What is LSDfi? LSDfi is one of the trends that has been mentioned a lot recently after the Ethereum Shapella hardfork. Not only stopping at being mentioned by many KOLs, projects in the LSDfi industry have strong growth in TVl as well as token prices. So why is LSDfi so attractive? Let’s find out together in my article.

In this article, we will follow the following route:

- Overview of LSDfi including definition, background,…

- Practical application of LSDfi projects.

- Will LSDfi Summer explode even more strongly?

To understand more about this article, people can refer to some of the articles below:

- What is Pendle Finance (PENDLE)? Overview of Cryptocurrencies Pendle Finance

- What is Agility (AGI)? Agility Cryptocurrency Overview

- What is Lybra (LBR)? Overview of Lybra Cryptocurrency

What is LSDfi?

Overview of LSDfi

LSDfi is a new niche consisting of DeFi projects built on the Liquid Staking Derivative (LSD) protocol that aims to bring new applications for Liquid Staking Tokens (LST) such as stETH, rETH, frxETH…

Background of LSDfi

Ethereum’s Shapella upgrade successfully took place in April 2023, eliminating the concerns of ETH stakers regarding withdrawing their ETH from the network. Along with that, users of LSD protocols such as Lido and Rocket Pool can now easily Redeem LSTs to ETH at a 1:1 ratio, instead of having to suffer losses when trading on Dexes like before. This unintentionally creates favorable conditions for users to easily switch between staking projects, in other words increasing competition for customers between LSD protocols. Here are the aspects where these projects are competing:

Liquidity: Creating deep liquidity for LSTs has been and remains a key factor in the battle between LSDs. Sufficient liquidity will help minimize costs for Staker (no waiting time to redeem ETH) when converting LST to ETH. Besides, deep liquidity creates favorable conditions for the LSD protocol to dominate the market on Layer 2 – where DeFi activities are showing strong growth trends.

Incentives: Before Shapella, LSD like Lido or Frax only focused on attracting users by giving strong incentives to farmers at AMM. Currently, when users can easily redeem LST for ETH, LSD has redirected incentives to other DeFi protocols to pull users to deposit LST into their ecosystem. Highly Incentives projects will maintain the attractiveness of LST in the eyes of stakers.

Create new features for LST: Incentives can attract users but the cost is very high, the effectiveness is not sustainable and it is susceptible to competition. Therefore, Use Case development is considered the long-term “game” that LSD projects need. In addition, LST is a special type of asset that generates yield, which is the factor that LSD protocols and DeFi developers are using to come up with the idea of creating a secondary market private – LSDfi.

Thus, LSDfi was born after the Ethereum Shapella hardfork due to the need to create new things feature new to the LST asset class, thereby indirectly motivating users to stake more ETH and keep LST in DeFi longer.

Applications of LSDfi projects In DeFi

Below are common features of LST developed by projects during the inception phase of LSDfi.

