The collapse of FTX dealt a strong blow to Crypto in general and centralized exchanges (CEX) in particular. However, from an optimistic perspective, the departure of the Sam Bankman-Fried empire is a catalyst for the explosion of DeFi projects in the future. In today’s article, we will learn about Perpetual Dex – a niche that is not new but is being underestimated compared to its potential. So what is Perpetual Trading? Let’s find out in the following article.

What is Perpetual Trading?

Perpetual are futures contracts with no expiration date, often called Vinh Cuu contracts (Vietnamese traders often call them Futures or Futures trading for short). To keep the position open, with the perp price tied to the underlying asset price, the investor will have to make ongoing interest payments. This interest rate is calculated depending on the investor’s position (long/short) and is commonly known as Funding rate.

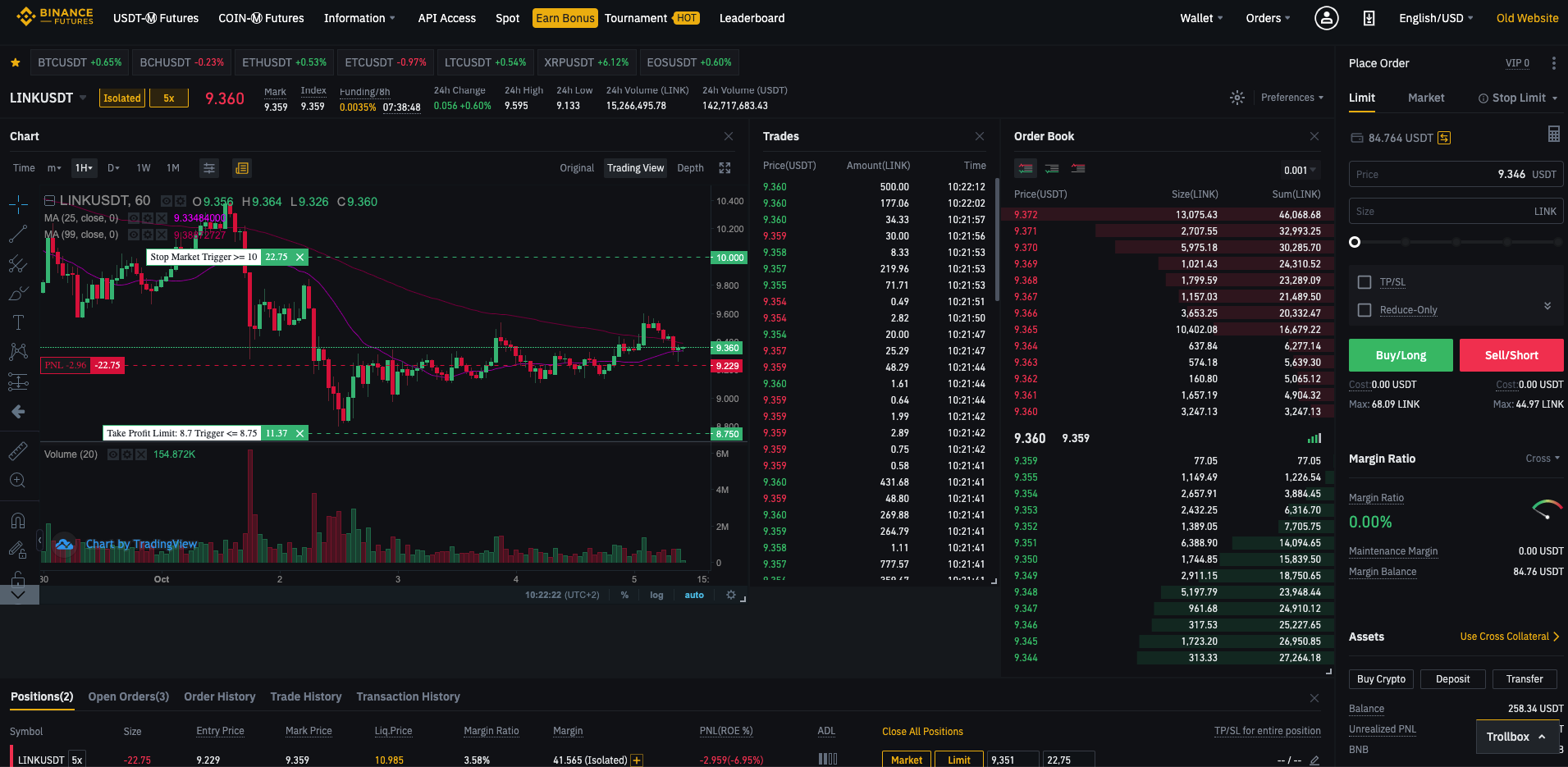

With the advantage of simple design, along with trading support tools such as leverage, profitable trading in both rising and falling price directions, Perpetual trading has quickly developed and become one of the mainstays. Forming the Crypto market. According to average statistics, Perpetual (Perp) trading volume at centralized exchanges is often much larger than spot volume, and Perp is also the goose that lays golden eggs, generating huge profits for CEX exchanges. at now.

Spot/Future ratio at CEX and DEX exchanges (src: Delphi Digital)

