In the field of cryptocurrency and Blockchain, when people first start learning, many people have headaches because of completely unfamiliar and difficult to understand terms. However, like any investment, it is important to understand the correct information before starting to make investment decisions. Through this article Weakhand will give everyone the knowledge to better understand what the loan to value ratio is.

Below are some articles that people can refer to to better understand the Crypto market:

- What is DeFi? All About DeFi

- What is Bitcoin? All About Bitcoin

- What is Ethereum? All About Ethereum

- What is Ponzi? Opportunities or Risks in the Crypto Market

What is Loan To Value Ratio

In the traditional market, Loan To Value Ratio, also known as Loan-to-Value Ratio, is often used as an important index to assess risk and determine the level of assets that the borrower must pay. mortgage to secure the loan.

In the Crypto market, Loan-to-Value Ratio is an important indicator in the process of borrowing and mortgaging crypto assets. LTV Ratio in the Crypto market allows borrowers to access capital without selling their crypto assets.

Simply put, the crypto market will provide cryptocurrency borrowing services, in which borrowers can put crypto assets as collateral to receive loans. The level of collateral required in the crypto market is determined based on the LTV Ratio, i.e. the ratio between the value of the crypto asset and the loan amount.

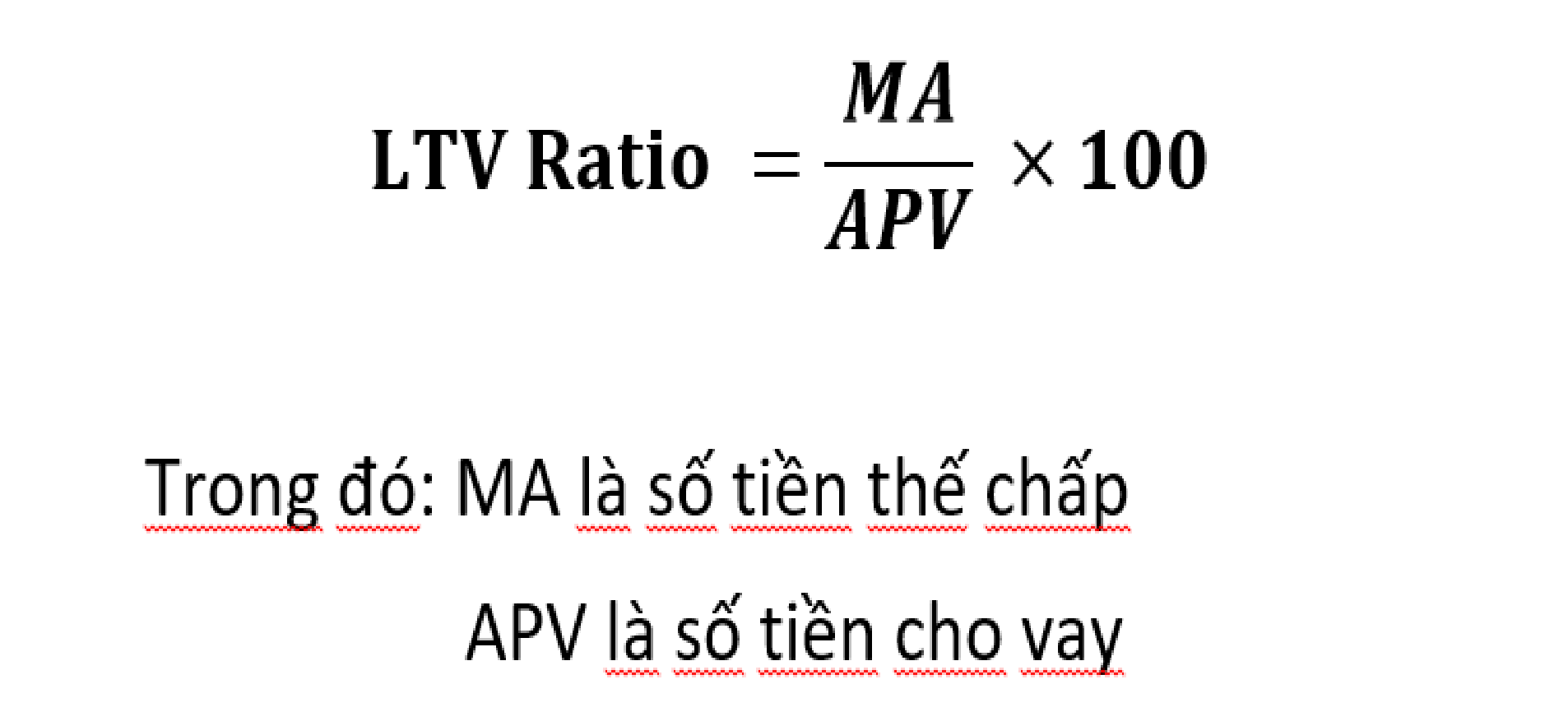

How to calculate loan-to-value ratio

Borrowers can easily access capital in crypto according to the following calculation formula:

