What is Notional Finance? Notion Finance is a fixed-rate borrowing and lending protocol on Ethereum. With a simple and effective operating mechanism as well as being very user-friendly, eliminating the difference between CeFi and DeFi. So what is Notional Finance? Let’s find out in this article!

You can read more about AAVE here, which is the leading Lending Borrow project to find out the difference between fixed and non-fixed interest rates.

What is Notional Finance?

Notional Finance is a fixed-rate borrowing and lending protocol on Ethereum. Works based on a tool called fCash. Because it is a fixed interest rate, there is a term attached, but assets withdrawn before the term will not be penalized.

On Notional Finance, 4 asset types used are DAI, USDC, ETH, WBTC.

Some concepts to understand:

- fCash: Is a token that represents negative and positive cash flows at a point in the future. It is created in pairs (assets and liabilities) that can be transferred, and its high flexibility expands the design space for DeFi on Ethereum.

- cToken: Is an interest-earning asset native to Compound, used in Notional to increase profits for liquidity providers.

- nToken: Is a tokenized asset following the ERC-20 standard that can be exchanged for a portion of Notional’s total liquidity. This is the main way users provide liquidity on Notional. nToken represents the asset that provides liquidity in the Perpetual Pool.

Mechanism of Action

Loan liquidation mechanism

Each type of asset will have a different mortgage level. When the value of the collateral falls below the specified level, it will be liquidated. For example:

- The borrower deposits 1 ETH as collateral at an ETH/USDC exchange rate of 4,000.

- The borrower then borrows 2,000 USDC. The collateral ratio is now 200% because the value of their collateral is double the value of the debt. The liquidation price is 2,900 because at that price, their collateral would be worth 145% of their debt. (ETH liquidation level at 145%)

- ETH/USDC exchange rate drops to 2,800. Their collateral ratio is currently 140% and they are eligible for liquidation.

- The liquidator buys 40% of the borrower’s ETH at an 8% discount from the ETH price at the time and places USDC in their account.

In this example, the liquidator would buy approximately 0.4 ETH for approximately 1,037 USDC. This leaves the borrower with collateral of 0.6 ETH, outstanding debt of 963 USDC, and a collateral ratio of approximately 175%.

Expire

When the maturity date on Notinal comes, the borrower needs to pay off the debt to get collateral or can continue to extend the debt. The lender can withdraw its assets or lend for a new term.

Exchange rate

fCash transactions are based on exchange rates calculated from cToken and fCash. This exchange rate takes into account current interest rates, slippages, fees, and maturity times to determine the ratio between fCash and cToken. Exchange rates can change over time and are directly affected by interest rates.

