Morpho Labs is the organization that develops the Morpho project, also known as Morpho Optimizer, which works on Compound and Aave to improve the efficiency of their interest rate model. But the development team realized many limitations of this product, so they decided to develop a new product called Morpho Blue.

So what is Morpho Blue? Let’s find out in this article!

To understand more about Morpho, you can read the articles below:

- What is Morpho Labs (MORPHO)? Morpho Labs Cryptocurrency Overview

- Mechanism of Action of Morpho (MORPHO)

- Morpho Labs – Potential Next Generation Lending & Borrowing Platform

Morpho Blue Overview

The reason Morpho Blue was born

Morpho Labs, an organization that has raised more than $19 million from large investment funds such as A16z, Variant Fund,… to develop products in the currency market, also known as Lending Market. Morpho Labs develops its first product called Morpho Optimizer, a Lending Market built on Compound and Aave’s liquidity.

Morpho Optimizer is essentially a Peer-to-Peer money market and combines with Aave and Compound’s Peer-to-Pool market to bring the most optimal interest rates to participating parties. Combining these two models helps borrowers and borrowers find each other on Morpho for Peer-to-Peer matching. When the two parties match, they will be charged the average interest rate between the loan interest rate and the loan interest rate on Compound or Aave.

Thanks to Aave and Compound’s underlying liquidity pools, user liquidity is always available and not locked. If the borrower or lender cannot find each other, the order will be transferred to Aave and Compound’s Pool for execution. When finding liquidity to match Peer-to-Peer on Morpho, the project will withdraw liquidity from the Pool to match. Or during the process of matching orders between two parties, if one party wants to cancel the order, the other party’s order will be transferred to the liquidity pool of Aave or Compound below.

Although I quite appreciate this product because it combines the advantages of both Peer-to-Peer and Peer-to-Pool models, providing optimal interest rates for both parties involved and instant liquidity. not locked. But no technology is perfect. Morpho Optimizer has product limitations that depend on the underlying liquidity layer, liquidity fragmentation due to the use of many versions such as Aave V2, Coumpound V2, Aave V3 and high fees. due to making many calls.

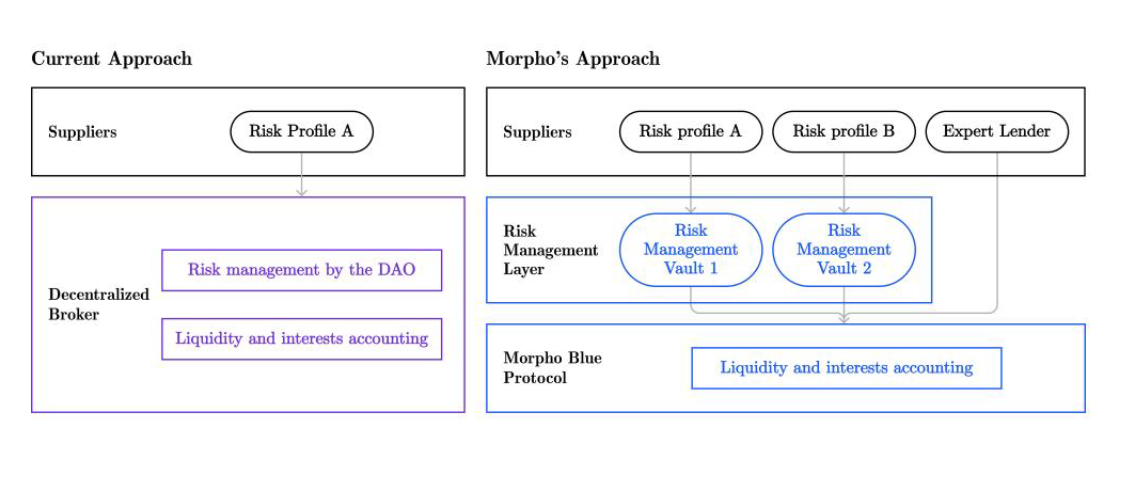

In particular, a big problem that other lending protocols have not been able to solve is the limitation of DAO. DAO decides all market parameters, recommends that it is not suitable for many types of users, and reacts slowly compared to the market.

With the initial orientation of the Morpho Labs team, it will develop original products for the Crypto currency market. Therefore, Morpho Labs has planned and developed a product called Morpho Blue, which is expected to become the center of the Crypto market.

What is Morpho Blue?

Morpho Blue is the original Lending Market developed by Morpho Labs, this product is independent from Morpho Optimizer. Morpho Blue offers a scalable native currency market unmatched in DeFi. This gives it the potential to become the center of the Lending Market.

As said above Morpho Blue is an angular DeFi protocol on Ethereum for most asset types accepted in DeFi. The protocol is also intended to become the base layer for other Lending-related projects or products.