I will give an example to make it easier for everyone to imagine. Suppose you want to borrow 50,000 USD from a cryptocurrency lending platform and you decide to put 5 Bitcoins as collateral. The current market value of each Bitcoin is 10,000 USD.

Apply the formula above:

- The mortgage amount is 5 BTC x 10,000 = 50,000 USD

- The APV in this case is a loan of 50,000 USD

- LTV = ($50,000 / $50,000) x 100 = 100%

Another example assumes the crypto platform lends at an LTV Ratio of 80%. This means people can only borrow up to 80% of the value of the collateralized crypto asset.

Apply the formula to this case:

- The mortgage amount is 5 BTC x 10,000 = 50,000 USD

- Loan APV = Mortgage Amount x LTV Ratio = $50,000 x 80% = $40,000

Since the LTV Ratio is 80%, people can only borrow a maximum of $40,000, which is lower than the collateralized crypto asset value of $50,000. Note that the LTV calculation and LTV Ratio value may vary depending on the regulations of each platform and service in the crypto market.

How does LTV affect borrowing capacity in crypto

Asset leverage: LTV regulates the asset leverage that people can use to borrow. With a high LTV, people can borrow a large portion of their property value. However, the higher the LTV, the greater the risk, as a small fluctuation in asset prices can make it difficult for people to repay their debts.

Risk to the lender: LTV also affects the risk the lender bears. Lenders often require a maximum LTV threshold to reduce risk in the event of a sharp decline in asset prices. If the LTV is too high, the lender may face the risk of not being able to recover the full loan amount.

Collateral limit: LTV regulates the ratio between the value of the collateral and the amount people want to borrow. For example, if the LTV is 70%, people can only borrow up to 70% of the property value. This means people have to use 100% of the collateral value to borrow 70%.

Asset value: If asset values increase, people may be able to borrow more. However, if property values fall, the LTV may exceed the threshold and people may find it difficult to borrow or have to secure additional assets to maintain the required LTV.

Benefits That LTV Brings

A good LTV ensures that the value of the collateral can cover debt repayment in the event of a decline in asset prices. Typically, a good LTV is when the ratio between the value of the collateral and the loan amount is low, allowing for enough provision to ensure repayment in the worst case scenario.

Another very important factor is the need to evaluate risks related to mortgage assets. People need to consider the stability and growth potential of the asset to ensure that the asset value does not decrease significantly in the near future.

With a good LTV comes transparency in rules and processes. Everyone needs to understand how LTV is calculated and applied, as well as the associated requirements and conditions. The lending platform or service needs to provide clear and easy-to-understand information about LTV so people can make smart decisions.

Diversification in mortgage and borrowing assets means people can use many types of collateral to increase borrowing capacity or reduce risk. Thus the platform will allow people to use many types of assets such as cash and cryptocurrencies.

How to Reduce LTV in Crypto

People can collateralize more crypto assets to increase collateral value and reduce LTV. This means providing more collateral for people’s loans. During the LTV reduction process, ensure compliance with the rules and regulations of the borrowing platform.

Another way to reduce LTV is to convert people’s crypto assets into stablecoins. Stablecoin is a digital currency pegged to a stable value such as the US dollar, often backed by collateral such as cash or financial assets. By converting crypto assets into stablecoins, people can reduce LTV by using stablecoins instead of unstable crypto assets. This helps reduce risk because stablecoin values are less volatile than crypto assets.

