What is Neutra Finance? Neutra Finance is a platform that helps people participate in high-profit Farming. Built on Arbitrum and also offers many strategies for users to choose from. Each strategy will suit each investor’s taste.

So what is Neutra Finance? Let’s find out in this article!

What is Neutra Finance?

Neutra Finance provides strategies for investors seeking high returns and taking risks. Developed on Arbitrum, the main Farm strategy is still built around Arbitrum and GMX.

Market-neutral strategies aim to protect users’ assets while providing high returns. And not affected whether the market goes up or down. This is done by offsetting losses due to price fluctuations or loss of assets when Farming. Although these strategies generate profits, they can be very complex and often involve costs and risks involved.

Core values of the project:

- Effective: Deliver sustainable, high-yield strategies that minimize risk while optimizing returns.

- Security: Focus on smart contract security and rebalancing mechanism.

- User experience: Providing strategies in an intuitive and user-friendly manner, lowering the barrier for general cryptocurrency investors.

Mechanism of Action

Strategies that Neutral Finance offers

1. Vault GLP

GLP is the liquidity token of GMX, the hottest Perpetual exchange on Arbitrum. This protocol is recognized as one of the most powerful and successful projects in DeFi, providing an attractive revenue stream in the form of real profits to the community through the GLP liquidity provider token.

The GLP pool is a multi-asset pool consisting of approximately 50% stablecoins and 50% (ETH and BTC). When providing liquidity, users will receive GLP tokens along with protocol fees. What’s even better is that LPs are automatically protected from temporary losses, as GMX’s pricing mechanism uses external centralized exchanges’ prices updated from Oracle instead of the traditional AMM model.

However, the price of GLP will fluctuate according to the value of the assets in the Pool because it is a Token that represents assets. Therefore, Neutra Finance has launched a strategy to help investors or users earn profits but are not affected by market price fluctuations.

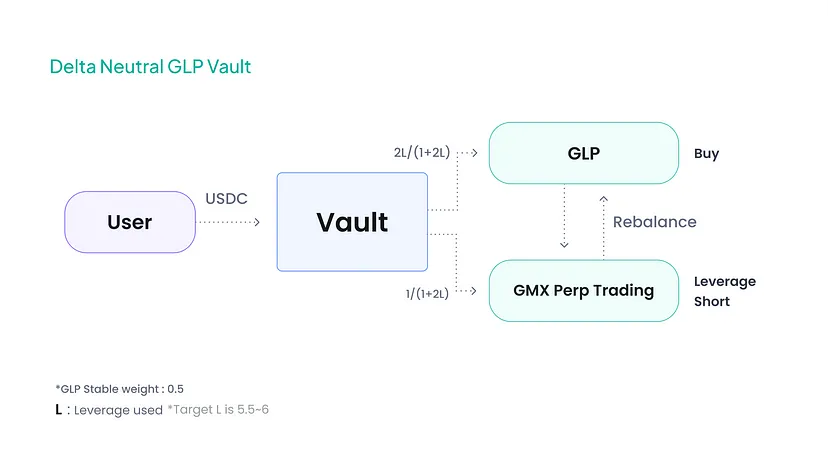

This strategy is called GLP Market Neutral Vault. Neutra opens a Vault for users to deposit assets into. The assets are then divided into 2 parts, 1 part sent to provide liquidity on GMX to earn profits from the protocol. But to avoid being affected by price fluctuations, the remaining assets will be used to open Short ETH and BTC orders. There will be 2 cases as follows:

- In case the asset price decreases: At this time, the user’s GLP price also decreases, but this discount is offset by the profit on the Short order.

- In case the asset price increases: The GLP asset will increase in price but the user will not receive that profit due to covering the loss on the Short order. This creates the risk of liquidating Short orders when asset prices increase sharply.

This strategy, aims to generate net profit from GMX for users. But it has many risks such as Short order liquidation and smart contract risks. This is also the main strategy working on Neutra Finance.

2. SushiSwap Vault

If you have ever provided liquidity on Sushiswap or any DEX that uses an AMM model. You will notice that temporary losses always occur whenever there is a fluctuation in price, the stronger the fluctuation, the greater the loss.

To avoid losses when Farming, Neutra Finance has come up with a strategy to help users earn net profits. That strategy is called SushiSwap Market Neutral Vault.

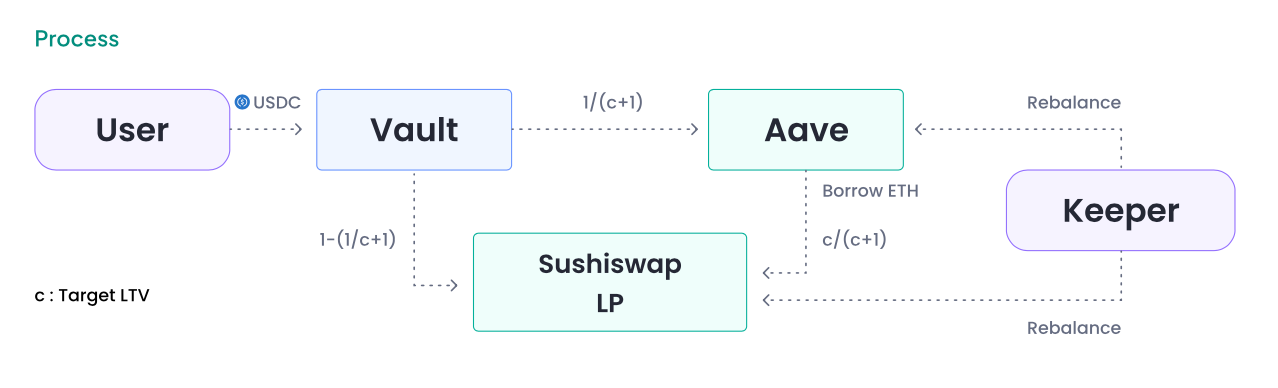

This strategy works like this: Neutra opens a Vault for users to deposit assets into. Then the property will also be divided into 2 parts. A part is converted into ETH and USDC (50:50) to take to the ETH/USDC pair liquidity farm on Shushiswap. The remainder is mortgaged to Aave to borrow ETH in accordance with the liquid ETH Farm volume. Then sell the borrowed ETH to Stablecoin. And there will be 2 cases that happen after the Farm is finished and assets are withdrawn:

