What is LiquidLayer? LiquidLayer is a highly scalable Proof of Work Blockchain that integrates the Liquid Staking Derivative Bridge (LSD). So what’s special about LiquidLayer? Let’s find out with HAK Research in this article.

LiquidLayer Overview

What is LiquidLayer?

What is LiquidLayer? LiquidLayer is a highly scalable Proof of Work Blockchain that integrates the Liquid Staking Derivative Bridge (LSD). It enhances Proof of Work Blockchains with EVM compatibility and is said to be the solution of the impossible trinity when it comes to ensuring decentralization, security, and scalability. Along with that, Liquid Staking Derivative Bridge can transfer assets from Ethereum, leveraging Defi instead of just locking them, to allow users to earn APY on those bridged assets.

LiquidLayer was born with a vision to revolutionize and narrow the gap between decentralized Blockchain networks. From there, it acts as a liquidity channel for decentralized finance.

What is LiquidLayer?

Outstanding features of LiquidLayer

Impossible trinity

LiquidLayer stands out by providing several solutions to the impossible trinity. It not only balances these three aspects, but also optimizes each aspect without diminishing their role. Thanks to Able to scale over 10,000 TPS and with a completion time of 5 seconds, LiquidLayer has broken the mold, proving that with the right technology and vision, the blockchain trilemma can be easily solved. smoothly and effectively.

Structure and design

LiquidLayer takes a pioneering architectural approach, combining traditional blockchain elements with innovative solutions. Specifically:

- Modular Design:

Core to LiquidLayer is its modularity, ensuring that different components can be updated, optimized or even replaced without disrupting the functionality of the main network. - Interactive abillity:

Compatible with EVM, LiquidLayer is not only an independent entity but also a participating member of a larger ecosystem, specifically Ethereum, allowing it to interact seamlessly with other platforms. and other protocols. - Ability of extension: This feature created to support transaction throughput in excess of 10,000 TPS, ensuring that as the user base grows, the system can accommodate any increased demand without compromising security.

- Hierarchy:

While pushing the boundaries of speed and efficiency, LiquidLayer remains committed to a decentralized model that prevents centralization of power and promotes network integrity.

To achieve such transaction speed, the detailed optimizations that the project team recommends are:

- Layered Processing Mechanism:

The transaction. transaction on LiquidLayer is managed using a hierarchical structure. The main layers handle basic transactions, while complex contractual interactions are separated into specialized layers. This layering ensures that resources are optimally used without bottlenecks. - Swift Validation and Consensus:

At the start, the transactions. transactions transmitted to the distributed network of Miners. Miner The first person to solve the cryptographic challenge will propose that Block to the network. After obtaining validation and consensus from the network, a completion time of 5 seconds is achieved. It ensures transactions are confirmed quickly. - Dynamic Gas System:

To accommodate high TPS and fast stability, LiquidLayer uses an adaptive gas charging system. It automatically adjusts to network activity, ensuring that users have minimal transaction fees while maintaining network efficiency.

Function of adding Block and maintaining Block

LiquidLayer uses advanced technologies to manage its blockchain, ensuring reliability and robustness such as:

- Efficient Block Mining: Miners play a core role, taking on the position of creating new blocks and receiving Block Rewards.

- Chain Integrity: TFollow the rules, maintain consistency. In In the rare case of two concurrent block proposals, the transaction will automatically be routed to the Node that solved the most algorithms.

- Proactive Fork Resolution: LiquidLayer effectively predicts and handles random forks using collation protocols, ensuring uninterrupted network continuity.

- Seamless Smart Contract Integration: DDesigned with native capabilities to incorporate and execute Smart Contracts. Whenever a Block includes one or more Smart Contracts, the specified terms are automatically implemented, ensuring the intent of the contract is fulfilled.

