What is Mole? Mole is a platform that optimizes profits for users with products such as Lending, Yield Farming,… The project is developed on the Aptos ecosystem. So what makes Mole stand out? How will the profit-making mechanism work? Let’s find out below in this article!

To understand more about Mole, you can read the articles below:

- What is Yield Farming? Make Profits As People Become “Farmers” In DeFi

- What is DeFi? All About DeFi

- What is Lending & Borrowing? The Essential Borrowing and Lending Puzzle in DeFi

What is Mole?

Overview of Mole

Mole is a DeFi platform on the Aptos ecosystem. The project brings users products to help users optimize profits. Mole provides users with safe investment products with different levels of risk, including products such as Savings, Leveraged Yield Farming, Funds.

Mechanism of action

The products available on Mole are:

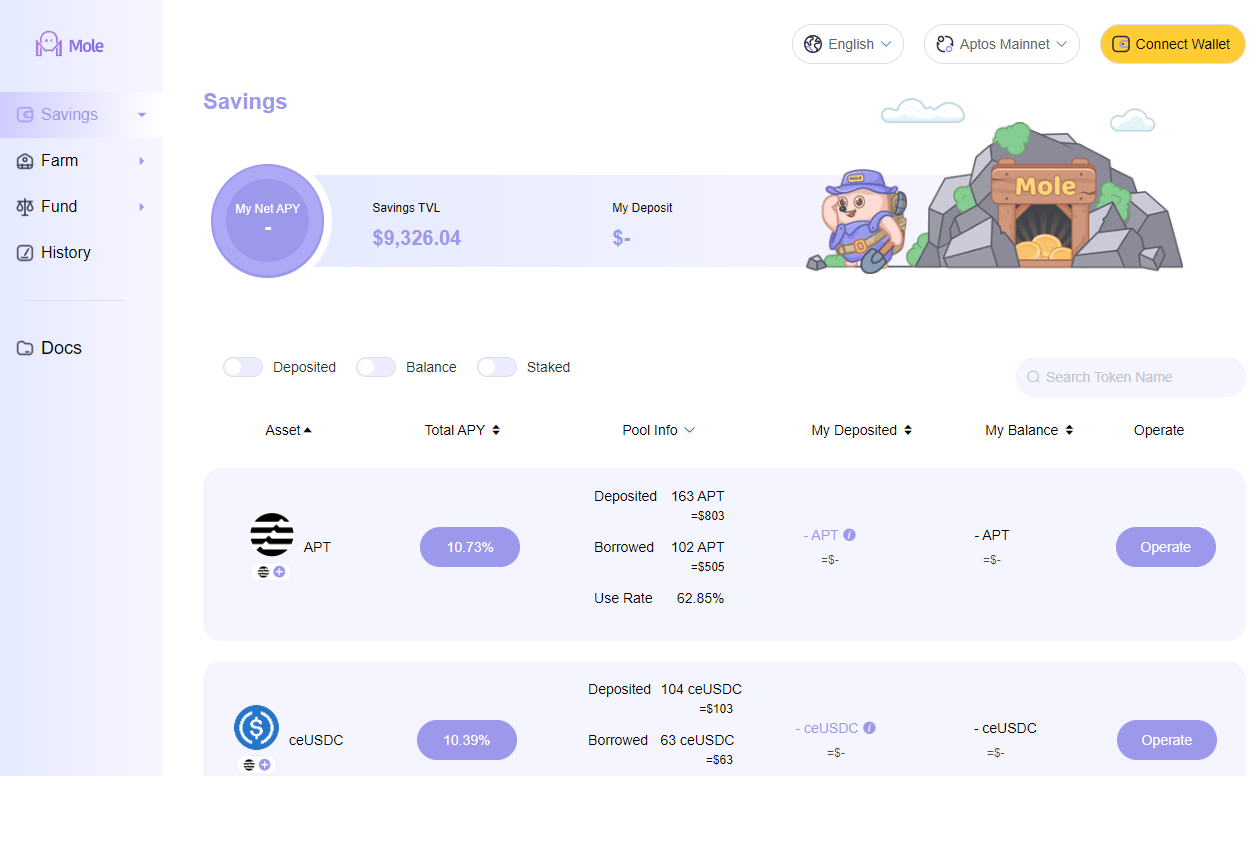

1. Savings

Savings provides users with a stable source of income. Users deposit idle assets into the platform to earn rewards. When depositing savings, users will receive 2 types of rewards:

- Savings deposit bonus: When depositing money, users will receive interest on the deposit. This interest is compound interest.

- Stake Rewards: Here users stake their savings certificates on the platform, called mToken. When using mToken to stake, users will receive additional rewards.

