What is Overnight finance? Build a platform that generates daily returns for stablecoin holders while allowing continued cash flow in DeFi. Let’s learn about Overnight Finance with HAK Research through the article below.

Overnight Finance What is that?

Overnight finance is one asset management protocol with investment products that provide passive income through delta-neutral trading strategies and target users who are stablecoin holders.

At present, Overnight finance is present on 5 ecosystems including: Avalanche, Optimism, Arbitrum, Polygon and BNB chain.

What Are Overnight Finance’s Products?

Aiming to optimize profits for idle stablecoins, Overnight finance clearly understands that their target customers are investors who are in a defensive state and want to ensure the safety of their assets. Therefore, the project has focused on developing products related to Delta-Neutral, specifically including:

USD+

Overnight fi allows users to mint USD+ from USDC at a 1:1 ratio pay interest daily based on the number of USD+ tokens they hold. Currently, besides USD+, Overnight fi has expanded to DAI+ with collateral assets of DAI and USDT+ from USDT (currently only available on BNB chain).

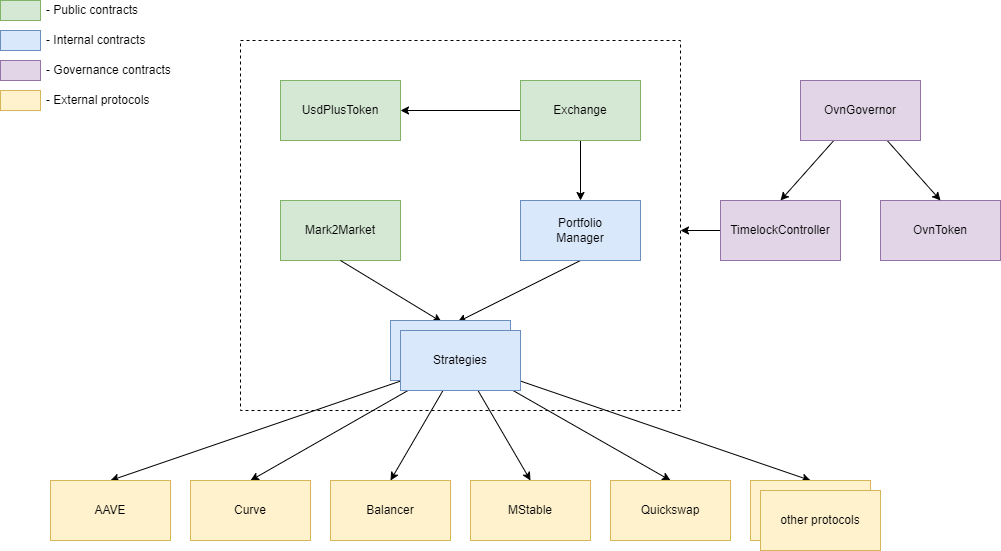

Profits paid to investors come from Overnight finance lending stablecoins and deploying investment strategies in the DeFi space with leading protocols such as Aave, Curve, Balancer, Quickswap,…

USD+/DAI+/USDT+ holders can use these tokens to participate in liquidity farming on other AMM platforms such as Wombat, Velodrome, Chronos,… to continue generating profits.

In case you want to receive the original stablecoin back, users can redeem on Overnigh_fi or swap directly on AMMs.

