What is ORC 20? ORC 20 is an open standard designed to create Fungible tokens on the Bitcoin network. ORC 20 was created after the BRC 20 standard to address some of the limitations of BRC 20 by improving security and enhancing flexibility. So what’s special about ORC 20? Let’s find out with Weakhand in this article.

What is ORC?

Experimental trends on the Bitcoin blockchain

In May 2023, the Bitcoin network received significant investor attention with the emergence of a standard designed to create Fungible tokens called BRC 20. This standard uses Ordinals to record a JSON code into Satoshi. However, one point to note is that BRC 20 technically does not represent a Fungible Token like the ERC 20 standard on the Ethereum network but just gives us a sense of the Token’s existence. Everyone can learn more about BRC 20 through the following article.

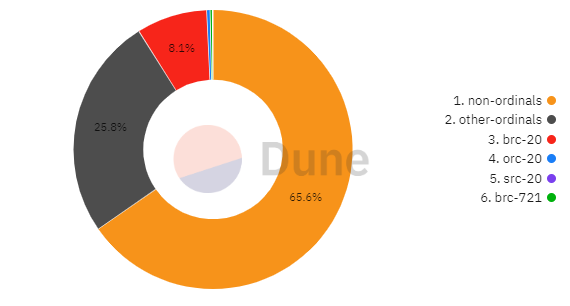

Market share of different token standards on Bitcoin

The popularity of BRC 20 has led to a significant increase in the number of transactions and network fees on the Bitcoin blockchain. The world’s largest cryptocurrency exchange Binance also had to block the withdrawal process due to concerns about the large transaction volume on the Bitcoin blockchain. However, the advent of new token standards such as: ORC 20 or SRC 20 creates a new wave on Bitcoin. From May 13 – 15, 2023, transactions related to ORC 20 accounted for a significant portion, about 10% of the total number of transactions.

Overview of ORC 20

ORC 20 is a new standard for Fungible Tokens running on the Bitcoin blockchain, created by attaching a JSON script to Satoshi similar to BRC 20.

ORC 20 was created by OrcDAO introduced this token standard as a solution to some of the limitations of BRC 20 by increasing security and flexibility. Additionally, ORC 20 expands the capabilities of BRC 20 by supporting more data formats and using Bitcoin’s UTXO model to eliminate the problem of doubling transaction fees.

Simply put, ORC 20 can be considered one “hard fork” of BRC 20. However, it is important to note that ORC 20 is still in beta and there is no guarantee that tokens created according to this standard will have any particular value or utility. how.

What is ORC 20?

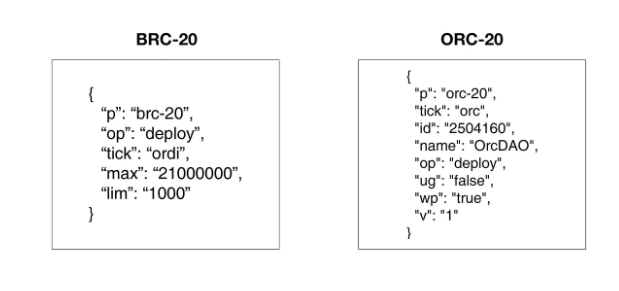

Below is an example of an ORC 20 token deployment with a total supply of 21,000,000 Tokens:

{

“p”: “orc-20”,

“tick”: “orc”,

“id”: “1”,

“op”: “deploy”,

“max”: “21000000”,

“lim”: “10000”

}

How Does ORC 20 Improve BRC 20 Standards?

Disadvantages of BRC 20

Although BRC 20 has paved the way for a new way to apply Tokens on the Bitcoin network, this is a new standard and has many shortcomings.

- When the BRC 20 token was initially deployed, the total supply and maximum number of tokens per mint were fixed and could not be changed. While this can be beneficial in certain situations, it has some disadvantages that limit flexibility in token design.

- Another limitation is that BRC 20 can only identify tokens with 4 characters. This can cause the problem of duplicate names for Tokens, making it difficult for users to distinguish.