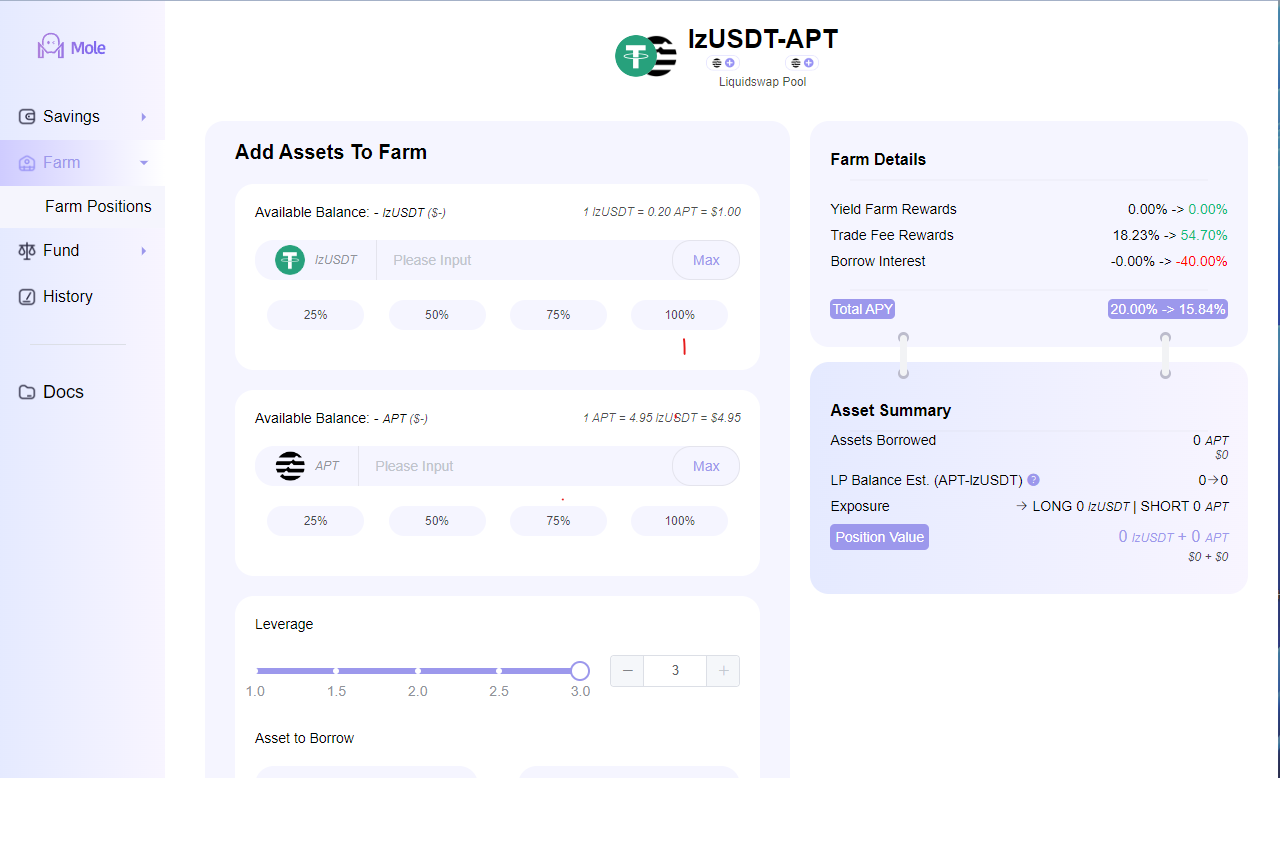

2. Leveraged Yield Farming

Leveraged yield farming will give users more options to make profits in this volatile market. Leveraged profit farming will make the most of savings and leverage to increase users’ investment efficiency.

The profit source of Mole’s Leveraged Farm is divided into the following sources:

- Yield Farm: Users will take their own farm tokens as collateral and borrow money in leveraged savings products. Then take the collateral plus leverage to provide liquidity on DEXs, and these DEXs will also reward liquidity providers.

- Rewards from transaction fees: When users farm on the platform, the platform will send that portion of assets to create liquidity on DEXs to receive rewards and can receive additional transaction fee rewards for the given DEX .

- Rewards from Mole: When users farm leverage at the platform, they will also profit.

- Loan interest rate: When users borrow from a savings group, they need to pay an interest amount. If you can take advantage of the loan and have a good strategy, the total profit of the above 3 items is greater than the interest rate, so the user will have a little more profit.

In the platform’s leverage farm, in addition to the above rewards, users can also rely on the ups and downs of the market to go Long – Short. Long – Short on the platform will bring huge profits to users but the risks are also extremely large so users need to consider.