ETS – Exchange Traded Strategy

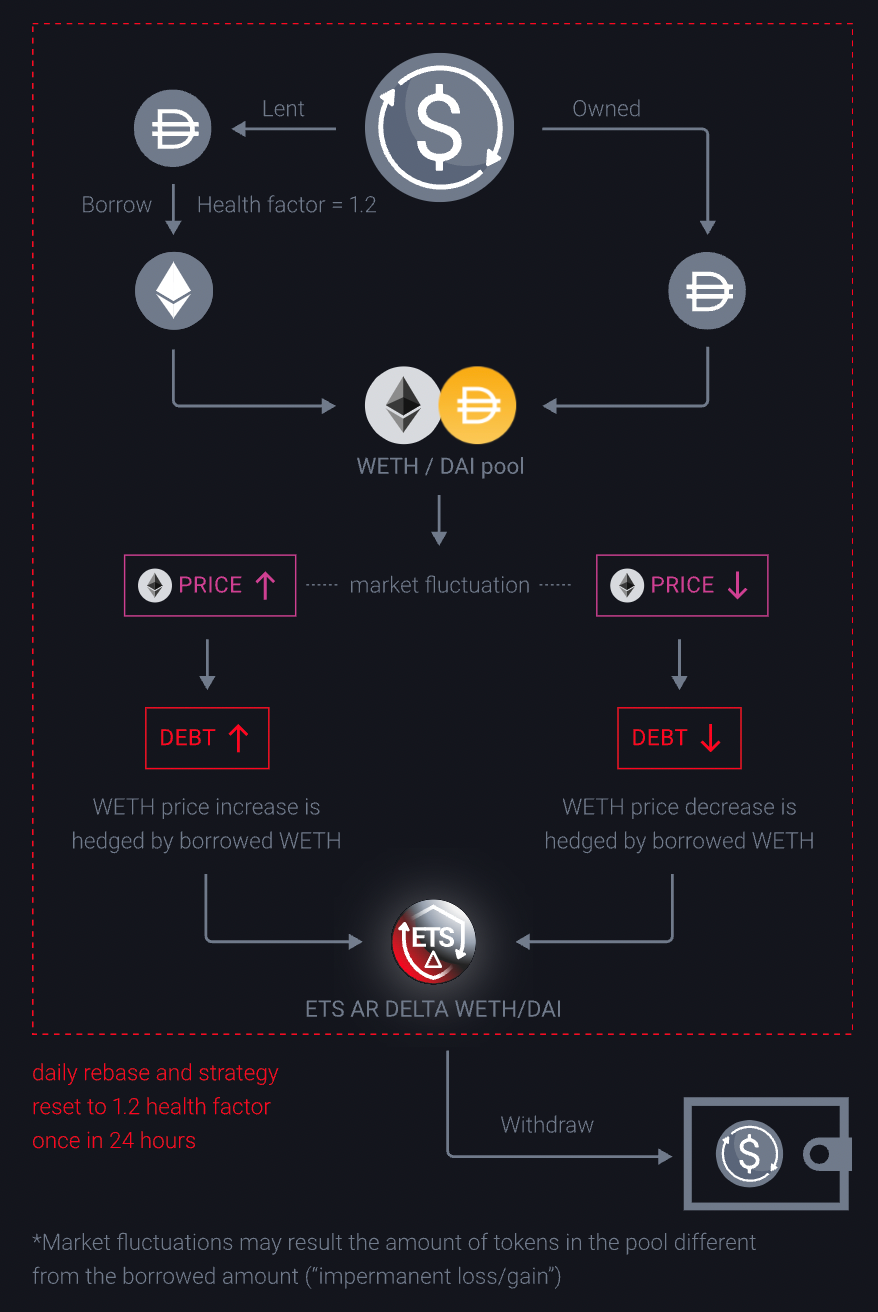

ETS is a product that allows users to use a collateralized loan position (eg: deposit DAI on Aave) to borrow a volatile asset (e.g. WETH)which combines ETH with a DAI and provides liquidity to the asset pool (e.g. WETH/DAI) on an automated liquidity management (AMM) protocol, like Uni V3.

=> This allows to increase the annual yield rate and insure against fluctuations in Crypto prices.

As in the example above, when the price of ETH decreases –> the value of the wETH/DAI pool decreases but the value of the wETH loan at Aave also decreases, and vice versa. This ensures increased profits for stablecoin holders, and at the same time, from the liquidity provider perspective, it will also reduce the risk of price fluctuations during Downtrend times. However, note that the risk of Impermanent Loss will still exist.