At first, centralized exchanges seemed to be the most suitable place to deploy Perp trading due to their advantages in liquidity, number of users, no network fees, and fast transaction speed. However, recently with the development of blockchain technology, especially Layer 2, as well as the flow of money and users gradually tending to flow to DeFi, it has created a push for the birth and strong development of these networks. Decentralized Perp exchange.

At CEX floors, investors have almost no opportunity to profit from the development of the floor. On the contrary, for Perp Dex, most have their own tokens to create conditions for investors to go along and profit from the growth of the project.

Below, I will analyze and compare the current prominent Perp Dex projects on the market and their tokenomics. Along with that, a number of new Perp Dex exchanges are receiving great attention from VCs and users.

Top 4 Decentralized Perpetual Exchanges

dYdX (MC: $185M)

dYdX is built on StarEx L2 technology powered by StarkWare allows the platform to process transactions in High speed with zero transaction fees. Besides, dYdX with its orderbook model design gives users a familiar feeling the first time they try the application. Finally, on dYdX uses off-chain matching engine and same participation Large amount of Market Makerhelping orders to be executed quickly with relatively low slippage.

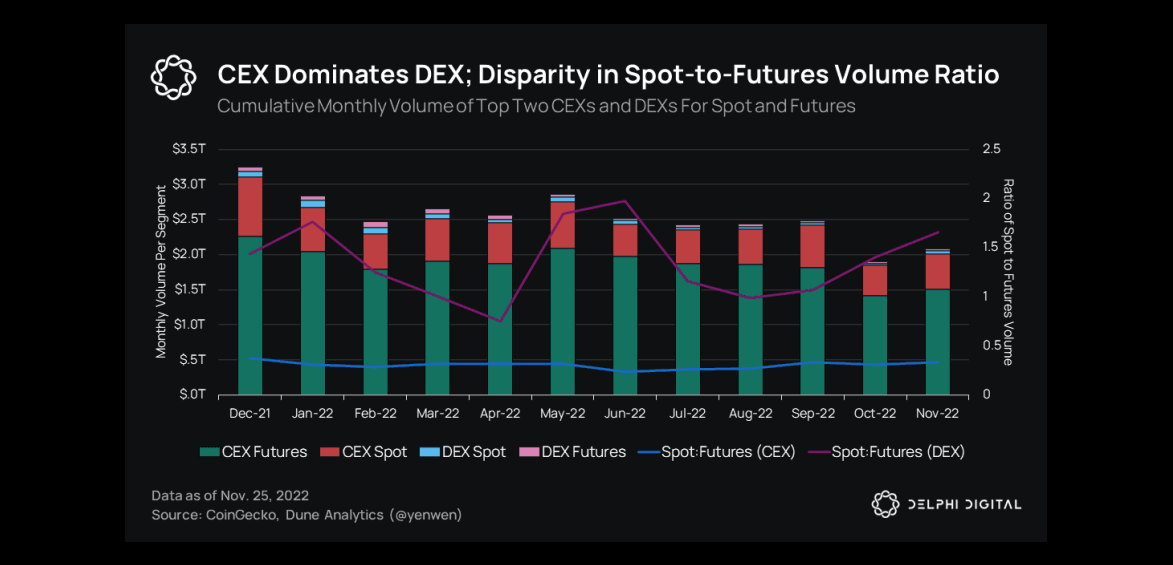

Trading volume at dYdX in180d

At the present time, dYdX is the number 1 Perp Dex on the market with a market share of nearly 80% of the entire industry, Trading volume is about $158.7B with revenue reaching about $37.6M in the most recent 6 months. Along with that, the project’s Market Cap is also