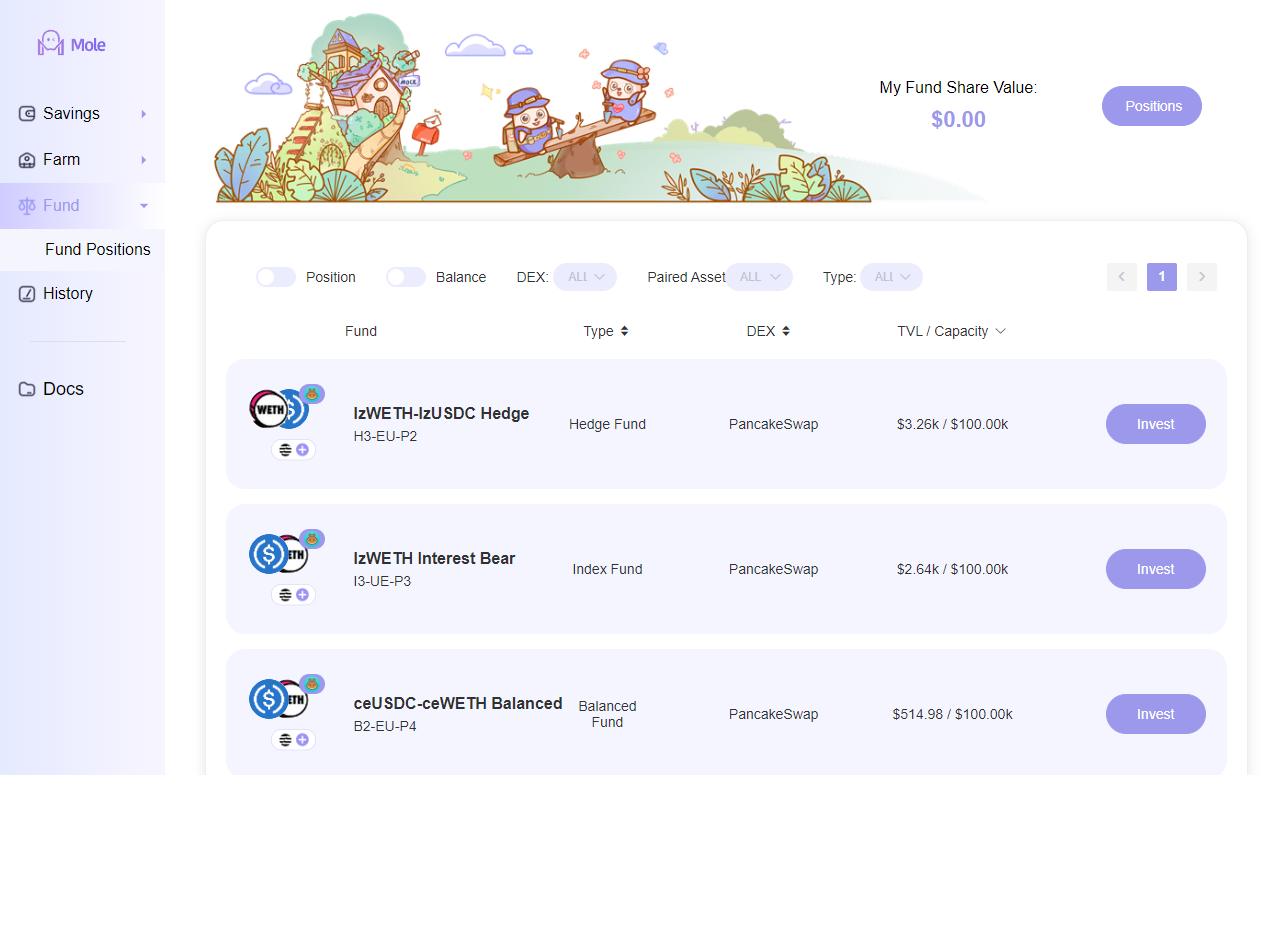

3. Funds

This product helps users make profits. There will be 5 types of funds for users to choose from:

- Bond fund: Bond fund is developed based on a dual stable token trading pair in a leveraged farm.

- Balanced Fund: Balanced Fund opens up for users a farming position with equity and balance of debt. Avoid market risks and get a stable income.

- Hedge Fund: Hedge Fund opens up long-term farming options for users and automatically adjusts options according to market fluctuations, to avoid risks.

- Trend Fund: This fund will invest according to the trend, borrowing assets to Long. This option is very risky but the profits are extremely large.

- Index Fund: The nature of this fund is to aggregate the exposure of two farm positions, so that the net exposure is 1x Long.

Development Roadmap

The project’s development roadmap this year will be divided into two phases:

Quarter 3 – 2023

- Out feature Portfolio on the platform.

- Community development.

- Feature development Smart Vaults Liquidity.

Quarter 4 – 2023

- Introducing administration features.

- Launching project token.

- Develop relationships with major partners.

Investor

Update, ..

Core Team

Update, ..

Tokenomics

The project currently has no token issuance, the project is planning to list by the end of this year.

Project Information Channel

- Website: https://mole.fi/

- Twitter: https://twitter.com/moledefi

- Discord: https://discord.com/invite/JfgJzJ8kkK

- Telegram:

Summary

Above is information about the Mole project that the Weakhand team learned. The project is waiting for the market to improve to launch the token. However, there is no information about the investment fund and development team, so you need to pay attention. Hope the above information can help you in your project research process.