Participating components

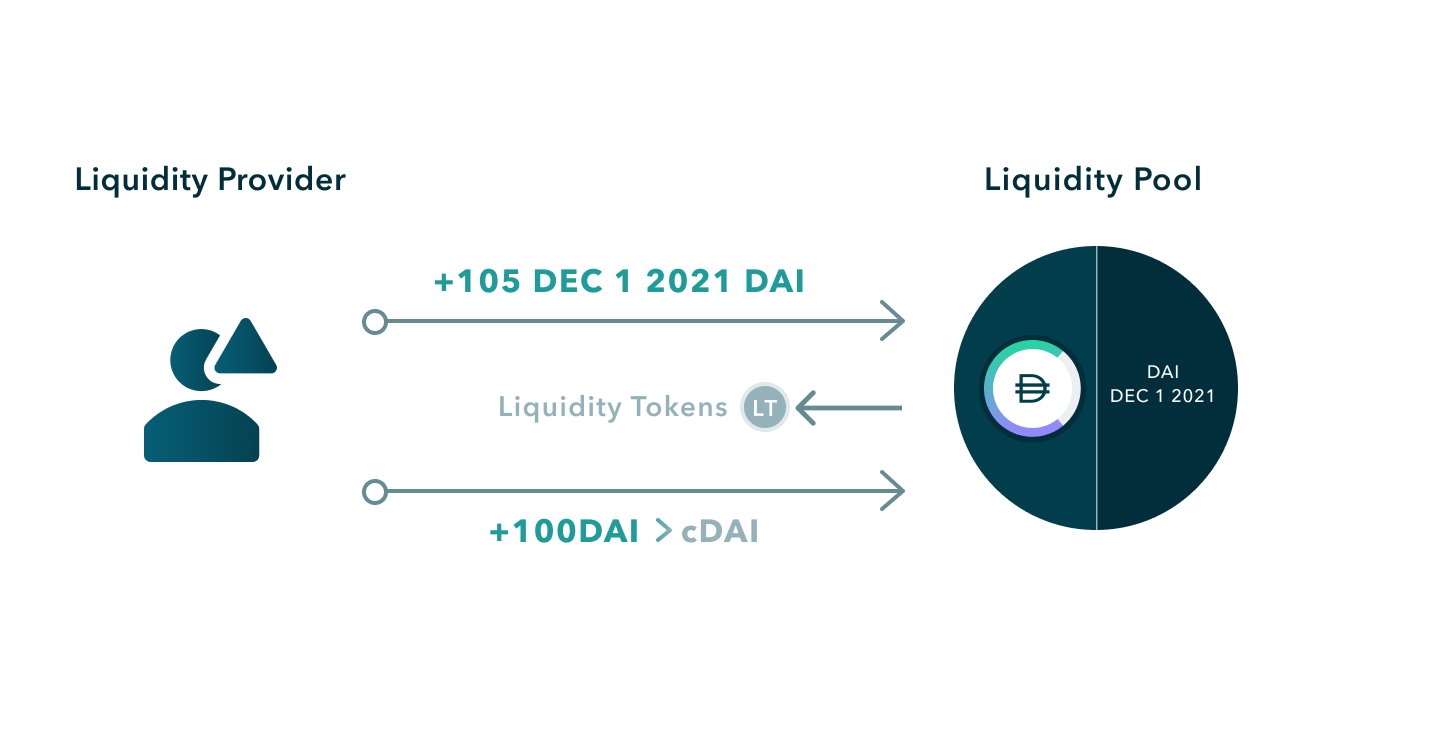

Liquidity providers: Liquidity providers provide cToken and fCash assets into an AMM-integrated Liquidity Pool to earn transaction fees.

Lender: Lenders must convert their assets into cTokens, then deposit cTokens into the liquidity pool to receive fCash at a rate that includes interest at maturity. To understand better, let’s look at the example below.

Example: A lender wants to lend 100 DAI on Notional at a fixed interest rate for one year. The lender first converts their 100 DAI to cDAI, then deposits that cDAI into the liquidity pool in exchange for 105 fDAI. When the loan matures on December 1, 2021, lenders can exchange their 105 fDAI for cDAI, then convert that cDai into 105 DAI.