Future Yield Trading

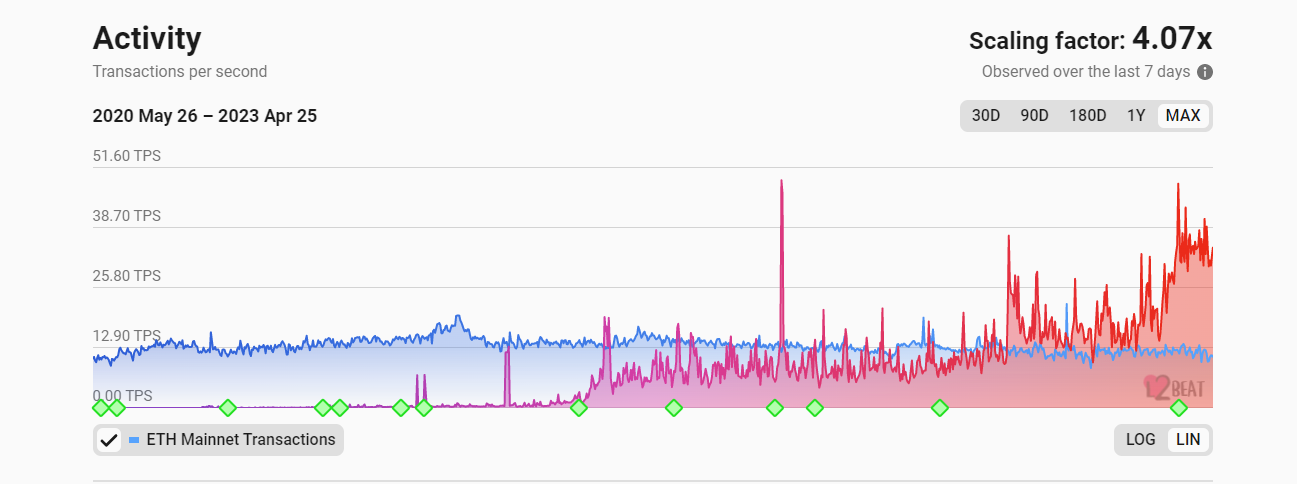

As mentioned above, yield is the highlight of LST assets. Besides, the yield level of LSTs is also different and changes continuously (depending on the amount of ETH staked & Network Activity). Exploiting these characteristics, LSDfi has launched the Yield Trading product with the first & most prominent project being Pendle.

Pendle allows users to implement a variety of trading strategies. When depositing assets into Pendle, this underlying asset will be expressed through Principle Token (PT) and its profit will be expressed through Yield Token (YT). Since principal and profits are separated, users have more flexibility in managing their assets.

Some strategies you can profit from Pendle include: Long Yield, Buy long assets at discount prices, fixed profits receive in the future, or combine strategies together.

Details: What is Pendle? Pendle Cryptocurrency Overview

Aggregate and unlock Liquidity

Optimizing liquidity and profits for LST or simply the mint stablecoin model with LST as collateral – this is one of the models that many LSDfi projects are focusing on and has the strongest growth over time. via. Stemming from the actual needs of DeFi users who always want to optimize profits from the assets they hold, some LSDfi protocols have taken advantage of this psychology quite well to explode recently.

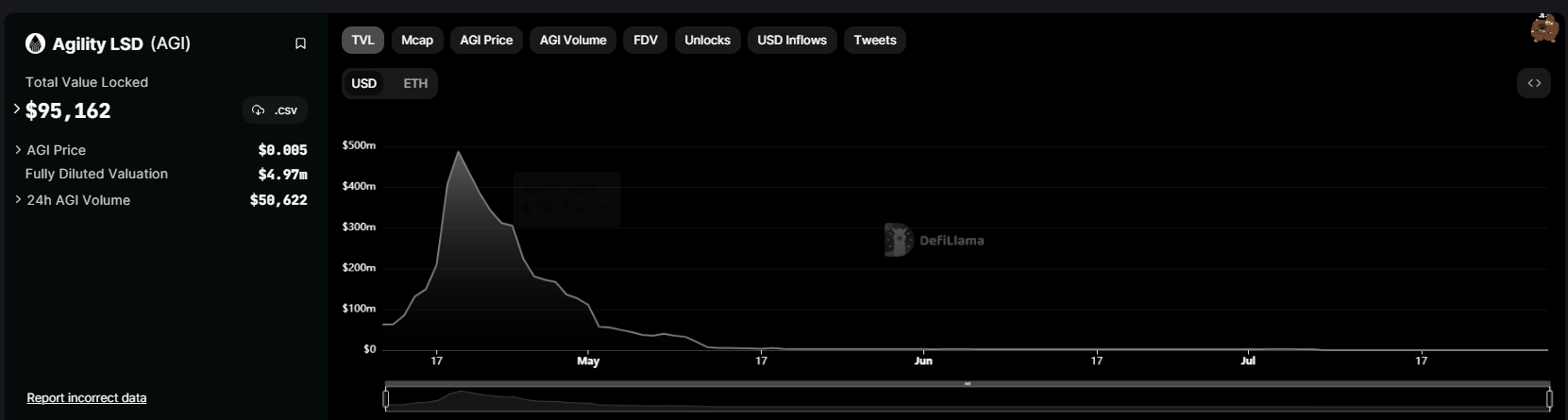

Agility – Liquidity Aggregator platform uses Curve’s veToken model. Agility allows users to deposit LSD tokens into the aLSD receiving protocol (keeping the staking yield intact). With aLSD, users can choose to either mint stablecoin aUSD or deposit aLSD into strategy vaults operated by Agility to earn more yield. Agility is one of the leading projects but only existed for just over half a month before falling into a “vegetative” state.