However, tokenomics of this platform is again considered Pretty bad for investing. Specifically, dYdX is administered through $DYDX. In addition to reduced transaction fees, token holders at the present time do not have any other benefits such as revenue sharing because all platform revenue is concentrated on dYdX Trading Inc – the organization behind the development. develop this platform. In addition, DYDX’s current circulating supply only accounts for 14% of the total supply and is currently also the top token with the highest inflation rate.

Around Q2/2023, dYdX v4 will be available Deployed on a blockchain exclusively built using the Cosmos SDK platform. This brings hope to create more use cases for DYDX tokens such as paying gas fees, validator incentives, staking and MEV. However, the right to decide on details will belong to dYdX DAO (largely in the hands of the development team).

GMX (MC: $386M)

GMX is a name that is aiming to take the leading position of dYdX with a new, relatively unique operating model. At GMX, users are divided into 2: traders and liquidity providers (LP). LP deposits several types of assets (BTC, ETH, UNI, USDC,…) into the GLP vault and lends liquidity to traders to open positions with leverage. This means that LP will become the “bookie” to bear losses and enjoy profits from traders’ transactions on GMX. Specifically, GLP stakers will receive 70% of the fees generated from the protocol, while the remaining 30% will belong to GMX holders.

Besides, GMX allows traders to trade with zero slippage by using the Chainlink oracle to provide prices for transactions. However, this is also a loophole of GMX when hackers can carry out price attacks to gain profits and cause damage to GLP stakers. Besides, the Oracle price source depends on data collected from major CEX exchanges, which raises questions about the protocol’s scalability in the future.