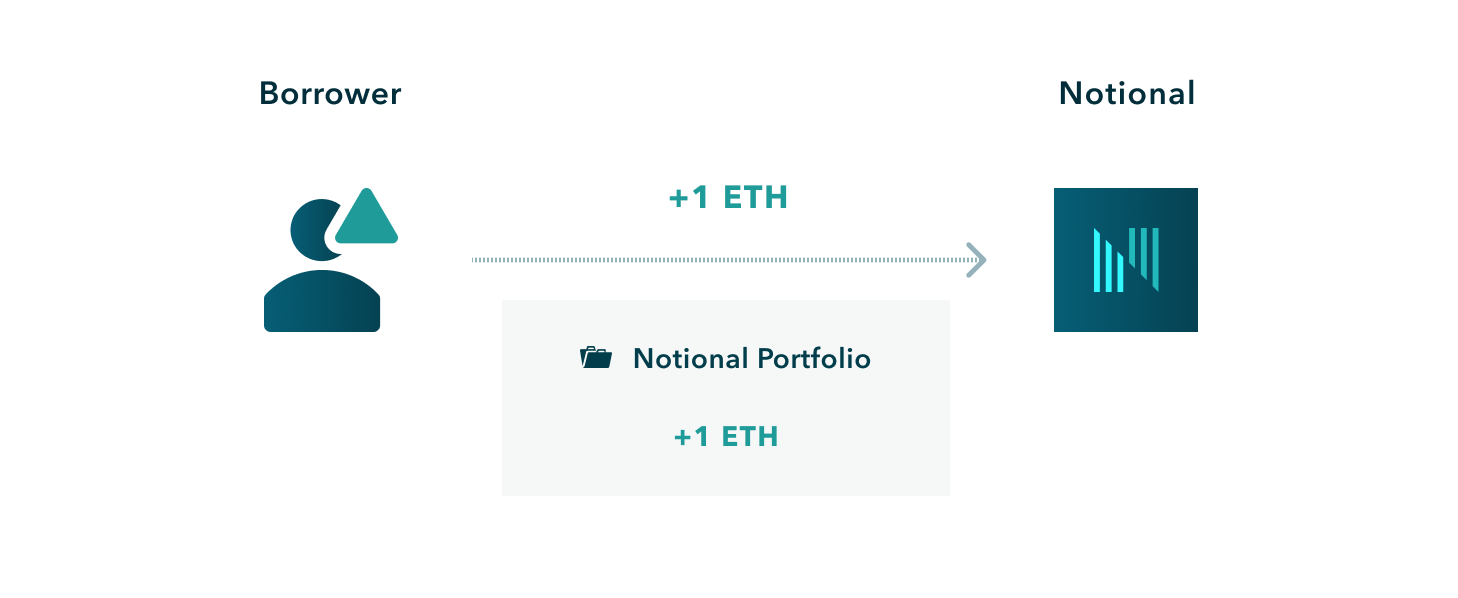

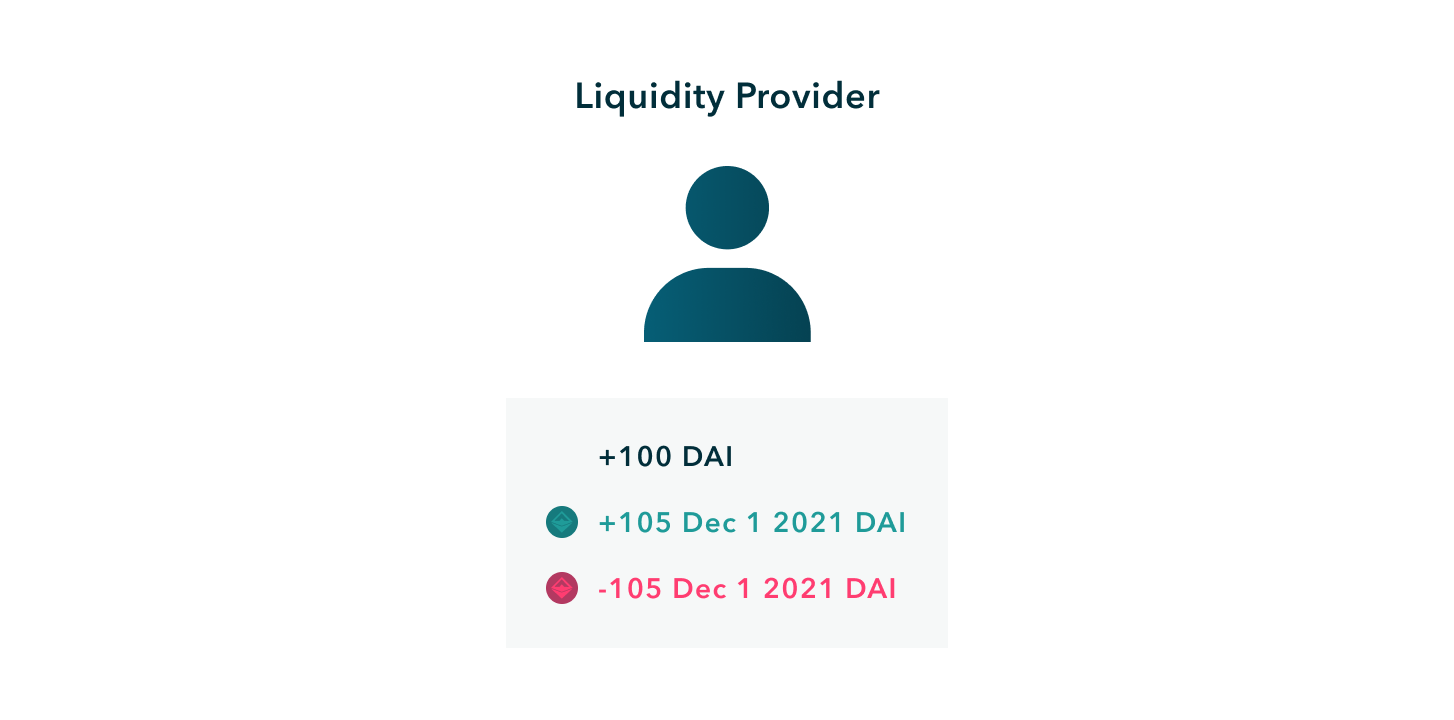

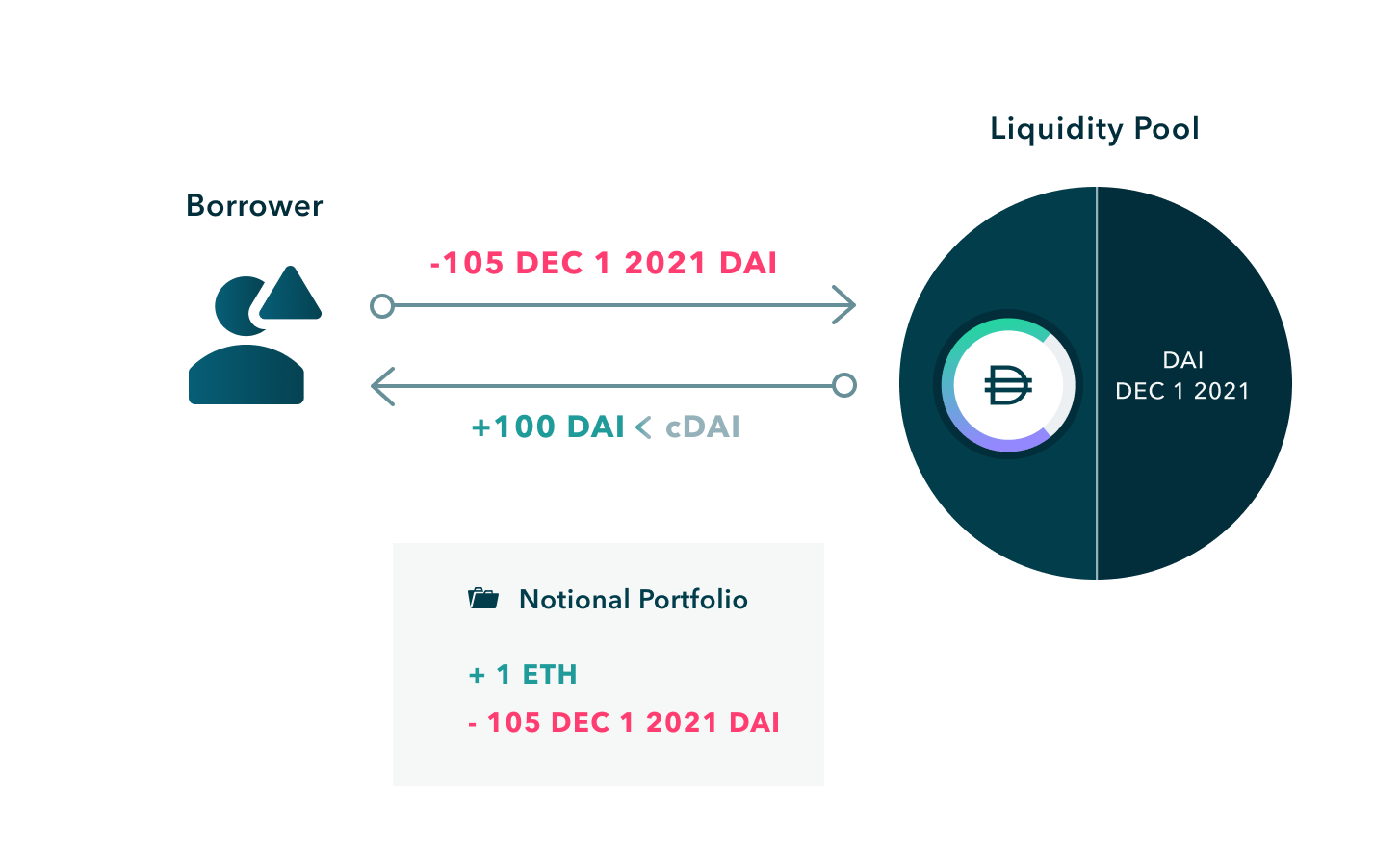

Borrower: Borrowers will deposit assets into a portfolio on Notional to mint fCash. Then sell positive fCash in the liquidity pool in exchange for assets. At maturity, the borrower must buy back positive fCash and then use fCash to get the property back as collateral.

For example: Borrower uses 1 ETH as collateral to borrow 105 DAI.

The borrower first deposits his ETH into a portfolio on Notional.

The borrower then mints a pair of fDAI tokens with the chosen maturity date.

Then sell positive fDAI for cDAI but at a rate that includes the loan interest rate at maturity. To have DAI, the borrower must change from cDAI to .

Right now, borrowers with 100 DAI can withdraw directly and are obligated to pay 105 DAI on the maturity date with a collateral of 1 ETH.

Core Team

- Teddy Woodward (Co-Founder | CEO): Interest rate swap trader at investment bank Barclays and cryptocurrency trader at Ayanda Capital.

- Jeff Wu (Co-Founder | CTO): Data engineering lead at Atlassian and blockchain product manager at Splunk.