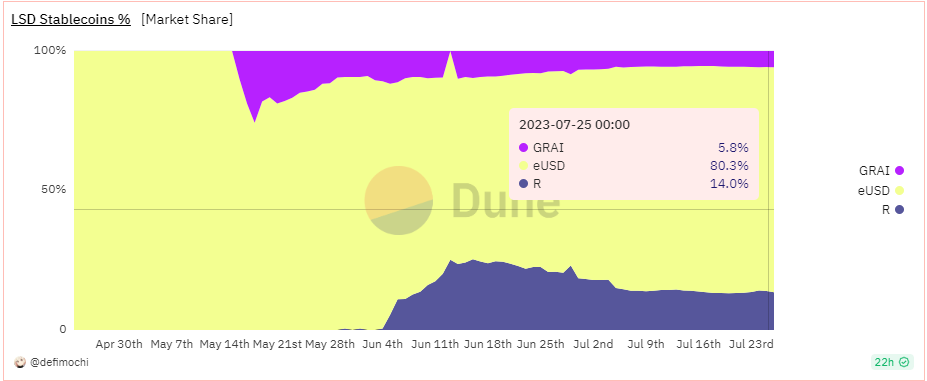

Lybra – The platform follows the CDP model similar to MakerDAO with the yield-bearing stablecoin eUSD product. Lybra’s mechanism is relatively simple, LST holders can deposit tokens (currently stETH) mint eUSD. Holding eUSD users will be paid profits (>7%) just like depositing money in a bank. This source of profit comes from the ETH staking interest converted to eUSD. Lybra is currently holding the Top 1 position with more than 80% of the stablecoin market share and promises to continue to explode with the Lybra V2 mainnet version in the near future.

Raft – The CDP protocol has many similarities with Lybra, however, Raft focuses more on the applicability of stablecoin $R minted from stETH and rETH through incentivizing liquidity pools on AMMs such as Balancer or Uniswap. Along with that, Raft also emphasizes the 1-click Leverage feature to help users leverage their ETH holding position up to x6 times with just 1 operation, instead of having to go through the cycle of depositing ETH -> borrowing Stable to buy. add ETH -> Deposit more ETH -> Borrow… many times. Currently, Raft is holding the 2nd position in terms of market share in the niche.

Gravita – CDP protocol is likened to a fork of Liquity Protocol with stablecoin $GRAI currently ranked in the top 3. Gravita’s highlight probably lies in accepting many different types of collateral such as wstETH, rETH, swETH, WETH and bLUSD to mint $GRAI, and there is also a Stable Pool used to insure the protocol in case of Liquidation. In addition, Gravita also tends to expand its presence in other L2s such as Arbitrum or Optimism early instead of focusing only on L1.

Liquidity Hub

Create a liquidity pool consisting of different LSTs and ETH, thereby helping stakers easily convert the LSD project they want to use, while building an additional layer of assets – index token represents the Pool – on top of LSD tokens to participate in the DeFi market.

LSDx – a protocol that helps improve liquidity for LSTs. Basically LSDx allows holders to deposit their LST (stETH, frxETH, rETH, ETH) into a Pool with the token representing ETHx. Users who want to change the LSD protocol can easily swap LSTs with low price slippage. Besides, LSDx also introduced their UM stablecoin with collateral assets of ETHx. UM holders will receive yield paid in LSD.

UnshETH – The project offers a vision to help reduce the concentration of validators through liquidity incentives with two key products, vdAMM and VDO, being built. Currently, unshETH operates similarly to LSDx with a pool of LSTs and ETH represented by the index unshETH.

Will LSDfi Open Up A Booming Summer?