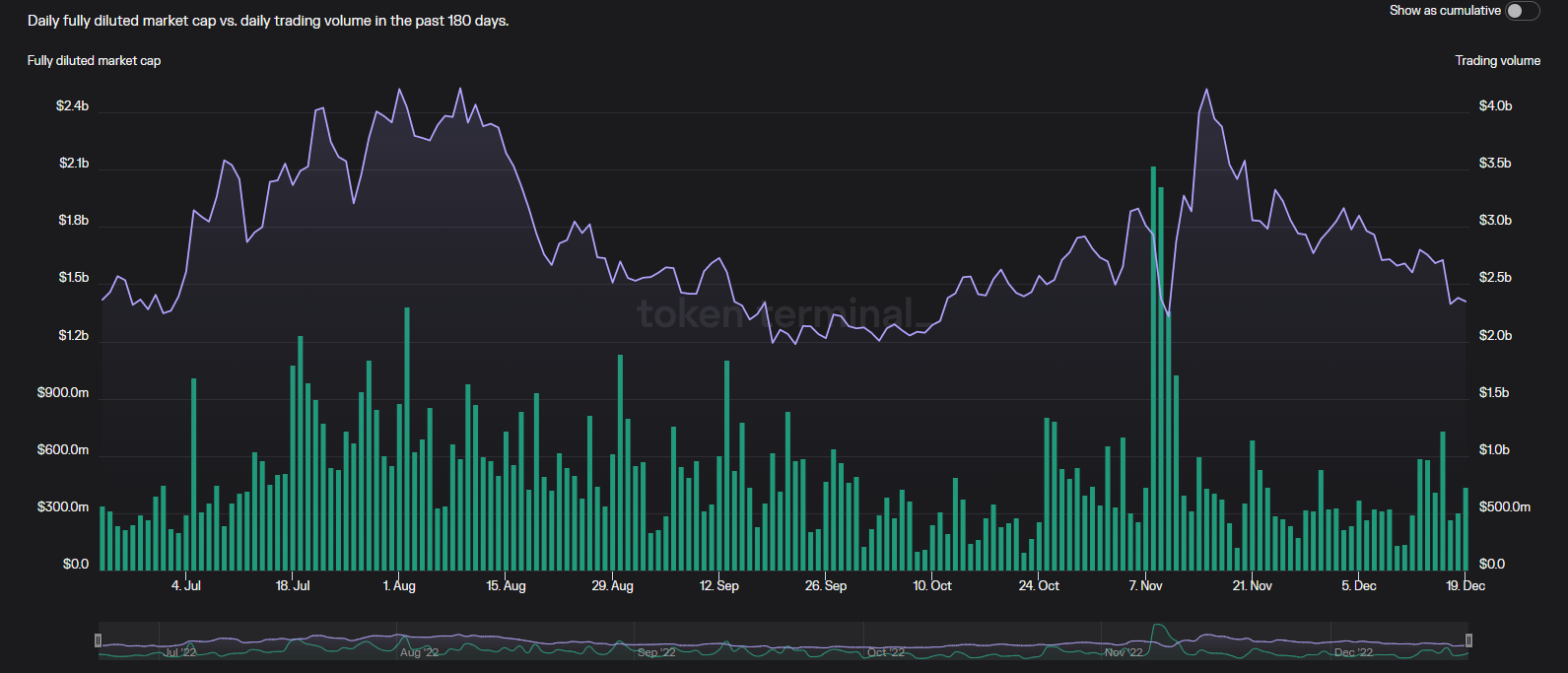

Trading volume at GMX in 180d

From mid-2022 onwards, GMX has grown relatively quickly, increasing its market share from 9.3% to 16.6% in just 6 months, processed about $47B in transaction volume and collected $18.2M in revenue.

GMX accounts for more than 40% TVL of the entire HST Arbitrum. Currently, there are many other platforms being built on GMX such as Rage Trage, GMD, Dopex, Umami with the purpose of optimizing profits from providing liquidity for GLP vault.

GMX has a mechanism Tokenomic is quite good when encouraging holders to stake and continuously stake their tokens. Specifically, GMX holders will receive 30% of the transaction fee in wETH, along with that they will receive an additional amount of esGMX (escrowed) and Multiplier Points (converted to GMX staked if they do not withdraw their stakes after 1 year). The above policies have partly helped keep the amount of GMX staked tokens in the protocol always maintained at a high level of around 85% of the total circulating supply.

Gains Network (MC: $106M)

Along with GMX, Gains is also a perp dex that has grown relatively quickly in recent times. Gains has a relatively similar operating model to GMX, however, unlike GLP vault, which accepts deposits with many types of assets, Gains only uses DAI as the asset to provide liquidity.

At Gains, besides Crypto trading pairs, traders also have options such as stocks and forex with leverage up to x100. However, there is a limitation that this platform limits the maximum deposit amount for trading to $75,000 and the trader’s profit amount does not exceed 900%.