-

Ultimately, the transfer and custody of BRC 20 tokens is entirely dependent on off-chain indexers. Since the inscription process itself is simply recording random data and Satoshis, there is no way for the Bitcoin network to prevent Ordinals from violating the BRC 20 standard.

For example: Ordi token has a total supply of 21,000,000 tokens and all 21,000,000 of these tokens have been minted, using the mint function to add Ordi tokens is not valid according to BRC 20 standards but the transaction is still recorded and users need to pay fees on the Bitcoin network. Therefore, determining whether transactions are valid or not depends on centralized indexing tools outside the chain. This can cause some hackers to take advantage and carry out attacks on the above security issue, causing financial loss.

ORC 20 enhancements

The ORC 20 standard builds on Ordinals and the BRC 20 token standard. The main goal of ORC 20 is to improve and promote the adoption of Fungible Tokens on the Bitcoin blockchain. Here are some key improvements that ORC 20 brings to BRC 20:

Differences of BRC 20 and ORC 20

Implement the UTXO model

ORC 20 implements the UTXO model to determine the origin and ownership of Tokens on the Bitcoin blockchain by specifying the amount the recipient will receive and the remaining balance to be sent to the sender in each transaction.

For example: Suppose A sends B $2 USD while B has $1 USD available. This would leave B’s balance at $3 USD with the initial $1 USD and $2 USD received from A. But according to the UTXO model, B’s balance would have two separate UTXOs, one for $1 USD and one for $2 USD . The advantage is that the UTXO can only be used once, essentially preventing the double-spending problem of double transaction costs. ORC 20 adds the concept of UTXO to token transfer, which is the biggest difference compared to BRC 20.

For ORC 20, users can write the above transaction to Satoshi and need an inscription at the end to send the remaining balance back to the sender. Users can also cancel the transaction midway if the final subscription is not fulfilled.

Unlimited naming space

The ORC 20 standard has brought a number of improvements to Token identifiers compared to the limitation of each token to only 4 characters like BRC 20. With ORC 20, users can name names of any written length. in “tick”. As the image above shows, one can see that the generated orc token consists of only 3 letters.

Token identifier

The ORC 20 standard has brought significant improvements over the BRC 20 standard. With ORC 20, users can name tokens without restrictions on naming characters. Additionally, in case there are 2 projects with the same name, BRC 20 needs to go through an off-chain indexing tool to check whether the original token is legitimate or not. In contrast, for ORC 20, tokens of the same name can still be distinguished through the “id” initially set for each token.

Upgradable

The ORC 20 standard introduced the ability to modify the total supply and maximum number of tokens per mint even after the initial implementation. This is done through the “ug” feature, although this can be exploited by the original implementer, it also creates opportunities for new experiments. These tests could include gradually reducing the maximum number of tokens per mint or increasing the number of previously minted tokens to reward community members.

User Accessible Features for ORC 20

The ORC 20 standard provides a range of user features such as:

- Deploy: Users can deploy new ORC 20 tokens or existing ORC 20 tokens.

- Mint: Unlike BRC 20, users can mint additional tokens that apply the ORC 20 standard through a number of predefined events.

- Send: The deposit process for ORC 20 tokens is through two component transactions. For example: A sends 1000 $ORC to recipient B. First, A will write 1000 $ORC to “send inscription” to B’s address. A will then record the remaining balance to his wallet address. A transaction is only complete once the remaining balance is deposited. A will send Satoshi containing the “send inscription” created above to B.

- Cancel: Transactions on ORC 20 tokens can be canceled using the feature “cancel event”.

Transactions that apply the ORC 20 standard are based on the UTXO model, and each transfer requires the sender to specify the amount the recipient will receive and the remaining balance sent to the sender. This approach ensures the safety of each transaction and eliminates high transaction fees.

summary

Since Bitcoin Ordinals was first introduced in January 2023, there have been many improvements and experiments that have been done on the Bitcoin blockchain. This started from BRC 20 and is currently ORC 20 with backward compatibility and improving the weaknesses that BRC 20 was facing. Above is all the information I want to provide about ORC 20, hope everyone has received interesting knowledge.