What is Pods Finance? Pods Finance is a Yield Farming platform similar to the legendary Yearn Finance, but the strategies of the two projects are completely different. Pods Finance is committed to bringing their users an attractive profit while still ensuring the safety of users’ capital.

So how can Pods Finance do that? Everyone, let’s learn about the Pods Finance project in this article.

What is Pods Finance?

Pods Finance is a project in the Structure Finance segment similar to the Yearn Finance platform but uses a derivative strategy to earn profits for users. In the early stages of development, Pods Finance only focused on stETH assets and will add ETH in the future.

Pods Finance promises users higher returns than staking ETH in BeaconChain or through Lido Finance without affecting customers’ principal.

How Pods Finance Works

Parties involved

Pods Finance’s first product is stETHvv, which stands for stETH Volatility Vault. And there will be 6 ingredients The composition of the stETH Volatility Vault includes:

- Depositors: Depositors

- Yield Source: Source of profit

- Investor: The person in charge of strategizing

- Vault Controller

- Vault: Is a pool that receives money from depositors, calculates interest, creates bonds for depositors and many other activities.

- Round Processor

Mechanism of action

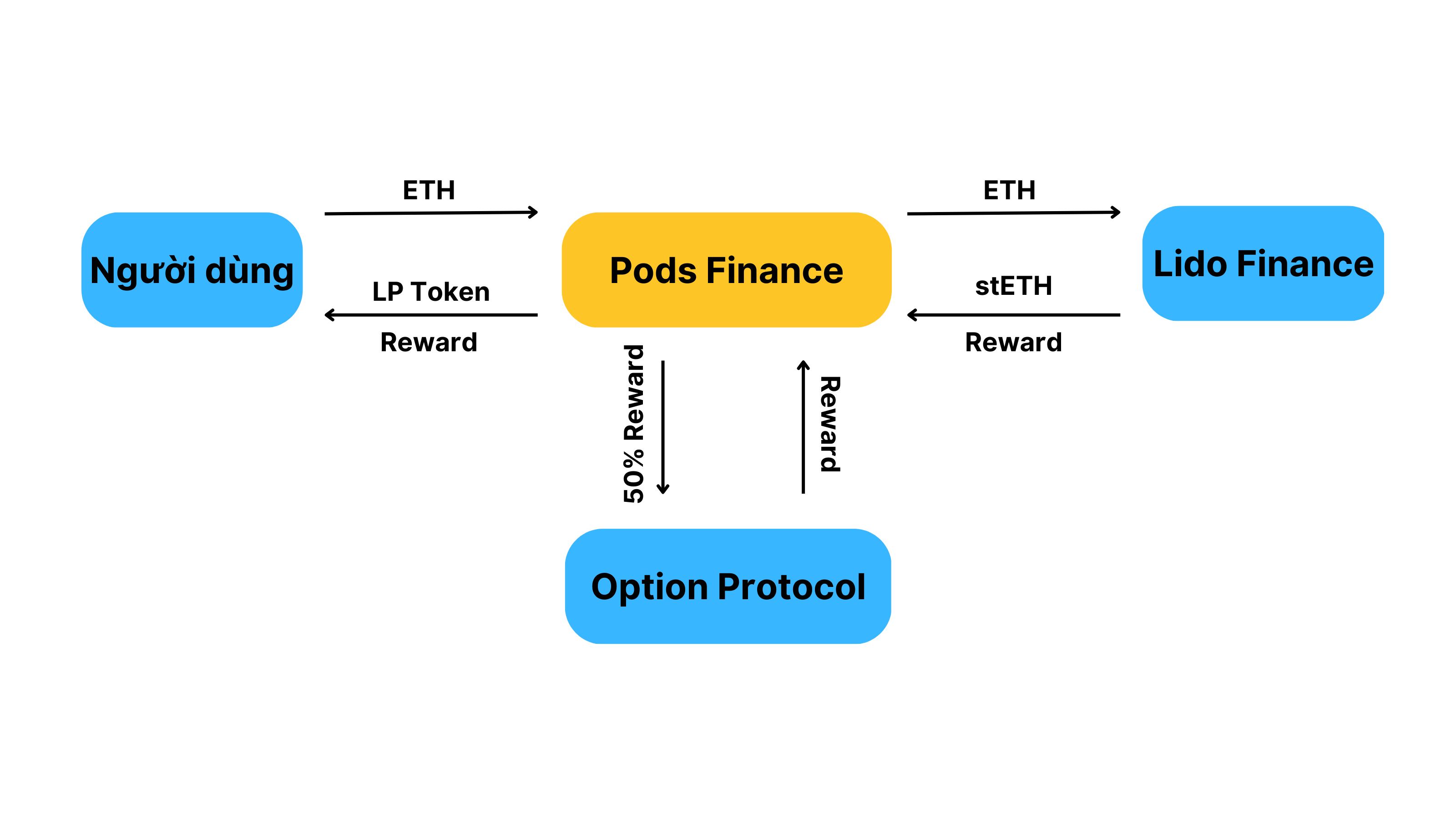

Up to now, users can only deposit stETH into Pods Finance vaults. When the vault holds stETH, Lido Finance will pay weekly interest (Pods Finance calls this profit source The Yield Source). After that, vaults will automatically deduct 50% of this profit to open leverage orders, mainly ETH buy and sell options at different prices ranging from 10 – 20% OTM with daily terms. week on decentralized derivatives exchanges.

Because of Option transactions, there will be no liquidation of orders because if the price of ETH increases or decreases, Investors will only lose the premium fee for not executing the option contract.

- If ETH increased in price significantly, Ethereum put options are profitable.

- If ETH price drops significantly, Ethereum call options are profitable.

- However if ETH goes sideways then these options generate no profit and the vault will lose 50% of the profits generated by Lido Finance that week but without affecting the principal.

Pods Finance only risks a portion of the profits they gain from Lido Finance.

Development Roadmap

Currently, Pods Finance only accepts stETH as an accepted asset to deposit into the vault, but in the future it will accept additional assets such as ETH.

Core Team

The Pods Finance development team from Brazil started working together on many projects including:

- yBond: Zero-coupon bond with STO as collateral was first introduced in September 2019.