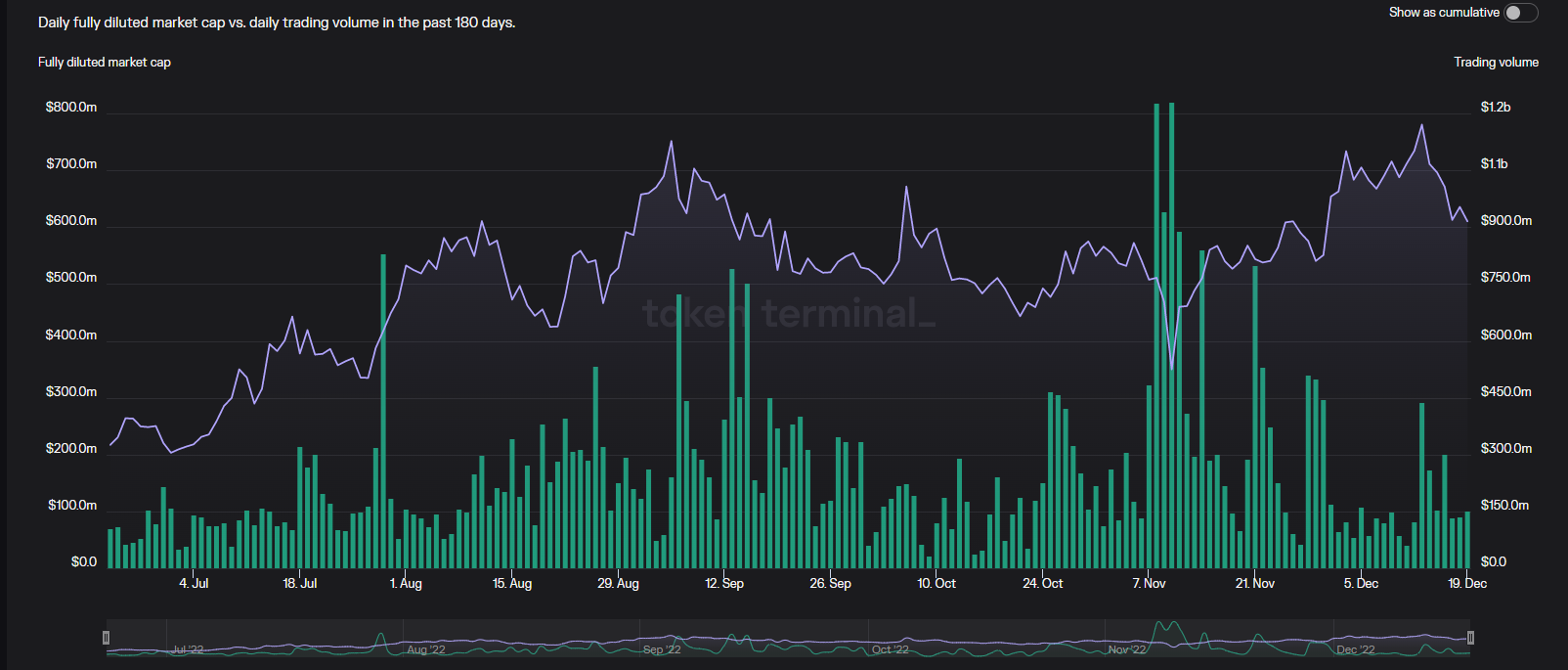

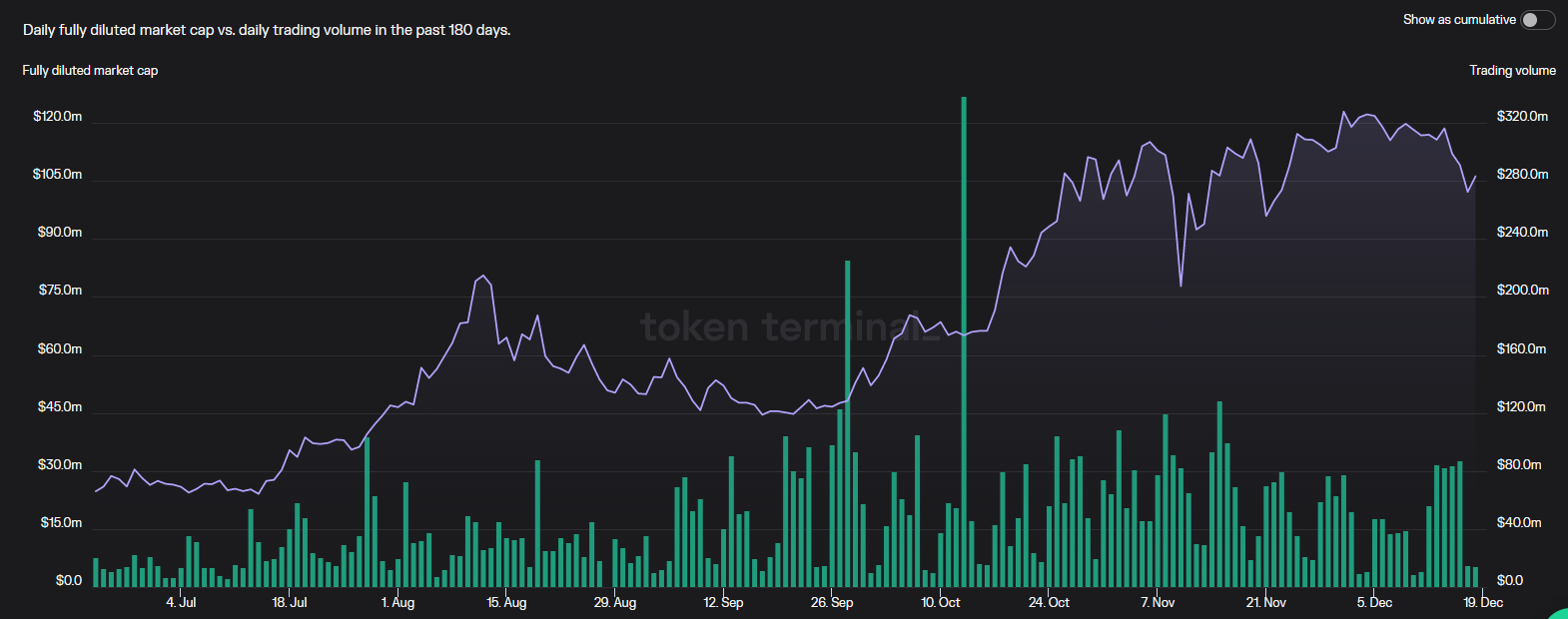

Trading volume at Gains in 180d

In the past 6 months, Gains has done more than $8B in transactions with an estimated revenue of $2.8M. In the near future, Gains is planning to expand to the ecosystem Arbitrum to receive the cash flow pouring into this ecosystem.

Similar to GMX, Gains’ GNS token can be staked to receive a portion of the network’s transaction fees. Besides, at Gains Has a GNS burning mechanism helps reduce the supply of this token on the market. Specifically, when the DAI vault exceeds the ratio of 130% of collateral assets, the protocol will deduct the excess DAI to buy back and burn GNS. However, in case this vault is below the collateral level, the protocol will also sell GNS to ensure the safety of the vault.

Perpetual Protocol (MC: $27M)

Perpetual uses v-AMM (virtual AMM) built from the foundation of Uniswap v3. Unlike Orderbook, where traders will often have to place limit orders and wait for matching or enter market orders with large fluctuations in price slippage, vAMM allows users to enter orders immediately like normal AMM while still using leverage.

Trading volume at Perpetual in 180d

In 2022, Perpetual deployed Optimism to take advantage of the gas fees and transaction speed advantages of Layer 2. However, Perpetual’s market share shrank from 2.9% to 1.8%. In the past 6 months, the protocol has only processed about $3.9B bringing in about $628k in revenue.

Regarding tokenomic, at present the project’s $PERP token can be staked to create vePERP with basic functions such as administration, boost yield from providing liquidity. Besides, Perpetual is also in the process of voting proposing a 25%, 50% or 75% share for vePERP holders in USDC.

Potential Trading Platforms