Liquid Staking Derivative Bridge

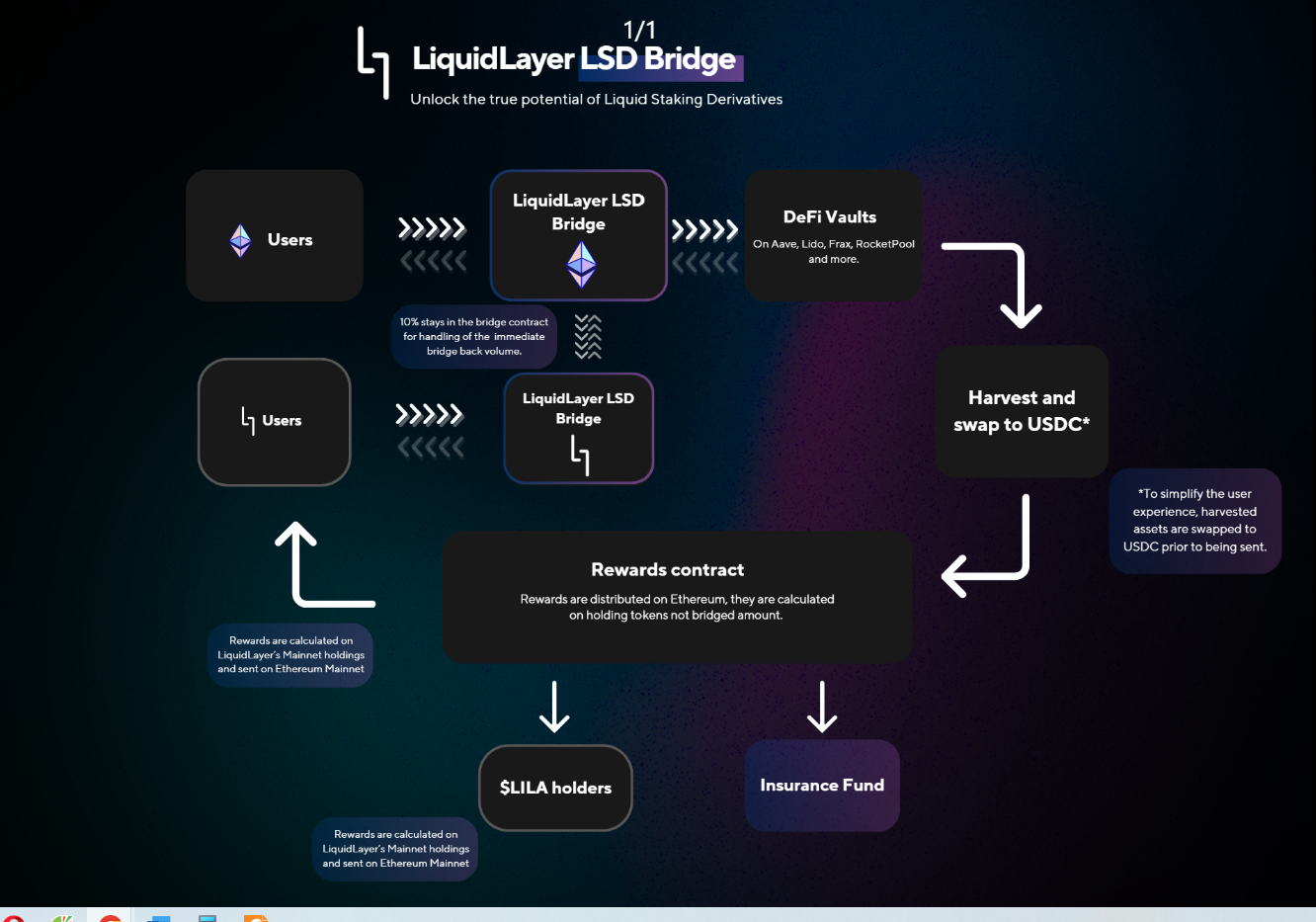

This is an innovative mechanism designed to seamlessly transfer assets between Ethereum and LiquidLayer. More than just a bridge, LSD integration turns the concept of asset connectivity into a profit-generating opportunity.

When Bridge from Ethereum to LiquidLayer Chain

- Supported asset types: ETH, USDC, USDT, DAI and FRAX.

- Token Minting: Once assets are bridged, they will be shown on LiquidLayer Chain equals the corresponding number of newly created Tokens (1:1 conversion). Ensures seamless presentation of assets across both networks.

- Contract and allocation: 90% of bridging assets are allocated to dedicated Smart Contracts on Ethereum. The remaining 10% is kept in the Bridge, which acts as a buffer to support immediate bridging requests.

