Almost each of us participating in the Crypto market will have at least once heard someone talk about On-Chain data. So what is On-chain data? How can we take advantage of the advantages it brings? Let’s find out with Weakhand in this article.

Some tools that may be useful for newcomers have been compiled by Weakhand:

- 5 Best On-chain Crypto Tools

- 20 Essential Crypto Websites for Beginners

- Instructions for Using Arkham for On-Chain Analysis

- Instructions for Using DeBank for Beginners

What is On-Chain Data?

Perhaps we all know that the Crypto market will always be associated with Blockchain and this is also the biggest difference if we compare it with the traditional financial market. The difference lies in the fact that Blockchain is very transparent, allowing everyone to check all information happening through On-chain data.

To fully understand all the data that a Blockchain displays, we will probably need a basic knowledge of code from before, but a normal user can also check some types of data. On-chain like:

- Loss datag shouted: Can include the total number of transactions, Gas price, current block number,… of that Blockchain.

- Transaction data: Helps everyone see the sending and receiving wallet addresses, what coins/tokens are sent, how much to send,…

- Interactive data: Are the interactive actions of a wallet address with any protocol or smart contract.

To protect and always maintain the transparency of the Blockchain network, a system consisting of Nodes or Validators will participate in verifying each newly added block. Anyone from anywhere in the world who meets the set conditions can join this network.

On-Chain Application In Practice

Although anyone can access and view all On-Chain data of a Blockchain, the number of skilled users who can provide analysis to make profits from investment is quite small. To make it easier to access, we can divide On-chain data into 2 types as follows:

- Macro On-Chain data.

- Data On-Chain micro.

Macro On-Chain data

The phrase “macro” or “macroeconomics” in traditional financial markets is often used to refer to the overall characteristics and structure of an economy as a whole. On-Chain macro data is quite similar to macroeconomics as this will be the general information of a Blockchain.

There are many different types of macro On-Chain data, but we can list a few commonly used indicators as follows:

- Total Value Locked (TVL): This is an indicator of the total amount of assets locked on a certain Blockchain, it shows whether that platform’s DeFi economy is really healthy or not.