- Ohmydai: One of the first projects working on Options in DeFi officially mainnet in November 2019. However, up to now, the Ohmydai project has officially stopped operating due to ineffectiveness.

- Pods Finance: First introduced with options contracts hedging crypto assets on Ethereum.

Rafaella Baraldo: Co Founder & CEO

- Rafaella has experience working at many large corporations such as Citi Bank, Barclays, Deloitte, Consenso, Remob,…

- However, in the past, Rafaella did not have a long-term relationship with any business. Only at Mainframe has Rafaella held the position of regional director the longest.

- Rafaella started approaching and building products in the crypto market since 2019 (The most recent crypto winter period).

Robson Silva Junior: Co Founder

- Robson has many years of experience as a Software Engineer at many different companies and corporations such as RevMob Mobile Network, BelugaDB, Mainframe.

- Robson first joined the crypto market as the founder of the 314coins platform – a place to easily buy and sell cryptocurrencies.

- Together with Rafaella, they founded Pods Finance in 2020.

Guilherme Guimarães: Co Founder

- Guilherme has many years of experience as a Front end Programmer at many large companies and corporations such as Celevryts, PagueMob, Boom Credit and Cuattro Trade Marketing.

- After that, Guilherme took on a new role as a Software Engineer at Hifi Finance.

Investor

- October 17, 2020: At the Pre Seed round, Pods Finance successfully called for a modest amount of $800K from large VCs such as Boost VC, Framework Ventures, P2P Capital, BitScale, Zeeprime, The LAO and many other investors. other angels.

- December 19, 2022: After 2 years of development, Pods Finance continues to successfully call for $5.6M in Seed round with the participation of IOSG, Tomahawk, Republic, Framework Ventures, 4RC, Alexia Ventures and many investment funds another.

Besides successfully calling for many investment funds, Pods Finance also has many large partners in the crypto market such as: Idle Finance, Arbitrum, SushiSwap, Mai Finance, Element Fi, Chainlink,…

Tokenomics

Update…

Exchanges

Update…

Pods Finance’s Information Channel

- Website: Pods.Finance

- Twitter: @PodsFinance

- Blog: https://blog.pods.finance/

- Youtube:

Summary

Pods Finance offers a variety of Yield Farming platform options for users holding stETH tokens. However, due to many product structure changes, users’ trust in the project and development team has been greatly reduced.

Besides, Pods Finance’s current strategy only brings in about 3% more, a number that is still quite modest compared to the risks that users may encounter such as rug pulling. Therefore, Pods needs to launch more diverse products and strategies to help bring vaults more yield in the future so they want to attract users.