- Fee: A 0.02% fiat fee is applied to connect assets to the LiquidLayer Chain. These fees are included in the profit distribution contract, ensuring the sustainability of the process.

When Bridge returns to Ethereum

- Standard Epoch Bridge-Back: Users who want to back their assets back to Ethereum will have to wait until epoch (epoch) next and is subject to a 0.05% fee.

- Instant Bridge-Back: For those who want to back assets immediately, a 0.1% fee will apply.

- Fee Distribution: 60% of fees will be distributed to asset holders on the Bridge and Holder add liquidity token LILA. The remaining 40% will Funding protocol development, auditing and necessary updates.

- Asset Release: Based on user wishes, assets will be released immediately if they increase gas fees or will wait for the next epoch.

The most attractive point of this Bridge is its ability to generate profits. Assets are staked in multiple V typesault and various Stable Pools such as Lido, Frax, RocketPool and Aave. They are then integrated into liquidity provisioning platforms. From there, optimize profits while maintaining asset liquidity.

At the end of each epoch, the accumulated profits from staked assets will be harvested. These profits will be automatically transferred to the user’s wallet in the form of USDC on the ETH network.

Besides, 90% of profits are transferred back to Holders who add liquidity and hold LILA Tokens on LiquidLayer. The remaining 10% will be further consolidated into the insurance fund. It acts as a layer of protection if there are failed transactions.

An essential feature of the Smart Contract Bridge in LiquidLayer is the need for a 10% liquidity reserve. This amount will play a role in ensuring both liquidity and flexibility of the system. Partly because of different harvest time frames, because both Vault and yield protocols are both susceptible to regulation through community governance.

When that 10% is not guaranteed. System will be remedied by releasing funds from the Vault in the near future.

Hashrate parameters

Currently the network is in testing phase (Public Testnet 1.0)

Development Roadmap

VQ4 2023: The Genesis Phase

- Launching LILA Native Token (Public Sale on Pinksale).

- Listing LILA on Uniswap.

- Marketing Phase 1 and Listing Coingecko and Coinmarketcap.

- Release test network products LiquidLayer.

- Explorer for Testnet.

- Faucet for Testnet.

Q1 2024: The Mainnet and Expansion Phase

- Launched LiquidLayer Mainnet and LiquidLayer Explorer.

- Listing CEX first.

- Launching LiquidLayer’s first native dApps.

- Marketing Phase 2. Popularizing research materials What is LiquidLayer?

- Launched the Incentive Program.

- Introduce LiquidLayer Governance.

Q2 2024: Bridging and Beyond

- Check LiquidLayer bridge.

- Launched LiquidLayer bridge.

-

LILA LSD Bridge Staking on Mainnet utility.

-

Announcing DeFi and Liquidity Providing partnerships.

-

Listing CEX 2nd and 3rd.

-

Marketing Phase 3.

Q3 2024: Expanding Horizons

- Launch a comprehensive dashboard for insights.

- Introducing Bridge Fee Adjustment to optimize costs.

- Implement sharding mechanism to increase transaction throughput.

- Extend Bridge support to multiple chains.

- Marketing Phase 4. Support wider promotion.

Q4 2024: Enhancing Accessibility

- Deploy Bridges with non-EVM chains.

- Release public API Bridge for greater interoperability.

- Marketing Phase 5. Increase community participation.

- Find out more improvements.