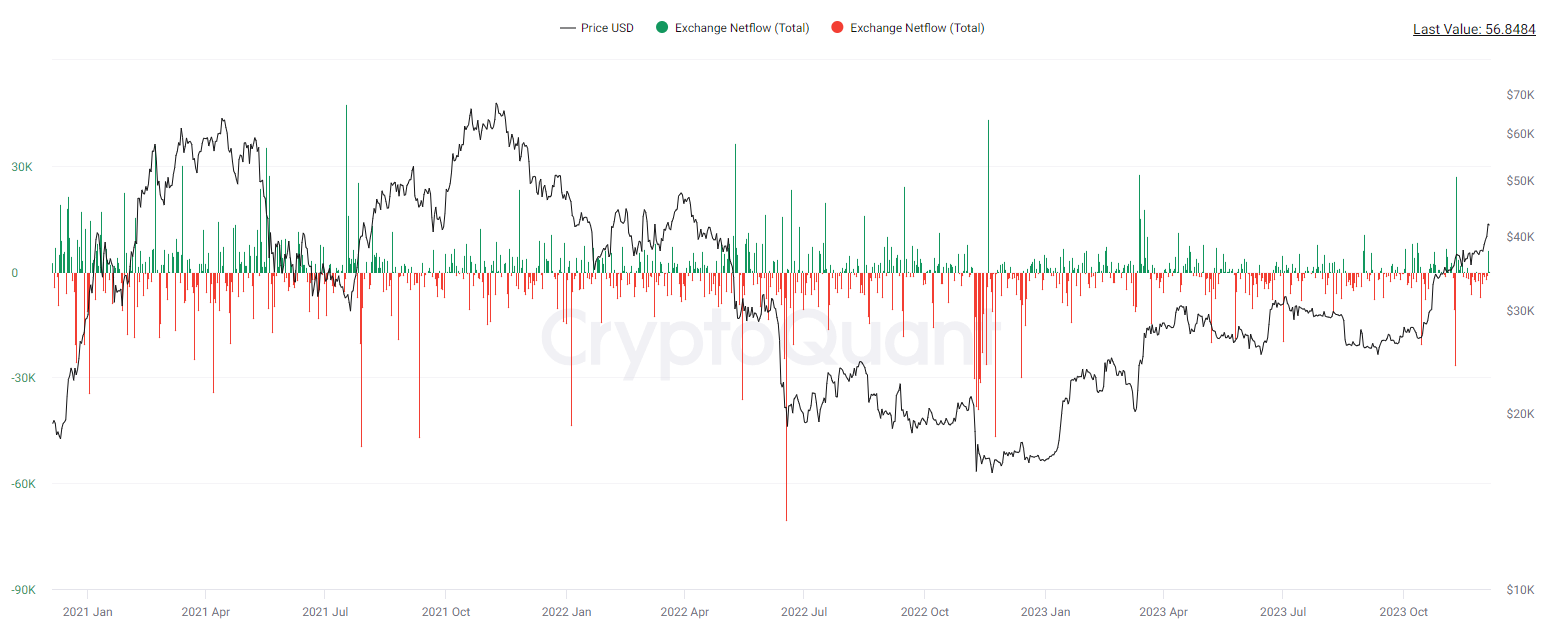

- CEX Netflow: This is an index indicating the deposit and withdrawal volume of users from centralized exchanges, representing the overall supply and demand of the market.

- Miner Flows: This index shows the cash flow of miners as well as the amount of capital they spend to create any coin (usually BTC), thereby telling us their actual profit and loss.

- Stablecoin Flows: This index lets everyone know which Blockchain is receiving stable cash flow or losing stable cash flow.

From that macro On-chain data, we can easily analyze and determine where the Crypto market will go in the near future. Or if we narrow it down a bit, we can find which DeFi ecosystem the money flow is in, thereby easily making profits.

A few platforms that provide macro On-Chain data that people can refer to are:

- The Block.

- Glassnode.

- Crypto Quant.

- CoinGlass.

- Token Terminal.

Micro On-Chain Data

Unlike macroeconomics, microeconomics is the study of individual entities in an economy such as companies, businesses, etc. And micro On-Chain data is similar when The objects we focus on will be individual entities such as whale wallet addresses, investment funds,… or a certain coin/token.

On-Chain data analysis will require people to need certain skills such as:

- Read the origin and destination of a transaction.

- Audit entities through 3rd party data.

- Analyze the interactions of a transaction with smart contracts.

If tested properly, On-Chain micro data can directly help people make investment decisions in a certain project. Some data that is often used by many people is:

- Project revenue: This is the decisive factor that shows whether the project is working really well or not.

- Project products: This is also a factor that shows the actual operating situation of the project.

- Activities of large entities: Large entities here are understood as wallet addresses of whales, investment funds, market makers,… as they hold a large number of tokens and can influence the price.

- The activities of the development team develop: This is also a factor that holds a large number of tokens and can directly impact the price.

How to best apply On-Chain data?

To best use On-Chain data, people can go from general through the macro situation first to be able to determine the upcoming general trend of the market. After forecasting the general situation, we will analyze each individual project in depth to make an investment decision.

Determining the general trend of the market in advance is very important because no matter how good the project people invest in, the macro situation, especially of Bitcoin, can turn bad. pull everything down together.

Notes When Analyzing On-Chain Data

CEX deposit is not for sale and withdrawal is not for purchase

Some misconceptions that people often make when analyzing On-Chain are that when an entity deposits tokens on the exchange, it is for sale, whereas if they just withdraw tokens to their wallets from CEX exchanges, it proves that They just made a buy order.

In fact, the data that CEX exchanges provide is Off-Chain and not many people can know exactly who bought or sold. Therefore, if we keep assuming the same thing as mentioned above, we will likely fall into a trap intentionally set up by someone.

In addition to sending tokens to exchanges to sell, we also have many different uses such as lending, staking, mortgage,… to make profits. On the contrary, tokens withdrawn from the exchange to the wallet can go to other sources besides buying the market, which is borrowing from another asset or buying OTC (does not affect the market price).

On-Chain is hardly suitable for long-term investment

The general On-Chain situation of the market or smaller, continuously fluctuating projects will be very suitable for traders to make the most of capital efficiency. On the contrary, to analyze and invest in a long-term project, we will need some information such as:

- Project development team.

- Project investment fund.

- Tokenomics model.

- Operational model and revenue of the project.

Therefore, analyzing On-Chain data and then making long-term investment decisions is not very reasonable. If anything, we can just use some micro On-Chain data to determine the long-term trend of the entire market.

Summary

Above is the basic information that everyone needs to understand to understand what On-Chain data is as well as how to apply On-Chain data to the investment process effectively. Hopefully through this article everyone has found useful information for the market research process.