- In case the ETH price decreases compared to the Farm starting price: In this case, we will lose the value of ETH assets while Farming. But thanks to the amount of Stablecoin obtained after selling the borrowed ETH, I was able to buy back the originally borrowed amount of ETH to pay Aave to withdraw the collateral. Then there is a surplus amount of Stablecoin to compensate for the loss caused by the Farm.

- In case the ETH price increases compared to the Farm starting price: In this case, the user will not enjoy the profit portion of the ETH price. Because the amount of Stablecoin to buy back ETH trae for Aave is not enough, it must be compensated by the price increase of ETH Farm on Shushi. But the risk that arises is that the loan is liquidated.

This strategy still brings net profit to users when Farming. But still face the risk of loan liquidation and Smart Contract risk. And this strategy is not yet operational on Neutra Finance.

3. Uniswap V3 Vault

This strategy is called Uniswap V3 Market Neutral Strategy Vault. It’s still a plan, no information yet.

Development Roadmap

Phase 0 (Q4 2022)

- review

- Open community

- OG recruitment

- Open the website

- Launching a partnership

Phase 1 (Q1,2 2023)

- Complete audit

- Launch token

- Public sale of tokens

- Launched on Arbitrum mainnet

- Token listing

- GLP Vault (nGLP Vault)

- 1x Automatic Bull Vaults (Coming Soon)

- Sushiswap Market Neutral Vault (Coming Soon)

- Start developing Uniswap V3 Strategy Vault

- Major UI/UX updates

- Expand partnerships using Vault tokens

Phase 2 (Q2,3 2023)

- More advanced strategic vault integration

- Uniswap V3 Automated Liquidity Manager (Coming Soon)

- Uniswap V3 Market Neutral Strategy Vault (Coming Soon)

- Prepare for multi-chain scaling

Core Team

Updating…

Investors

Updating…

Tokenomics

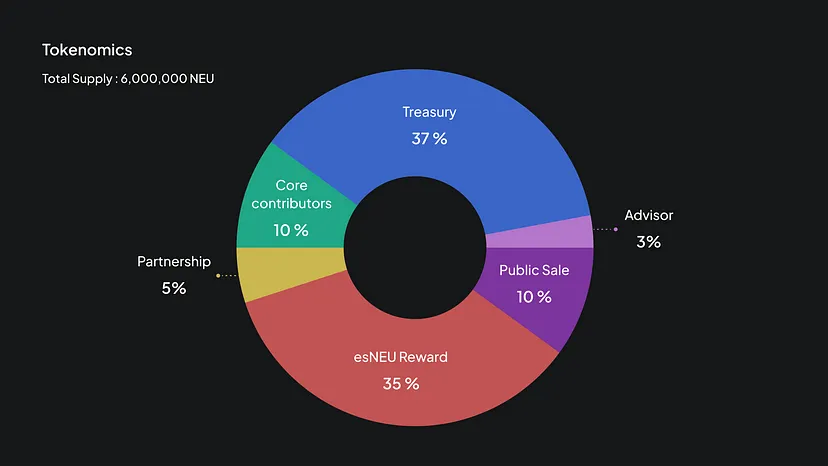

esNEU Tokens are distributed to NEU token stakers and strategy participants. It non-transferable and can be used in two ways: staking to receive rewards and fees such as NEU, which is exchanged to NEU after 12 months of waiting.

Overview information about Neutra Finance Token

- Token Name: Neutra Finance

- Ticker: NEU

- Blockchain: Arbitrum

- Standard: ERC-20

- Contract: 0xda51015b73ce11f77a115bb1b8a7049e02ddecf0

- Total supply: 6,000,000

- Maximum supply: 6,000,000

Token Allocation and Token Release

- 10% Public: Of the public allocation, 40% will be used to create POL for NEU, 30% will be distributed to core contributors, and 30% will be allocated to the treasury.

- 35% esNEU reward: esNEU rewards are earned by staking $NEU. This reward helps encourage active participation and supports the long-term growth of Neutra Finance. Emissions will be capped annually at 2% of total $NEU supply and are subject to change.

- 3% Advisor: This allocation will be used to reward advisors for their contributions and will be paid out over 36 months.

- 37% Treasury: Fund allocation will be used for POL, marketing, future audits, community rewards, and operations.

- 10% Core contributors: This will be allocated to the core team and contributors to Neutra Finance and will be paid in installments over 24 months.

- 5% Partnership: This allocation will be used to establish strategic partnerships and collaborations that benefit the Neutra Finance ecosystem and will amortize over 36 months.

Token Use Case

The utility of NEU Token is protocol governance and staking to enjoy protocol fees.

Exchanges

NEU tokens are traded on the Camelot decentralized exchange.

Information Channel of

- Website: https://neutra.finance/

- Twitter: https://twitter.com/Neutrafinance

- Medium: https://discord.gg/VS6A4e5sns

- Discord:

Summary

Neutra Finance offers strategies that help users make high profits. But along with that come risks. These forms are being popularized on Arbitrum and also support GMX.

So I have clarified what Neutra Finance is? Hope this article brings you a lot of useful knowledge!