Core Team

Update…

Investor

Update…

Tokenomics

Basic information about LILA token

- Token name: LiquidLayer

- Ticker: LILA

- Blockchain: LiquidLayer

- Standard: Native token

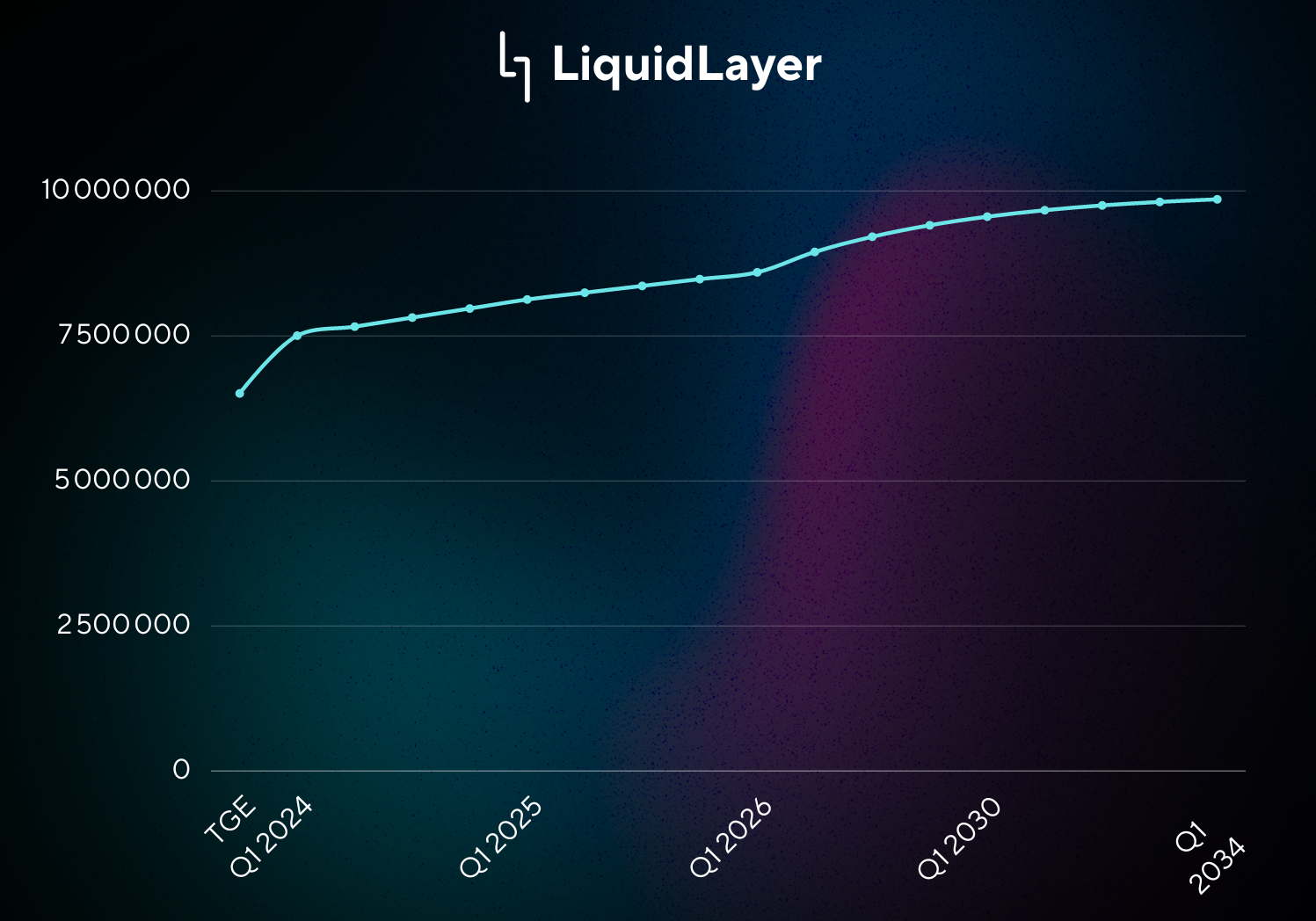

- Total Supply: 10,000,000

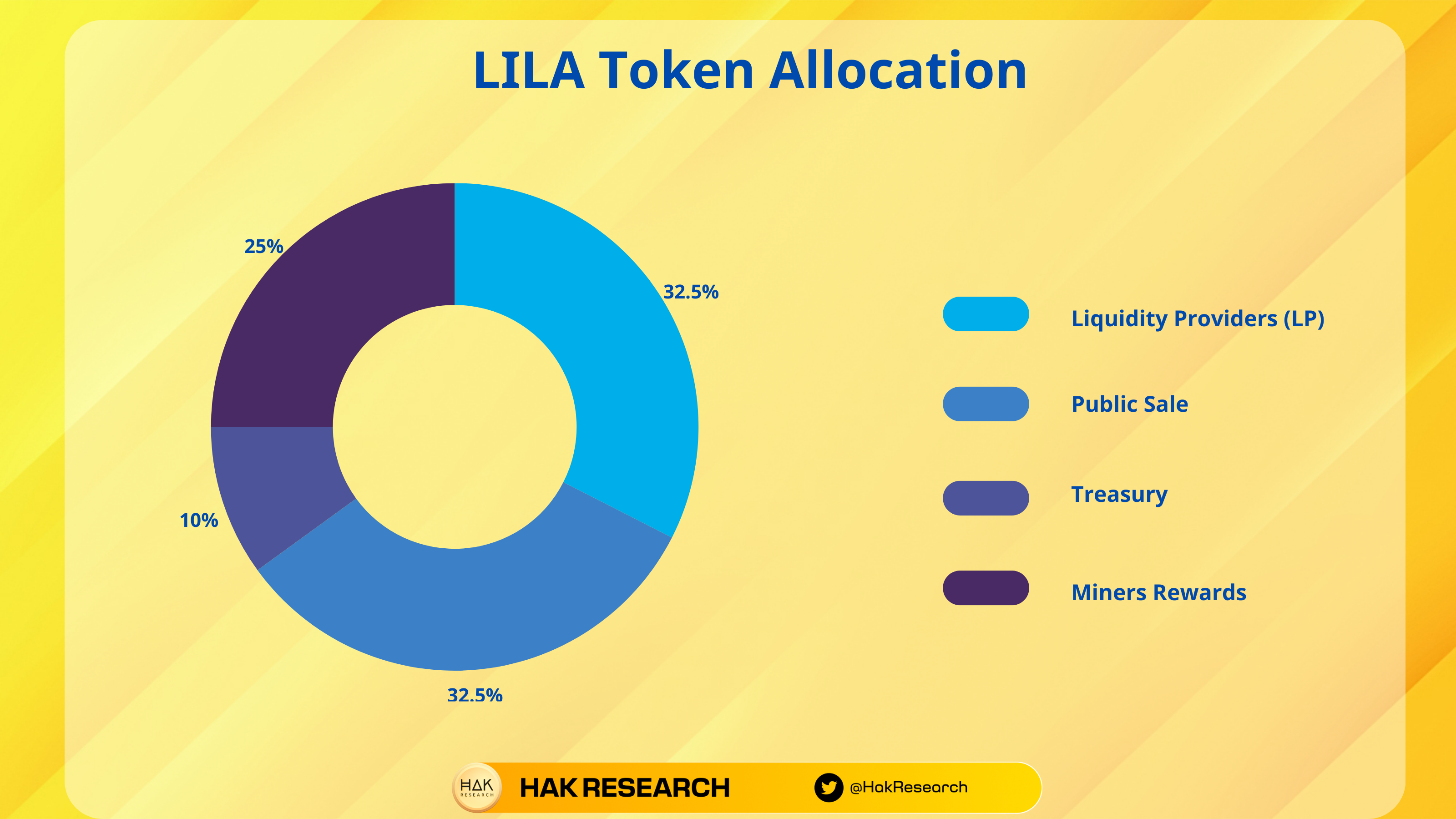

Token Allocation

LILA’s total supply is distributed as follows:

- Liquidity Providers (LP): 32.5%

- Public Sale: 32.5%

- Treasury: 10%

- Miner Rewards: 25%

Token Release

Block Reward for miners in the first year will be 625,000 LILA. After that having will take place annually with Block Reward reduced by 25%.

Token Use Cases

- Pay transaction gas fee.

- Miners are rewarded for participating in transaction validation and network security.

- Administration participates in community suggestions on the network.

- Collateral in DeFi protocols.

- Use and access premium Dapp features in the ecosystem.

Exchanges

Currently, LILA is present on Uniswap decentralized exchanges.

Liquidlayer’s Information Channel

- Website: https://www.liquidlayer.network/

- Twitter: https://twitter.com/liquidlayer_

- Telegram:

Summary

LiquidLayer brings users many utilities, not only a bridge but also an opportunity to increase profits. It is underpinned by a system that values flexibility and security. Hopefully through this article, everyone can understand what LiquidLayer is. This is a very new PoW coin project and is still in the Testnet process. This will be an investment opportunity in the context of the event BTC having 2024 is approaching.