Top 3 LTV data reference platforms

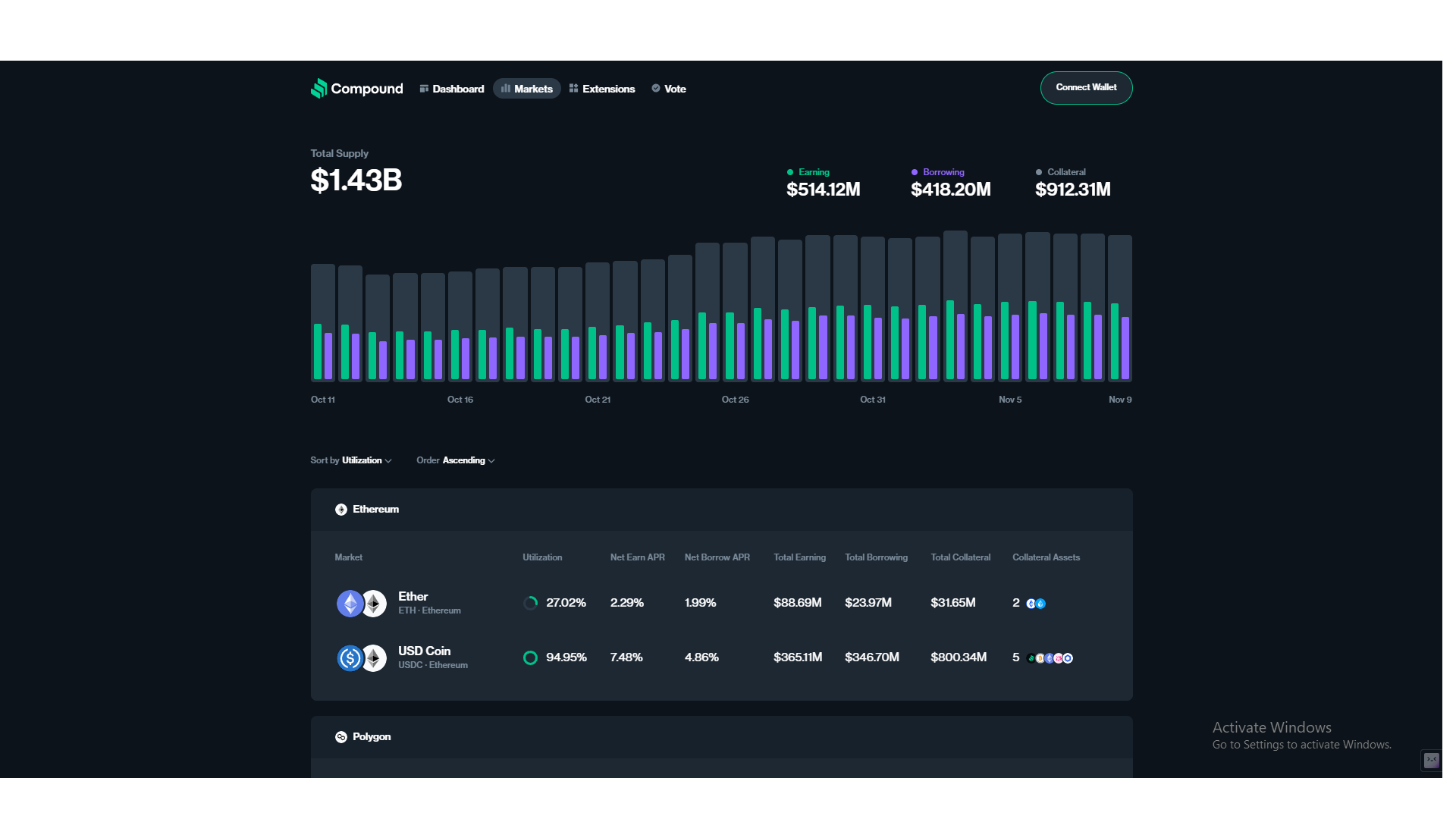

Compound Finance

Compound Finance is one of the leading DeFi solutions for crypto borrowing and lending. This protocol provides crypto asset owners with great options to gain passive income. On Compound, LTV is determined using a mechanism called “Collateral Factor”. Collateral Factor is the maximum percentage of collateral value that a user can use to borrow.

Collateral selection and LTV prioritization are important when using Compound. Users need to carefully review the Collateral Factor of each asset type, ensure that they have enough information and understand the risks associated with using collateral on this platform.

