is lower than 150%, the entire protocol will fall into Recovery Mode. The purpose of this recovery mode is to ensure stability for the protocol, motivating people to deposit money into the Stability Pool, or in simple terms, Prisma urges everyone to quickly repay their debts and those who have mkUSD should do so. deposited into Stability Pool.

When entering Recovery Mode, the mkUSD mint fee drops to 0% to invite people to borrow. In this case if your personal mortgage has a rate below GTCR (150%), your loan is also likely to be liquidated (even if it is above the required mortgage ratio of 120%). To prevent this, people should keep their collateral ratio above 150% so that even if the entire protocol goes into recovery mode, it does not affect the personal loan.

Peg holding mechanism for mkUSD

mkUSD maintains a strong link to the USD due to its ability to redeem collateral at par ($1 mkUSD is interchangeable with $1 USD of collateral) and a required minimum collateral ratio of 120%.

Development Roadmap

Update…

Core Team

Update…

Tokenomics

Overview information about Prisma tokens

- Token name: Prisma Governance Token

- Code: PRISMA

- Blockchain: Ethereum

- Token classification: ERC-20

- Contract: 0xda47862a83dac0c112ba89c6abc2159b95afd71c

- Total supply: 300,000,000

Token Allocation & Release

- 62% is used as an incentive. Additionally, emissions can be used to incentivize liquidity on Liquidity Pools.

- 20% is allocated to Core Contributors. This amount of tokens will be unlocked linearly over 12 months starting from Genesis.

- 10% is allocated to Early Supporters. These Tokens will be unlocked linearly over 12 months starting from Genesis.

- 5% will be sent to Prisma DAO Treasury.

- 3% will be distributed to veCRV voters and Prisma Point holders.

Token Use Cases

Prisma Finance uses the veToken model similar to many DeFi platforms today with 2 tokens PRISMA and vePRISMA. The use cases of these two tokens are as follows:

- PRISMA is used as incentives for users in minting mkUSD activities, depositing mkUSD into Stability Pool,…

- Users staking PRISMA will receive vePRISMA (locked for a minimum of 1 week and a maximum of 52 weeks) to have protocol governance rights on issues such as:

- Increase PRISMA emissions in mkUSD minting activities, depositing mkUSD into Stability Pool,…

- Changed parameters for collateral types and Stability Pool.

- Change fees in the protocol.

- Decide which collateral will receive PRISMA emissions tokens.

Exchanges

Currently you can trade $PRISMA Token at CEX exchanges such as: HTX and DEX exchanges such as: Curve Finance, Uniswap V2

Prisma Finance’s Information Channel

Summary

Hope this article has partly helped you understand What is Prisma Finance? It can be said that with its unique model, Prisma Finance is slowly growing stronger. I will continuously update Prisma Finance’s information as soon as possible to send to readers.