- Cameron Schorg (Head of Business Development): Founder at BitBrothers LLC, first employee at ShapeShift, strategic partnership lead at Dish Wireless Blockchain, and Ethereum ICO participant.

- Kyle Long (Head of Marketing): Entrepreneur, writer and co-founder of culinary travel brand UnTour.

- Michael Burkett (Head of Design): Co-founder of Accomplice Design, a product design studio in San Francisco specializing in Blockchain and Fintech.

Investor

- October 26, 2020: Notional Finance successfully raised $1.3M in Seed round with the participation of Polychain, Coinbase Venture and 1confirmation.

- April 29, 2021: At the Series A round, the project continued to successfully raise an amount of up to $10M led by Pantera Capital along with Parafi, 1Confirmation, Spartan, Nascent and Nima Capital.

Tokenomics

General information about the token + Project name

- Token name: Notional Finance

- Code: NOTE

- Blockchain: Ethereum

- Token classification: ERC-20

- Contract: 0xcfeaead4947f0705a14ec42ac3d44129e1ef3ed5

- Total supply: 100,000,000

- Maximum supply: 100,000,000

Token Allocation and Token Release

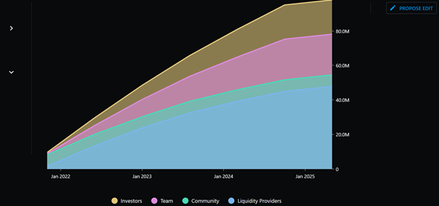

- Founders and Team – 20 million Tokens paid over 3 years (20% of total supply).

- Future Team – 3.5 million paid over 3 years (3.5% of total supply).

- Early Investors – 19.8 million tokens with payout over 3 years (~19.8% of total supply).

- Development Grants and Community Building – 6.6 million tokens (6.6% of total supply).

- Liquidity Incentives – 50 million tokens (50% of total supply). 20,000,000 NOTE for the first year, 15,000,000 NOTE for the second year, 10,000,000 NOTE for the third year and 5,000,000 NOTE for the fourth year.

Token Use Case

NOTE tokens are staked on the protocol to share transaction fees and participate in governance on Notional Finance.

Exchanges

NOTE tokens are traded on Coinex and Balancer exchanges.

Notional Finance’s Information Channel

- Website: https://www.notional.finance/

- Twitter: https://twitter.com/NotionalFinance

- Discord: https://discord.gg/UNawHBQxw6

- Telegram:

summary

Fixed interest rates are important in traditional finance, and DeFi is no exception. But in DeFi, we still haven’t found a prominent name in the fixed interest rate segment. So the opportunity is still there for Notional Finance.

So, I have answered the question What is Notional Finance? Hope this article brings you a lot of useful knowledge.