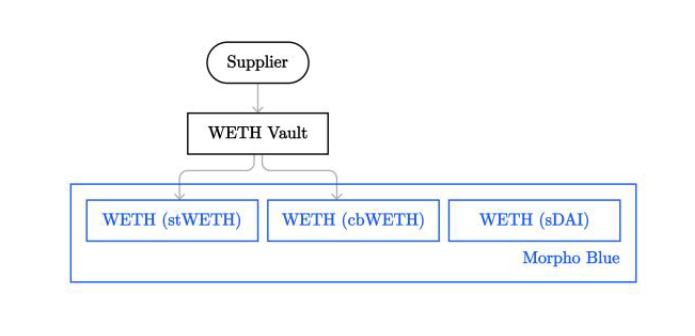

Morpho Blue allows anyone to launch a private and isolated lending marketplace by specifying one loan asset, one collateral, liquidation LTV (LLTV), and one oracle. This protocol is completely decentralized and designed to be more efficient and flexible than any other decentralized lending platform.

The Lending Pools created will be set by the creator with their own parameters and assets. These Pools are created on a single Smart Contract, i.e. 1 Smart Contract containing all the Pools like Uniswap V4 to bring the necessary simplicity, about 70% cheaper fees compared to other protocols, the ability to becomes the base liquidity layer for the applications above.

Creating a free loan market helps bring diversity of products and assets with different levels of risk. This makes the lending market more flexible and responsive. In particular, the protocol is created with only 650 lines of code in Solidity language, maximum simplicity eliminates security-related risks.

Morpho Blue provides fast, fee-free loans to liquidators, allowing them to borrow and repay in the same block on the Blockchain. This will attract liquidators to participate in monitoring and liquidating the position to receive collateral for a small profit.

Developers or projects can build general lending marketplaces like Aave or Compound using Morpho Blue Pools. Or you can build products to manage risks on Morpho Blue,…

DAO (Morpho Governance) is decided by MORPHO token holders who manage the Morpho association (Morpho Association). Therefore, DAO is the owner of Morpho Blue and Morpho Optimizer. For Morpho Blue, the DAO will not manage the asset pools, especially the DAO will have the right to collect protocol fees on the pools or asset types.

Morpho Blue’s code is released under the Business Source 1.1 license under the name of the non-profit Morpho Association but controlled by Morpho Governance, consisting of MORPHO token holders. It is important to note that the license will convert to GPL after two years or if protocol fee migration is enabled.

Structure

Compared to conventional lending protocols, Morpho Blue separates the risk management layer from the protocol. That is, risk parameters will not be decided or managed by the protocol and other components can easily participate in monitoring the borrower’s position in each Pool. This allows Pools to operate independently and easily react to fluctuating market conditions.

Highlights

- Invariant: Morpho Blue cannot be upgraded. The protocol will run and function the same way forever.

- Minimize administration: Morpho Administration cannot suspend market operations or manage funds on behalf of users nor impose specific Oracle implementations. Instead, risk management is delegated to external components or upper layers.

- Simple: The protocol consists of only 650 lines of Solidity code. This simplicity makes it especially easy to understand and safe.

Limit

I often talk about how any technology or model has its own advantages and disadvantages. Morpho is no exception, hThe biggest limitation of the protocol is the problem of liquidity fragmentation. Allowing the creation of Pools with separate parameters causes liquidity to be divided. Not only is each asset group a separate Pool, but each different parameter also creates separate Pools. This is the point that the Aave or Compound model overcomes with a common Pool for all assets.

Another problem is that creating many Pools with many different parameters will be difficult for new users to access. Especially the complex product interface will be a huge barrier, it can only be used by long-time DeFi users.

Personal Projection

Morpho Blue is a product that brings newness to the Lending market with infinite scalability. Morpho Blue also focuses on solving the problem of DAO’s slow response as well as DAO managing all risk parameters.

But through that, the development team determined to trade off liquidity fragmentation. Their vision is a Crypto market that is more vibrant and flexible than ever. On the other hand, projects built on the basis of Morpho Blue can group Pools to reduce liquidity fragmentation.

As for the complexity of the product, it can also be solved with the layers above. Morpho Blue’s orientation is to become the base layer and center of the Lending Market in the future. I also appreciate this vision. When the community has determined that the Lending market will no longer be able to develop, Morpho Blue will bring a breath of fresh air.

Summary

Morpho Blue will be the product the market needs now and in the future. Becoming the base layer of the Lending market, something that not many projects have focused on developing before. With this development, Morpho Blue can also become a Layer 2 or Layer 3 in the future to develop its own application chain and use Cross-chain technology to connect with other blockchains.

So, I have clarified what Morpho Blue is? Hope this article gives you an in-depth perspective on this new product.