Although we know that Perpetual trading is an area with great potential in DeFi, it has not been until recently that with the improvement of L2 infrastructure, it has optimized transaction processing speed as well as reduced gas fees many times ( Ensuring the security factor of Ethereum), Perp Dex is truly exploding.

Maybe in 2023 we will soon see a race between Perp Dex exchanges competing for liquidity providers, traders and token holders. Among them, some outstanding projects are highly expected to participate in this race next year:

- Rage Trade: Project with 80-20 vault structure and using Omnichain deep liquidity to recreate liquidity on the pool of AMMs from many different chains.

- Vertex: The project received $8.5M in investment, built from the collapse of Terra. Although it is in the testnet phase, it is receiving a lot of attention from the market.

- ZKX: The project located on the StarkNet ecosystem stands out with building a node system to match orders in the orderbook. ZKX raised $4.5M in 2022 and is currently preparing to launch in 2023.

- Vela Exchange: The project started the P2P protocol with the name Dexpool before rebranding and expanding to develop Perp trading. Although the project is in the early stages of development, it is still worth following.

Summary

The Crypto market in winter is also the time when the “innovation” fires begin to be rekindled. The ice age of 2018-2019 has passed and we will receive sweet fruits from DeFi or GameFi in 2020 – 2021. Will we see the rise of DEXs with Perp transactions next this winter? There is no answer at this time, however, if you look at trending leaders like CZ who are building Perp for Pancakeswap, it can be said that this is one of the pre-calculated trends.

Hope this article helps readers understand What is Perpetual Trading? At the same time, get a preliminary view of the race that is gradually heating up in this niche as well as pocket a list of potential projects to follow and find early investment opportunities in the future.