Insurance

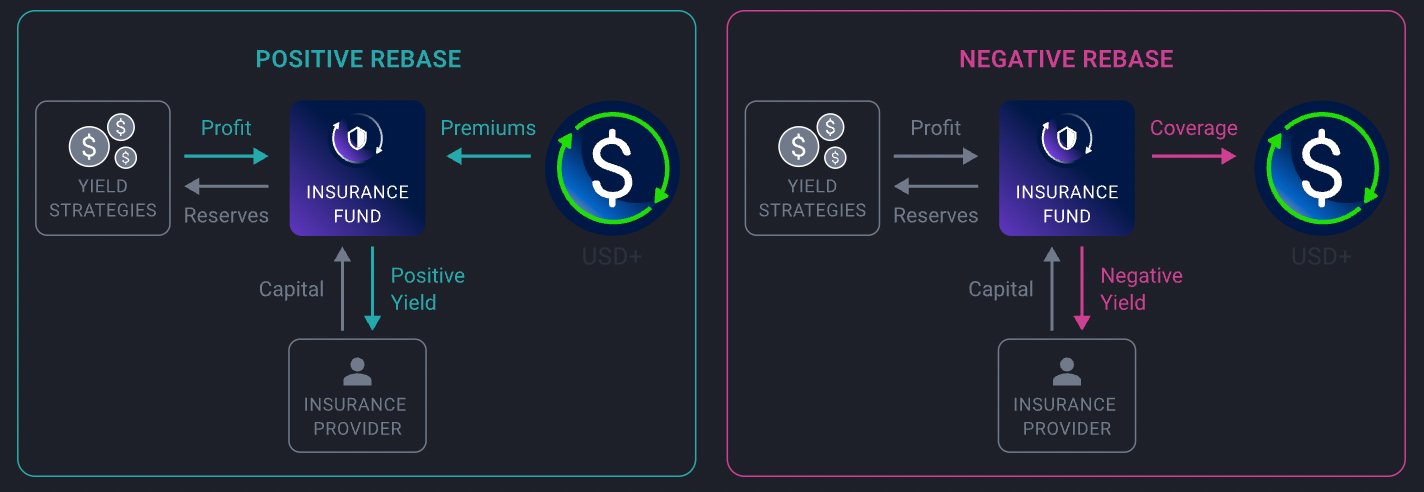

Although it is a project focusing on Delta Neutral trading strategies and promoting safety when collaborating with leading protocols, risk is a factor that always exists in the financial world. As mentioned above, USD+ is paid daily interest through Overnight finance’s investment strategies. Although, most of the time the strategies bring profits, however, there are also days when the strategies incur losses. This is the reason for the birth of Insurance products.

Insurance is used to ensure profits for USD+ holders on days when the trading strategy does not work as desired, and on days when it performs well, there will be a premium fee deducted from profits to pay to the fund. .

Development Roadmap

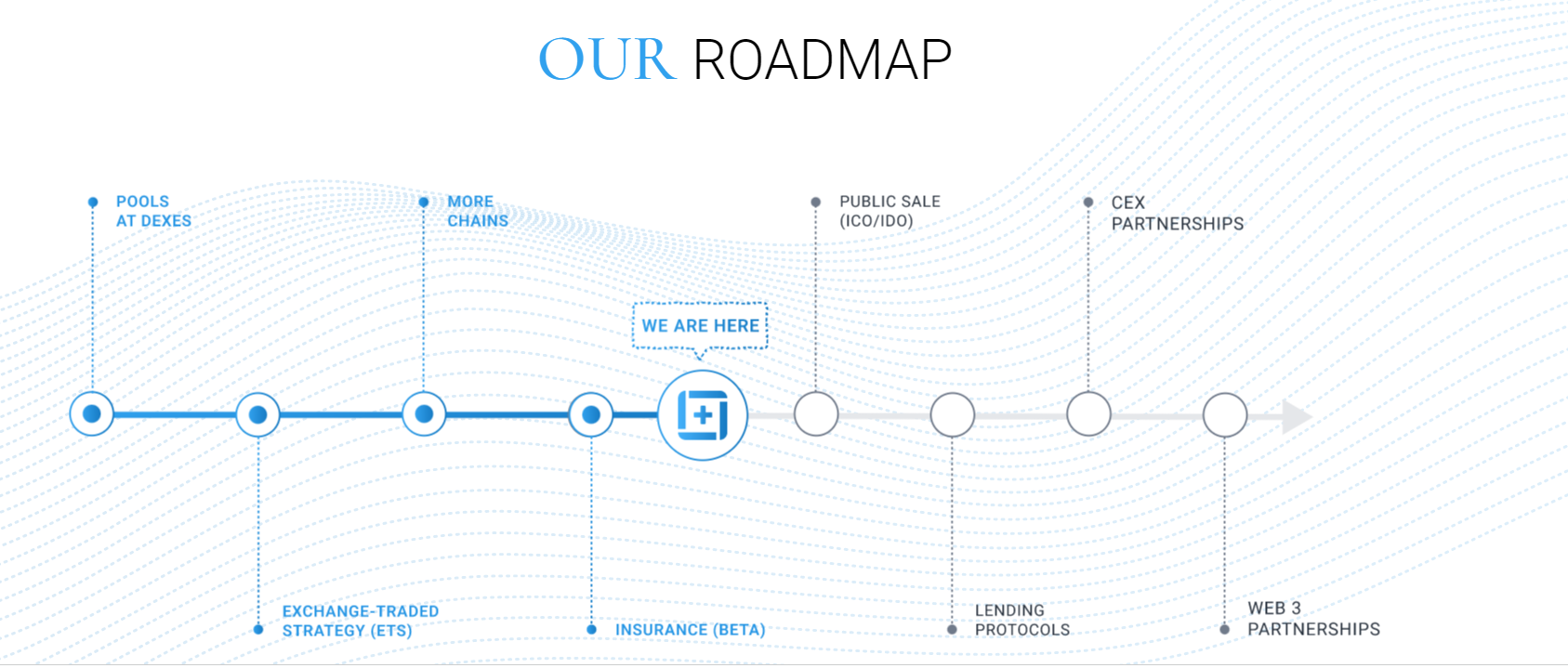

Currently, Overnight finance has just launched the beta version of Insurance on Polygon. In the coming time, the project will gradually promote the completion of IDO token, link with CEX, launch Lending Protocols and expand cooperation with Web 3 projects.

