What is Magpie XYZ? Magpie XYZ is a platform built on BNB Chain to increase profitability for liquidity providers and governance token holders of veTokenomics protocols.

Built on top of Wombat Exchange to maximize administrative benefits on Wombat. So what is Magpie XYZ? Let’s find out in this article!

To better understand the project as well as the Wombat Exchange ecosystem, you can read some of the following articles:

- What is Wombat Exchange? Wombat Exchange cryptocurrency overview

- What is Wombex Finance? Wombex Finance cryptocurrency overview

- What is Quoll Finance? Quoll Finance cryptocurrency overview

- Wombat Exchange ecosystem and WOM Wars

What is Magpie XYZ?

Magpie XYZ is a platform built on BNB Chain to increase profitability for liquidity providers and governance token holders of veTokenomics protocols.

Incubated by Wombat Exchange Magpie focuses on locking up WOM tokens to own governance and increase profit benefits as a liquidity provider on Wombat.

Magpie helps Wombat Exchange:

- Increase income for WOM owners: WOM holders can convert their tokens into mWOM to earn revenue share from Magpie.

- Diverse user base: Risk-averse liquidity providers can earn higher returns without having to hold veWOM themselves.

- Lower the voting bar: Magpie provides a cost-effective way to gain voting rights on Wombat by leveraging veWOM holdings accumulated by the platform.

Magpie started from integrating with Wombat Exchange and can be extended to other veTokenomics protocols such as PancakeSwap. In the long term, Magpie will provide veTokenomics as a service to help other protocols easily convert to the veTokenomics model and enjoy the maximum benefits of this great Tokenomics design.

Mechanism of Action

Magpie XYZ participants:

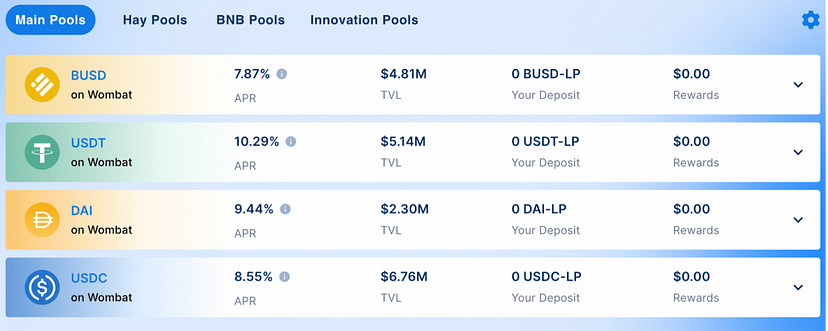

Liquidity Providers: Stablecoin, BNB and depositors Liquid BNB bars can deposit their assets on the platform to earn higher profits on one-sided pools without having to lock up any WOM. Essentially, Magpie shares its productivity gains with the liquidity providers on the protocol. Bringing higher productivity when Farming on Wombat itself is thanks to the amount of veWOM that Magpie holds.

WOM Holder: When a user converts WOM to mWOM on Magpie, the platform automatically locks all WOM for conversion to veWOM on Wombat. While it provides users with mWOM tokens allowing them to earn enhanced APR. This mechanism allows Magpie to own governance rights on Wombat and increase productivity through veWOM holdings. Users can exchange mWOM back to WOM on Wombat Exchange.

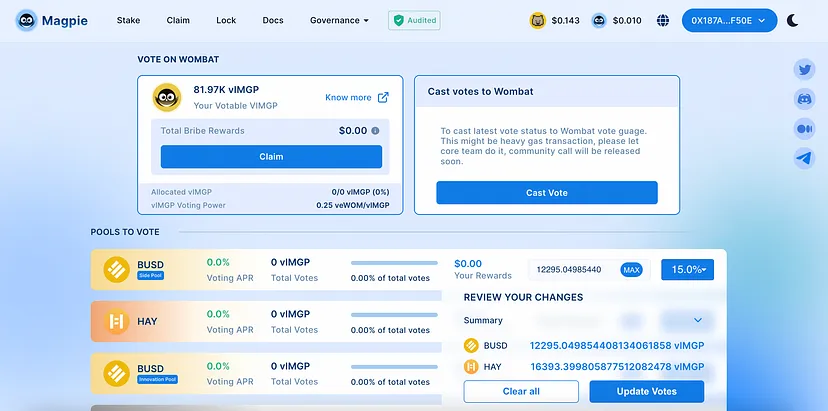

MGP Holder: When Staking MGP you can control the voting power that Magpie has accumulated through veWOM shares. Each WOM that Magpie locks on Wombat will be locked for 4 years. This means that all of Magpie’s veWOM owns the highest benefit on Wombat. Additionally, you also receive fee rewards from the protocol.

Magpie revenue distribution from Wombat Exchange:

- 80% to liquidity providers.

- 12% for mWOM bettors.

- 8% to vlMGP holders.

Main products on Magpie:

1.Stake

Allows users to add liquidity to assets on Wombat through Magpie. And convert WOM into mWOM, similar to veWOM.

2.Lock MGP

Lock MGP to get 8% revenue share and additional MGP rewards. After MGP activation key you will get vlMGP. And have to wait 60 days to unlock MGP.

3. Bribe

vlMGP holders can vote to distribute rewards to Wombat Pools thanks to the amount of veWOM Magpie holds.

Development Roadmap

Updating…

Core Team

Magpie only announced 3 important names and did not have much other information about them.

Investors

August 2022: Strategic Round successfully raised $1M from the community through Pancake.

Tokenomics

Overview information about Token Magpie

- Token Name: Magpie

- Ticker: MGP

- Blockchain: BNB Chain

- Standard: BEP-20

- Contract: 0xd06716e1ff2e492cc5034c2e81805562dd3b45fa

- Total supply: 1,000,000,000

- Maximum supply: 1,000,000,000

Token Allocation and Token Release

- Strategic sales (5%): 0% initial unlock, followed by a 3-month lock-in, then quarterly payments for the remaining 3 years.

- PancakeSwap IFO (7%): Unlock initial 30%, then pay in installments for the remaining 3 months.

- PancakeSwap Syrup Pool (2.4%): 0% initial unlock, followed by vesting in installments for the remaining 2 months.

- Liquidity Mining (45%): 0% initial unlock, followed by up to 2% unlock for the first 2 months, then up to 1% unlock each month.

- Ecosystem (9%): 0% initial unlock, followed by installment payments over the remaining 3 years.

- Airdrop (3%): 5% initial unlock, followed by weekly payments for the remaining 1 year.

- Liquidity And Exchanges (1.1%): 100% original unlocked.

- Team & Advisors (17.5%): 0% initial unlock, followed by a 6-month lock-in, followed by semi-annual vesting for the remaining 4 years.

Token Use Case

MGP Token holders have the right to govern the Magpie protocol and distribute rewards on the Wombat Exchange.

Exchanges

MGP tokens are traded on the Pancakeswap exchange.

Magpie XYZ’s Information Channel

- Website: https://www.magpiexyz.io/

- Twitter: https://twitter.com/magpiexyz_io

- Medium: https://blog.magpiexyz.io/

- Discord:

Summary

Magpie XYZ is a project that brings many benefits to users and makes a major contribution to the development of the Wombat Exchange ecosystem. But the project is still competing with other projects such as Wombex Finance, Quoll Finance.

So I have clarified what Magpie XYZ is? Hope this article provides you with a lot of useful knowledge!