What is Meteora? Meteora is a platform built with a variety of different products with the goal of promoting TVL of the Solana ecosystem. Recently, Meteora has begun to attract a large amount of interest from the Solana community. So what’s special about Meteora? Let’s find out together in the article below.

Meteora Overview

History of Meteora

Meteora was originally Mercurial – a leading DEX in the Solana ecosystem with the ambition of becoming a liquidity center for Stablecoins and stable, parity assets such as mSOL, stSOL, jitoSOL,… However, after the collapse pour of FTX and Alameda Research, the development team started a new journey Meteora Plan.

If you don’t know, the old Mercurial development team and the current Meteora development team are the same development team. Jupiter Exchange – Famous DEX Aggregator on the Solana ecosystem.

What is Meteora?

Meteora is an ecosystem of many different products built on Solana to take advantage of fast transaction speeds and low fees including:

- Vaults: Product similar to Yield Aggregator where user funds in the Vault will be sent by the protocol to Lending Protocol platforms to earn profits.

- Pools: A place to aggregate liquidity pools with attractive APY on Solana.

- DLMM: AMM with centralized liquidity based on Trader Joe’s Liquidity Book.

- Farm: This is where users can stake LP Tokens of AMMs to earn additional rewards.

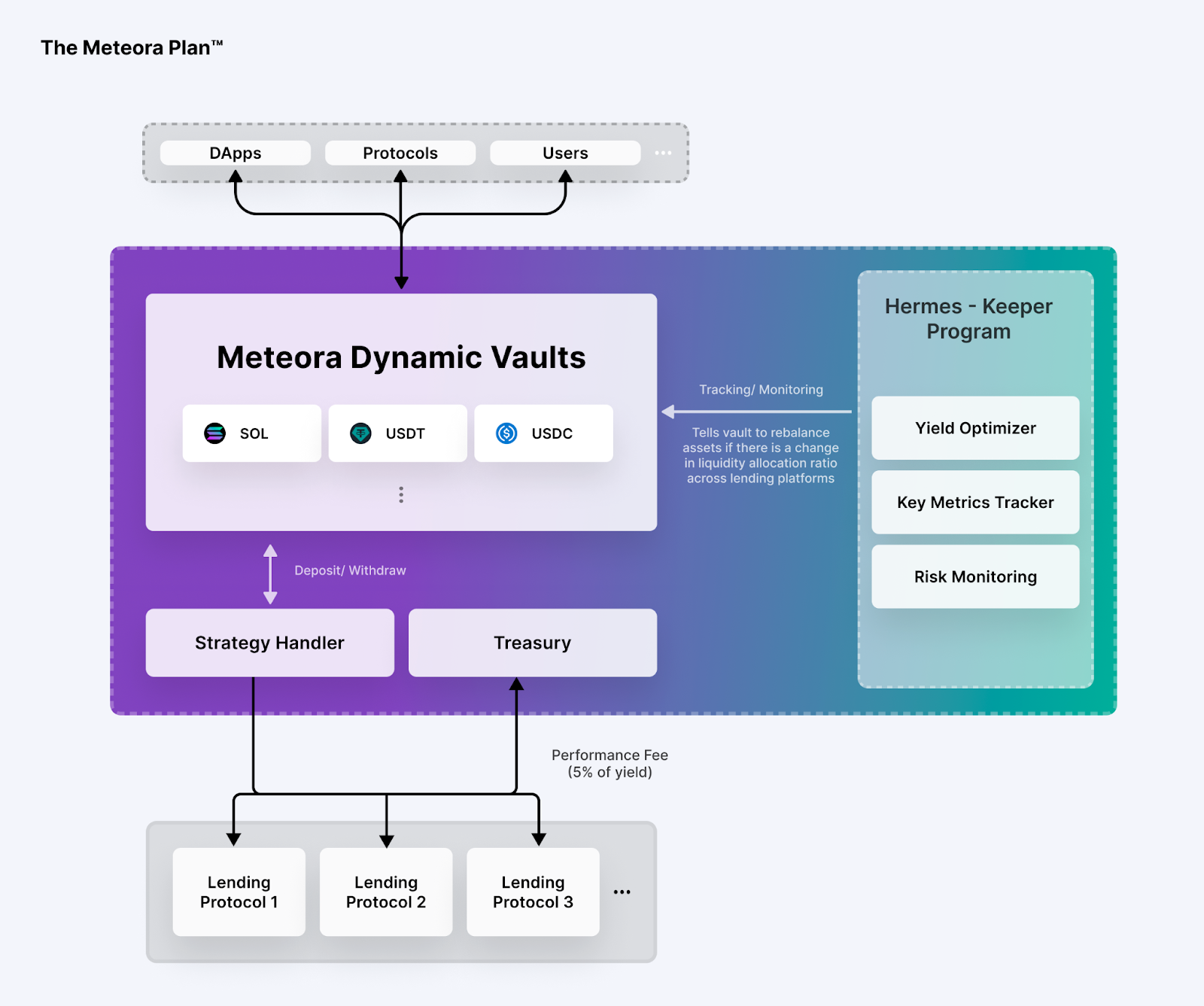

First we will come to Dynamic Vault where users and protocols can deposit money into Vaults and withdraw at any time. The assets in the Vault will then be distributed across DeFi protocols on the Solana ecosystem to earn profits. Besides, the development team also built Hermes to play the role of:

- Calculate and allocate assets from Vaults into different protocols to receive the most profit.

- Monitor the calculation, planning and allocation process closely.

- Risk monitoring. Depositing funds into Lending Protocols also creates some risks around liquidation.

Besides, Dynamic Vault can also be integrated into other protocols on the Solana network through the available SDK module.

Meteora Pools is a collection of highly profitable trading pairs on the Solana network. With Meteora users can provide liquidity directly without needing to go directly to a liquidity pool. Meteora is divided into many types of liquidity pools such as:

- LST Pool: These are liquidity pools for LST types on Solana such as stSOL, mSOL, jitoSOL,…

- Dynamic Pool: These are liquidity pools of volatile assets.

- Multi-token Pool: These are liquidity pools of many different assets.

Next about DLMM, DLMM is a new AMM built and developed by the development team based on Trader Joe’s Liquidity Book model with the story of centralized liquidity. Meteora’s DLMM will offer users and liquidity providers a number of differentiating factors such as:

- Increase capital efficiency for LPs when they can choose price ranges for assets to provide liquidity.

- DLMM also creates extremely diverse liquidity provision strategies, thereby helping liquidity providers be flexible in many strategies to be most effective.

- By trading in Bins, users are not afraid of price slippage if their liquidity is sufficient to the Bin’s liquidity.

- Liquidity providers can make more profit based on the model Dynamic Fees.

Finally, Farm is where users can Stake LP Tokens of trading pairs on AMM platforms to farm rewards from Meteora.

Development Roadmap

Update…

Core Team

The team that built and developed Meteora is the Jupiter Exchange team.

Investor

Update…

Tokenomics

Update…

Exchanges

Update…

Project Information Channel

Summary

Meteora aspires to become a DeFi Hub platform on Solana with an extremely diverse ecosystem. Hopefully through this article everyone can understand more about Meteora.