What is LlamaLend? LlamaLend is a decentralized lending platform built on the Ethereum blockchain. LlamaLend provides a solution that is more secure, transparent and accessible than traditional lending models. So what’s special about this project? Let’s find out with Weakhand in this article.

What is LlamaLend?

NFT Finance is an area that has received a lot of attention recently. Users can use NFT for Defi activities such as: Dex, lending,… If you don’t understand what NFT Finance is, you can read the following article to understand better.

Regarding the NFT lending market, BendDAO is the platform that occupies the largest piece of the pie, but the platform only supports Blue Chip NFTs, making it difficult for many users who own NFTs to access it.

What is LlamaLend

Main participants on LlamaLend:

- Borrower (Borrower): Pledge the NFT to the platform to borrow the corresponding amount of ETH.

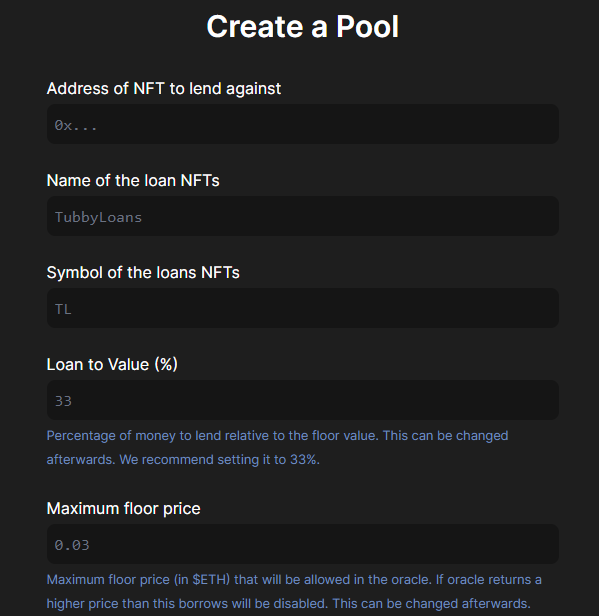

- Lender (Lender): Provide ETH into Lending Pools to receive interest. Lenders create their own Pools, so interest rates are also created by them for Borrowers.

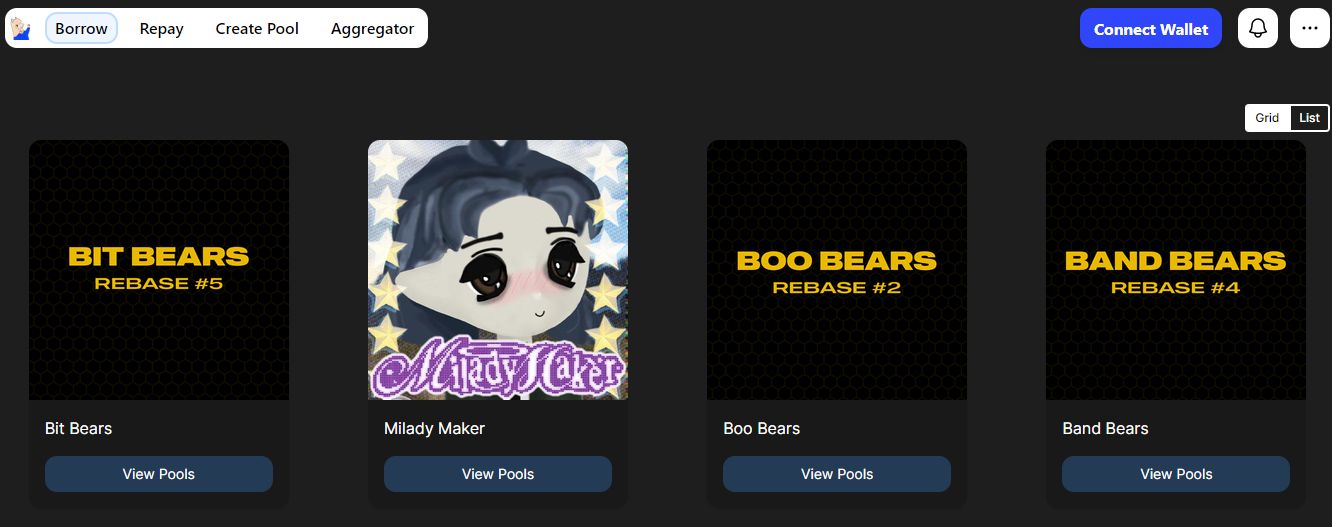

Lenders create their own Lending Pool

Sale: The borrower’s loan will not be liquidated based on price or mortgage rate, as long as the borrower repays the loan on time. In case the borrower does not pay on time, the Lender who owns the Pool containing that NFT can negotiate liquidation with the borrower or own the borrower’s NFT itself.

At this time, they can dump NFTs if they want to avoid bad debts, auction to receive the optimal amount of money, or implement low late fees, extended debt repayment plans, … if wants to help users get their NFTs back.

What is the LlamaLend Difference?

LlamaLend creates an open market with NFTs, anyone can participate in borrowing and lending activities on LlamaLend.

So with NFTs other than Blue Chip NFTs, how does LlamaLend handle the risk of liquidity, price fluctuations or liquidation?

Basically, Lenders create their own Lending Pools, so information on the Pool such as: NFT address, loan interest rate,… are all created by Lenders. So they are aware of the risk to this asset or this is also a form of increasing the liquidity of their NFT collection itself.

Core Team

Update…

Investor

Update…

Tokenomics

Update…