Core Team

Maxim Ermilov | Founder: Maxim has more than 17 years of experience through many management positions at The Boston Consulting Group, a leading financial corporation in Russia. He is also the founder of Mach49 Vostok, a consulting company that supports the development of start-ups in Russia.

Yaroslav Pavlov | Co-Founder & Tech Lead: He has many years of experience working as a Java programming engineer through many companies in Russia since 2016 before taking on the Tech Lead position at Overnight finance in 2021.

Nikita Ovchinnik | CBDO: He held a similar position at 1inch for 2.5 years.

Investor

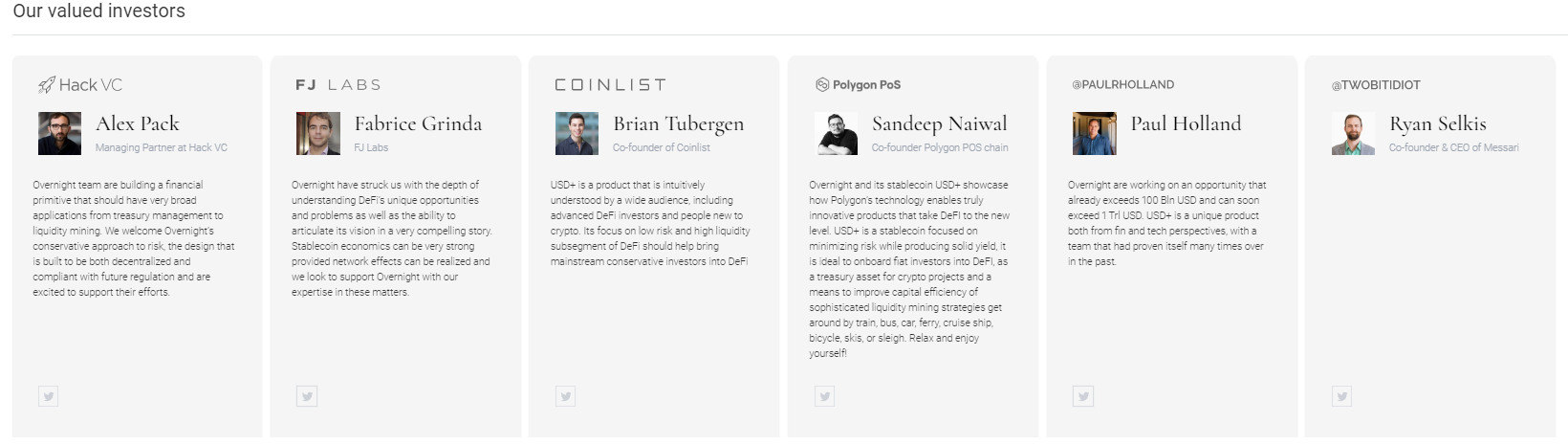

Overnight finance has raised $850,000 in a pre-seed round led by Hack VC with participation from FJ Labs, Sandeep Naiwal (co-founder of Polygon), Brian Tubergen (co-founder of Coinlist), Ryan Selkis (Founder & CEO, Messari) and Paul Holland

Tokenomics

General information about OVN token

- Token Name: Overnight finance

- Ticker: OVN

- Blockchain: …

- Token Standard: …

- Contract: …

- Token Type: Utility.

- Total Supply: …

Token Allocation

Update…

Use Cases

Update.,..

Exchanges

Update…

unshETH’s Information Channel

- Website: https://overnight.fi/

- Twitter: https://twitter.com/overnight_fi

- Discord:

Summary

Hope this article has partly helped you understand What is Overnight finance? This is a project with a relatively practical purpose for stablecoin holders. In addition, the project is also active in providing incentives for USD+ and DAI+ asset pools to help increase liquidity as well as gradually expand use cases for stablecoins. This.

However, you should consider because although USD+ and DAI+ are both backed 1:1 by reputable stablecoins, using Overnight Finance’s investment strategy still has potential risks for the collateral Pool.