LPDfi is a new niche being developed by many DeFi protocols and has recently begun to be warmed up by Crypto KOLs. In this article, we will find out What is LPDfi? Potential projects in the LPDfi niche.

- What is Dopex (DPX)? Overview of Dopex Cryptocurrency

- What is Panoptic? Panoptic Cryptocurrency Overview

What is LPDfi?

LPDfi stands for Liquid Providing Derivatives include the The protocol uses Uniswap V3 LP (CLAMM) to build its own products such as Perpetual DEX, Option, Money Market (Lending & Borrowing) and Stablecoin,…

The benefits that LPDfi brings:

- For Users: Increased Yield from liquidity farming due to additional project token incentives + yield from LPDfi and reduced IL (LPDfi projects mostly develop IL risk hedge). In addition, LPDfi also simplifies the provision of centralized liquidity for new users when there is no need to calculate and change LP positions regularly to optimize yield.

- For Uniswap v3: Increase liquidity, users and trading volume.

- For LPDfi: Solve the problem of liquidity shortage for output products (Perps, Options) at a reasonable cost.

Potential Projects In LPDfi Niche

Dopex

Dopex is a project with many products built around Options trading. Dopex is one of the OGs with the most contributions to the Arbitrum ecosystem.

In early 2023, Dopex had strong growth in DPX token price when the founder of the TzTokChad project introduced the “OpFi concept” of applying Options into DeFi along with the Fomo Arbitrum Airdrop ARB wave. However, after more than half a year, Dopex has not yet had any significant development in terms of the number of users even though the project is still making continuous efforts to launch a series of new products such as Stradle, Scalp and upgrading rDPX V3. .

There are many reasons to explain this situation, however, “liquidity” is currently being identified as the biggest bottleneck of Dopex in particular and the Options industry in general. Specifically, liquidity in Options is fragmented from asset classification, strike price until contract validity,… Weak liquidity increases slippage, fewer contract options for traders and insufficient liquidity for MMs to trade. Few traders means low project revenue and not being able to inject many incentives to attract more liquidity.

You’ve probably seen a few threads on @dopex_io v2 and thought to yourself “sounds cool but wot mean”.

Allow the CEO to explain how we use CLAMM liquidity to absolutely giga-juice your LP rewards.

NFA, NMA, Modafileenis, etc.

(we use an example of 1 $ETH print $1,750 ticks/strike) pic.twitter.com/GssroRrtlY

— Nutoro D. Chutoro (@chutoro_au) August 21, 2023

To escape this loop, recently, CEO Chutoro shared a thread about how Dopex V2 will integrate and take advantage of the abundant liquidity from LPs on Uni v3 to launch American Options (Contract execution before expiration date). ).

In addition, the improvements to rDPX V3 turn this rebate token into a back asset to mint dpxETH (peg with ETH) which is expected to attract a large number of LPs from Uniswap V3 to come and break the Dopex siege in next time.

Panoptic

Operating in the same Options field as Dopex, however, Panoptic is an Option trading protocol with a relatively different product line focusing on Perps Options – allowing traders to trade Long – Short Options without a term with leverage up to x10 ( similar to Long – Short Crypto Asset).

You can learn more about Panoptic in the following article

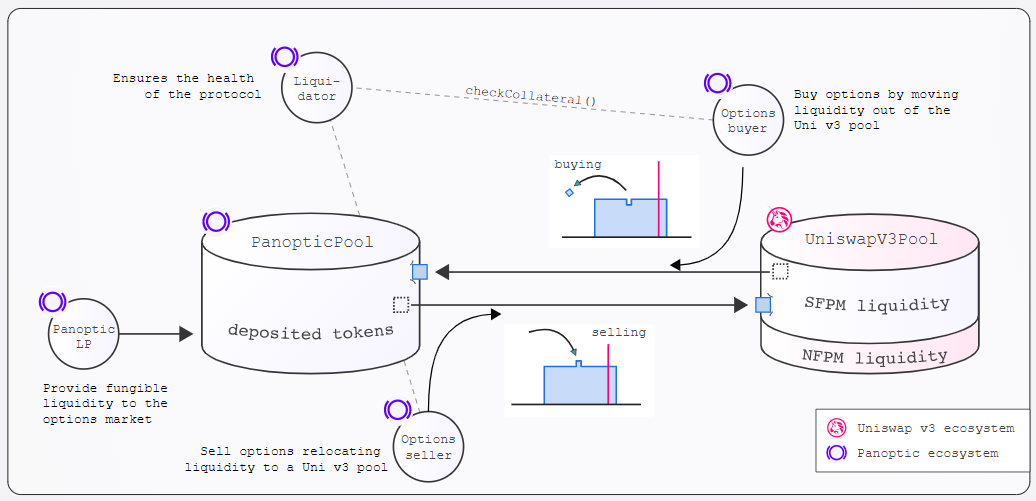

Panoptic uses Uniswap V3 LP to provide liquidity to both Options buyers and sellers earning a commission fee to share back to those Lending assets in Panoptic’s Pool (used for LP on Uni V3).

Limitless

Limitless is a platform providing derivative asset trading solutions with high leverage built on Uniswap V3. With Limitless, liquidity providers on Uniswap V3 will lend liquidity when LP positions are not within the trading price range (idle LP) to receive a premium in return from borrowers and traders. Meanwhile, Borrowers can borrow with high LTV (Loan-to-Value) and avoid Liquidation risks, while Traders can use leverage up to x1000 for their trading positions.

Currently, Limitless is in Beta Testnet phase. In the future, the project also plans to build more Options products similar to Dopex and Panoptic.

Good Entry

Good Entry is a Perps position protection product with x10 leverage that helps Traders not have to worry about being liquidated when the market fluctuates strongly or fictitiously. Good Entry is built on Uniswap V3 with a mechanism similar to Options above. When users deposit into ezVault, LP will be sent and optimized as well as reallocated on Uniswap V3. LPs at ezVault act as Options Sellers and traders are Options buyers at certain Entry (Strike Price) points.

Traders using Good Entry will have to pay a funding fee to borrow money using leverage calculated on an hourly basis.

summary

Hope this article has helped you understand somewhat What is LPDfi? Potential projects in this LPDfi niche. In my personal opinion, LPDfi projects mostly apply Options to resolve Impermanent Loss and simplify LP work at CLAMM, or in other words, use liquidity more effectively. Meanwhile, end products such as options trading or perp protection of projects are still quite difficult to access for common DeFi users, so it will probably be difficult for LPDfi to create an explosive and sustainable trend in a short time. Much better than LSDfi.

However, LPDfi is the premise to open up a niche with “on top” liquidity aggregation projects in this niche, such as Logarithm with the ability to create large incentives (fee + LPDfi token + project token). Attracts TVL strongly and creates Fomo. I and the Weakhand team will closely monitor and update more about LPDfi in the near future.