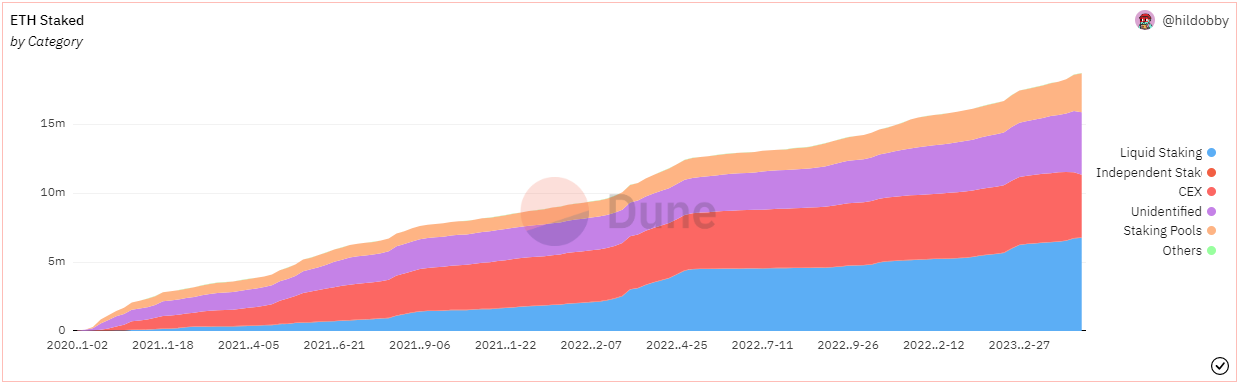

LSDfi is unique in that it builds on top of centralized LSD protocols, providing new features for LSTs. Therefore, the development of LSDfi will first of all depend on the future development of the LSD segment. The HAK Research team has an article you can read about the growth potential of LSD here.

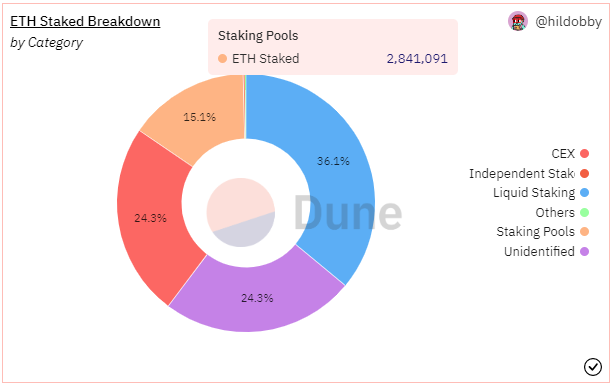

Along with that, we can see that the proportion of ETH on Liquid Staking platforms currently only accounts for ~36% of the total ETH staked. If they do well in creating bonus yield and new Use cases for LSTs, LSD’s door to occupying over 50% of the ETH stake market share is very wide.

There are so many opportunities, But is LSDfi the promised land? In my personal opinion, currently, LSDfi is gradually asserting its position in the market – a niche that meets real needs and is beneficial for the development of DeFi & ETH network, but it still contains many risks. return ponzi model (print tokens to pay high yield to boost liquidity), smart contracts (bug & intentional bug mint token) and finally the risk of economics in the project model (yield, liquidation, peg maintenance,…)

One of the typical examples is Agility, whose liquidity boost when launched quickly brought TVL to nearly $500M after 10 days of launch, $AGI increased by x5. But due to the model using the $AGI token itself to pay rewards, along with the reduction in hype from the project, the $AGI token price is divided by 10 -> reduces yield LST holder -> Reduces TVL -> Die. Or more gently like unshETH was exploited last May.

Summary

Liquid Staking Derivatives is an area with great growth opportunities in the future, especially after the success of Shapella hardfork. This is a necessary condition to bullish branches branching off from LSD like LSDfi. However, this is a new niche, requiring creativity in ideas and rigorous calculations in economic models as well as strong financial support. Therefore, a good LSDfi project for long-term investment will probably have high requirements development time as team behind, not a project born in time for FOMO according to LSD Narrative.