Recently, there has been a lot of information and articles about Real World Assets (RWA), also known as real world assets, which are valuable assets in real life. These can be traditional assets such as real estate, stocks, bonds, commodities, currencies, or other assets that have real value. By tokenizing hundreds of trillions worth of RWA, it benefits improved liquidity, enhancing interoperability between the blockchain world and reality.

But currently RWAs are mostly encoded on the Ethereum blockchain and were first released by projects MakerDAO, Goldfinch, TrueFi,… Polymesh was born to solve problems effectively and open up opportunities for financial tools. main, encrypting real world assets into the blockchain, allowing Crypto asset holders to invest in real world assets. So what is Polymesh, everyone let’s find out with Weakhand.

To understand more about Polymesh, please read the articles below:

- What Are Real World Assets (RWA)? Potential Projects In RWA Array

- Will Real World Assets (RWA) Become Narrative After LSDFi

- Summary of Potential Projects in the Real World Assets (RWA) Industry

Overview of Polymesh

What is Polymesh?

Polymesh is the first permissioned, public Layer 1 Blockchain built specifically for regulated assets such as security tokens and real world asset markets. Open the door to new financial tools by solving challenges around governance, identity, compliance, security and payments.

Users participating in Polymesh must complete an identity verification process. This verification process applies to all actors on the chain, from issuers and investors to stake participants and node operators.

Polymesh uses the Substrate module as its architectural foundation, allowing developers to build a blockchain by combining existing reusable components together that target different protocol components: consensus mechanism, transaction processing and smart contract execution, etc. Relying on the flexibility of Substrate helps Polymesh to adjust and optimize its features and functions to meet the requirements separate request for security tokens.

Polymesh uses a highly customizable NPoS (Nominated Proof of Stake) consensus mechanism, delivering high throughput and fast non-probabilistic finalization.

Mechanism of action of Polymesh

Polymath created the Security Token Standard (ERC-1400) to address financial institutions’ need for consistency in how assets are created and handled.

Consensus mechanism on Polymesh: Validators and Nominators work together to drive Polymesh’s backend economy by staking in the network and acting according to consensus rules. Participants receive rewards for successfully validating blocks for Polymesh. Validators and Nominators are not responsible for ensuring transaction compliance, only that the transaction has been completed properly according to protocol rules. Validators vote on the blocks that are created, and when more than 2/3 of Validators have voted in favor of a block, the block is completed.

Polymesh seamlessly supports many different types of wrapped tokens. For assets originating from other Blockchains, the assets are bridged to Polymesh. Assets will be locked on their original network, then reminted as wrapped tokens on Polymesh (by Lock – Mint – Burn mechanism)

Polymesh provides a streamlined process to enable issuers of existing managed assets to migrate those assets to Polymesh to take advantage of unique features and optimizations. This process can be complicated for pre-existing assets with multiple investors as these investors need to be moved individually. To mitigate this concern, Polymesh provides placeholder identities and accounts that can be used for existing investors who have not yet migrated to the chain. These placeholders can be reliably claimed by investors on Polymesh when they want to interact with the assets they own.

Highlights of Polymesh

- Consensus mechanism: Polymesh uses a highly customizable NPoS consensus mechanism, delivering high throughput and fast non-probabilistic finalization. Combined with Polymesh’s settlement engine allows for near-instant final decision and settlement.

- Transaction processing: Fast and instant.

- Smart contracts: Polymesh is built for regulated assets so many of the core functions of security tokens are integrated at the protocol level, meaning participants do not need to rely on smart contracts.

- Administration: Polymesh uses an industry-based governance model to prevent hard forks and address significant legal and tax challenges for tokens backed by real assets.

- Identity: Polymesh uses a customer due diligence process to ensure all actors in the chain are verified and all transactions are authorized by licensed entities.

- Security: Polymesh has designed a secure asset management protocol that enables the issuance and transfer of confidential assets.

- Approach: By creating assets at the protocol layer, Polymesh can provide a simplified approach to transactions, enabling instant settlement.

Polymesh Development Roadmap

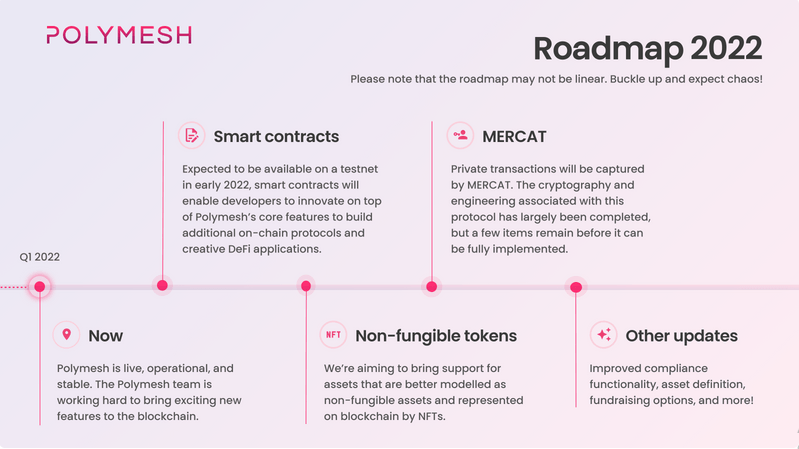

- October 2021: Mainnet launch.