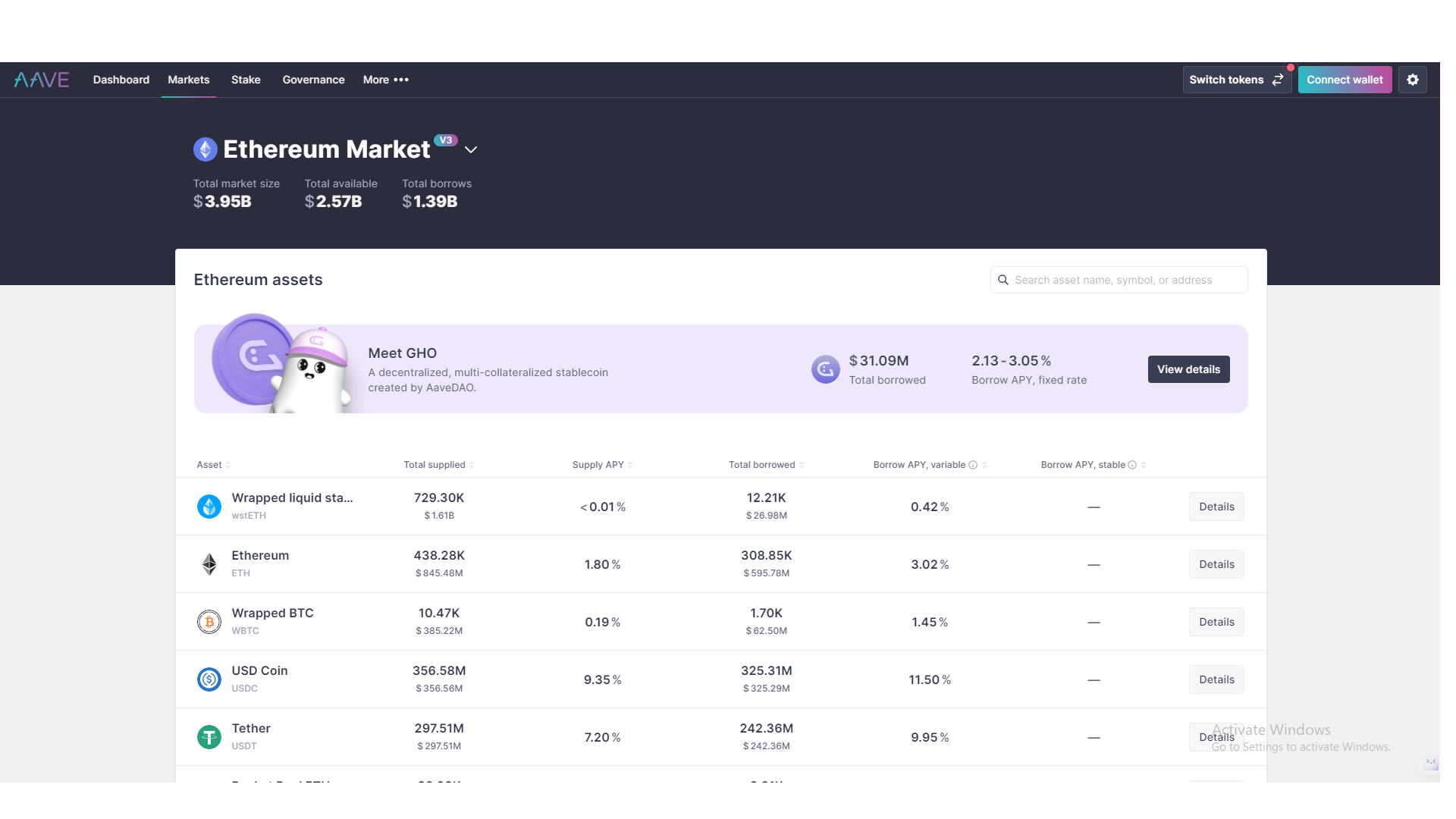

Aave

Aave is a decentralized Lending & Borrowing protocol that allows users to borrow and lend a variety of crypto assets. Aave uses a mechanism called “Liquidation” to protect lenders from risk. Once the LTV exceeds a specified threshold (usually 80-85%), Aave can begin the process of liquidating the collateral to repay the debt and ensure that the lender does not lose money. Therefore, managing LTV and ensuring compliance with Aave requirements and conditions is critical to avoid risk and collateral loss.

MakerDao

On MakerDAO, LTV is called Collateralization Ratio. Collateralization Ratio is the minimum ratio that users must ensure between the value of the collateral and the amount they borrow. Note that MakerDAO uses stablecoin DAI as the currency in the system. This means that the value of the collateral and the loan amount are both determined in DAI.

Collateralization Ratio management is important when using MakerDAO for borrowing. Users need to ensure that their Collateralization Ratio is not lower than the required level to avoid the risk of asset liquidation and loss of collateral.

Before using MakerDAO or any other borrowing platform, please familiarize yourself with the requirements, conditions and risks involved to ensure safety and understand the process and how it works. of the system.

Summary

Above is all the information to help people understand what Loan To Value Ratio is? And what you need to know when considering the LTV index from Weakhand. Hopefully this article can bring everyone useful content.