- Q1/2022: Smart contracts, NFTs and privacy through MERCAT will be the top features integrated on Polymesh.

Core Team

Chris Housser: Head of Strategy

- Chris H graduated with a Bachelor of Arts, history from Victoria University; Chris H graduated with a Doctor of Laws from Western University.

- Chris H has worked and held the following positions: Lawyer at Chris H working at Bennett Best Burn; Co-Founder at Polymath; Independent consultant at Creed Assets Self-employed.

- Since February 2022, Chris H has worked at Polymesh as Head of Strategy.

Adam Dossa: Head of Blockchain

- Adam Dossa graduated with a Bachelor of Arts (BA), Mathematics and Computation from Oxford University; Earned a Master’s degree in Computer Science from Columbia University.

- Adam Dossa has worked and held positions: Blockchain Advisor for DREAM Ecosystem; Blockchain School, Chief Technology Officer at Polymath; Blockchain consulting at AID Consulting LLC; Founder at Enclaves.

- From February 2022 until now, Adam Dossa has worked at Polymesh as Head of Blockchain.

Graeme Moore: Head of Tokenization

- Graeme Moore graduated with a degree in Economics from Queen’s University.

- Graeme Moore was the first employee at Polymath; creative director at Spartan Race; and is a partner at Canada’s largest independent investment advisory firm. Graeme is the author of B is for Bitcoin, the first ABC book about Bitcoin.

- From February 2022 to present, Graeme Moore is Head of Tokenization at Polymesh.

William Vaz–Jones: Head of Partnership Development

- William Vaz-Jones graduated with a degree in Finance from Western University.

- William was a Senior Financial Analyst – Corporate Credit at DBRS; Senior Business Development Manager at Fidelity Investments; Vice President of Sales at Barometer Capital Management; Will joined Polymath in early 2019 as Director of Partnership Development.

- February 2022, William Vaz-Jones is Head of Partnership Development at Polymesh, Work includes training, onboarding, and developing and managing key partner relationships.

Robert Jakabosky – Head of Applied Blockchain Research

- Robert G was an English Teacher at Rockies English School; Independent computer consulting; IT Manager & ERP Developer at The Meeting Point Limited (Hong Kong/China); In 2021, Robert began using his highly sought-after Rust skills to build the Polymesh blockchain as a Senior Rust Engineer at Polymath.

- At Polymesh, Robert G was Head of Applied Blockchain Research in May 2022.

- Francis O’Brien graduated in Mechanical Engineering from Cork Institute of Technology in 2004.

- Francis O’Brien has 17 years as a product engineer in the oil and gas industry. Francis has worked on a variety of products for global projects and has worked at Polymesh. granted many patents.

- Francis O’Brien is currently Head of Developer Relations at Polymesh.

Investors

Update…

Tokenomics

Basic information about POLYX token

- Token name: Polymesh

- Symbol: POLYX

- Blockchain: Polymesh

- Total supply: 1,000,000,000

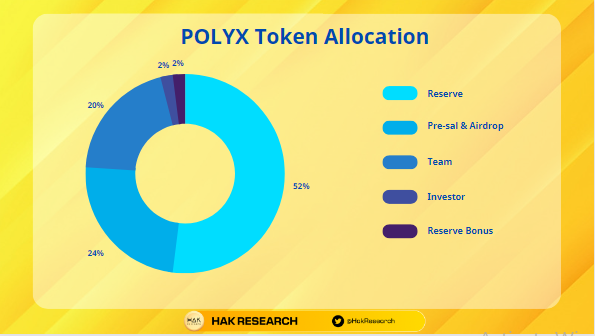

POLYX Token Allocation

- Reserve: 52%

- Pre-sal & Airdrop: 24%

- Team: 20%

- Investors: 2%

- Reserve Bonus: 2%

POLYX Token Release

Updating

POLYX Token Use Case

POLYX is a utility token that officially operates in the Polymesh ecosystem, used for the following purposes:

- Users stake POLYX to participate in the process of securing the network.

- Pay transaction fees.

- Participate in platform governance.

POLYX Token Exchange

Currently, POLYX tokens are traded on exchanges: Binance, Gate, HTX, Crypyo.com, …

Polymesh Project Information Channel

- Website: https://polymeresh.network/

- Twitter: https://twitter.com/PolymeshNetwork

- Discord: https://discord.com/invite/Z9MAUtYaG7

- Youtube:

Summary

Polymesh is a layer 1 blockchain that provides a customizable, optimized, and scalable solution for security tokens. As the Polymesh ecosystem continues to expand (especially with enterprise-level projects in the works), Polymesh adoption is setting the stage for a future where security tokens thrive.

Hopefully this article provides useful information about what is Polymesh? And understand about POLYX Token.